|

市場調查報告書

商品編碼

1444408

發電用蒸汽渦輪機 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Steam Turbine For Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

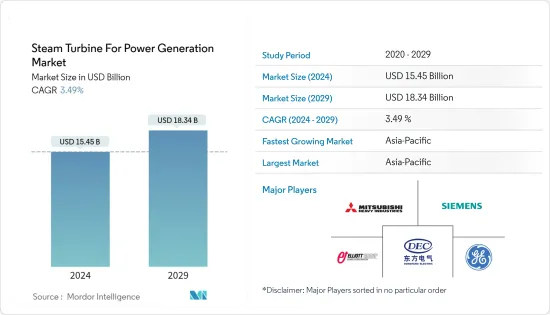

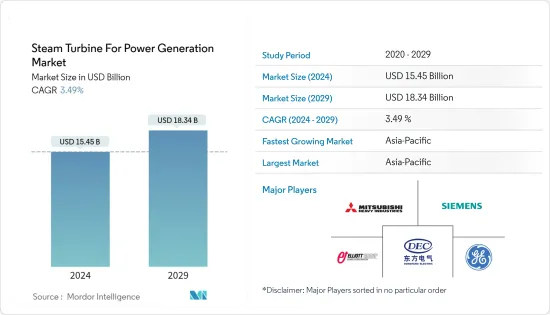

發電用蒸汽渦輪機市場規模估計到2024年為 154.5 億美元,預計到2029年將達到 183.4 億美元,在預測期內(2024-2029年)CAGR為 3.49%。

預計今年底,發電用蒸汽渦輪機市場規模將達到149.3億美元,預計未來五年將達到177.2億美元,預測期內CAGR將超過3.49%。

主要亮點

- 從中期來看,即將建成的天然氣聯合循環電廠和熱煤電廠以及對不間斷電力供應的日益重視等因素預計將推動發電市場的蒸汽渦輪機。

- 另一方面,再生能源發電的日益普及和對清潔能源的需求預計將阻礙預測期內的市場成長。

- 儘管如此,隨著大部分需求來自北美和亞太地區,聯合循環發電廠效率的提高可能會在預測期內為市場創造利潤豐厚的成長機會。

- 由於能源需求不斷成長,亞太地區是預測期內成長最快的市場。該成長歸因於對該地區國家(包括印度、中國和澳洲)投資的增加。

發電蒸汽渦輪機市場趨勢

天然氣工廠將顯著成長

- 燃氣聯合循環發電廠(CCP)結合使用燃氣和蒸汽渦輪機,使用相同的燃料可比傳統的簡單循環發電廠多發電 50%。燃氣渦輪機的廢熱被輸送到附近的蒸汽渦輪機,產生額外的電力。

- 與燃煤發電廠相比,天然氣聯合循環發電廠產生的溫室氣體(例如二氧化碳(CO2))以及其他污染物(例如二氧化硫(SO2)和氮氧化物(NOx))的排放量顯著降低。這使它們成為更清潔的發電選擇,有助於改善空氣品質並減少對環境的影響。

- 全球對再生能源的需求不斷成長,提高了天然氣發電廠的受歡迎程度。由於從煤炭轉向天然氣,天然氣需求不斷增加,特別是在亞太地區。例如,根據能源研究所《世界能源統計回顧》的資料,2022年,全球天然氣消費總量約為39,413億立方公尺。預計這將產生對天然氣作為發電來源的巨大需求。

- 天然氣聯合循環發電廠提供營運彈性,使其能夠快速回應電力需求的變化。它們可以相對快速地提高或降低功率輸出,非常適合平衡太陽能和風能等再生能源的間歇性。

- 隨著城市化進程的不斷發展、能源需求的不斷成長,以及政府推動工業化和基礎設施發展活動的努力,全球對天然氣聯合動力循環的需求不斷增加。大多數國家投資這些發電設施來滿足不斷成長的電力需求。

