|

市場調查報告書

商品編碼

1444369

農業化學品 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

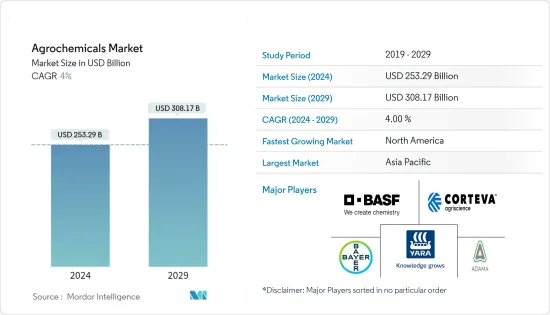

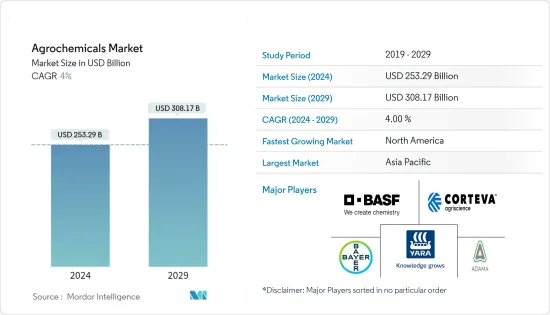

2024年農業化學品市場規模預估為2,532.9億美元,預估至2029年將達到3,081.7億美元,預測期(2024-2029年)CAGR為4%。

世界各地人口的成長以及富裕程度的提高正在促使消費模式的轉變。不僅需要增加產量以滿足需求,還需要確保滿足日益富裕人口的營養需求。例如,根據國際貨幣基金組織的數據,2021年印度總人口估計約為13.9億人。據糧農組織稱,2021年,全球11.7%的人口經歷了嚴重的糧食不安全。由於蟲害侵襲,耕地面積減少和農作物損失導致浪費,對確保糧食和營養安全構成嚴峻課題。根據美國農業部統計,從2000年起,美國農場的土地總面積逐年減少。截至2021年,耕地總面積減少了近5,000萬英畝,達到8.953億英畝。這些因素增加了對農業化學品的需求,從而提高了農業產量。

主要亮點

- 農化市場上的價格溢價和創新的環保生產方法正在穩步興起。人們越來越需要平衡最佳化學品的明智使用並儘量減少該使用的影響。然而,農業化學品對土地、環境和人類健康造成的有害影響預計將阻礙市場的成長。

農業化學品市場趨勢

人口增加以及隨之而來的糧食需求增加

- 據聯合國糧農組織稱,到2050年,世界人口預計將達到90億。不斷成長的人口對糧食產品產生了巨大的需求,而隨著農田面積的減少,這正成為一項重大課題。例如,2021年,英國約有1723萬公頃土地被列為已利用農業面積,較2020年的1727萬公頃有所減少。農業面積的縮小預計將需要更多可用土地生產農產品。

- 農業化學品對於獲得高產量非常重要,因為它們是預防田間病蟲害所必需的。根據聯合國糧農組織的報告,全球每年有近 40% 的農作物因病蟲害而損失。為了解決這些問題並增加產量,預計作物保護化學品的使用將會增加。據聯合國糧農組織稱,2020年,全球除草劑消費量接近140萬噸,而殺菌劑和殺菌劑消費量分別約為606和47.1萬噸。

- 農業化學品在作物生長中也發揮著至關重要的作用,表現出改善的性能和顯著的效果。提供充足的植物養分對於植物的健康生長和生產能力至關重要。養分需求因作物和土壤而異。這些營養需求可以透過使用化學物質有效地滿足。例如,尿素為土壤提供了 46% 的氮,而印楝餅等有機肥料只能提供 2-5% 的氮,而氮是植物生長和發育的必需元素。因此,人口成長是世界各地需要增加農業化學品使用的主要因素。

