|

市場調查報告書

商品編碼

1444563

卵磷脂:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Lecithin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

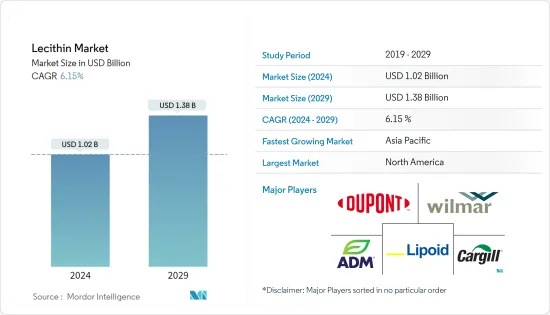

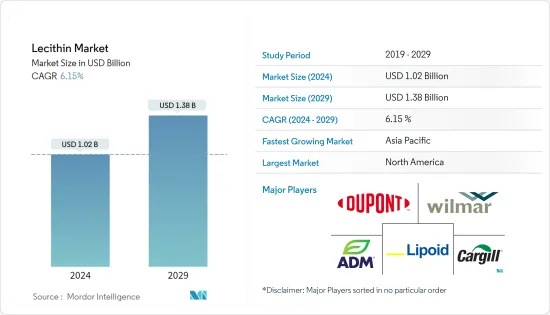

卵磷脂市場規模預計2024年為10.2億美元,預計到2029年將達到13.8億美元,在預測期內(2024-2029年)年複合成長率為6.15%成長。

主要亮點

- 心血管疾病、肥胖、骨質疏鬆症和糖尿病等與生活方式相關的健康問題的發生率不斷增加,增加了消費者對營養補充的需求。卵磷脂是重要成分之一。由於其多種醫療功效,它可以作為藥物食用或用於製造藥物。

- 卵磷脂在各種新產品的發布中發揮著重要作用,因為它可以改善肝臟和細胞功能、脂肪運輸和代謝、健康生殖、兒童發育,並為膽結石提供更好的治療方法。

- 向日葵卵磷脂因其較高的磷脂醯膽鹼 (PC) 含量和必需脂肪酸 (EFA) 等特性而被廣泛用作大豆卵磷脂的替代品。它的黏度比大豆卵磷脂低。因此,食品製造商選擇向日葵卵磷脂而不是無麩質。市場對有機卵磷脂的需求正在增加,主要是在糖果零食應用領域。此外,天然、安全、無過敏原等產品屬性也推動了需求。

- 此外,卵磷脂有助於結合脂肪並使其懸浮在即食食品中,改善高蛋白質成分的水合,降低蒸餾過程中的脂肪限制,並改善高脂肪粉末的分散。此外,其改善口感和質地以及促進成分均勻分佈的卓越能力使其有望進入即食食品類別。

- 巧克力、冰淇淋、口香糖和焦糖等富含糖分的產品構成了砂糖糖果零食。卵磷脂表面品質的提高增加了消費量在糖果零食行業的消費量。預計最終用途行業的需求在預測期內將保持在較高水平,因為這也有助於降低食品的水分含量。

卵磷脂市場趨勢

營養補充需求快速成長食品市場

- 卵磷脂補充品可以治療多種疾病,包括潰瘍性大腸炎、高膽固醇和其他幾種治療方法。印度健身科技公司GOQii進行的一項綜合調查顯示,2021年出現膽固醇問題的受訪者中,超過29.5%是60歲以上的老年人。當年,年輕人約佔受訪者的6%,青少年約佔6%。 7%的人有膽固醇問題。這些健康狀況增加了對卵磷脂補充品的需求。

- 此外,健康的生活方式促使消費者尋找各種營養補充食品維持和改善他們的整體健康。因此,對預防性醫療保健系統的關注加上對改善生活方式的產品的大力認可和行銷努力正在推動營養補充食品的卵磷脂市場。

