|

市場調查報告書

商品編碼

1444448

汽車ECU(電控系統):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Electronic Control Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

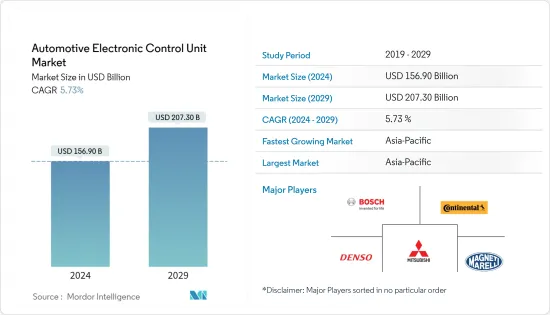

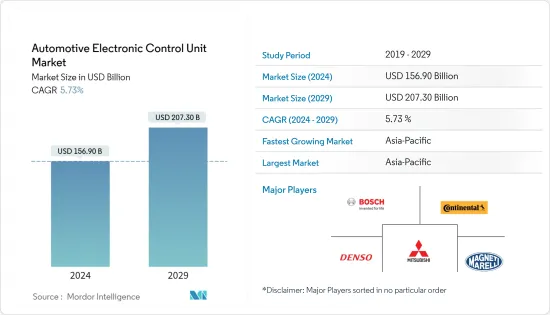

汽車ECU(電控系統)市場規模預計到2024年為1569億美元,預計到2029年將達到2073億美元,在預測期內(2024-2029年)增加57.3億美元,年複合成長率為%。

由於汽車製造業的關閉和封鎖,COVID-19感染疾病不可避免地對汽車ECU(電控系統)市場產生負面影響。然而,隨著全球電動車的採用率與前一年同期比較快速成長,市場預計將重新獲得動力。

市場主要由技術進步和製度創新所驅動。在已開發國家,消費者對駕駛便利性和安全性的偏好正在推動市場成長。導航和資訊娛樂系統是全球大多數汽車的標準配置,其採用率正在不斷增加。為了將這些系統相互連接,需要電控系統汽車連接器。

政府減少燃油使用的法規以及公眾提高車輛燃油效率的需求不斷增加也是導致汽車領域ECU市場高速成長的主要因素。

已開發國家混合動力汽車和純電動車等替代車輛選擇的穩定成長對 ECU 市場做出了重大貢獻,因為這些車輛與傳統車輛相比非常複雜。促進因素安全、保全問題、駕駛便利性、客戶要求的減少維護負擔也是推動 ECU 市場成長的一些因素。

將智慧型手機連接到車輛並為駕駛員提供有關車輛狀況的即時資訊已成為當今的一大趨勢。這些先進的 ECU 系統能夠輕鬆地與智慧型手機連接,從而促進 ECU 系統的發展。

由於該地區對電動車的需求不斷成長,預計亞太地區,其次是北美和歐洲,在預測期內將顯著成長。此外,已開發國家和新興國家對混合動力汽車等技術先進車輛的需求不斷成長,預計將推動 ECU 市場的成長。

汽車ECU(電控系統)市場趨勢

由於電動車銷量的增加,對 ECU 的需求正在擴大

全球對電動車的需求正在快速成長,預計這將增加這些車輛對 ECU 的需求。此外,有利的政府補貼和措施也成為促進 ECU 市場成長的催化劑。到 2040 年,近 54% 的新車銷量和 33% 的全球持有將是電動車。

歐洲各國政府已經啟動了各種計劃,在全部區域建造充電基礎設施,以滿足電動車銷售目標。汽車產業的轉變預計將影響汽車製造商、電子元件製造商、售後市場和產業的供應鏈。

隨著電動車需求和銷量的增加,僅與內燃機汽車相關的零件製造商正在將業務擴展到電動車領域。在汽車診斷市場中,用於引擎控制和變速箱的ECU等組件將被用於電氣架構和電池管理系統的ECU所取代。

此外,預計傳統的診斷系統將完全被汽車診斷系統所取代,該系統可以持續監控車輛所有電氣和機械部件的狀況。

預計亞太地區將主導 ECU 市場

由於小客車汽車娛樂和通訊應用的需求不斷成長、可支配收入的增加以及該地區汽車產量的增加,亞太地區在汽車 ECU(電控系統)市場佔據主導地位。

由於中國和日本的存在,亞太地區的電動普及很高。中國是電動車的主要市場,推進電動車技術的汽車製造商大多是日本人。電動車的發展可能與該地區 ECU 市場需求的增加有關,該地區目前在收益和銷售方面佔據最高的市場佔有率。

