|

市場調查報告書

商品編碼

1444405

石油和天然氣 EPC:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Oil & Gas EPC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

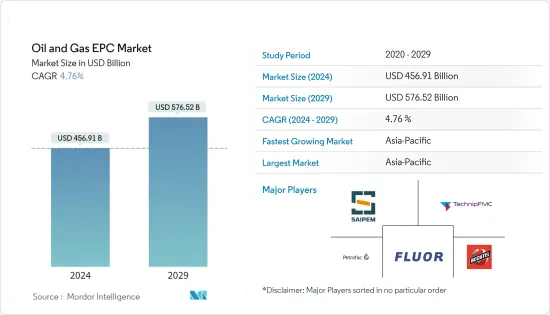

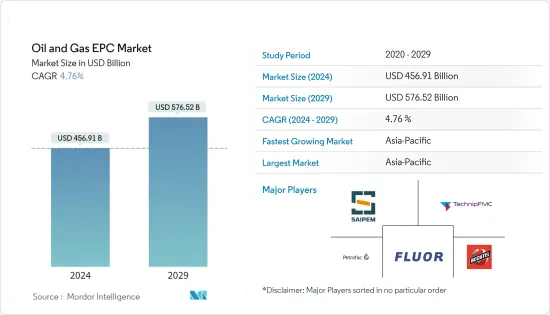

石油和天然氣EPC市場規模預計2024年為4569.1億美元,預計到2029年將達到5765.2億美元,在預測期內(2024-2029年)成長4.76%,年複合成長率成長。

主要亮點

- 從中期來看,石油和天然氣需求的成長以及天然氣消費量的增加將產生天然氣基礎設施發展的需求,預計海上石油和天然氣探勘和生產(E&P)活動也將增加。

- 另一方面,油氣價格的大幅波動是油氣EPC市場的主要限制因素之一。

- 儘管如此,預計在預測期內,各國新油氣天然氣田的發現將為上游、中游和下游所有產業的油氣EPC市場創造充足的機會。

- 亞太地區主導市場,並可能在預測期內顯著成長。這一成長歸因於天然氣需求的增加以及即將建成的液化天然氣設施,從而創造了對 EPC 服務的巨大需求。

石油和天然氣EPC市場趨勢

上游領域預計將主導市場

- 上游油氣產業的EPC包括陸上和海上探勘和生產相關服務。傳統上,陸上EPC總投資高於離岸板塊,主要是因為它比離岸板塊投資要求更低、複雜性更小、場地更容易到達、風險更低。然而,由於陸上產業的成熟,過去十年對離岸產業的投資有所增加。

- 海上海洋工程(包括固定平台、浮體式式生產儲油裝運裝置、淺水、深水、超深水浮體式式生產設施的設計、製造、安裝、試運行和啟動等設備)的EPC服務正在取得進展牽引力。

- 當涉及海上結構的 EPC 時,重要的是確定和評估海上設施的開發方案,無論是基於固定結構還是浮體結構。淺水固定平台的EPC服務包括導管架、三腳架、整體上部設施、壓縮平台等的建造和部署,以確保固定平台穩定且能抵抗風和水的運動。我保證是的。深水浮體平台服務通常包括建造和部署半潛式平台的船體和甲板、FPSO 的模組和轉塔、錨碇系統和浮標。

- 浮動平台通常無需鋪設從生產設施到陸上碼頭的昂貴的遠距管道。浮體式平台在小型油田中也很經濟,因為固定石油平台和管道的安裝成本太高。當油田耗盡時,FPSO可以移動到新位置並使用,而不是退役固定平台。

- 根據BP《2023年世界能源統計年鑑》顯示,2022年全球原油產量約44億噸。這一數字在 2018 年達到頂峰,當時全球石油產量達到約 45 億噸。原油產量與前一年同期比較成長約4.2%。

- 在非洲,營運商簽署了許多新的探勘和生產合約。例如,2022年1月,義大利石油天然氣公司埃尼公司在埃及簽署了5個區塊的探勘合約。礦區位於東地中海、西部沙漠和蘇伊士灣。該國其他公司已就東部和西部沙漠簽署了七項石油和天然氣生產協議。

- 這些發展預計將導致未來油氣EPC市場的快速發展。

預計亞太地區將主導市場

- 亞洲國家的高都市化導致能源需求增加,導致該地區石油和天然氣產量較高。中國等國家的存在是該地區EPC市場成長的主要動力。

- 中國是亞太地區最大的原油和天然氣生產國。 2020年,該國天然氣產量約佔全國的30%。該國正在規劃進一步的上游和中游計劃,以實現該國天然氣供需平衡。中國工業和商業領域對天然氣的需求正在迅速成長。

