|

市場調查報告書

商品編碼

1444409

可再生能源:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

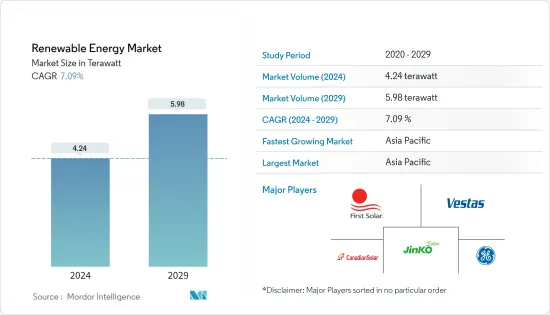

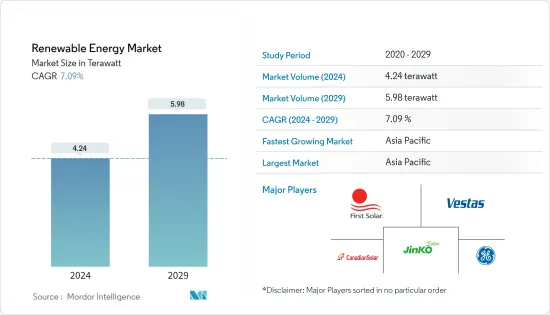

可再生能源市場規模預計到 2024 年為 4.24 兆瓦,預計到 2029 年將達到 5.98 兆瓦,在預測期內(2024-2029 年)年複合成長率為 7.09%。

2020 年,市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從長遠來看,市場的主要驅動力是有利的政府政策,隨著太陽能板和風力發電機設備價格的下降,可再生能源的採用越來越多。

- 另一方面,擴大採用燃氣發電廠和核能計劃等替代清潔能源可能會減緩市場成長。

- 太陽能生產和使用能源儲存系統解決間歇性問題的技術進步可能為所研究的市場提供重要機會。

- 預計亞太地區將成為預測期內成長最快的市場,其中大部分需求來自中國和印度。

可再生能源市場趨勢

水電產業佔市場主導地位

- 水力發電(水力發電)是再生能源來源,利用從高地流向低地的水的能量來發電。發電工程也有助於為農業、家庭和企業提供清潔用水,並減少洪水和乾旱等極端天氣事件的影響。

- 水力發電是世界上最大的再生能源來源。 2022年,水力發電將佔可再生能源可再生能源發電的近41%,成為全球可再生能源發電的最大貢獻者。

- 根據國際可再生能源機構的數據,2022年全球水力發電裝置容量達到1,393吉瓦(GW),較2021年成長2.19%。由於未來水力發電發電工程和技術進步,水電裝置容量預計將增加。

- Natel Energy 由兄弟和麻省理工學院的畢業生於 2022 年 8 月創立,開發水力發電系統,配備對魚類安全的渦輪機和其他模仿自然河流條件的功能。因此,由於這種環保發展,預計在預測期內對水力發電領域的需求將會增加。

- 此外,2022年8月,印度政府宣佈在尼泊爾開發兩個水力發電發電工程,分別為西塞蒂發電工程和塞蒂河水力發電發電工程。這些計劃的總成本預計約為24億美元。

- 因此,預計水電領域將在預測期內主導市場。

亞太地區主導市場

- 近年來,亞太地區在可再生能源市場上佔據主導地位。在預測期內,它可能會保持其主導地位。

- 到2022年,中國將成為可再生能源部署的世界領導者。 與前一年同期比較全國可再生能源總裝置容量達1,160.8吉瓦,較去年同期成長約13.4%。水力發電、太陽能和風電是該國主要的再生能源來源。

- 由於經濟擴張和人口成長,印度的電力需求大幅增加。 2022年,該國水電發電量將為162.96吉瓦,高於2021年的147.12吉瓦。

- 此外,印度是繼中國和美國之後的世界第三大電力消耗。此外,印度的淨發電能力在過去十年中大幅成長,其中大部分來自再生能源來源。

- 印度政府設定了2022年部署175GW可再生能源的目標,其中包括100GW太陽能、60GW風電、10GW生物發電和5GW小型水力。此外,印度新能源和可再生能源部預計到2022年可再生能源、電動車、太陽能設備製造和綠色氫能的投資將達到150億美元。

