|

市場調查報告書

商品編碼

1444461

有機塗料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Organic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

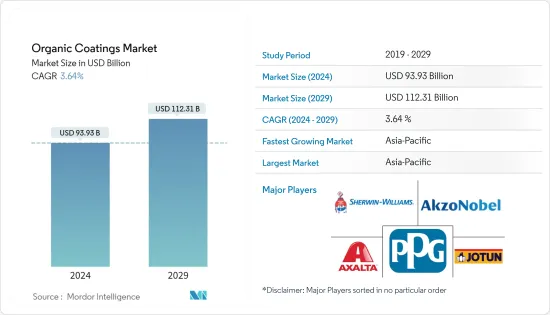

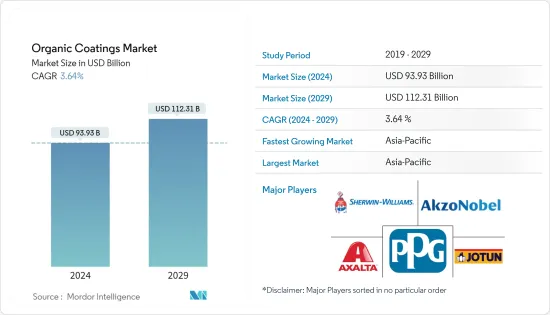

有機塗料市場規模預計到2024年為939.3億美元,預計到2029年將達到1,123.1億美元,預測期內(2024-2029年)年複合成長率為3.64%。

2020年,由於所有工業活動受到限制以及供應鏈中斷,市場受到了COVID-19疾病的負面影響。然而,自從限制解除以來,該行業一直在良好復甦。建築活動水準的增加可能會對所研究的市場產生正面影響。

主要亮點

- 從短期來看,有機塗料在防護應用中的使用不斷增加以及建築業的需求不斷增加是推動市場需求的一些因素。

- 與有機塗料相關的環境問題和替代品的可用性是阻礙市場成長的因素。

- 對環保有機塗料需求的潛在成長可能會在未來幾年創造市場機會。

- 預計亞太地區將主導市場,並且在預測期內也可能呈現最高的年複合成長率。

有機塗料市場趨勢

建築應用需求增加

- 建築塗料是用於建築物內部和外部的裝飾材料。建築塗料的主要目的是裝飾。然而,塗層為下面的建築材料提供了一些保護。

- 醇酸塗料是有機塗料中用途最廣泛、最有用的材料之一。風乾長油醇酸樹脂因其優異的彈性和室外耐久性而廣泛應用於高品質建築內牆塗料和磁漆。

- 根據中國的五年計畫(2022年1月),預計2022年中國建築業將成長6%。香港住宅委員會已推出多項措施,鼓勵興建廉租住宅。該機構的目標是在 10 年內提供 301,000 套社會住宅。

- 歐洲零售業也出現擴張,整個大陸都在興建新的購物中心。土耳其的大都會購物中心、瑞典的斯堪的斯堪地那維亞購物中心、英國的韋斯特菲爾德布拉德福德、奧地利的韋伯澤萊里德、比利時的歐洲購物中心和波蘭的盧布林購物中心是歐洲最近建設的一些購物中心。

- 根據美國人口普查局的數據,2021年12月美國建築支出經季節調整後的年率估計為16,399億美元,比11月修正估計值的16,365億美元成長0.2%。此外,2021年建築支出達到15,890億美元,比2020年的14,692億美元增加8.2%,顯示建築應用對塗料的需求增加。

- 這些因素可能會增加預測期內對有機塗料的需求。

亞太地區主導市場

- 在亞太地區,中國是GDP最大的經濟體。中國和印度是世界上成長最快的經濟體之一。

- 有機塗料在中國建築業的使用不斷增加。中國擁有全世界最大的建築業。隨著幾個大型建設計劃正在進行,中國可能會在一段時間內保持這一地位。

- 有機塗料也廣泛應用於車輛製造。在印度,汽車業對GDP總量的貢獻率為7.1%。製造業也對GDP貢獻了49%。印度汽車工業預計在未來幾年內成為全球銷售第三大汽車市場。

- 此外,2021年印度生產了4,399,112輛汽車,比2020年的3,394,446輛成長了30%。儘管半導體短缺導致製造業放緩,但印度汽車業對今年達到疫情前的生產水準持樂觀態度。

- 日本電動車市場正在成長,預計到 2035 年,電動車將佔汽車銷量的 100%。美國公司也可能在與電動車相關的各個領域找到商機。因此,國內電動車市場的擴大預計將推動有機塗料的成長。

- 所有上述因素都可能在預測期內擴大所研究的市場。

有機塗料產業概況

有機塗料市場本質上是部分整合的。市場上的主要企業包括(排名不分先後)宣偉公司、PPG工業公司、阿克蘇諾貝爾、佐敦和艾仕得塗料系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加在防護應用的使用

