|

市場調查報告書

商品編碼

1444241

印刷油墨 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Printing Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

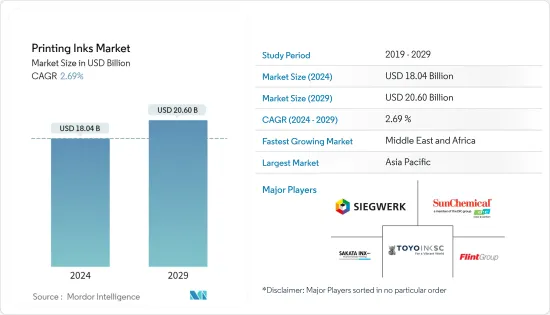

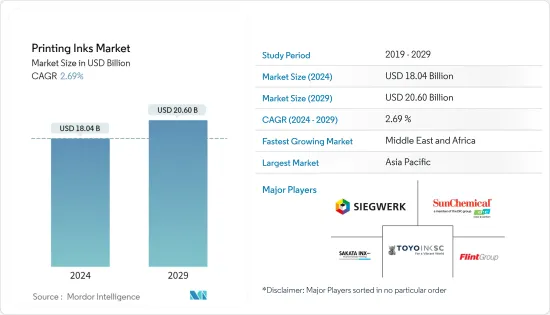

印刷油墨市場規模預計到2024年為180.4億美元,預計到2029年將達到206億美元,在預測期內(2024-2029年)CAGR為2.69%。

2020年,受COVID-19影響,各製造工廠關閉,包裝需求下降。因此,這影響了包裝行業印刷油墨的消耗。然而,食品和飲料行業開始復甦並顯示出積極影響。 2021年,產業處於復甦過程中,製造商克服了疫情帶來的許多課題。

主要亮點

- 短期內,數位印刷行業需求成長以及包裝和標籤行業需求成長等主要因素預計將推動市場成長。

- 另一方面,傳統商業印刷業的衰退以及有關處置的嚴格法規預計將阻礙所研究市場的成長。

- 儘管如此,生物基和紫外線固化油墨的出現可能很快就會為全球市場創造利潤豐厚的成長機會。

- 亞太地區在全球市場中佔據主導地位,其中中國的消費量最大。

印刷油墨市場趨勢

包裝領域的需求不斷增加

- 根據包裝與加工技術協會 PMMI 發布的報告,全球包裝產業的成長預計將從 2016 年的 368 億美元增至 2021 年的 422 億美元。發展中地區消費能力的增強預計將增加對包裝的需求。

- 數位印刷正在迅速擴展到標籤生產和電子照相領域。由於數位印刷的應用不斷增加,預計包裝行業在未來十年將經歷一場重大革命。

- 由於數位印刷具有快速週轉的能力,因此深受各品牌商的歡迎。數位印刷的最新發展,例如數位紙盒切割、壓痕和其他完成技術,增加了在軟包裝、瓦楞包裝和折疊紙盒中更多應用的潛力。

- 噴墨製程具有非接觸式、低成本等優點,廣泛用於在各種基材上進行大幅面印刷,適合包裝。它可以比碳粉系統更有效地整合到現有的轉換生產線中。

- 隨著中國、印度和美國等國家食品工業的發展和人口的成長,硬包裝在過去幾年中不斷增加。

- 軟包裝是整個包裝市場中最大的包裝應用領域,具有多種優勢,例如比硬包裝所需材料少91%,節省空間約96%。此外,隨著對永續性的日益關注,傳統的硬質包裝解決方案正在被創新的軟性包裝解決方案所取代。

- 在食品業中,軟包裝因其吸濕性能、產品新鮮度和溫度控制而受到青睞,同時能夠保持產品的保存期限。除瓶裝水等其他產品外,捲菸及相關菸草產品是軟包裝產業的主要產品。

- 在食品業中,軟包裝因其吸濕性能、產品新鮮度和溫度控制而受到青睞,同時能夠保持產品的保存期限。除瓶裝水等其他產品外,捲菸及相關菸草產品是軟包裝產業的主要產品。

- 因此,包裝產業對印刷油墨的需求預計在預測期內將快速成長。

中國將主導亞太市場

- 亞太地區主導了全球市場佔有率。隨著建築活動的不斷成長和對家具的需求不斷增加

- 中國是世界上最大的製造經濟體和出口國,其包裝需求龐大。 2022年9月,中國包裝產業生產了1,160萬噸包裝紙和紙板,是當年全球最大的生產國。中國軟性、剛性、紙和紙板包裝材料的使用呈成長趨勢。包裝行業的這一積極勢頭預計將提振印刷油墨的市場需求。

