|

市場調查報告書

商品編碼

1444353

平板玻璃 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

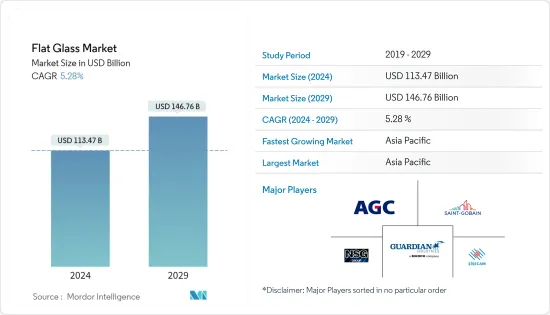

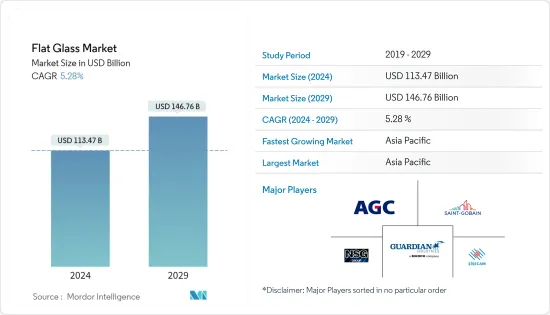

平板玻璃市場規模預計到2024年為1134.7億美元,預計到2029年將達到1467.6億美元,在預測期內(2024-2029年)CAGR為5.28%。

受疫情影響,大部分生產設施停工,汽車生產受到嚴重影響,生產設施因停工而受到影響達數月之久。全世界的供應鏈都斷裂了。由於債務增加,疫情爆發造成的經濟不穩定也使得公共和私營部門的開發商重新考慮他們的項目。這造成了建築業的衰退。

主要亮點

- 短期內,電子顯示器需求的成長和建築業需求的成長是推動所研究市場成長的主要因素。

- 然而,全球經濟衰退的影響和中國 COVID-19 的復甦可能會抑制所研究市場的成長。

- 儘管如此,汽車行業的進步和太陽能行業的不斷湧現可能很快就會為全球市場創造利潤豐厚的成長機會。

- 亞太地區主導平板玻璃市場,最大消費來自中國、日本、東協國家等國家。

平板玻璃市場趨勢

建築業將拉動平板玻璃的需求

- 平板玻璃因其廣泛的功能而在建築行業中廣泛應用,從隔熱到隔音,從安全應用到遮陽。

- 平板玻璃的最新進展使該材料表現出自清潔能力。有機污垢會被陽光中的紫外線分解。下雨時,破碎的污垢被簡單地從窗戶上沖走,幾乎不留下任何痕跡;水不會像在傳統玻璃上那樣形成水滴,而是形成一層覆蓋玻璃整個表面的薄膜,並在流走時帶走污垢。因此,在下雨時,自清潔玻璃比傳統玻璃具有更好的可視性。

- 建築和基礎設施發展的成長與平板玻璃的需求直接相關,從而推動了市場的成長。最近的趨勢顯示建築結構正在迅速變化,在外牆和屋頂上使用平板玻璃,最佳化自然採光。

- 在北美,美國在該地區整體住宅建築業中佔有重要佔有率。根據美國人口普查局的數據,2021 年美國住宅建設年價值為 8,029.33 億美元,而 2020 年為 6,442.57 億美元。

- 從2021年開始,亞太地區的一些地區的建築業預計將成為該國成長最快的產業之一。建築業預計將從 2020 年收縮 18.7% 反彈至 2021 年成長 13.9%。

- 根據普華永道的數據; Urban Land Institute認為,2022年工業不動產是亞太地區商業不動產中前景最好的,指數得分為6.99(分數範圍為1-9)。

- 根據土木工程師學會預測,未來十年,全球建築產量預計將成長 85%,收入將達到 15.5 兆美元,其中印度、中國等新興國家和美國等已開發國家領先。

- 由於印度和東協國家等發展中國家住房建設市場的不斷擴大,亞太地區預計將見證新住宅建設項目的最高成長。

- 在印度,建築業貢獻了該國GDP的約9%。允許在自動路線下對印度建築業進行 100% 外國直接投資,用於城鎮、商場/購物中心和商業建築營運和管理的已竣工項目。預計這些因素將有助於所研究市場的成長。

