|

市場調查報告書

商品編碼

1444570

液體包裝紙盒 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Liquid Packaging Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

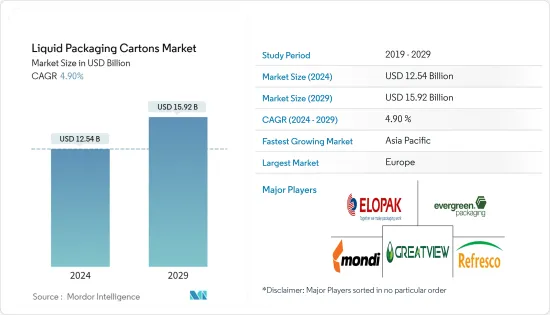

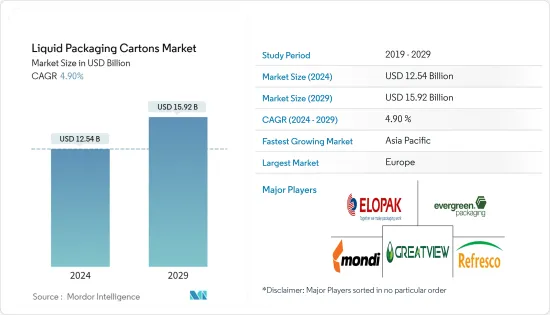

液體包裝紙盒市場規模估計到2024年為 125.4 億美元,預計到2029年將達到 159.2 億美元,在預測期內(2024-2029年)CAGR為 4.90%。

液體包裝紙盒可確保內容物的安全並免受外界污染物的影響,延長產品的保存期限。可食用液體(如乳製品、果汁、番茄醬、軟性飲料和水)和不可食用液體(如油、燃料和清潔劑)均包裝在紙箱中。

主要亮點

- 發展中國家的快速城市化推動了對包裝液體產品的需求,促進了市場擴張。此外,消費者支出的增加和可支配收入的增加推動了液體包裝紙盒市場的成長。

- 由於環保意識不斷增強,該行業透過引進生態友善的液體包裝紙盒來擴大規模。各國政府推動使用可回收和環保包裝的優惠政策進一步支持了這一趨勢,加速了市場擴張。

- 果汁是一種迅速擴張的飲料類別,但大多數果汁都容易氧化。維生素在氧化過程中會流失,風味和外觀也會發生不利的改變。這些不良的品質變化經常發生在流體的加工、包裝、運輸或儲存過程。液體紙盒的擴張受到品質控制要求帶來的新包裝設計進步的影響。

- 由於塑膠容器易於運輸且具有成本效益,人們越來越傾向於使用塑膠容器來包裝液體食品,因此對液體包裝紙盒的需求可能會受到阻礙。

- 隨著COVID-19的爆發,由於世界各地實施封鎖,液體包裝紙盒市場成長緩慢,這擾亂了供應鏈並導致生產工廠關閉。

液體包裝紙盒市場趨勢

牛奶和其他乳製品飲料見證成長

- 牛奶是主要主食之一,也是均衡飲食的重要組成部分,因為它含有高比例的鈣和其他必需營養素。各種研究表明,牛奶對健康有益,例如預防糖尿病、增強骨骼健康和健康的大腦功能。

- 消費者對牛奶等包裝商品的日益偏好推動了對液體紙盒包裝解決方案的需求。對塑膠使用的永續性擔憂的增加推動了對磚液紙盒的需求。

- 牛奶傳統上採用紙盒包裝,因為它們可以保護食品並且環保。紙板是經常用於製造牛奶包裝紙盒的材料之一。牛奶紙盒通常稱為屋頂紙盒,是一種聚酯塗佈紙包裝。

- 牛奶盒具有更長的保存期限和更低的污染風險。由於液體包裝紙盒在使用後易於重新封閉,因此預計這些容器的消耗量將比過去 10年成長得更快。

- 乳製品飲料市場(尤其是亞太地區)的穩定成長帶動了牛奶無菌包裝的發展。與傳統包裝方法相比,保存期限長和無需冷藏等優點也可能有助於紙盒的成長。

亞太地區預計將出現最高成長

- 領先的飲料企業最近進入中國和印度市場,這為亞太液體紙盒包裝行業帶來了銷售的大幅成長。此外,千禧世代擴大使用包裝飲料,包括乳製品、軟性飲料和果汁,是推動液體紙盒包裝需求的另一個因素。