- 此外,2022年1月,SJVN(Satluj Jal Vidyut Nigam Ltd)透過北方邦新能源和可再生能源發展局(UPNEDA)舉行的競標,獲得了北方邦125兆瓦的太陽能發電工程,並中標。其中包括賈勞恩 (Jalaun) 的 75 兆瓦併網太陽能發電工程和坎普爾德哈特 (Kanpur Dehat) 地區的 50 兆瓦太陽能發電工程。

- 日本政府也計劃在2030年將碳排放減少50%,到2050年實現碳中和。在預測期內,亞太地區可能主導可再生能源市場。

可再生能源產業概況

可再生能源市場本質上是分散的。市場的主要企業包括(排名不分先後)First Solar Inc.、Vestas Wind Systems A/S、Canadian Solar Inc.、Jinko Solar Holding 和 General Electric Company。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 調查先決條件

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 可再生能源結構,2022 年

- 可再生能源發電趨勢

- 到 2028 年可再生能源裝置容量(GW)和預測

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 有利的政府政策和擴大可再生能源的引進

- 太陽能電池板和風力發電機設備的價格下降

- 抑制因素

- 更多採用替代清潔能源

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對的強度

第5章市場區隔

- 類型

- 太陽

- 風

- 水力發電

- 生質能源

- 其他類型(地熱、潮汐等)

- 地區

- 北美洲

- 美國

- 加拿大

- 其他

- 歐洲

- 英國

- 德國

- 法國

- 其他

- 亞太地區

- 中國

- 印度

- 日本

- 其他

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 伊朗

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- EPC開發商/營運商/業主

- Orsted AS

- EDF SA

- NextEra Energy Inc.

- Duke Energy Corporation

- Berkshire Hathway Energy

- Acciona Energia SA

- 設備供應商

- First Solar Inc.

- Vestas Wind Systems A/S

- Canadian Solar Inc.

- Jinko Solar Holding Co. Ltd

- General Electric Company

- Siemens Gamesa Renewable Energy, SA

- EPC開發商/營運商/業主

第7章市場機會與未來趨勢

- 太陽能發電的技術進步和使用能源儲存系統解決間歇性問題

The Renewable Energy Market size is estimated at 4.24 terawatt in 2024, and is expected to reach 5.98 terawatt by 2029, growing at a CAGR of 7.09% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market are the favorable government policies, increasing adoption of renewable energy with the declining price of solar panels and wind turbines installations.

- On the flip side, the rising adoption of alternate clean power sources, such as gas-fired power plants and nuclear energy projects are likely to slow down the market growth.

- Technological advancements in solar PV manufacturing and solving intermittency problems using energy storage systems are likely to provide huge opportunities for the market studied.

- Asia-Pacific is expected to be the fastest-growing market during the forecast period, with the majority of the demand coming from China and India.

Renewable Energy Market Trends

Hydropower Segment to Dominate the Market

- Hydroelectric power (hydropower) is a renewable energy source where electrical power is derived from the energy of water moving from higher to lower elevations. Hydropower projects also supply clean water for agriculture, homes, and business and help mitigate the impacts of extreme weather events, such as floods and drought.

- Hydropower is the single largest source of renewable electricity globally. In 2022, renewable electricity generation from hydropower accounted for nearly 41% of total renewable energy, the largest contribution from hydropower in global renewable-based electricity generation.

- According to International Renewable Energy Agency, in 2022, the global hydropower installed capacity reached 1393 gigawatts (GW), representing a rise of 2.19% compared to 2021. The hydropower installed capacity is expected to grow with the upcoming hydro projects and technological advancements.

- In August 2022, Natel Energy, created by MIT alumni siblings, is developing hydropower systems that include fish-safe turbines and other features that imitate natural river conditions. Thus, with such kind of eco-friendly developments, the hydropower segment's demand is expected to increase in the forecast period.