- 此外,包裝產業成長顯著,快遞量呈上升趨勢。 2021年中國快遞總量約1,080億件。

- 中國的紡織業僱用了數百萬人,為國家的出口和經濟做出了巨大貢獻。中國服裝布料業務獲利且規模不斷擴大,出口產業日益成長。

- 在國內和全球消費市場,中國服裝布料產業在原料品質、產業結構、現代高科技機械、標籤開發和工作流程等多個領域都在進步。

- 此外,該國紡織業對印刷油墨的需求也不斷增加。儘管過去幾年紡織業成長緩慢,但該國仍是世界上最大的服裝出口國,擁有龐大的產能。

- 由於上述所有因素,該地區的印刷油墨市場預計在預測期內將會成長。

印刷油墨產業概況

全球印刷油墨市場部分整合,前五名廠商主導了全球市場佔有率。主要參與者包括 Sun Chemicals、Flint Group、Sakata Inx Corporation、Toyo Ink SC Holdings 和 Siegwerk Druckfarben AG & Co 等

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 數位印刷產業不斷成長的需求

- 包裝和標籤行業的需求不斷成長

- 限制

- 傳統商業印刷業的衰退

- 嚴格的處置規定

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場規模依數量計算)

- 類型

- 溶劑型

- 水性

- 油基

- 紫外線

- 紫外線LED

- 其他類型

- 過程

- 平版印刷

- 柔版印刷

- 凹版印刷

- 數位印刷

- 其他流程

- 應用

- 包裝

- 硬質包裝

- 紙板容器

- 瓦楞紙箱

- 硬質塑膠容器

- 金屬罐

- 其他硬質包裝

- 軟包裝

- 標籤

- 其他包裝

- 商業及出版

- 紡織品

- 其他應用

- 包裝

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 東協國家

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 領先企業採取的策略

- 公司簡介

- ALTANA

- Dainichiseika Color & Chemicals Mfg. Co. Ltd

- Dow

- Epple Druckfarben AG

- Flint Group

- FUJIFILM Corporation

- Hubergroup Deutschland GmbH

- SAKATA INX CORPORATION

- Sanchez SA de CV

- SICPA HOLDING SA

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- T&K TOKA Corporation

- Tokyo Printing Ink Mfg Co. Ltd

- Toyo Ink SC Holdings Co. Ltd

- Wikoff Color Corporation

- Yip's Chemical Holdings Limited

- Zeller+Gmelin

第 7 章:市場機會與未來趨勢

- 生物基和紫外線固化油墨的出現

- 其他機會

The Printing Inks Market size is estimated at USD 18.04 billion in 2024, and is expected to reach USD 20.60 billion by 2029, growing at a CAGR of 2.69% during the forecast period (2024-2029).

Due to the COVID-19 impact in 2020, various manufacturing plants were shut down, and the demand for packaging has declined. Thus, this affected the consumption of printing inks in the packaging sector. However, the food and beverage industry started recovering and has shown a positive impact. In 2021 the industry was in the recovery process, and the manufacturers overcame many challenges that the pandemic created.

Key Highlights

- In the short term, the major factors such as growing demand from the digital printing industry and the rising demand from the packaging and labels sector are expected to drive the market's growth.

- On the flip side, a decline in the conventional commercial printing industry, and stringent regulations regarding disposal are expected to hinder the growth of the market studied.

- Nevertheless, the emergence of bio-based and UV-curable Inks is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific dominated the market across the world, with the largest consumption from China.

Printing Inks Market Trends

Increasing Demand from the Packaging Segment

- According to a report published by PMMI, the Association for Packaging and Processing Technologies, growth in the global packaging industry is anticipated to reach USD 42.2 billion by 2021 from USD 36.8 billion in 2016. This is due to the increasing population, growing sustainability concerns, and more spending power in developing regions are expected to increase the demand for packaging.

- Digital printing is rapidly expanding into label production and electrophotography. The packaging industry is expected to experience a significant revolution over the next decade due to the increasing application of digital printing.

- Due to the quick turnaround capability that digital printing offers, it has been very popular among various brand owners. Recent developments in digital printing, such as digital carton cutting, creasing, and other completion technologies, have increased the potential for more applications in flexible packaging, corrugated packaging, and folding cartons.

- With the advantages of the inkjet process, such as being non-contact and low cost, this process is extensively used for printing large formats on a wide range of substrates, making it suitable for packaging. It can be integrated into existing conversion lines more efficiently than toner systems.