- 對永續性、技術進步和誘人的經濟效益的擔憂是過去二十年來推動中國液體包裝擴張的幾個因素。消費者對包裝的看法以及與包裝的互動迅速改變。供應商更加強調永續性,創意和更永續的紙板紙盒包裝取代該國舊的硬包裝選擇。由於市場對消費者友善包裝和增強產品保護的需求不斷成長,液體包裝預計將成為更實用、更實惠的替代品。

- 天然材料很容易取得並用於製造液體包裝的紙箱。此外,從製造商和消費者的角度來看,液體包裝紙盒擴大用於工業和機構環境,有助於該領域的擴張。

- 政府為減少碳足跡和開發永續包裝的有利措施也刺激了亞太地區對液體紙盒包裝的需求。例如,印度被印度品牌資產基金會評為第四大快速消費品市場。

液體包裝紙盒產業概況

由於 Elopak、Evergreen Packaging LLC 和 SIG Global Pte 等知名企業的加入,液體包裝市場呈現零碎狀態。有限公司以及該行業的本地參與者。不斷成長的合作、合併和收購也可能支持未來幾年的市場擴張。液體包裝產業將受益於環境問題日益嚴重、塑膠包裝的過度使用、紙箱包裝的可回收性以及使用液體包裝而不是玻璃包裝的便利性等因素。再生紙和輕量包裝是推動該市場的液體包裝創新的例子。

- 2022年 4月 - Elopak AS 宣布與 GLS 合作,為印度各地的消費者提供永續包裝解決方案。客戶可以從 GLS 購買「ALPAK」品牌的各種尺寸的捲筒式無菌紙盒,並提供端對端服務支援。該業務計劃提供新鮮的 Pure-Pak 紙盒、Pure-Pak 無菌紙盒和輔助解決方案。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 產業供應鏈分析

第5章 市場動態

- 市場促進因素

- 對環保包裝的需求不斷成長

- 市場限制

- 來自玻璃和塑膠包裝等替代品的競爭

- COVID-19 對市場的影響

第6章 市場細分

- 按液體類型

- 牛奶

- 果汁

- 能量飲品

- 其他液體類型

- 按地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 英國

- 德國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 亞太地區其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Elopak AS

- Evergreen Packaging LLC

- Greatview Aseptic Packaging Co. Ltd

- Mondi PLC

- Refresco Group NV

- SIG Global Pte. Ltd

- Tetra Laval International SA

- Nippon Paper Industries Co. Ltd

- IPI SRL

第8章 投資分析

第9章 市場的未來

The Liquid Packaging Cartons Market size is estimated at USD 12.54 billion in 2024, and is expected to reach USD 15.92 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Liquid packing cartons ensure content security and protection from outside pollutants, extending the product's shelf life. Both edible liquids, such as dairy goods, fruit juices, tomato sauce, soft drinks, and water, and non-edible liquids, like oils, fuels, and cleansers, are packaged in cartons.

Key Highlights

- The need for packaged liquid products is driven by the quick urbanization of developing countries, fostering market expansion. In addition, rising consumer expenditure and higher disposable income fuel the growth of the liquid packaging cartons market.

- The industry is expanding by introducing ecologically friendly liquid packing cartons due to growing environmental awareness. This trend is further supported by favorable policies by governments from various nations to promote the use of recyclable and eco-friendly packaging choices, speeding up market expansion.

- Fruit juice is a beverage category that is expanding quickly, yet the majority of these juices are susceptible to oxidation. Vitamins are lost during oxidation, and flavor and appearance also undergo unfavorable modifications. These undesirable quality changes frequently occur during the fluid's processing, packaging, transportation, or storage. Liquid carton expansion is impacted by new package design advancements brought on by the requirement for quality control.

- The demand for liquid packaging cartons will likely be hampered by the increased preference for plastic containers for packaging liquid food products due to their ease of transportation and cost-effective benefits.

- With the COVID-19 outbreak, the liquid packaging cartons market saw slow growth due to lockdowns being imposed across the world, which disrupted the supply chains and led to the closure of production plants.

