|

市場調查報告書

商品編碼

1444386

環氧樹脂 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

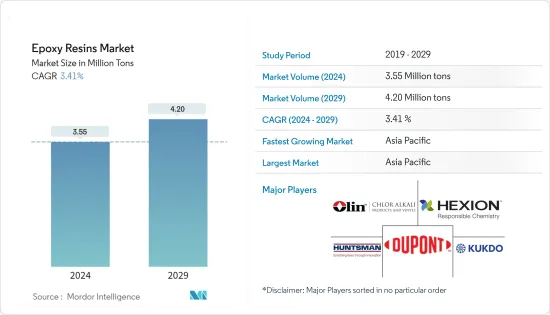

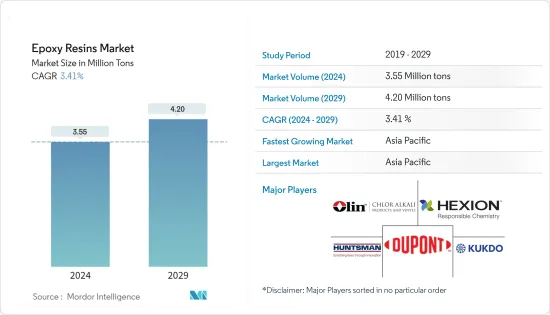

環氧樹脂市場規模預計到2024年為355萬噸,預計2029年將達到420萬噸,在預測期間(2024-2029年)CAGR為3.41%。

2020 年,由於大流行的情況和多個國家的嚴格監管,市場受到了 COVID-19 大流行的負面影響。由於供應鏈中斷、停工和勞動力短缺,油漆和塗料、黏合劑和密封劑、電氣和電子等多個行業受到影響。然而,情況已經正常化,市場從大流行中恢復並正在顯著成長。

主要亮點

- 短期內,航空航太和汽車業對環氧複合材料的需求不斷成長,建築業的強勁成長以及對電氣和電子設備的需求不斷成長正在推動預測期內的市場發展。

- 然而,環氧樹脂的危險影響預計將在預測期內對環氧樹脂市場的成長率產生重大限制。

- 儘管如此,亞太、中東和非洲新興國家建築業的不斷發展正在為這個區隔市場的未來創造新的機會。

- 亞太地區主導了全球市場,大部分需求來自中國和印度。

環氧樹脂市場趨勢

油漆和塗料領域預計將主導市場

- 環氧樹脂用作塗料應用的黏合劑,以增強地板和金屬應用塗料的耐久性。

- 環氧樹脂有助於提高塗料的多種性能,例如強度、耐久性和耐化學性。它們具有快乾、韌性、優異的附著力、良好的固化性、耐磨性和出色的耐水性等特性和能力,適合保護金屬和其他表面。

- 從全球來看,受宏觀經濟不利、消費者支出減少、能源價格高企等多重因素影響,油漆塗料產量成長緩慢。

- 由於這些因素,歐洲和北美地區的油漆和塗料的生產和消費受到的影響比其他地區更為嚴重。

- 根據歐洲塗料協會公佈的資料顯示,持續的能源危機、歐洲央行利率上升以及德國、英國、法國、義大利等主要國家經濟成長放緩等因素對塗料需求產生了負面影響。油漆和塗料來自該地區,因為超過50% 的地區需求來自這些國家。

- 儘管該地區的產品產量並未大幅削減,但 2022 年該地區裝飾和非裝飾塗料的消費量較 2021 年下降了近 6%。這一下降在 2022 年最後一個季度最為顯著。

- 油漆和塗料廣泛用於各行業的內部和外部應用,包括建築、汽車、工業等。

- 不斷成長的建築業預計將促進油漆和塗料行業的成長。美國在北美建築業中佔有主要佔有率。美國、加拿大和墨西哥也對建築業投資做出了巨大貢獻。

- 根據美國人口普查局的數據,2022年美國新開工計畫的年度價值為17,928.5億美元,而前一年為16,264.4億美元。此外,2022年美國住宅建設年價值為9,080億美元,比去年的8,030億美元成長13%。

- 亞太地區的建築業是世界上最大的。由於人口成長、中產階級收入增加和城市化進程,這一數字正在以健康的速度成長。由於中國和印度住房建設市場的不斷擴大,預計亞太地區的住房成長將達到最高。預計到 2030 年,這兩個國家將佔全球中產階級的 43.3% 以上。