- 例如,在美國,截至2021年,約 32.3 吉瓦的新建天然氣發電廠計劃於2025年開始營運,並處於開發後期階段。目前有 14.2 吉瓦建設中,3.4 吉瓦處於預建階段,14.7 吉瓦提前獲得許可。

- 許多天然氣聯合循環工廠可以在現有地點建造或改造,利用天然氣供應和電力傳輸的基礎設施。這有助於加快新發電能力的部署。

- 例如,2023年3月,亞洲開發銀行宣布將在印度特里普拉邦興建一座120兆瓦燃氣聯合循環發電廠。同樣,同月,黑山政府與美國 Enerflex Energy Systems 和 Wethington Energy Innovation 等公司簽署了一份合作備忘錄,內容包括建造液化天然氣(LNG)終端和燃氣發電廠。 CCGP 發電廠的容量可能在 240 兆瓦至 440 兆瓦之間。

- 因此,天然氣聯合循環發電廠在效率、低排放、靈活性、可靠性和成本效益之間取得了平衡,使其成為發電的熱門選擇,增加了全球對蒸汽渦輪機的需求。

亞太地區預計將主導市場

- 亞太地區已經是蒸汽渦輪機最大的市場,預計未來幾年將創造對蒸汽渦輪機的巨大需求。亞太地區火力發電佔其發電量的50%以上。

- 根據中國電力企業聯合會(CEC)的資料,2021年火力發電廠發電量約為5646.3太瓦時,核電發電量約為407.5太瓦時,佔2021年發電量的約72.2%。類似的趨勢在2021年也出現過。過去幾年,預計未來幾年也將出現類似的成長趨勢。

- 截至2023年 1月,該國擁有全球營運中燃煤火力發電廠數量最多的國家。截至2023年1月,中國已營運燃煤火電廠約3,092座,興建中燃煤電廠499座,已公佈的燃煤電廠112座。因此,這種趨勢將推動未來幾年的蒸汽渦輪機市場。

- 根據中央電力局(CEA)的資料,印度擁有205.2 吉瓦的煤炭、6.62 吉瓦的褐煤、24.8 吉瓦的天然氣和 0.58 吉瓦的柴油火力發電廠。截至2023年 4月,印度將擁有 6.7 吉瓦的核電和 172.5 吉瓦的再生能源發電廠。

- 據電力部表示,印度有近28460兆瓦在建火力發電廠,預計在未來五年內併網。在所有在建計畫中,約12830兆瓦可能由中央部會營運,而15630兆瓦預計將由國務院營運。因此,此類即將建成的火力發電廠將增加未來幾年對蒸汽渦輪機市場的需求。

- 根據永續能源政策研究所(ISEP)的資料,2022年,化石燃料佔日本總發電量的72.4%,比前一年的71.7%略有上升。液化天然氣(LNG)發電比例從去年的31.7%下降至29.9%,部分原因是價格上漲。

- 然而,日本的煤炭發電量卻增加,從上年的26.5%上升至27.8%。相反,核電佔發電量的4.8%,較前一年的5.9%下降。

- 因此,隨著上述發展和即將建成的火力發電廠,亞太地區預計將在預測期內主導市場。

發電業蒸汽渦輪機概述

發電用蒸汽渦輪機市場處於半整合狀態。該市場的一些主要參與者(排名不分先後)包括Siemens Energy AG, General Electric Company, Dongfang Turbine Company Limited, Bharat Heavy Electricals Limited, Mitsubishi Heavy Industries Ltd.。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究範圍

- 市場定義

- 研究假設

第2章 研究方法

第3章 執行摘要

第4章 市場概覽

- 介紹

- 2028年之前的市場規模與美元需求預測

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進要素

- 需 24/7 不間斷供電

- 提高天然氣發電的滲透率

- 克制

- 燃煤電廠碳排放

- 增加再生能源在能源結構中的佔有率

- 促進要素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭激烈程度

第5章 市場細分

- 植物類型

- 氣體

- 煤炭

- 其他電廠類型(核電廠、熱電聯產電廠等)

