|

市場調查報告書

商品編碼

1444460

PGM(鉑族金屬):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Platinum Group Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

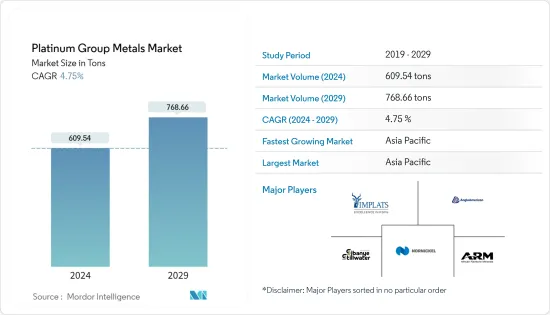

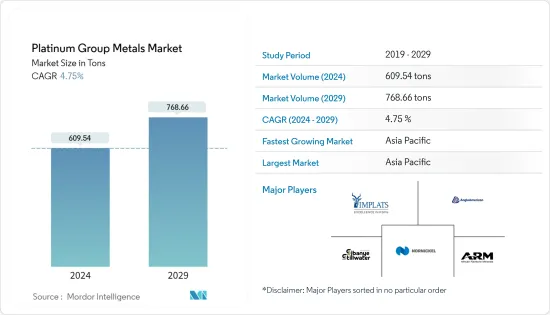

PGM(鉑族金屬)市場規模預計到2024年為609.54噸,預計到2029年將達到768.66噸,在預測期內(2024-2029年)年複合成長率為4.75%。

COVID-19 大流行對 2020 年的市場產生了負面影響。然而,市場預計將達到大流行前的水平,並在預測期內穩定成長。

主要亮點

- 短期內,汽車產業對觸媒轉換器的需求不斷成長,以及電子產業對鉑、鈀和釕的需求不斷成長,預計將推動市場成長。

- 然而,與維護 PGM(鉑族金屬)相關的高成本預計將阻礙市場成長。

- 儘管如此,PGM(鉑族金屬)在電子領域應用的研發活動不斷增加,以及非洲國家對PGM(鉑族金屬)投資的增加,將在未來幾年為市場創造機會。 。

- 預計亞太地區將在預測期內佔據主導地位並呈現出最高的年複合成長率。

PGM(鉑族金屬)市場趨勢

自動催化劑領域佔據市場主導地位

- 觸媒轉換器使用蜂巢狀結構中塗有 PGM(鉑族金屬)的陶瓷工具來引發轉化有害污染物的化學反應。它安裝在排氣系統中的引擎和消音器之間。當引擎加熱金屬時,它會中和污染物。

- 鉑金受益於 2022 年汽車產量的增加,因為經濟型汽車製造商擴大尋求用更昂貴的鈀金取代鉑金。鉑金是柴油觸媒轉換器的首選,鈀金是汽油動力車輛的首選。儘管如此,在柴油車和汽油車中,這兩種金屬都可以互換為一種金屬,如果一種金屬相當昂貴,這種情況很常見。

- 根據國際汽車建設組織(OICA)的數據,2021年所有汽車的全球銷量為8268萬輛,而2020年為7877萬輛。根據OICA的數據,2021年所有汽車的總產量統計為8014萬輛。 2020年將增至7,762萬人。

- 根據世界貿易組織的數據,2021年進口額約2,860億美元,使美國成為第二大汽車產品進口國。同時,該國出口了價值約 1,260 億美元的汽車產品。

- 所有上述因素預計將在預測期內推動汽車催化劑領域的發展並增加對 PGM(鉑族金屬)的需求。

亞太地區預計將主導市場

- 亞太地區在PGM(鉑族金屬)市場中佔據最大佔有率,幾乎佔據全球佔有率的一半。預計它將成為成長最快的市場。

- 2021年3月,根據當局製定的節能汽車發展計畫,中國宣布計畫在2030年擁有100萬輛燃料電池汽車運作。儘管未來八年建造了 1,000 個加氫站(主要集中在重型車輛),但去年該類型汽車僅售出 2,700 輛。這可能會在預測期內推動國內燃料電池需求。

- 印度電子市場預計未來三年將達到4000億美元。此外,預計2025年印度將成為全球第五大消費性電子與電器產品產業。

- 此外,計劃推出的 5G 網路和物聯網 (IoT) 使用的增加等技術變革正在推動印度電子產品的採用。由於「數位印度」和「智慧城市」計劃等舉措,該國對物聯網的需求正在增加。

- 日本化學工業是該國僅次於運輸設備的第二大製造業,為貴金屬催化劑提供了優良的市場基礎。主要企業集團主導日本的化學工業。大多數都高度多元化,並擁有眾多子公司。

- 因此,所有上述因素都可能增加預測期內PGM(鉑族金屬)市場的需求。

PGM(鉑族金屬)產業概況

PGM(鉑族金屬)市場得到整合,前五名公司佔據了主要市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車產業對觸媒轉換器的需求不斷成長

- 電子業對鉑、鈀和釕的需求增加

- 亞太國家珠寶消費增加

- 抑制因素

- 維護成本高

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 生產分析

- 價格趨勢

第5章市場區隔(市場規模(數量))