- 此外,輕型和商用車產量的成長預計將推動汽車塗料行業使用的環氧樹脂的整體市場。

- 根據國際汽車製造商組織 (OICA) 的數據,2022 年全球機動車產量超過 85,016,728 輛,較去年同期成長 6%。

- 汽車、船舶和航空航太工業使用環氧塗料作為防腐底漆。由於電動車 (EV)、船舶和航空航太產業的需求不斷成長,環氧塗料的使用量預計將進一步成長。

- 預計這些因素將顯著影響油漆和塗料中環氧樹脂的需求,進而影響預測期內環氧樹脂市場的成長。

預計亞太地區將主導市場

- 亞太地區電子產品的需求主要來自中國、印度和日本。此外,由於中國低廉的勞動力成本和靈活的政策,中國對於電子產品生產商來說是一個強大且有利的市場。

- 根據 ZEVI 統計,去年亞洲電氣和電子市場規模達到 31,060 億歐元(36,740 億美元),成長 10%。 2022年市場成長13%,預計2023年將成長7%。中國市場是全球最大的市場,甚至比所有工業化國家市場的總和還要大。 2022年中國電子產業成長14%,預計2023年成長8%。

- 此外,根據印度品牌資產基金會(IBEF)的預測,到2025年,印度電子製造業的產值預計將達到5,200億美元。

- 例如,由於對公共和私人基礎設施、再生能源和商業項目的投資增加,預計日本的建築業將在未來五年內適度擴張。反過來,它也提高了消費者和投資者的信心。

- 此外,在亞太地區,中國、東南亞和南亞航空航太市場預計將大幅成長,進一步支持研究市場的需求。根據波音《2022-2041年中國商業展望》,到2041年將新增約8,485架飛機交付,市場服務價值達5,450億美元。

- 預計這些因素將在預測期內增加亞太地區對環氧樹脂的需求。

環氧樹脂產業概況

環氧樹脂市場本質上是分散的。主要參與者(排名不分先後)包括 Hexion、Olin Corporation、Huntsman International LLC、DuPont 和 KUKDO CHEMICAL

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 航太和汽車產業對環氧樹脂複合材料的需求不斷增加

- 建築業強勁成長

- 對電氣和電子設備的需求不斷成長

- 限制

- 環氧樹脂的危險影響

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場規模依數量計算)

- 原料

- DGBEA(雙酚 A 和 ECH)

- DGBEF(雙酚 F 和 ECH)

- 酚醛清漆(甲醛和苯酚)

- 脂肪族(脂肪醇)

- 縮水甘油胺(芳香胺和 ECH)

- 其他原料

- 應用

- 油漆和塗料

- 黏合劑和密封劑

- 複合材料

- 電氣和電子

- 海洋

- 風力發電機

- 其他應用

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- 3M

- Aditya Birla Chemicals

- Atul Ltd

- BASF SE

- Chang Chun Group

- Covestro AG

- Daicel Corporation

- DuPont

- Hexion

- Huntsman International LLC

- Jiangsu Sanmu Group

- Kemipex

- KUKDO CHEMICAL CO., LTD.

- NAMA Chemicals

- NAN YA PLASTICS CORPORATION

- Olin Corporation

- Sika AG

- SPOLCHEMIE

第 7 章:市場機會與未來趨勢

- 亞太、中東和非洲新興國家建築業的成長

- 其他機會

The Epoxy Resins Market size is estimated at 3.55 Million tons in 2024, and is expected to reach 4.20 Million tons by 2029, growing at a CAGR of 3.41% during the forecast period (2024-2029).

The market was negatively impacted due to the COVID-19 pandemic in 2020, owing to the pandemic scenario and strict regulations in several countries. It affected various industries such as paints and coatings, adhesives and sealants, electrical and electronics, and others due to supply chain disruptions, work stoppages, and labor shortages. However, the condition normalized, and the market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the increasing demand for epoxy-based composites from the aerospace and automotive industries, strong growth in the construction industry, and rising demand for electrical and electronic devices are driving the market over the forecasted period.

- However, the hazardous impact of epoxy resins is expected to include major limitations on the growth rate of the epoxy resin market during the projected period.

- Nevertheless, the growing construction industry in the emerging countries of Asia-Pacific, the Middle East, and Africa are creating new opportunities for this market segment in the future.

- Asia-Pacific dominated the market across the world, with the majority of demand coming from China and India.

Epoxy Resin Market Trends

The Paints and Coatings Segment is Expected to Dominate the Market

- Epoxy resins are used as binders for coating applications to enhance the durability of coatings for floor and metal applications.

- Epoxy resins help to develop several properties in coatings, such as strength, durability, and chemical resistance. Their properties and abilities of quick drying, toughness, excellent adhesion, good curing, abrasion resistance, and outstanding water resistivity make them suitable for protecting metals and other surfaces.