亞太地區主導市場

- 中國在全球農化市場中佔有最大佔有率。由於耕地面積減少,中國有機氮、磷、鉀肥料的消耗量正在減少。例如,根據中國綠色食品發展中心的數據,2021年,中國約有984萬公頃農地獲得有機農地認證,較2019年的1390萬公頃有所減少。水果和蔬菜耕地面積不斷增加,而穀物種植面積正在減少。

- 同樣,印度水稻和小麥等穀類作物的大量生產是支撐市場成長的主要因素。印度農藥的使用量正穩定上升。截至 2022 年 6 月,一些領先農藥和農化公司的收入清楚地顯示了該國及該地區農化市場的成長。

- 截至2022 年6 月,UPL 是印度領先的農藥和農化公司,淨銷售額超過1,640 億印度盧比(19.8 億美元)。緊隨其後的是巴斯夫印度公司,排名第二,淨銷售額約為1,300 億印度盧比(15.7 億美元)。數據顯示,只有8個邦的農藥消費量就佔印度農藥消費總量的70.0%以上。隨著人們對環境和永續發展的日益重視,該地區各國政府正在實施清潔生產和環境友善農業政策,這可能會導致該國合成農藥的使用量下降。然而,政府鼓勵微生物農藥的使用,預計未來幾年將迅速成長。

農化業概況

全球農化市場較為分散,主要參與者包括拜耳作物科學、安道麥農業解決方案、雅苒國際 ASA、巴斯夫 SE、Corteva Agriscience 和 Nufarm。新產品推出、併購、合作是這些市場領導者採取的主要策略。市場參與者正專注於在創新、合作和擴張方面進行投資,以增加市場佔有率。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 依產品類型

- 化肥

- 農藥

- 佐劑

- 植物生長調節劑

- 依應用

- 以作物為主

- 穀物和穀物

- 豆類和油籽

- 水果和蔬菜

- 非農作物為主

- 草坪和觀賞草

- 其他非農作物為主

- 以作物為主

- 依地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 澳洲

- 亞太地區其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第 6 章:競爭格局

- 最常用的策略

- 市佔率分析

- 公司簡介

- Bayer CropScience AG

- BASF SE

- Corteva Agriscience AG

- Archer-Daniels-Midland (ADM)

- FMC Corporation

- Adama Agricultural Solutions

- Potash Corporation of Saskatchewan

- Nufarm Ltd

- Nutrien Ltd

- Yara International ASA

第 7 章:市場機會與未來趨勢

The Agrochemicals Market size is estimated at USD 253.29 billion in 2024, and is expected to reach USD 308.17 billion by 2029, growing at a CAGR of 4% during the forecast period (2024-2029).

The rising population across the world, accompanied by rising affluence, is creating a shift in consumption patterns. There is a need to not just increase production to meet demand but also to ensure that the nutritional needs of an increasingly affluent population are met. For instance, according to the IMF, in 2021, the estimated total population in India amounted to approximately 1.39 billion people. According to FAO, in 2021, 11.7% of the global population experienced severe food insecurity. Shrinking arable land and loss of crops due to pest attacks lead to wastage, posing a critical challenge to ensuring food and nutritional security. According to the US Department of Agriculture, from 2000 onwards, the total area of land in the United States farms has decreased annually. The total farmland area has decreased by almost 50 million acres, reaching a total of 895.3 million acres as of 2021. Such factors are raising the demand for agrochemicals which boosts agriculture output.

Key Highlights

- Price premiums and innovative eco-friendly production methods are emerging steadily in the agrochemical market. There is an increasing need to balance the judicious use of the best chemicals and minimize the impact of that use. However, the harmful effects caused by agrochemicals on the land, environment, and human health are expected to hamper the growth of the market.