- 容量

- 小於20兆瓦

- 20 - 40 兆瓦

- 40兆瓦以上

- 地理(區域市場分析{2028年之前的市場規模與需求預測(僅限區域)})

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太

- 中國

- 印度

- 日本

- 亞太其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 領先企業採取的策略

- 公司簡介

- Siemens Energy AG

- Mitsubishi Heavy Industries Limited

- Bharat Heavy Electricals Limited

- General Electric Company

- Dongfang Turbine Company Limited

- Toshiba Corporation

- Doosan Enerbility Co., Ltd.

- Elliot Group

- WEG SA

- MAN Energy Solutions SE

第7章 市場機會與未來趨勢

- 提高複合循環發電廠的效率

The Steam Turbine For Power Generation Market size is estimated at USD 15.45 billion in 2024, and is expected to reach USD 18.34 billion by 2029, growing at a CAGR of 3.49% during the forecast period (2024-2029).

The steam turbine for power generation market is estimated to be at USD 14.93 billion by the end of this year and is projected to reach USD 17.72 billion in the next five years, registering a CAGR of over 3.49% during the forecast period.

Key Highlights

- Over the medium term, factors such as upcoming natural gas combined cycle plants and thermal coal plants and growing emphasis on uninterrupted power supply are expected to drive the steam turbine for power generation market.

- On the other hand, the increasing adoption of renewable energy power generation and the demand for clean energy sources is expected to hinder the market growth during the forecast period.

- Nevertheless, increasing efficiency of combined cycle power plants with most of the demand coming from the North America and Asia Pacific region will likely create lucrative growth opportunities for the market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments in the countries of this region, including India, China, and Australia.

Steam Turbine For Power Generation Market Trends

Natural Gas Plants to Witness Significant Growth

- A gas combined-cycle power plant (CCP) uses gas and a steam turbine together to produce up to 50% more electricity from the same fuel than a traditional simple-cycle plant. The waste heat from the gas turbine is routed to the nearby steam turbine, which generates extra power.

- Compared to coal-fired power plants, natural gas combined cycle plants produce significantly lower emissions of greenhouse gases, such as carbon dioxide (CO2), as well as other pollutants like sulfur dioxide (SO2) and nitrogen oxides (NOx). This makes them a cleaner option for electricity generation, contributing to improved air quality and reduced environmental impact.

- The rising global demand for renewable energy has increased the popularity of natural gas power plants. The demand for gas is increasing, especially in Asia-Pacific, due to the shift from coal to natural gas. For instance, according to the Energy Institute Statistical Review of World Energy statistics, in 2022, the total natural gas consumption recorded about 3941.3 billion cubic meters across the globe. This is expected to create significant demand for natural gas as a power generation source.

- Natural gas combined cycle plants offer operational flexibility, allowing them to respond quickly to changes in electricity demand. They can ramp up or down their power output relatively quickly, making them well-suited for balancing the intermittent nature of renewable energy sources like solar and wind.

- With growing urbanization, rising demand for energy, and government efforts to boost industrialization and infrastructure development activities, the need for a global gas-combined power cycle is increasing. Most countries invest in these generation facilities to meet the rising electricity demand.

- For instance, in the United States, as of 2021, approximately 32.3 GW of new natural gas-fired power plants are scheduled to begin operations in 2025 and are in advanced stages of development. 14.2 GW is currently under construction, 3.4 GW is in pre-construction, and 14.7 GW is in advanced permitting.

- Many natural gas combined cycle plants can be built or retrofitted at existing sites, leveraging the infrastructure for natural gas supply and electricity transmission. This can help to expedite the deployment of new power generation capacity.

- For instance, In March 2023, the Asian Development Bank announced that it would set up a 120 MW gas-fired combined cycle power plant in Tripura, India. Similarly, in the same month, the government of Montenegro signed an MoU with companies like Enerflex Energy Systems and Wethington Energy Innovation from the United States on the construction of a liquefied natural gas (LNG) terminal and a gas-fired power plant. The CCGP plant will likely have a capacity between 240 MW to 440 MW.