- 據 IBEF 稱,政府在 2022-23 年聯邦預算中撥款 10 億印度盧比(1,305.7 億美元)來加強基礎設施部門,大力推動基礎設施部門的發展。

中國將主導亞太地區

- 中國是全球最大的平板玻璃生產國,在該地區佔有重要的市場佔有率。中國的許多製造商一直致力於創造符合西方生產水準和環境標準的產品。

- 能源產業對太陽能應用中平板玻璃的需求不斷成長。中國擁有比世界上任何其他國家都多的太陽能發電能力。它是騰格里沙漠世界上最大的太陽能發電場之一的所在地。在可預見的未來,預計該國仍將是再生能源的最大投資者。

- 亞太地區在全球汽車市場的產量佔有率最高,2021年產量為46,732,785輛。2021年,中國約佔全球汽車產量的32.5%。在乘用車市場,中國乘用車年產量超過日本、德國、印度、韓國的總和。 2021年中國也是全球最大的汽車銷售市場。

- 根據OICA的數據,汽車總產量從2020年的25,225,242輛增加到2021年的26,082,220輛。

- 根據CEC;中國能源入口網站數據顯示,截至2021年,中國太陽能發電裝置容量已超過300吉瓦。預測期內,中國在增加太陽能發電容量方面取得了長足進步,累計容量從2017年的125.79吉瓦增加到2021年的306.56吉瓦。

平板玻璃產業概況

平板玻璃市場本質上是整合的。主要參與者包括 Saint-Gobain、AGC Inc.、Guardian Industries、Nippon Sheet Glass 和 Sisecam 等(排名不分先後)。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 對電子顯示器不斷成長的需求

- 建築業需求不斷增加

- 限制

- 即將到來的全球經濟衰退的影響以及 COVID-19 在中國的死灰復燃

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場價值規模)

- 產品類別

- 退火玻璃(包括有色玻璃)

- 鍍膜玻璃

- 反光玻璃

- 加工玻璃

- 鏡子

- 最終用戶產業

- 建築與施工

- 汽車

- 太陽能玻璃

- 其他最終用戶產業

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 東協國家

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 領先企業採取的策略

- 公司簡介

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries Inc.

- China Glass Holdings Limited

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries

- Nippon Sheet Glass Co. Ltd

- Phoenicia

- Saint-Gobain

- SCHOTT

- Sisecam

- Taiwan Glass Industry Corporation

- Vitro

第 7 章:市場機會與未來趨勢

- 汽車工業的進步

- 太陽能產業不斷湧現的舉措

The Flat Glass Market size is estimated at USD 113.47 billion in 2024, and is expected to reach USD 146.76 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

Most manufacturing facilities were shut down due to the pandemic, and automotive production was affected severely, which impacted production facilities for several months due to the lockdown. The supply chain throughout the world was fractured. The economic instability due to the pandemic outbreak has also made developers, in both public and private sectors, rethink their projects as debts mount. This has created a downfall in the construction sector.

Key Highlights

- Over the short term, the growing demand for electronic displays and increasing demand from the construction industry are major factors driving the growth of the market studied.

- However, the impact of the global recession and the resurgence of COVID-19 in China are likely to restrain the growth of the studied market.

- Nevertheless, advancements in the automotive industry and rising initiatives in the solar industry are likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region dominates the flat glass market, with the largest consumption coming from countries such as China, Japan, ASEAN countries, etc.

Flat Glass Market Trends

Construction Industry to Drive the Demand for Flat Glass

- Flat glass is used significantly in the construction industry owing to its wide range of functions, from heat insulation to soundproofing and from safety applications to solar protection.

- Recent advancements in flat glass have enabled the material to exhibit self-cleaning abilities. Organic dirt is broken down by ultraviolet light in sunlight. When it rains, the broken-down dirt is simply washed off the windows, leaving almost no streaks; instead of forming droplets as it would on conventional glass, the water forms a film that covers the entire surface of the glass and takes the dirt with it as it runs off. Thus, self-cleaning glass offers better visibility than conventional glass when it rains.