由於豪華車需求的增加、節能汽車需求的增加以及政府為減少該地區碳排放而製定的嚴格法規,預計北美汽車電控系統市場也將成長。

由於豪華車和小客車對資訊娛樂和通訊應用的需求不斷成長,歐洲汽車 ECU 市場正在不斷成長。德國、義大利等歐洲國家的主要汽車製造商越來越注重提供豪華和舒適功能,這為市場成長創造了進一步的機會。

汽車ECU(電控系統)產業概況

汽車電控系統市場由李爾公司、羅伯特博世有限公司、日本電產公司、大陸集團和德爾福科技等公司主導。世界各地的公司正在採用各種創新技術並投資研發計劃。此外,製造商正在透過在世界各地開設經銷商和分銷網路來擴大其網路,以賺取利潤並加強其在行業中的影響力。例如,

2021 年 10 月,Motherson 擴大了與馬瑞利汽車照明 (Marelli) 的合作,在印度設立了一個新工具室。這將是印度第一個專門用於特定照明應用的此類工具室。該工具室將是現有合資企業 Marelli Motherson Automotive Lighting India Private Limited 的延伸。這家 50/50 合資企業成立於 2008 年,旨在迎合印度戶外照明市場,目前在印度擁有四家工廠。

2020年3月,羅伯特·博世有限公司與尼古拉馬達公司建立合作夥伴關係,開發一款負載容量為40噸的燃料電池卡車。先進卡車系統的關鍵要素是博世車輛控制單元,它減少了獨立單元的數量,同時為先進功能提供了更高的運算能力。 VCU 透過為複雜的電子/電子架構提供可擴展的平台來支援未來的創新,這對於支援 Nikola 卡車的高級功能至關重要。

2021年10月,採埃孚宣布其主動後軸轉向系統AKC(主動運動控制)自2013年推出以來已生產100萬套。 AKC 在各種駕駛情況下都能提供敏捷性、安全性和舒適性。

由於上述案例和發展,汽車電控系統市場的參與者預計將集中精力佔領大部分市場佔有率,並可能在預測期內擴大其地理分佈。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 透過促銷

- 內燃機

- 混合

- 電池電動車

- 按用途

- ADAS 與安全系統

- 車身控制與舒適系統

- 資訊娛樂和通訊系統

- 動力傳動系統系統

- 透過ECU

- 16位ECU

- 32位ECU

- 64位ECU

- 自主性別

- 常規車

- 半自動駕駛汽車

- 自動駕駛汽車

- 搭車

- 小客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Lear Corporation

- Robert Bosch GmbH

- Nidec Corporation

- Continental AG

- Aptiv PLC

- Leopold Kostal GmbH &Co. KG

- ZF Friedrichshafen AG

- Autoliv Inc.

- Magneti Marelli

第7章市場機會與未來趨勢

The Automotive Electronic Control Unit Market size is estimated at USD 156.90 billion in 2024, and is expected to reach USD 207.30 billion by 2029, growing at a CAGR of 5.73% during the forecast period (2024-2029).

The negative impact of the COVID-19 pandemic on the automotive electronic control unit market was inevitable due to shut down of automotive manufacturing units and lockdowns. However, the market is expected to regain momentum due to the swiftly escalating year-on-year adoption rate of electric vehicles worldwide.

The market is primarily driven by technological advancements and innovation in systems. In developed nations, increasing consumer preference for driving convenience and safety is driving the market's growth. The adoption of navigation and infotainment systems is growing as they have become standard features in most cars across the world. Central electronic control unit automotive connectors are required to connect these systems to one another.

Government regulations to reduce fuel usage and increasing demand for better mileage of vehicles from the general public are other major factors leading to the high growth of the ECU market in the automotive sector.

The steady growth of alternative vehicle choices, such as hybrid and pure electric cars, in developed nations has contributed significantly to the ECU market due to the high complexities of these vehicles over conventional vehicles. Driver safety, security concerns, ease of driving, and low maintenance demanded by the customers are also some of the factors driving the growth of the ECU market.

Connecting smartphones to the vehicle and providing the driver with real-time information about the vehicle's state is a major trend in recent times. These advanced ECU systems, with the provision to connect with smartphones easily, can lead to an improvement in the growth of ECU systems.

The Asia-Pacific region, followed by North America and Europe, is anticipated to witness significant growth during the forecast period owing to the growing demand for electric vehicles in the region. Moreover, increased demand for technologically advanced vehicles like hybrid vehicles in developed and developing countries is expected to drive the growth of the ECU market.

Automotive Electronic Control Unit Market Trends

Rising Electric Vehicle Sales to Boost Demand for ECUs

The demand for electric vehicles is growing rapidly across the world, and this is expected to augment the demand for ECU in these vehicles. In addition, favorable government subsidies and initiatives act as catalysts for boosting the growth of the ECU market. By 2040, nearly 54% of new car sales and 33% of the global car fleet will be electric.