- 許多公司都有陸地和海上探勘和生產活動的藍圖。 2021年2月,中海油宣布計畫加速天然氣探勘開發,包括南海深海蘊藏量和中國陸地非傳統資源。該公司計劃在 2021 年投資約 139.3 億美元至 154.8 億美元,到 2025 年將其投資組合的 30% 製成天然氣,到 2035 年將 50% 製成天然氣。

- 印度是亞太地區第二大原油生產國。根據英國石油公司《2023年世界能源統計年鑑》顯示,2022年印度佔該地區原油產量的9.5%。印度擁有石油和天然氣基礎設施,但印度的石油和天然氣工業擁有各種設施。 、鑽機、生產平台、煉油廠、管線、碼頭等。

- 截至 2022 年 6 月,印度擁有 77 座運作中鑽機。由於油田老化和缺乏重大發現,該國的石油產量近十年來一直在下降。國營和私營公司都在製定投資計劃,以提高老油田的採收率。

- 例如,2022年4月,印度石油公司(IOCL)宣布計畫投資1,020億美元用於石油、石油和潤滑油(POL)儲存能力,包括在東北地區建立待開發區設施。

- 由於這些發展,未來幾年該地區的石油和天然氣 EPC 市場可能會顯著成長。

石油和天然氣EPC行業概況

石油和天然氣EPC市場較為分散。市場主要企業包括(排名不分先後)Saipem SpA、TechnipFmc PLC、Petrofac Limited、Fluor Corporation 和 Bechtel Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 調查先決條件

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028 年之前的市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 天然氣基礎設施發展需求不斷成長

- 海上石油和天然氣探勘和生產 (E&P) 活動增加

- 抑制因素

- 石油和天然氣價格波動較大

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 部門

- 上游

- 下游

- 中產階級

- 地區:2028 年之前的地區市場分析、市場規模和需求預測(僅限地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- National Petroleum Construction Company

- Petrofac Limited

- Tecnicas Reunidas SA

- Daewoo Engineering &Construction Co. Ltd

- Fluor Corporation

- Samsung Engineering Co. Ltd

- Korea Shipbuilding &Offshore Engineering Co. Ltd

- Hyundai Engineering &Construction Co. Ltd

- John Wood Group PLC

- TechnipFMC PLC

- Bechtel Corporation

- Saipem SpA

- McDermott International Ltd

- KBR Inc.

- Sinopec Engineering(Group)Co. Ltd

第7章市場機會與未來趨勢

- 世界各地發現新油氣天然氣田

簡介目錄

Product Code: 57107

The Oil & Gas EPC Market size is estimated at USD 456.91 billion in 2024, and is expected to reach USD 576.52 billion by 2029, growing at a CAGR of 4.76% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the growing demand for oil & gas and the rising consumption of natural gas, which is creating a need to develop the natural gas infrastructure, and an increase in offshore oil and gas exploration and production (E&P) activities are also expected to drive the growth of the market studied.

- On the other hand, the high volatility of oil and gas prices is one of the major restraints for the oil and gas EPC market.

- Nevertheless, the discovry of new oil and gas fields in various countries are exoected to create ample opportunities for the oil and gas EPC market for all the upstream, midstream, and downstream sectors during the forecast period.

- The Asia-Pacific region dominates the market and is also likely to witness significant growth during the forecast period. This growth is attributed to the increasing demand for natural gas and upcoming LNG facilities resulting in massive demand for EPC services.

Oil and Gas EPC Market Trends

Upstream Segment Expected to Dominate the Market

- The EPC in the upstream oil and gas sector includes onshore and offshore exploration and production-related services. Traditionally, the total investments in onshore EPC are more than that of the offshore segment, mainly due to lower investment requirements, lesser complexity, more accessible sites, and lower risk than the offshore segment. However, investment in the offshore segment has risen during the last decade due to maturing onshore fields.

- The EPC services for offshore, such as installations, including design, fabrication, installation, commissioning, and start-up of a fixed platform, floating production storage and offloading (FPSO) units, and floating production facilities for shallow, deep water, and ultradeep waters, are gaining traction.