- Moreover, in August 2022, the Government of India announced the development of two hydropower projects in Nepal, namely the West Seti Hydropower Project and the Seti River Hydropower Project. The total cost of these projects is expected to be around USD 2.4 billion.

- Thus, the hydropower segment is ecpected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the renewable energy market in recent years. It is likely to maintain its dominance during the forecast period.

- As of 2022, China is the global leader in renewable energy deployment. The country's total renewable energy capacity reached 1160.8 GW in 2022, representing an increase of approximately 13.4% compared to the previous year. Hydropower, solar, and wind are the major renewable energy sources in the country.

- India's power demand increased significantly in line with its expanding economy and growing population. In 2022, the country generated 162.96 GW of hydropower, up from 147.12 GW in 2021.

- Also, India has become the world's third-largest power consumer after China and the United States. Further, India's net power generation capacity increased significantly in the last decade, most of which came from renewable energy sources, including large hydro.

- The Government of India has set a target of installing 175 GW of renewable energy capacity by FY 2022, including 100 GW from solar, 60 GW from wind, 10 GW from bio-power, and 5 GW from small hydro-power. Moreover, the Indian Ministry for New and Renewable Energy expects investment of USD 15 billion in renewable energy, electric vehicles, manufacturing of solar equipment, and green hydrogen in 2022.

- Moreover, In January 2022, SJVN (Satluj Jal Vidyut Nigam Ltd) bagged a solar project of 125 MW in Uttar Pradesh through a bidding process held by the Uttar Pradesh New and Renewable Energy Development Agency (UPNEDA). It includes a 75 MW grid-connected solar project in Jalaun and a 50 MW solar project in Kanpur Dehat districts.

- Japan's government has also targeted reducing carbon emissions to 50% by 2030 and achieving carbon neutrality by 2050. In September 2022, Green Power Investment (GPI) chose GE Renewable Energy as the provider for the Fukaura Wind Farm in Fukaura Town, Nishi Tsugaru District, Aomori Prefecture, Japan. The project, which will include 19 units of GE's 4.2-117 onshore wind turbines, is GE's third in Japan.

- Hence, such developments will likely make Asia-Pacific dominant in the renewable energy market during the forecast period.

Renewable Energy Industry Overview

The renewable energy market is fragmented in nature. Some of the major players in the market (in no particular order) include First Solar Inc., Vestas Wind Systems A/S, Canadian Solar Inc., Jinko Solar Holding Co. Ltd, and General Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2022

- 4.3 Renewable Energy Generation Trend

- 4.4 Renewable Energy Installed Capacity and Forecast in GW, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Favorable Government Policies and Increasing Adoption of Renewable Energy

- 4.7.1.2 The Declining Price of Solar Panels and Wind Turbine Installations

- 4.7.2 Restraints

- 4.7.2.1 The Rising Adoption of Alternate Clean Power Sources

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Types (Geothermal, Tidal, etc.)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Rest of the Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 Iran

- 5.2.4.4 Rest of the Middle-East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of the South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 EPC Developers/Operators/Owners

- 6.3.1.1 Orsted AS

- 6.3.1.2 EDF SA

- 6.3.1.3 NextEra Energy Inc.

- 6.3.1.4 Duke Energy Corporation

- 6.3.1.5 Berkshire Hathway Energy

- 6.3.1.6 Acciona Energia SA

- 6.3.2 Equipment Suppliers

- 6.3.2.1 First Solar Inc.

- 6.3.2.2 Vestas Wind Systems A/S

- 6.3.2.3 Canadian Solar Inc.

- 6.3.2.4 Jinko Solar Holding Co. Ltd

- 6.3.2.5 General Electric Company

- 6.3.2.6 Siemens Gamesa Renewable Energy, S.A.

- 6.3.1 EPC Developers/Operators/Owners

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Solar PV Manufacturing and Solving Intermittency Problems Using Energy Storage Systems