The European government has already started various projects for building charging infrastructure across the regions to meet the electric vehicle sales target. This transformation in the automotive sector is expected to impact the automakers, electronic component manufacturers, aftermarkets, and the sector's supply chain.

Manufacturers of parts and components only pertaining to IC engine vehicles are now expanding their business into the electric vehicle domain as the demand for and sale of electric vehicles increases. In the automotive diagnostics market, components, such as ECU for engine control and transmission would be replaced by ECUs for electrical architecture and battery management systems.

Moreover, the conventional diagnostic systems are anticipated to be replaced entirely by onboard diagnostic systems that would continually monitor the health of all the electric and mechanical components of the vehicle.

Asia-Pacific Anticipated to Dominate the ECU Market

Asia-Pacific dominates the automotive electronic control unit market due to a rise in the demand for in-vehicle infotainment and communication applications in passenger vehicles, increased disposable income, and a rise in automobile production in this region.

Electrification in the Asia-Pacific region has witnessed a high penetration rate due to the presence of China and Japan, as China is the leading market for electric vehicles, and most automakers advancing in electric vehicle technology are from Japan. This development in electric vehicles can be correlated to the increased demand in the market for ECU in the region, which currently holds the highest market share in terms of both revenue and volume.

North America is also expected to witness growth in the automotive electronic control unit market due to increased demand for luxury cars, growing demand for energy-efficient vehicles, and strict government regulations to reduce carbon emissions in this region.

The European automotive ECU market is growing as infotainment & communication applications are experiencing high demand for their implementation in luxury & passenger vehicles. The growing focus on providing luxury and comfort features by leading automotive manufacturers present in European countries, including Germany, Italy, etc., is further creating opportunities for the market's growth.

Automotive Electronic Control Unit Industry Overview

The automotive electronic control unit market is dominated by players such as Lear Corporation, Robert Bosch GmbH, Nidec Corporation, Continental AG, and Delphi Technologies, among others. Companies worldwide are adopting various innovative technologies and investing in R&D projects. Moreover, manufacturers are expanding their networks by developing dealership and distribution networks globally to gain profits and strengthen their industry presence. For instance,

In October 2021, Motherson extended its cooperation with Marelli Automotive Lighting (Marelli) for a new tool room in India. This will be the first of its kind tool room in India dedicated to specific lighting applications. The toolroom will be an extension of the existing joint venture company Marelli Motherson Automotive Lighting India Private Limited. The 50/50 JV was established in 2008 to address the Indian exterior lighting market, and now it has four plants in India.

In March 2020, Robert Bosch GmBH and Nikola Motor Company formed a partnership to develop a fuel cell truck with a capacity of 40 ton. The key element of the advanced truck system is the Bosch vehicle control unit, which provides higher computing power for advanced functions while reducing the number of independent units. The VCU supports future innovations by providing a scalable platform for the complex e/e architecture, which is essential to support the advanced features of Nikola's trucks.

In October 2021, ZF announced that one million units of its active rear-axle steering system AKC (Active Kinematics Control) had been produced since its launch in 2013. AKC enables agility, safety, and comfort in numerous driving situations.

Owing to the abovementioned instances and developments, players in the automotive electronic control unit market are anticipated to focus on capturing the majority of the market share and are likely to expand their geographical presence during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Propulsion

- 5.1.1 Internal Combustion Engine

- 5.1.2 Hybrid

- 5.1.3 Battery Electric Vehicle

- 5.2 By Application

- 5.2.1 ADAS and Safety System

- 5.2.2 Body Control and Comfort System

- 5.2.3 Infotainment and Communication System

- 5.2.4 Powertrain System

- 5.3 By ECU

- 5.3.1 16-bit ECU

- 5.3.2 32-bit ECU

- 5.3.3 64-bit ECU

- 5.4 By Autonomy

- 5.4.1 Conventional Vehicle

- 5.4.2 Semi-autonomous Vehicle

- 5.4.3 Autonomous Vehicle

- 5.5 By Vehicle

- 5.5.1 Passenger Car

- 5.5.2 Commercial Vehicle

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 US

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 UK

- 5.6.2.2 France

- 5.6.2.3 Germany

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle-East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Lear Corporation

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Nidec Corporation

- 6.2.4 Continental AG

- 6.2.5 Aptiv PLC

- 6.2.6 Leopold Kostal GmbH & Co. KG

- 6.2.7 ZF Friedrichshafen AG

- 6.2.8 Autoliv Inc.

- 6.2.9 Magneti Marelli