- 影響市場的主要因素包括對源自各種自然資源的食品原料的需求不斷增加,推動了該行業的發展。根據市場需求,產品推出的快速增加預計將推動產業成長。

- 例如,Lasenor 宣布推出 VEROLEC ORGANIC,這是一種美國本土有機大豆卵磷脂,已獲得美國農業部 (USDA) 有機認證。此外,2021 年 9 月,AAK 宣布收購 BIC Elements。 BIC Elements 是卵磷脂市場的參與者,供應非基因改造特種卵磷脂和卵磷脂化合物。

亞太地區佔最大市場佔有率

- 天然原料的需求不斷增加,導致烘焙、糖果零食、乳製品和肉品中卵磷脂的使用量增加。烘焙產品對卵磷脂的需求龐大,因為它廣泛用於烘焙程序中,以均勻混合麵粉和添加成分以增加保濕性。基於麵粉重量,麵包配方中卵磷脂的添加量通常為 0.2%,夾心蛋糕中的添加量為 0.5-1.5%。亞洲國家正在迅速增加烘焙產品的生產和出口。

- 根據聯合國貿易聯合會的數據,印度出口了麵包、糕點、蛋糕和其他烘焙產品,價值 4.076 億美元,高於去年的 3.468 億美元出口。因此,烘焙產品銷售的增加正在推動全部區域的卵磷脂市場。

- 另一方面,由於各國對個人保健產品和化妝品的需求不斷增加,預計對脫油卵磷脂的需求也會增加。此外,中國水產養殖業的快速成長預計將增加動物飼料產業對卵磷脂的需求。

卵磷脂產業概況

全球卵磷脂市場正在經歷激烈的競爭,存在大量的地區和國際參與者。卵磷脂製造商正在加快產品推出的步伐,以加深客戶參與並滿足對卵磷脂產品不斷成長的需求。研究市場的主要企業包括 Lipoid GmbH、嘉吉公司、阿徹丹尼爾斯米德蘭公司、杜邦德內穆爾公司和豐益國際。

研究市場中的參與者提供了廣泛的卵磷脂,用於摻入麵包和糖果、化妝品、食品、營養補充和動物飼料等食品中,吸引更廣泛的最終用戶群以佔領更多市場佔有率。 。

公司正在積極擴大產品基礎並提高產能,以滿足食品和飲料行業新興應用的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

第5章市場區隔

- 材料

- 蛋

- 大豆

- 向日葵

- 其他原料

- 目的

- 食品和飲料

- 餵食

- 營養和補充品

- 藥品

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場分析

- 公司簡介

- Cargill Inc.

- Archer Daniels Midland Company

- Lipoid GmbH

- DuPont de Nemours, Inc

- Sternchemie Gmbh &Co. Kg

- VAV Life Sciences Pvt Ltd

- Bunge Limited

- Wilmar International

- Fishmer Lecithin

- American Lecithin Company

第7章市場機會與未來趨勢

The Lecithin Market size is estimated at USD 1.02 billion in 2024, and is expected to reach USD 1.38 billion by 2029, growing at a CAGR of 6.15% during the forecast period (2024-2029).

Key Highlights

- The rising incidences of lifestyle-based health issues, such as cardiovascular diseases, obesity, osteoporosis, and diabetes, have fuelled consumers' need for food supplements. Lecithin is one of the key ingredients; owing to its various medical benefits, it can be consumed as a medicine and used in medicine manufacturing.

- Lecithin improves liver and cell functioning, fat transport and metabolism, healthy reproduction, and child development, and offers better treatment for gallstone, thereby finding its place in various new product launches.

- Sunflower lecithin is widely used as a substitute for soy lecithin for its properties like higher phosphatidylcholine (PC) content and essential fatty acids(EFA). It is lower in viscosity than soy lecithin. Hence, food manufacturers are choosing sunflower lecithin over soy lecithin as it has gluten-free properties. The demand for organic lecithin has witnessed an uptick in the market, majorly in the confectionery application segment. Furthermore, the demand is also assisted by the product properties like natural, safe, and allergen-free.

- Moreover, lecithin helps to bind fat and keep it suspended in convenience food products, improve the hydration of high-protein components, lower the fat cap during the retort process, and improve the dispersion of high-fat powders. Additionally, its outstanding abilities to enhance mouthfeel and texture and make it easier for ingredients to be distributed evenly are anticipated to support its inclusion in the convenience food category.