- 金屬型

- 鉑

- 鈀

- 銠

- 銥

- 釕

- 鋇

- 目的

- 汽車觸媒

- 電氣和電子

- 燃料電池

- 玻璃、陶瓷、顏料

- 珠寶

- 醫療(牙科和製藥)

- 化學品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析**/排名分析

- 主要企業採取的策略

- 公司簡介

- African Rainbow Minerals

- Anglo American Platinum

- Glencore

- Implats Platinum Limited

- Johnson Matthey

- Northam Platinum Limited

- PJSC MMC Norilsk Nickel

- Royal Bafokeng Platinum

- Sibanye-Stillwater

- Vale Acton

第7章市場機會與未來趨勢

- 燃料電池的未來用途

- 增加對非洲國家的投資

The Platinum Group Metals Market size is estimated at 609.54 tons in 2024, and is expected to reach 768.66 tons by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and grow steadily during the forecast period.

Key Highlights

- Over the short term, the growing demand for catalytic converters from the automotive industry and increasing demand for platinum, palladium, and ruthenium from the electronics industry are expected to drive market growth.

- However, the high costs involved in maintaining platinum group metals are expected to hinder the market's growth.

- Nevertheless, increasing R&D activities for applying platinum group metals in the electronics sector and increasing investments in the African countries in platinum group metals will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate and witness the highest CAGR during the forecast period.

Platinum Group Metals Market Trends

Autocatalysts Segment Dominated the Market

- Catalytic converters employ a ceramic tool structured like a honeycomb and covered with PGMs (platinum group metals) to initiate a chemical reaction that transforms hazardous pollutants. It is installed between the engine and the muffler in the exhaust system. When the engine heats the metals, the procedure neutralizes the contaminants.

- Platinum profited from increased car manufacture in 2022 as economical automakers increasingly attempt to swap it for more expensive palladium. Platinum is preferred in diesel catalytic converters, while palladium is preferred in gas-powered automobiles. Nevertheless, both metals may be exchanged, one for the other, in diesel- and gas-powered vehicles, which is common when one of the metals is somewhat expensive.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global sales of all vehicles in 2021 were 82.68 million, compared to 78.77 million in 2020. According to the OICA, total production statistics for all vehicles was 80.14 million in 2021, compared to 77.62 million in 2020.

- According to the World Trade Organization, with a value of about USD 286 billion in 2021, the United States was the second largest importer of automotive products. Simultaneously, the country exported automobile items worth around USD 126 billion.

- All the factors above are expected to drive the autocatalysts segment, enhancing the demand for platinum group metals during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region accounted for the largest share in the market for platinum group metals, with almost half of the global share. It is expected to be the fastest-growing market.

- In March 2021, the country announced the plan to include 1 million fuel-cell vehicles in operation by 2030, according to an energy-savings vehicle development plan drafted by authorities. Despite only 2,700 such cars selling in the country last year and the construction of 1,000 hydrogen refueling stations over the next eight years, majorly focusing on heavy-duty vehicles. It will likely drive the demand for fuel cells in the country during the forecast period.

- The Indian electronics market is expected to reach USD 400 billion over the next three years. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- Additionally, in India, technology transitions, such as the country planning to introduce 5G networks and the increasing use of IoT (Internet of Things), are driving the adoption of electronics products. Initiatives such as 'Digital India' and 'Smart City' projects have raised the demand for IoT in the country.

- The Japanese chemical industry is the country's second-largest manufacturing industry behind transportation machinery, providing a good market base for precious metal catalysts. A group of significant corporations dominates the Japanese chemical industry. Most of them are highly diversified and sport a large number of subsidiaries.

- Thus, all the above factors will likely increase the demand for the platinum group metals market during the forecast period.

Platinum Group Metals Industry Overview

The platinum group metals market is consolidated, with the top five players accounting for a significant market share. Some of the major players in the market include (not in a particular order) Anglo American Platinum, Norilsk Nickel, Implats Platinum Limited, Sibanye-Stillwater, and African Rainbow Minerals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Catalytic Converters from the Automotive Industry

- 4.1.2 Increasing Demand for Platinum, Palladium, and Ruthenium from the Electronics Industry

- 4.1.3 Growing Jewelry Consumption in Asia-Pacific Countries

- 4.2 Restraints

- 4.2.1 High Costs Involved in Maintenance

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Analysis

- 4.6 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Osmium

- 5.2 Application

- 5.2.1 Auto Catalysts

- 5.2.2 Electrical and Electronics

- 5.2.3 Fuel Cells

- 5.2.4 Glass, Ceramics, and Pigments

- 5.2.5 Jewellery

- 5.2.6 Medical (Dental and Pharmaceuticals)

- 5.2.7 Chemicals

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 African Rainbow Minerals

- 6.4.2 Anglo American Platinum

- 6.4.3 Glencore

- 6.4.4 Implats Platinum Limited

- 6.4.5 Johnson Matthey

- 6.4.6 Northam Platinum Limited

- 6.4.7 PJSC MMC Norilsk Nickel

- 6.4.8 Royal Bafokeng Platinum

- 6.4.9 Sibanye-Stillwater

- 6.4.10 Vale Acton

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Use of Fuel Cells

- 7.2 Increasing Investment in the African Countries