- Therefore, natural gas combined cycle power plants offer a balance between efficiency, lower emissions, flexibility, reliability, and cost-effectiveness, making them a popular choice for electricity generation and hence increasing the demand for steam turbines across the globe.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is already the largest market for steam turbines and is expected to create significant demand for steam turbines over the coming years. Thermal power generation in the Asia-Pacific contributes to more than 50% of their electricity generation.

- As per the China Electricity Council (CEC), electricity generation from thermal power plants was around 5646.3 TWh, and nuclear was about 407.5 TWh in 2021, representing an electricity generation share of approximately 72.2% in 2021. Such a similar trend was witnessed during the past several years and is expected to have a similar growth trend during the upcoming years.

- As of January 2023, the country has the highest number of operating coal thermal power plants worldwide. Till January 2023, China has around 3092 units of operating coal thermal power plants, 499 under-construction coal power plants, and 112 announced coal power plants. Hence, such a trend would propel the steam turbine market in the upcoming years.

- As per the Central Electricity Authority (CEA), India has 205.2 GW of coal, 6.62 GW of lignite, 24.8 GW of natural gas, and 0.58 GW of diesel thermal power plants. Rest, 6.7 GW of nuclear and 172.5 GW of renewable power plants are present in India till April 2023.

- As per the Ministry of Power, there are nearly 28460 MW of under-construction thermal power plants in India, expected to come online during the next five years. Among all the under-construction, about 12830 MW is likely to be operated by the Central Ministry, while 15630 MW is expected to be operated by the State Ministry. Hence, such upcoming thermal power plants would increase demand for the steam turbine market in the forthcoming years.

- According to the Institute for Sustainable Energy Policies (ISEP), in 2022, fossil fuels constituted 72.4% of the overall electricity generation in Japan, marking a slight increase from the previous year's figure of 71.7%. The proportion of electricity generated from liquefied natural gas (LNG) decreased to 29.9%, down from 31.7% recorded in the previous year, partly influenced by price escalations.

- However, Japan's coal-based electricity generation saw an increase, rising to 27.8% compared to the previous year's 26.5%. Conversely, nuclear power contributed 4.8% to electricity generation, declining from the previous year's 5.9%.

- Thus, with the above developments and upcoming thermal power plants, the Asia-Pacific region is expected to dominate the market during the forecast period.

Steam Turbine For Power Generation Industry Overview

The steam turbine for power generation market is semi consolidated. Some of the major players in the market (in no particular order) include Siemens Energy AG, General Electric Company, Dongfang Turbine Company Limited, Bharat Heavy Electricals Limited, and Mitsubishi Heavy Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Need for Continuous 24/7 Supply of Electricity

- 4.5.1.2 Increasing Penetration of Natural Gas for Power Generation

- 4.5.2 Restraint

- 4.5.2.1 Coal Fired Power Plants Carbon Emissions

- 4.5.2.2 Increasing Share of Renewables in Energy Mix

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Plant Type

- 5.1.1 Gas

- 5.1.2 Coal

- 5.1.3 Other Plant Types (Nuclear, CHP, etc.)

- 5.2 Capacity

- 5.2.1 Less than 20 MW

- 5.2.2 20 - 40 MW

- 5.2.3 Above 40 MW

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Middle-East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Qatar

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Energy AG

- 6.3.2 Mitsubishi Heavy Industries Limited

- 6.3.3 Bharat Heavy Electricals Limited

- 6.3.4 General Electric Company

- 6.3.5 Dongfang Turbine Company Limited

- 6.3.6 Toshiba Corporation

- 6.3.7 Doosan Enerbility Co., Ltd.

- 6.3.8 Elliot Group

- 6.3.9 WEG S.A.

- 6.3.10 MAN Energy Solutions SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Efficiency of Combined Cycle Power Plants