|

市場調查報告書

商品編碼

1444299

資料中心液體冷卻 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Center Liquid Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

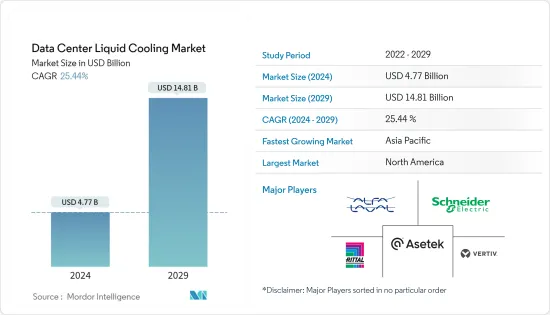

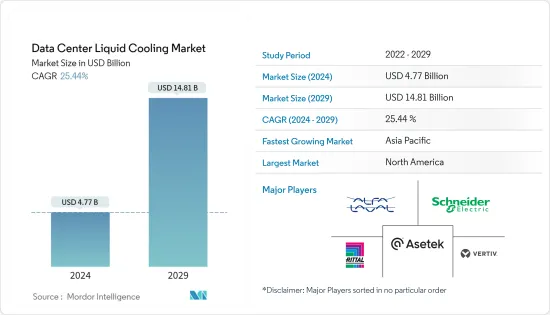

資料中心液體冷卻市場規模預計到2024年為47.7億美元,預計到2029年將達到148.1億美元,在預測期內(2024-2029年)成長25.44%。年複合成長率為

技術的進步使得液體冷卻變得易於維護、擴充性且經濟實惠,在具有炎熱、潮濕內置環境的資料中心中,液體使用量減少了15% 以上,在較好的地區,液體使用量減少了80 %。專用液體冷卻的能量可以重新用於加熱建築物和水,先進工程冷卻劑的應用可以有效減少空調的碳排放。

主要亮點

- 液體冷卻的其他優點包括比空氣冷卻更高的容量,在更大的體積中提供相同的冷卻,透過直接應用高功率密度組件來降低整體容量要求,以及高效的例子包括熱量去除。直接液體冷卻中使用的介電液體可以有效吸收熱量。因此,可以在更小的空間中插入更多的硬體,從而減少了容納硬體的額外空間的需要。

- 綠色資料中心是資料儲存、管理和分發的地方。機械、照明、電氣和電腦系統計畫盡可能提高能源效率,將對環境的負面影響降至最低。採用創新技術和技術來建立和營運綠色資料中心。隨著網際網路的快速成長和使用,資料中心的電力消耗量顯著增加。由於環境影響、公眾意識不斷增強、能源成本上升和政府措施,企業面臨綠色政策的壓力。這些因素導致了永續資料中心的發展,直接推動了資料中心液體冷卻市場。

- 同時,由於適應性要求,希望採用冷卻系統的資料中心營運商面臨更大的挑戰。資料中心非常複雜,擁有大量伺服器,數量、時間和位置都不確定。如此高密度的冷卻會產生許多額外成本。它必須具有適應性和擴充性,以滿足資料中心的需求。企業擔心他們目前的冷卻系統是否能夠應對未來伺服器負載的增加。這使得基礎設施的改變更加頻繁,公司也不太願意投資新的冷卻系統。

- 此外,新冠肺炎 (COVID-19) 疫情的爆發也顯著增加了對資料中心的需求。隨著越來越多的員工在家工作,視訊通話和 VPN 的使用正在增加。聯合醫療專業人員對遠端醫療應用程式的使用正在成長。

- Amwell 的數據顯示,紐約的遠端醫療就診量增加了 312%。為了保持娛樂並與親人保持聯繫,消費者也經常轉向串流媒體服務。隨著 Verizon 等服務供應商增加了頻寬容量,串流媒體服務變得更加容易獲得。這些產業變化增加了對雲端基礎的解決方案的渴望,增加了對資料中心及相關領域的需求。

資料中心液體冷卻市場趨勢

間接冷卻預計將佔據較大市場佔有率

- 直接晶片冷卻,也稱為間接冷卻或液對晶片冷卻或冷板冷卻,是最常見的液體冷卻方法,它使用冷凍水迴路和冷卻器中的冷卻劑將熱量從伺服器傳遞到外界。裡面的盤子。資料中心正在進入現代時代具有前所未有的計算和核心數量需求的應用程式。如今,傳統的空氣冷卻已達到其極限,迫使資料中心營運商和所有者重新考慮增加的密度以及隨之而來的挑戰。

