|

市場調查報告書

商品編碼

1444372

乾混砂漿 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

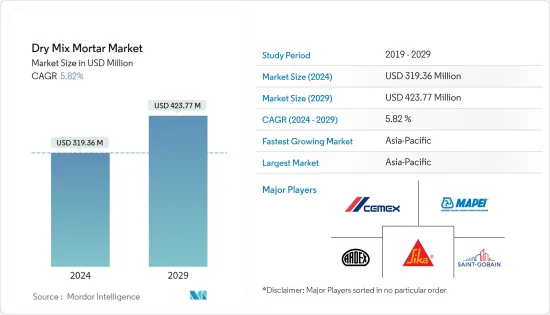

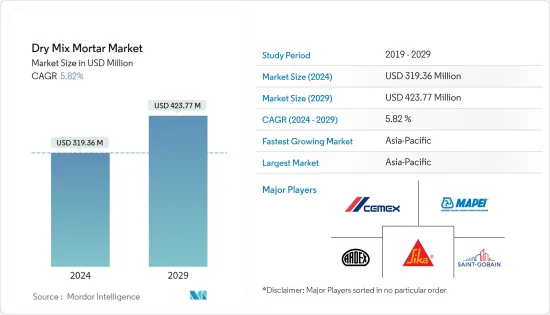

乾混砂漿市場規模預計到2024年為3.1936億美元,預計到2029年將達到4.2377億美元,在預測期內(2024-2029年)CAGR為5.82%。

COVID-19 大流行對 2020 年的市場產生了負面影響。然而,建築業在疫情後的情況下正在加快步伐。因此,這將增加未來幾年乾混砂漿的市場需求。

主要亮點

- 從中期來看,美國和亞太地區建築活動的增加預計將推動市場的成長。

- 簡化的混合和施工作業也是乾混砂漿市場蓬勃發展的機會。

- 綠建築認證的新興趨勢可能會成為一個機會。

- 亞太地區在研究的市場中佔據主導地位,其中中國、印度和日本等國家的消費量最大。

乾混砂漿市場趨勢

增加渲染部分的需求

- 抹灰的成分中水泥比例較高,用於塗覆建築物的外表面。抹灰用於建築物的外部,以改善外觀的外觀,同時也提供防水和防火的好處。

- 乾混產品提供卓越的技術性能,可滿足當前施工場景中常見的嚴格性能要求。此外,使用乾混砂漿產品是經濟的,因為它們透過簡單的材料方法確保結構的長期完整性,從而減少潛在的施工問題。

- 乾混砂漿含有精確混合的材料,只需添加水即可產生適當的抹灰。乾混砂漿含有特殊添加劑,可提高抹灰的和易性,幫助它們與背景黏合,並降低開裂風險。它們也可用於裝飾飾面。

- 幾乎所有建築應用程式都會進行渲染,以獲得光滑或刻意紋理的表面。預計全球建築活動的增加將在預測期內推動乾混砂漿的使用。

- 因此,考慮到上述因素,乾混砂漿市場的抹灰市場需求預計將上升。

中國可望主導亞太地區市場

- 該國最大的建築市場,佔全球建築投資總額的 20%。預計到2030年,中國將在建築方面花費近13兆美元,為乾混砂漿等建築材料創造了積極的市場前景。

- 公共和私營部門對經濟適用房的日益關注可能會推動住宅建築業的成長,從而推動市場需求。

- 中國的主要推動力是住宅和商業建築的大量開發以及經濟成長的支持。在內地,香港房管局推出多項措施推動廉租房建設。官員的目標是到 2030 年提供 301,000 套公共住宅。

- 同樣,中國可能會再建造 7,000 個購物中心,預計到 2025 年開業。建築業的這種成長預計將推動市場需求。

- 然而,隨著中國正在應對恆大危機(截至 2021 年 6 月,光是該公司的負債就達 3,000 億美元)和全面的中國金融危機,經濟看起來搖搖欲墜,同時也不能排除經濟衰退的可能性。

- 上述所有因素都可能推動預測期內中國乾混砂漿市場的成長。

乾混砂漿產業概況

乾混砂漿市場本質上是分散的。市場上的一些主要參與者(排名不分先後)包括 Sika AG、CEMEX SAB de CV、MAPEI SpA、Ardex Group 和 Saint-Gobain 等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 美國和亞太地區建築活動的增加

- 建築業的長期成本效益

- 簡化的混合和應用操作

- 限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔

- 依最終用戶產業

- 住宅

- 非住宅

- 商業的

- 基礎設施

- 工業/機構

- 其他非住宅最終用戶產業

- 依應用

- 石膏

- 使成為

- 磁磚膠

- 灌漿

- 防水漿料

- 混凝土保護與修復

- 隔熱和飾面系統

- 其他應用

- 依地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 領先企業採取的策略

- 公司簡介(概述、財務、產品和服務以及最新動態)

- 3M

- Ardex Group

- BASF SE

- CEMEX SAB de CV

- Colmef Monneli

- Conmix Ltd

- Grand Aces Ventures Inc.