- Globally, the production of paints and coatings experienced slow growth due to multiple factors like unfavorable macroeconomic factors, reduced consumer spending, high energy prices, and others.

- The production and consumption of paints and coatings in Europe and North American regions were more severely affected than others due to these factors.

- According to the data published by Coatings Europe, factors like the ongoing energy crisis, rising interest rates from the European Central Bank, and the slowing economic growth in key countries like Germany, the United Kingdom, France, and Italy has negatively affected the demand for paints and coatings from the region as over 50% of the regional demand is generated from these countries.

- Even though the region has not witnessed significant product cuts, the consumption volume of both decorative and nondecorative coatings in the region declined by nearly 6% in 2022 compared to 2021 volumes. This decline was most significant in the last quarter of 2022.

- Paints and coatings are extensively used for interior and exterior applications in various industries, including building and construction, automotive, industrial, and others.

- The growing construction industry is expected to augment the growth of the paints and coatings industry. The United States includes a major share of the construction industry in North America. The United States, Canada, and Mexico also contribute significantly to the construction sector investments.

- According to the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,792.85 billion in 2022, compared to USD 1,626.44 billion in the previous year. Moreover, the annual value of residential construction in the United States was valued at USD 908 billion in 2022, an increase of 13 % compared to USD 803 billion last year.

- The construction sector in the Asia-Pacific region is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India. These two countries are expected to represent over 43.3% of the global middle class by 2030.

- Additionally, the growth in the production of lightweight and commercial vehicles is expected to drive the overall market of epoxy resins used in the automotive coatings industry.

- According to Organisation Internationale des Constructeurs d'Automobiles(OICA), more than 85,016,728 motor vehicles were manufactured worldwide in 2022, an increase of 6% from a year earlier.

- The automotive, marine, and aerospace industries use epoxy coatings as primers for corrosion protection. The usage of epoxy coatings is expected to grow further due to the rising demand from the electric vehicle (EV), marine, and aerospace industries.

- Such factors are expected to significantly impact the demand for epoxy resins in paints and coatings, thereby affecting the growth of the epoxy resins market during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- The demand for electronics products in the Asia-Pacific region majorly comes from China, India, and Japan. Furthermore, China is a strong, favorable market for electronics producers, owing to the country's low labor cost and flexible policies.

- According to ZEVI, the Asian electrical & electronics market reached EUR 3,106 billion (USD 3,674 billion) in the previous year, a 10% rise. The market increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even larger than the combined markets of all industrialized countries. The Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023.

- Furthermore, as per the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025.

- For instance, Japan's construction sector is expected to expand moderately over the next five years, owing to increasing investments in public and private infrastructure, renewable energy, and commercial projects. It, in turn, is improving both consumer and investor confidence.

- Furthermore, in the Asia-Pacific region, China, Southeast Asia, and South Asia aerospace market are expected to rise significantly, further supporting the demand for the studied market. According to the Boeing Commercial Outlook 2022-2041 in China, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion.

- Such factors are expected to increase the demand for epoxy resins in the Asia-Pacific region during the forecast period.

Epoxy Resin Industry Overview

The epoxy resins market is fragmented in nature. The major players (not in any particular order) include Hexion, Olin Corporation, Huntsman International LLC, DuPont, and KUKDO CHEMICAL CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Epoxy-based Composites from the Aerospace and Automotive Industries

- 4.1.2 Strong Growth in the Construction Industry

- 4.1.3 Rising Demand for Electrical and Electronic Devices

- 4.2 Restraints

- 4.2.1 Hazardous Impact of Epoxy Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenols)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Marine

- 5.2.6 Wind Turbines

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Atul Ltd

- 6.4.4 BASF SE

- 6.4.5 Chang Chun Group

- 6.4.6 Covestro AG

- 6.4.7 Daicel Corporation

- 6.4.8 DuPont

- 6.4.9 Hexion

- 6.4.10 Huntsman International LLC

- 6.4.11 Jiangsu Sanmu Group

- 6.4.12 Kemipex

- 6.4.13 KUKDO CHEMICAL CO., LTD.

- 6.4.14 NAMA Chemicals

- 6.4.15 NAN YA PLASTICS CORPORATION

- 6.4.16 Olin Corporation

- 6.4.17 Sika AG

- 6.4.18 SPOLCHEMIE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Construction Industry in the Emerging Countries of Asia-Pacific and Middle-East and Africa

- 7.2 Other Oppurtunities