Agrochemicals Market Trends

Increasing Population and Consequent Rise in Food Demand

- According to FAO, the world population is expected to reach 9 billion by 2050. The increasing population creates a huge demand for food products to feed the population, which is turning into a major challenge with the decreasing farmland. For instance, in 2021, approximately 17.23 million hectares of land in the United Kingdom was classified as the utilized agricultural area, which has decreased from 17.27 million hectares in 2020. The shrinking area under agriculture is expected to demand more produce from the available land.

- Agrochemicals are highly important in obtaining high yields as these are necessary to prevent pests and diseases in the field. As per a report by FAO, nearly 40% of the world's agricultural crops are lost to pests and diseases each year. To tackle these problems and to increase production, the use of crop protection chemicals is anticipated to increase. According to FAO, in 2020, herbicide consumption worldwide nearly reached 1.4 million metric tons, whereas consumption of fungicides and bactericides stood at around 606 and 471 thousand metric tons, respectively.

- Agrochemicals also play a vital role in crop growth, showing improved performance and noticeable results. Supplying adequate plant nutrients is essential for healthy growth as well as the production capacity of plants. The nutrient demand varies with crops and soil. These nutrient demands can be effectively fulfilled through the use of chemicals. For instance, urea provides 46% nitrogen to the soil, whereas organic fertilizers like neem cake could provide only 2-5% of nitrogen, which is an essential element for plant growth and development. Thus, the growing population is the major factor for the need to increase the use of agrochemicals across the world.

Asia-Pacific Dominates the Market

- China accounts for the largest share among other countries in the agrochemicals market globally. Chinese consumption of organic N, P, and K fertilizers is reducing due to decreasing cropland area. For instance, according to the China Green Food Development Center, in 2021, approximately 9.84 million hectares of farmland had been certified as organic farmland in China, which has decreased from 13.9 million hectares in 2019. The cropland area under fruits and vegetables is increasing, while the area under cereals is decreasing.

- Similarly, the large production of cereal crops, like rice and wheat, in India is the major factor supporting the growth of the market. The use of pesticides is rising steadily in India. Revenues of a few leading pesticides and agrochemical companies as of June 2022 are a clear indication of the growth of the agrochemical market in the country as well as the region.

- UPL was the leading pesticides and agrochemical company in India based on net sales worth over INR 164 billion (USD 1.98 billion) as of June 2022. The company was followed by BASF India, which ranked in second place with net sales of roughly INR 130 billion (USD 1.57 billion). Data reveals that only eight states account for more than 70.0% of the total pesticide consumption in India. With a growing emphasis on the environment and sustainability, various governments in the region are enforcing clean production and environment-friendly agriculture policies, which may lead to a decline in synthetic pesticide usage in the country. However, the government has encouraged the use of microbial pesticides, which is expected to grow rapidly in the coming years.

Agrochemicals Industry Overview

The global agrochemicals market is fragmented, with major players including Bayer CropScience, Adama Agricultural Solutions, Yara International ASA, BASF SE, Corteva Agriscience, and Nufarm. New product launches, mergers and acquisitions, and partnerships are the major strategies adopted by these leading companies in the market. Market players are focusing on making investments in innovation, collaborations, and expansions to increase their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.2 Pesticides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.2 By Application

- 5.2.1 Crop-based

- 5.2.1.1 Grains and Cereals

- 5.2.1.2 Pulses and Oilseeds

- 5.2.1.3 Fruits and Vegetables

- 5.2.2 Non-crop-based

- 5.2.2.1 Turf and Ornamental Grass

- 5.2.2.2 Other Non-crop-based

- 5.2.1 Crop-based

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer CropScience AG

- 6.3.2 BASF SE

- 6.3.3 Corteva Agriscience AG

- 6.3.4 Archer-Daniels-Midland (ADM)

- 6.3.5 FMC Corporation

- 6.3.6 Adama Agricultural Solutions

- 6.3.7 Potash Corporation of Saskatchewan

- 6.3.8 Nufarm Ltd

- 6.3.9 Nutrien Ltd

- 6.3.10 Yara International ASA