- 資料中心對高效能、高頻率、密集工作負載條件、包括人工智慧 (AI) 和機器學習 (ML) 在內的多核心運算以及端到端資料中心解決方案的需求不斷增加。資料中心所有者可以利用間接或直接片上液體冷卻和系統整合商服務的最新進展來滿足公司範圍內的各種需求。

- 間接或直接晶片冷卻利用液體或相變傳熱機制。在最低的動作溫度下提供寬範圍的功率和散熱。此外,與透過其他傳統方式冷卻的處理器相比,該處理器可以在運行條件下以明顯更高的速度運行。

- 許多公司提供可在新伺服器和現有伺服器上實施的冷板技術。直接晶片冷卻技術通常比背板熱交換器具有更高的散熱能力。對晶片的直接冷卻通常只能消除框架中機械產生的 70-75% 的熱量,因此需要採用混合冷卻方法。

- 直接晶片冷卻的趨勢預計將在 2022 年持續,並在預測期內顯著增加。 IT 產業正在研究與處理器直接接觸的熱源的新冷卻技術。 ZutaCore 的直接片上電介質解決方案能夠為日益強大的 CPU 和 GPU 提供高效且永續的冷卻。這種高效能運算透過新的微處理器和 SoC(系統晶片)架構增強了效能。這種成長將實現更先進的處理,例如大規模資料分析和身臨其境型虛擬實境體驗。

預計北美將佔據壓倒性的市場佔有率

- 北美是新技術的較早採用者。該地區的連網設備普及顯著提高。資料中心投資者擴大投資於直接晶片冷卻和液浸冷卻技術。隨著全球5G網路的發展,邊緣資料中心變得越來越重要,美國是5G網路的早期採用者之一。許多美國通訊業者已開始投資這些中心,包括 EdgePresence、EdgeMicro 和 American Towers。

- 根據Cisco的資料,近年來行動資料流量大幅成長,從每月 1.26Exabyte增加到 2021 年每月 7.75Exabyte。愛立信表示,預計到 2030 年,資料流量將進一步增加兩倍,分散式雲端可切實確保如此實用化的快速連線所需的低延遲和高頻寬。一些最大的科技公司正在應對關鍵挑戰,同時管理其伺服器和運算需求。密度成長的主要驅動力是人工智慧資料處理的快速增加。

- 在美國,人們和企業上網的時間急劇增加。該國是最大的資料中心營運市場,並且由於最終用戶資料消費量的增加而仍在不斷擴大。物聯網 (IoT) 的日益普及使得更多設施能夠支援商業用戶和消費者產生的Exabyte資料。物聯網是美國超大規模資料中心的關鍵驅動力,增加了對資料中心的需求。液體冷卻市場。

- 直接晶片液體冷卻在北美越來越受歡迎。使用冷卻水的設備還包括雙管道現場水處理設備。該國東南部和西部地區的許多供應商正在改用具有節熱器模式的水冷式冷卻器,使他們能夠利用外部空氣來部分冷卻其設施。

- 此外,隨著對高效資料中心的需求不斷增加、對環保資料中心解決方案的承諾以及全部區域功率密度的顯著增加,加拿大將繼續發展並提供更多的資料中心基礎設施解決方案。據加拿大自然資源部稱,資料中心消耗的能源大約有一半用於計算伺服器,另外 40% 用於冷卻這些伺服器。此外,根據記錄,這座加拿大城市的年氣溫為 42.8°F。這消除了在資料中心安裝大型冷卻系統的需要,從而降低了營運成本。

資料中心液冷產業概況

資料中心液體冷卻市場競爭激烈,由幾個主要參與者組成,例如 Alfa Laval AB、Asetek AS、Liquid Cool Solutions 和 Vertiv Co。從市場佔有率的角度來看,目前主導市場的重要參與者很少。這些大公司擁有龐大的市場佔有率,並專注於擴大國際客戶。這些公司利用策略合資企業來增加市場佔有率和盈利。公司需要專門為其系統開發的流體。例如,最近進入市場的 Submer 開發了一種專門針對其技術量身定做的冷媒。新的競爭對手可能會加劇競爭,帶來策略和技術投資,並擴大高效技術的市場。

- 2022 年 5 月,英特爾啟動了一項新計劃,投資 7 億美元建造專門從事液體和浸入式冷卻的新研究設施,以解決資料中心的永續性。同時,英特爾宣布推出首款投入市場的浸沒式冷卻參考設計,以加速該技術在全球資料中心的使用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 區域IT基礎設施建設

- 綠色資料中心的出現

- 市場限制因素

- 成本、適應性要求和停機

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間敵對的強度

- 評估 COVID-19 對市場的影響

第5章市場區隔

- 按解決方案

- 直接冷卻或浸沒式冷卻

- 對晶片進行間接冷卻或直接冷卻

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區

第6章 競爭形勢

- 公司簡介

- Alfa Laval AB

- Liquid Stack Inc.