- Products primarily high in sugar make up the confectionery segment, including chocolate, ice cream, gum, and caramels. Lecithin's improved surface qualities increase its consumption in the confectionery industry. The demand for it in the end-use segment is anticipated to remain high during the forecast period because it also helps to lower the moisture content of foods.

Lecithin Market Trends

Surge in Demand for Dietary Supplement Driving the Market

- Lecithin supplements can treat various conditions, including ulcerative colitis, high cholesterol, and a few other treatments. According to a comprehensive study performed by GOQii, a fitness technology company in India, over 29.5% of respondents who experienced cholesterol issues in 2021 were seniors over 60. Young people made up around 6% of the responders that year, whereas teens made up approximately 7% of those with cholesterol issues. Such health conditions have been driving the demand for lecithin-based supplements.

- Furthermore, a healthy lifestyle is prompting consumers to seek various dietary supplements to maintain and enhance their overall well-being. Thus, the intense focus on the preventive healthcare system, coupled with robust endorsements and marketing efforts of lifestyle enhancement products, is driving the market for lecithin in the dietary supplement industry.

- The primary factor affecting the market includes the increase in demand for food ingredients derived from various natural sources that would boost the sector. The surge in product launches according to the market demand is expected to propel the industry's growth.

- For instance, Lasenor announced the launch of VEROLEC ORGANIC, organic soya lecithin that originated in the United States with United States Department of Agriculture (USDA ) Organic Certification. Additionally, in September 2021, AAK announced the acquisition of BIC Ingredients. BIC Ingredients is a player in the lecithin market that supplies non-GM specialty lecithin and lecithin compounds.

Asia Pacific Holds the Largest Market Share

- The rising demand for natural ingredients is witnessing a rise in the usage of lecithin in bakery and confectionery, dairy, and meat products. The demand for lecithin in bakery products is significant as it is extensively used in baking procedures to increase moisture retention with even blending of flour with added ingredients. Lecithin is usually added to bread formulations at 0.2% and layer cakes at 0.5 - 1.5% based on flour weight. In Asian countries, there has been a surge in the production and exports of bakery products.

- According to the UN Comtrade, India exported bread, pastry, cakes, and other bakery products worth USD 407.6 million, which was higher than the previous year's exports valued at USD 346.8 million. Hence, the rise in sales of bakery products has been driving the lecithin market across the region.

- On the other hand, increased demand for personal care products and cosmetics in the countries is expected to boost the demand for de-oiled lecithin. Additionally, the booming aquaculture industry in China is expected to increase the demand for lecithin in the animal feed segment.

Lecithin Industry Overview

The global lecithin market witnesses high competition, with a considerable number of regional-level and international players. Lecithin manufacturers are increasing the pace of product releases to better engage with customers and meet the rising demand for lecithin-based goods. The top players in the market studied include Lipoid GmbH, Cargill Inc., Archer Daniels Midland Company, DuPont de Nemours, Inc, and Wilmar International.

The players in the market studied are focussing on developing a wider variety of lecithin formats for incorporation into food items, including bakery and confectionary, cosmetic, pharmaceutical, nutraceuticals, animal feed, and others, appealing to a broader end-user demographic to gain more market share.

Companies are actively expanding their product bases and are increasing their production capacity to meet the demand for the applications emerging from the food and beverage sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Egg

- 5.1.2 Soy

- 5.1.3 Sunflower

- 5.1.4 Other Sources

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.2 Feed

- 5.2.3 Nutrition and Supplements

- 5.2.4 Pharmaceuticals

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Position Analysis

- 6.3 Company Profiles

- 6.3.1 Cargill Inc.

- 6.3.2 Archer Daniels Midland Company

- 6.3.3 Lipoid GmbH

- 6.3.4 DuPont de Nemours, Inc

- 6.3.5 Sternchemie Gmbh & Co. Kg

- 6.3.6 VAV Life Sciences Pvt Ltd

- 6.3.7 Bunge Limited

- 6.3.8 Wilmar International

- 6.3.9 Fishmer Lecithin

- 6.3.10 American Lecithin Company