- Henkel AG & Co. KGaA

- Knauf Gips KG

- Holcim

- Laticrete International Inc.

- MAPEI SpA

- M&P Drymix

- Plaxit

- Saint-Gobain

- Saudi Readymix

- Saudi Vetonit Co. Ltd

- Sika AG

- The Ramco Cements Limited

- UltraTech Cement Ltd

- Wuensch Plaster

第 7 章:市場機會與未來趨勢

- 綠建築認證的新趨勢

The Dry Mix Mortar Market size is estimated at USD 319.36 million in 2024, and is expected to reach USD 423.77 million by 2029, growing at a CAGR of 5.82% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. However, the construction sector is picking up pace in the post-pandemic scenario. Thus, this will enhance the market demand for dry mix mortar over the coming years.

Key Highlights

- Over the medium term, increasing construction activities in the United States and Asia-Pacific are expected to drive the market's growth.

- Simplified mix and apply operation is also a blooming opportunity for the dry mix mortar market.

- The emerging trend of green building certifications will likely act as an opportunity.

- Asia-Pacific dominated the market studied, with the most significant consumption from countries like China, India, and Japan.

Dry Mix Mortar Market Trends

Increasing\sDemand\sfrom\sthe Render Segment

- Rendering has a higher proportion of cement in its composition and is used to coat the exterior surfaces of buildings. Rendering is used on the outside of buildings to improve the appearance of the exterior facade while also providing waterproofing and fireproofing benefits.

- Dry mix products provide excellent technical properties to meet the stringent performance requirements common in the current construction scenario. Additionally, using dry mix mortar products is economical as they reduce potential construction problems by ensuring the long-term integrity of structures with a simple materials approach.

- Dry mixed mortar contains a precise blend of materials and only requires the addition of water to produce a suitable render. Dry mix mortar comprises special additives that improve the workability of renders, help them bond to the background, and reduce the risk of cracking. They can also be used for decorative finishes.

- Rendering is done in almost all construction applications to achieve a smooth or deliberately textured surface. The increasing construction activities worldwide are expected to drive the use of dry mix mortar over the forecast period.

- Therefore, considering the abovementioned factors, the demand in the dry mix mortar market is expected to rise in the render segment.

China is Expected to Dominate the Market in the Asia-Pacific Region

- The country's largest construction market, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive market outlook for construction materials such as dry mix mortar.

- The increased focus on affordable housing by both the public and the private sector may drive growth in the residential construction sector, which is likely to drive market demand.

- China has been majorly driven by ample residential and commercial construction developments and supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- Similarly, China will likely witness the construction of 7,000 more shopping centers, estimated to be opened by 2025. Such growth in the construction industry is expected to propel market demand.

- However, the economy looks shaky as the country is dealing with the Evergrande crisis (the company had USD 300 billion of liabilities alone as of June 2021) and a full-fledged Chinese financial crisis, while a recession can't be ruled out either.

- All factors above are likely to fuel the growth of the dry mix mortar market in China over the forecast period.

Dry Mix Mortar Industry Overview

The dry mix mortar market is fragmented in nature. Some of the major players (in no particular order) in the market include Sika AG, CEMEX SAB de CV, MAPEI SpA, Ardex Group, and Saint-Gobain, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the United States and Asia-Pacific

- 4.1.2 Long-term Cost Effectiveness in the Construction Industry

- 4.1.3 Simplified Mix and Apply Operation

- 4.2 Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Residential

- 5.1.2 Non-residential

- 5.1.2.1 Commercial

- 5.1.2.2 Infrastructure

- 5.1.2.3 Industrial/Institutional

- 5.1.2.4 Other Non-residential End-user Industries

- 5.2 By Application

- 5.2.1 Plaster

- 5.2.2 Render

- 5.2.3 Tile Adhesive

- 5.2.4 Grout

- 5.2.5 Water Proofing Slurry

- 5.2.6 Concrete Protection and Renovation

- 5.2.7 Insulation and Finishing Systems

- 5.2.8 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Ardex Group

- 6.4.3 BASF SE

- 6.4.4 CEMEX SAB de CV

- 6.4.5 Colmef Monneli

- 6.4.6 Conmix Ltd

- 6.4.7 Grand Aces Ventures Inc.

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Knauf Gips KG

- 6.4.10 Holcim

- 6.4.11 Laticrete International Inc.

- 6.4.12 MAPEI SpA

- 6.4.13 M&P Drymix

- 6.4.14 Plaxit

- 6.4.15 Saint-Gobain

- 6.4.16 Saudi Readymix

- 6.4.17 Saudi Vetonit Co. Ltd

- 6.4.18 Sika AG

- 6.4.19 The Ramco Cements Limited

- 6.4.20 UltraTech Cement Ltd

- 6.4.21 Wuensch Plaster

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Trend of Green Building Certifications