- 建築業的需求不斷增加

- 抑制因素

- 與有機塗料相關的環境問題

- 確保替補人員

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(收益市場規模)

- 類型

- 底漆

- 面漆

- 其他類型

- 目的

- 保護

- 海洋

- 建築學

- 車

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- AKZO Nobel NV

- Anochrome Group

- Axalta Coating Systems Ltd

- Dupont

- Dymax

- Jotun

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

第7章市場機會與未來趨勢

- 對環保有機塗料的潛在需求不斷成長

The Organic Coatings Market size is estimated at USD 93.93 billion in 2024, and is expected to reach USD 112.31 billion by 2029, growing at a CAGR of 3.64% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020 due to restrictions on all industrial activities and disruptions in the supply chain. However, the sector has been recovering well since restrictions were lifted. The rise in the level of architectural activities is likely to positively impact the studied market.

Key Highlights

- Over the short term, increasing usage of organic coatings in protective applications and the rising demand from the building and construction sector are some of the factors driving the market demand.

- The environmental concerns related to organic coatings and the availability of substitutes are the factors hindering the market's growth.

- The rising potential demand for eco-friendly organic coatings is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Organic Coatings Market Trends

Increasing Demand from Architectural Applications

- Architectural coatings are finishes used for the interiors and exteriors of buildings. The main purpose of an architectural coating is decorative. However, the coating also provides some protection to the underlying building materials.

- Alkyd paints are among the most versatile and useful materials in organic coatings. Long-oil alkyds of the air-drying type are widely used in high-quality interior architectural paints and enamels due to their good elasticity and exterior durability.

- According to China's Five Year Plan (January 2022), the construction industry in the country is estimated to register a growth rate of 6% in 2022. The housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years.

- Europe also witnessed an expansion in retail, with the new construction of malls across the continent. The Metropol Mall in Turkey, the Mall of Scandinavia in Sweden, Westfield Bradford in the United Kingdom, Weberzeile Ried in Austria, the Mall of Europe in Belgium, and Lublin Mall in Poland are some of the recent constructions in Europe.

- According to the US Census Bureau, in December 2021, the construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,639.9 billion, 0.2% more than the revised November estimate of USD 1,636.5 billion. Moreover, in 2021, construction spending amounted to USD 1,589.0 billion, 8.2% above USD 1,469.2 billion in 2020, thereby indicating an increase in the demand for coatings from architectural applications.

- Such factors are likely to increase the demand for organic coatings during the forecast period.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, China is the largest economy in terms of GDP. China and India are among the fastest-growing economies in the world.

- Organic coatings are increasingly used in China's building and construction industry. China is home to the world's largest construction industry. With several major construction projects in progress, China will likely maintain this position for the foreseeable future.

- Organic coatings are also widely used in vehicle manufacturing. In India, the contribution of the automobile sector to the overall GDP stands at 7.1%. It also contributes 49% of the manufacturing GDP. The Indian automotive industry is expected to be the world's third-largest automotive market in terms of volume in a few years.

- In addition, 43,99,112 vehicles were produced in India in 2021, which increased by 30% compared to 33,94,446 units manufactured in 2020. The Indian automotive sector is optimistic about reaching pre-pandemic levels of production volume this year, despite manufacturing being hampered by a semiconductor shortage.

- Japan is expected to have 100% of its car sales be EVs by 2035, and the Japanese electric vehicle market is growing. US companies may also find business opportunities in various areas related to electric vehicles. The expansion of the electric vehicle market in the country is therefore projected to aid the growth of organic coatings.

- All the aforementioned factors are likely to augment the studied market over the forecast period.

Organic Coatings Industry Overview

The organic coatings market is partially consolidated in nature. Some of the major players in the market include Sherwin-Williams Company, PPG Industries Inc., Akzo Nobel, Jotun, and Axalta Coating Systems (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in Protective Applications

- 4.1.2 Rising Demand From the Building and Construction Sector

- 4.2 Restraints

- 4.2.1 Environmental Concerns Related to Organic Coatings

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Type

- 5.1.1 Primers

- 5.1.2 Topcoats

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Protective

- 5.2.2 Marine

- 5.2.3 Architectural

- 5.2.4 Automotive

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AKZO Nobel NV

- 6.4.2 Anochrome Group

- 6.4.3 Axalta Coating Systems Ltd

- 6.4.4 Dupont

- 6.4.5 Dymax

- 6.4.6 Jotun

- 6.4.7 Nippon Paint Holdings Co. Ltd

- 6.4.8 PPG Industries Inc.

- 6.4.9 RPM International Inc.

- 6.4.10 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Potential Demand for Eco-friendly Organic Coatings

![類鑽碳 [DLC] 市場(類型:純 DLC 和混合 DLC;應用:鑽頭和銑刀、鋸片和刀片、模具、刀片等)- 全球行業分析、規模、佔有率、成長、 2023-2031 年趨勢和預測](/sample/img/cover/42/1420855.png)