- Asetek AS

- Asperitas Company

- Chilldyne Inc

- CoolIT Systems Inc.

- Fujitsu Limited

- Mikros Technologies

- Kaori Heat Treatment Co. Ltd

- Lenovo Group Limited

- Liquid Cool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd

- USystems Ltd

- Rittal GmbH &Co. KG

- Schneider Electric

- Submer Technologies

- Vertiv Co.

- Wakefield-Vette Inc.

- Wiwynn Corporation

第7章 投資分析

第8章市場機會及未來趨勢

The Data Center Liquid Cooling Market size is estimated at USD 4.77 billion in 2024, and is expected to reach USD 14.81 billion by 2029, growing at a CAGR of 25.44% during the forecast period (2024-2029).

Technological advancements have made liquid cooling simple to maintain, easily scalable, and affordable and have reduced liquid usage by more than 15% for data centers in built-in hot and humid climates and 80% in more excellent areas. The energy dedicated to liquid cooling can be recycled to heat buildings or water, effectively shrinking the carbon footprint of air conditioning due to the application of advanced engineering coolants.

Key Highlights

- Other benefits of liquid cooling include higher capacity than air cooling, providing the same cooling with a much larger volume, reduced overall capacity requirement due to applying high-power density components directly, and efficient heat rejection. The dielectric liquid used in the direct liquid cooling method effectively absorbs heat. Hence, more hardware can be inserted into a smaller space, lowering the need for additional space to accommodate the hardware.

- A green data center is where data is stored, managed, and distributed. The mechanical, lighting, electrical, and computer systems are planned to be as energy-efficient as possible while minimizing their adverse environmental effects. Innovative techniques and technologies are used in building and running green data centers. With the exponential growth and usage of the Internet, power consumption in data centers has increased significantly. Companies are under more pressure to adopt a green policy due to the environmental impact, rise in public awareness, higher cost of energy, and governmental action. These factors have made the development of sustainable data centers directly drive the data center liquid cooling market.

- On the other hand, Operators of data centers wishing to employ cooling systems face substantial challenges due to the requirements for adaptability. Data centers are complex, with a vast server array, and they carry the uncertainty of quantity, timing, and location. When cooling at such a high density, many extra expenses are incurred. To satisfy the demands of the data center, it must be adaptable and scalable. Companies are worried if their current cooling systems can support the increased server load in the future. This makes infrastructure changes frequent and pushes companies unwilling to invest much in newer cooling systems.

- Furthermore, the COVID-19 epidemic has significantly increased the demand for data centers. As more employees work from home, video calls and VPN usage are rising. The use of telehealth applications by allied health practitioners is expanding.

- In New York, telehealth visits have increased by 312%, as per Amwell. To keep entertained and in touch with loved ones, consumers are also heavily utilizing streaming services, which are becoming more readily available due to service providers like Verizon, who enhance their bandwidth capacity. Such industry changes have fueled the desire for cloud-based solutions, fueling demand for data centers and their related sectors.

Data Center Liquid Cooling Market Trends

Indirect Cooling is Anticipated to Account for a Significant Market Share

- Direct-to-chip cooling, also known as indirect or liquid-to-chip cooling or cold plate cooling, is the most common liquid cooling method which transfers heat from the server to the outside using a chilled water loop and a coolant on a cold plate inside. Data centers are entering applications with unprecedented computation and core count demands in the modern era. These days, as traditional air cooling hits its limits, data center operators and owners must reconsider the growing density and the challenge offered.

- High-performance, high-frequency, and intensive workload conditions, multi-core computing, including artificial intelligence (AI) and machine learning (ML), and end-to-end data center solutions are in high demand in data centers. Data center owners could meet various needs across the company due to the most recent advancements in indirect or direct-on-chip liquid cooling and system integrator services.

- Indirect or direct-to-chip cooling utilizes liquid or phase-change heat-transfer mechanisms. It offers extensive power and heat dissipation at a minimum operating temperature. Furthermore, it allows it to work under operating conditions, and a processor can perform significantly faster than a processor cooled by other conventional means.

- Many firms offer cold plate technology that can be implemented into new and existing servers. Direct-to-chip cooling technology often has a higher heat dissipation capability than backplane heat exchangers. A hybrid cooling approach is necessary because direct-to-chip cooling typically only removes 70-75 percent of the heat produced by the machinery in the frame.