Liquid Packaging Cartons Market Trends

Milk and Other Dairy Beverages to Witness Growth

- Milk is one of the main staple foods and a crucial component of a balanced diet as it contains a high percentage of calcium and other essential nutrients. Various research studies have shown that milk offers health benefits, such as preventing diabetes and enhancing bone health and healthy brain functioning.

- Consumers' growing preference for packaged goods like milk drives the need for liquid carton packaging solutions. The demand for brick-liquid cartons is fueled by increased sustainability concerns surrounding plastic usage.

- Milk has traditionally been packaged in cartons because they protect food and are eco-friendly. Paperboard is one of the materials that is regularly utilized to create milk packing cartons. Milk cartons, commonly referred to as gable-top cartons, are a type of poly-coated paper packaging.

- Milk cartons have a longer shelf life and a lower risk of contamination. Because liquid packing cartons are easy to reclose after use, consumption of these containers is anticipated to increase more quickly than in the previous 10 years.

- Steady growth in the dairy beverage market, especially in Asia-Pacific, has led to the development of aseptic packaging for milk. Advantages such as long shelf life and no refrigeration may also aid the growth of cartons over traditional packaging methods.

Asia-Pacific is Expected to Witness the Highest Growth

- Leading beverage businesses have recently entered the markets of China and India, which has given the Asia-Pacific liquid carton packaging industry a substantial boost in sales. In addition, millennials' growing use of packaged beverages, including dairy products, soft drinks, and juices, is another factor driving the need for liquid carton packaging.

- Concerns about sustainability, technological advancement, and alluring economics are a few factors that have contributed to the expansion of liquid packaging in China over the past two decades. Consumer perceptions of and interactions with packaging are evolving quickly. Vendors are emphasizing more on sustainability, and creative and more sustainable paperboard carton packaging is replacing old rigid packaging options in the country. Liquid packaging is anticipated to become a more practical and affordable alternative due to the market's growing desire for consumer-friendly packaging and enhanced product protection.

- Natural materials are readily available and used to make cartons for liquid packing. In addition, from the standpoints of manufacturers and consumers, liquid packing cartons are increasingly being used in industrial and institutional settings, thus contributing to the expansion of the segment.

- Favorable government initiatives to reduce carbon footprints and develop sustainable packaging also boost the demand for liquid carton packaging in Asia-Pacific. For instance, India is ranked as the fourth-largest fast-moving consumer goods market by the Indian Brand Equity Foundation.

Liquid Packaging Cartons Industry Overview

The liquid packaging market is fragmented because of prominent players, like Elopak, Evergreen Packaging LLC, and SIG Global Pte. Ltd, and local players in this industry. Growing collaborations, mergers, and acquisitions will also likely support the market expansion in the coming years. The sector for liquid packaging will be benefitted by factors such as rising environmental concerns, the excessive use of plastic packaging, the recyclable nature of carton packs, and the convenience of using liquid packaging rather than glass packaging. Recycled paper and lightweight packaging are examples of liquid packaging innovations propelling this market.

- April 2022 - Elopak AS announced a collaboration with GLS to deliver sustainable packaging solutions to consumers across India. Customers can purchase Roll-Fed aseptic cartons in a range of sizes from GLS under the "ALPAK" brand, together with end-to-end service support. The business plans to provide fresh Pure-Pak cartons, Pure-Pak aseptic cartons, and ancillary solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Eco-friendly Packaging

- 5.2 Market Restraints

- 5.2.1 Competition from Substitutes, such as Glass and Plastic Packaging

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Liquid Type

- 6.1.1 Milk

- 6.1.2 Juices

- 6.1.3 Energy Drinks

- 6.1.4 Other Liquid Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 France

- 6.2.2.2 United Kingdom

- 6.2.2.3 Germany

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia and New Zealand

- 6.2.3.5 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.5.3 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Elopak AS

- 7.1.2 Evergreen Packaging LLC

- 7.1.3 Greatview Aseptic Packaging Co. Ltd

- 7.1.4 Mondi PLC

- 7.1.5 Refresco Group NV

- 7.1.6 SIG Global Pte. Ltd

- 7.1.7 Tetra Laval International SA

- 7.1.8 Nippon Paper Industries Co. Ltd

- 7.1.9 IPI SRL