- Concerning the EPC for offshore structures, identifying and assessing development options for offshore facilities, whether based on fixed or floating structures, is crucial. The EPC services for fixed platforms used for shallow waters include constructing and deploying jackets, tripods, integrated topsides, compression platforms, etc., to ensure that fixed platforms are stable and resilient to wind and water movements. The floating platform services, generally for deepwater, include constructing and deploying hulls and decks for semi-submersible platforms, modules and turrets for FPSOs, and mooring systems and buoys.

- Floating platforms generally eliminate the need for laying expensive long-distance pipelines from the production facility to an onshore terminal. Floating platforms are also economical in smaller oil fields, where the expense of installing a fixed oil platform and pipeline is too high. Once the field is depleted, FPSOs may be moved and used at a new location instead of decommissioning a fixed platform.

- According to BP Statistical Review of World Energy 2023, in 2022, global crude oil production amounted to about 4.4 billion metric tons. The figure peaked in 2018 when oil production worldwide reached nearly 4.5 billion metric tons. The crude oil production witness about 4.2% growth compared to previous year.

- In Africa, the operators have signed many new exploration and production contracts. For example, in January 2022, Eni, the Italy-based oil and gas company, clinched an exploration contract in five blocks in Egypt. The blocks are located in the Eastern Mediterranean Sea, Western Desert, and Gulf of Suez. Seven oil and gas production agreements were signed for the Eastern and Western deserts by other companies in the country.

- Such developments are likely to propel the oil and gas EPC market rapidly in the future.

Asia-Pacific Expected to Dominate the Market

- The growing energy demand due to the high urbanization rate in Asian countries has led to the region's high oil and gas production rate. The presence of countries like China is the main driver of the region's EPC market's growth.

- China is the largest crude oil and natural gas producer in Asia-Pacifi. In 2020, the country accounted for around 30% of the total natural gas production. The country has planned even more upstream and midstream projects to achieve an equilibrium in the demand-supply situation of natural gas in the country. China has witnessed an upsurge in the natural gas demand in both the industrial and commercial sectors.

- Many companies have blueprints for exploration and production activities onshore and offshore. In February 2021, CNOOC Ltd stated its plans to accelerate the exploration and development of natural gas, including deepwater reserves in the South China Sea and unconventional resources onshore in China. The company planned a capital spending of around USD 13.93-USD 15.48 billion in 2021 to make gas part of 30% of its portfolio by 2025 and 50% by 2035.

- India is the second-largest crude oil producer in the Asia-Pacific region. It accounted for 9.5% of the regional crude oil production in 2022, according to the BP Statistical Review of World Energy 2023. Although the country has a relatively less complex and new oil and gas infrastructure than China, India's oil and gas industry includes various installations, including drilling rigs, production platforms, refineries, pipelines, and terminals.

- As of June 2022, India has 77 active rigs. The country's oil production has been falling for almost a decade due to aging fields and the absence of major discoveries. Both state-owned and private players have been working on investment plans to raise recovery from older fields.

- For instance, in April 2022, Indian Oil Corporation Limited (IOCL) announced its plans to invest USD 102 billion in petroleum, oil, and lubricant (POL) storage capacities, including setting up a greenfield facility in the northeast region.

- Owing to such developments, the region is likely to witness rich growth in the oil and gas EPC market in the coming years.

Oil and Gas EPC Industry Overview

The oil and gas EPC market is fragmented. Some of the major players in the market (in no particular order) include Saipem SpA, TechnipFmc PLC, Petrofac Limited, Fluor Corporation, and Bechtel Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand to Develop the Natural Gas Infrastructure

- 4.5.1.2 Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 4.5.2 Restraints

- 4.5.2.1 High Volatility of Oil and Gas Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Downstream

- 5.1.3 Midstream

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 National Petroleum Construction Company

- 6.3.2 Petrofac Limited

- 6.3.3 Tecnicas Reunidas SA

- 6.3.4 Daewoo Engineering & Construction Co. Ltd

- 6.3.5 Fluor Corporation

- 6.3.6 Samsung Engineering Co. Ltd

- 6.3.7 Korea Shipbuilding & Offshore Engineering Co. Ltd

- 6.3.8 Hyundai Engineering & Construction Co. Ltd

- 6.3.9 John Wood Group PLC

- 6.3.10 TechnipFMC PLC

- 6.3.11 Bechtel Corporation

- 6.3.12 Saipem SpA

- 6.3.13 McDermott International Ltd

- 6.3.14 KBR Inc.

- 6.3.15 Sinopec Engineering (Group) Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Discovery of New Oil and Gas Fields Worldwide

02-2729-4219

+886-2-2729-4219