- The direct-to-chip-cooling trend is expected to continue in 2022 and increase significantly over the forecast period. The IT industry is researching new cooling technologies for heat sources directly contacting the processor. ZutaCore's direct-on-chip dielectric solutions enable efficient and sustainable cooling of increasingly powerful CPUs and GPUs. With this high-performance computing, power grows with new microprocessors and SoC (system on chip) architectures. This growth allows for more advanced processing, such as large-scale data analysis and immersive virtual reality experiences.

North America is Anticipated to Hold a Dominant Market Share

- North America is an early adopter of newer technologies. The region saw a tremendous increase in the penetration of linked devices. Investors in data centers are increasingly funding direct-to-chip and liquid immersion cooling technologies. The worldwide development of 5G networks, of which the United States is one of the early adopters, has boosted the significance of edge data centers. Many American operators have begun investing in these centers, including EdgePresence, EdgeMicro, and American Towers.

- The mobile data traffic has increased considerably over the years, from 1.26 exabytes per month of data traffic to 7.75 exabytes per month in 2021, as reported by Cisco Systems. According to Ericsson, the data traffic is expected to triple further by 2030. Thus, the distributed cloud that can secure the low latency and high bandwidth required to connect to such a scale quickly is expected to come into action. Several technology giants address critical challenges while managing their server and computational needs. A major factor responsible for the rising densities is the rapid rise in data-crunching for AI.

- The time people and businesses spend online is dramatically increasing in the United States. The country is the largest market for data center operations, and it is still expanding due to the increased data consumption by end users. There are now more facilities that can support exabytes of data created by commercial users and consumers due to the growing popularity of the Internet of Things (IoT), which is a significant driver for the US hyper-scale data center and enhances the need for a liquid cooling market.

- Direct-to-chip liquid cooling is growing in popularity in North America. On-site water treatment facilities with dual piping systems are included in the facilities that use water for cooling. Many vendors in the Southeastern and Western regions of the country are switching to water-cooled chillers, which have an economizer mode that enables partial facility cooling by using outside air.

- Additionally, Canada is continuously growing and providing more data center infrastructure solutions due to increased demand for efficient data centers, initiatives for ecological data center solutions, and substantial growth of power density across the region. According to Natural Resources Canada, around half of the energy consumed in a data center is utilized by computing servers, with a further 40% being attributable to cooling these servers. Furthermore, the climatic conditions of the cities in Canada are recorded with an annual temperature of 42.8 °F. This eliminates the need for extensive cooling systems in the data centers and, in turn, helps to reduce operational costs.

Data Center Liquid Cooling Industry Overview

The data center liquid cooling market is highly competitive and consists of several significant players like Alfa Laval AB, Asetek AS, Liquid Cool Solutions, Vertiv Co, etc. In terms of market share, few important players currently dominate the market. These leading firms have significant market shares and are concentrating on growing their clientele internationally. These businesses use strategic joint ventures to raise their market shares and profitability. Companies want specially developed fluids for their systems. For instance, Submer, a recent market entrant, created a coolant, especially for its technology. New competitors intensify the competition, which may induce them to make strategic and technological investments, expanding the market for highly effective technologies.

- In May 2022, Intel launched a new initiative to address data center sustainability with a $700 million investment into a new research facility specializing in liquid and immersion cooling. Along with this, Intel unveiled the first immersion cooling reference design in the market to promote the use of the technology in data centers worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of IT Infrastructure in the Region

- 4.2.2 Emergence of Green Data Centers

- 4.3 Market Restraints

- 4.3.1 Costs, Adaptability Requirements, and Power Outages

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the market

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Direct Cooling or Immersion Cooling

- 5.1.2 Indirect Cooling or Direct-to-chip Cooling

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alfa Laval AB

- 6.1.2 Liquid Stack Inc.

- 6.1.3 Asetek AS

- 6.1.4 Asperitas Company

- 6.1.5 Chilldyne Inc

- 6.1.6 CoolIT Systems Inc.

- 6.1.7 Fujitsu Limited

- 6.1.8 Mikros Technologies

- 6.1.9 Kaori Heat Treatment Co. Ltd

- 6.1.10 Lenovo Group Limited

- 6.1.11 Liquid Cool Solutions

- 6.1.12 Midas Green Technologies

- 6.1.13 Iceotope Technologies Ltd

- 6.1.14 USystems Ltd

- 6.1.15 Rittal GmbH & Co. KG

- 6.1.16 Schneider Electric

- 6.1.17 Submer Technologies

- 6.1.18 Vertiv Co.

- 6.1.19 Wakefield-Vette Inc.

- 6.1.20 Wiwynn Corporation