- The growth of construction and infrastructure development directly links to the demand for flat glass, which drives the market's growth. The recent trend suggests a rapid change in building architecture, with the use of flat glass in facades and roofs, optimizing natural daylight.

- In North America, the United States has a significant share of the overall residential construction sector in the region. According to the United States Census Bureau, the annual value of residential construction put in place in the United States was USD 802,933 million in 2021, compared to USD 644,257 million in 2020.

- From 2021, a few regions of Asia-Pacific in the construction sector are expected to be one of the fastest-growing sectors in the country. The construction sector is projected to rebound to a growth of 13.9% in 2021, from an 18.7% contraction in 2020.

- According to PwC; Urban Land Institute, industrial real estate had the best prospects among commercial properties in the Asia-Pacific region in 2022 with an index score of 6.99 on a scale of 1-9.

- According to the Institution of Civil Engineers, the volume of construction output is forecasted to grow by 85%, with a revenue of USD 15.5 trillion worldwide in the upcoming decade, led by emerging countries such as India and China and developed countries like the United States.

- The Asia-Pacific is expected to witness the highest growth in new residential construction projects due to the expanding housing construction market in developing countries, like India, and ASEAN countries.

- In India, the construction industry contributes to about 9% of the country's GDP. 100% Foreign direct investment in the construction industry in India under automatic route is permitted in completed projects for operations and management of townships, malls/shopping complexes, and business constructions. These factors are expected to contribute towards the growth of the market studied.

- According to IBEF, the government has given a massive push to the infrastructure sector by allocating INR 10 lakh crore (USD 130.57 billion) to enhance the infrastructure sector in the Union Budget 2022-23.

China to Dominate the Asia-Pacific Region

- China is the largest producer of flat glass in the world, holding a significant market share in the region. Many manufacturers in China have been geared to create products that meet Western production levels and environmental standards.

- The energy sector is witnessing rising demand for flat glass in solar power applications. China has more solar capacity than any other country in the world. It is home to one of the biggest solar farms in the world in the Tengger Desert. The nation is expected to remain the largest investor in renewable energy for the foreseeable future.

- The Asia-Pacific region holds the highest production share in the global automotive market, with 46,732,785 units in 2021. In 2021, China accounted for about 32.5% of global car production. In the passenger car market, China's annual production for passenger cars exceeded that of Japan, Germany, India, and South Korea combined. China was also the world's largest automobile sales market in 2021.

- According to OICA, the total number of vehicle production increased from 25,225,242 units in 2020 to 26,082,220 units in 2021.

- According to CEC; China Energy Portal, as of 2021, China has installed more than 300 gigawatts of solar power capacity. China made great strides in increasing solar power capacity during the forecast period, increasing cumulative capacity from just 125.79 GW in 2017 to 306.56 GW in 2021.

Flat Glass Industry Overview

The flat glass market is consolidated in nature. The major players include Saint-Gobain, AGC Inc., Guardian Industries, Nippon Sheet Glass Co., Ltd, and Sisecam, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Electronic Displays

- 4.1.2 Increasing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Impact of the Upcoming Recession Across the Globe and the Resurgence of COVID-19 in China

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Annealed Glass (Including Tinted Glass)

- 5.1.2 Coater Glass

- 5.1.3 Reflective Glass

- 5.1.4 Processed Glass

- 5.1.5 Mirrors

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Asahi India Glass Limited

- 6.4.3 Cardinal Glass Industries Inc.

- 6.4.4 China Glass Holdings Limited

- 6.4.5 Fuyao Glass Industry Group Co., Ltd.

- 6.4.6 Guardian Industries

- 6.4.7 Nippon Sheet Glass Co. Ltd

- 6.4.8 Phoenicia

- 6.4.9 Saint-Gobain

- 6.4.10 SCHOTT

- 6.4.11 Sisecam

- 6.4.12 Taiwan Glass Industry Corporation

- 6.4.13 Vitro

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in the Automotive Industry

- 7.2 Rising Initiatives in the Solar Industry