- With the developments in the food industry and the growing population in countries like China, India, and the United States, rigid packaging has been increasing over the past few years.

- Flexible packaging is the largest packaging application segment of the overall packaging market, owing to its various advantages, such as requiring 91% lesser material than rigid packaging, and about 96% of space saving. Moreover, with an increasing focus on sustainability, traditional rigid packaging solutions are being replaced by innovative and flexible packaging solutions.

- In the food industry, flexible packaging is preferred due to its moisture absorption properties, product freshness, and temperature control, while being able to maintain the shelf life of the product. Cigarettes and associated tobacco products are the major products for the flexible packaging industry, among other products, such as bottled water.

- In the food industry, flexible packaging is preferred due to its moisture absorption properties, product freshness, and temperature control, while being able to maintain the shelf life of the product. Cigarettes and associated tobacco products are the major products for the flexible packaging industry, among other products, such as bottled water.

- Hence, the demand for printing inks from the packaging industry is expected to grow at a rapid rate during the forecast period.

China to Dominate the Asia-Pacific Market

- The Asia-Pacific region dominated the global market share. With growing construction activities and the increasing demand for furniture

- China stands to be the world's largest manufacturing economy and exporter, due to which its packaging requirement is huge. The packaging industry in China produced 11.6 million metric tons million metric ton of packaging paper and paperboard in September 2022 and was the largest producer worldwide that year. China sees a growing trend in the use of flexible, rigid, and paper and board packaging materials. This positive momentum in the packaging industry is expected to boost the market demand for printing inks.

- Additionally, the packaging industry witnessed noticeable growth, with the increasing trend of express deliveries. the total volume of express delivery in China amounted to about 108 billion pieces in 2021.

- The textile industry in China employs millions of people and contributes significantly to the country's exports and economy. Chinese apparel cloth businesses are profitable and expanding, with the export sector experiencing day-to-day growth.

- In both the domestic and global consumer markets, the Chinese garment cloth industry is progressing in many areas, including raw material quality, industrial structure, modern high-tech machinery, label development, and the work process.

- Additionally, printing ink demand has also been increasing from the textile industry in the country. The country stands to be the largest clothing exporter in the world, holding massive production capacity, although the textile industry witnessed a slow growth in the past few years.

- Owing to all the above-mentioned factors, the market for printing inks in the region is projected to increase during the forecast period.

Printing Inks Industry Overview

The global printing inks market is partially consolidated, the top five players dominated the global market share. Some of the Major players include Sun Chemicals, Flint Group, Sakata Inx Corporation, Toyo Ink SC Holdings Co. Ltd, and Siegwerk Druckfarben AG & Co, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Digital Printing Industry

- 4.1.2 Rising Demand from the Packaging and Labels Sector

- 4.2 Restraints

- 4.2.1 Decline in the Conventional Commercial Printing Industry

- 4.2.2 Stringent Regulations Regarding Disposal

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Solvent-based

- 5.1.2 Water-based

- 5.1.3 Oil-based

- 5.1.4 UV

- 5.1.5 UV-LED

- 5.1.6 Other Types

- 5.2 Process

- 5.2.1 Lithographic Printing

- 5.2.2 Flexographic Printing

- 5.2.3 Gravure Printing

- 5.2.4 Digital Printing

- 5.2.5 Other Processes

- 5.3 Application

- 5.3.1 Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.1.1.1 Paperboard Containers

- 5.3.1.1.2 Corrugated Boxes

- 5.3.1.1.3 Rigid Plastic Containers

- 5.3.1.1.4 Metal Cans

- 5.3.1.1.5 Other Rigid Packaging

- 5.3.1.2 Flexible Packaging

- 5.3.1.3 Labels

- 5.3.1.4 Other Packaging

- 5.3.2 Commercial and Publication

- 5.3.3 Textiles

- 5.3.4 Other Applications

- 5.3.1 Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia & New Zealand

- 5.4.1.6 ASEAN Countries

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA

- 6.4.2 Dainichiseika Color & Chemicals Mfg. Co. Ltd

- 6.4.3 Dow

- 6.4.4 Epple Druckfarben AG

- 6.4.5 Flint Group

- 6.4.6 FUJIFILM Corporation

- 6.4.7 Hubergroup Deutschland GmbH

- 6.4.8 SAKATA INX CORPORATION

- 6.4.9 Sanchez SA de CV

- 6.4.10 SICPA HOLDING SA

- 6.4.11 Siegwerk Druckfarben AG & Co. KGaA

- 6.4.12 Sun Chemical

- 6.4.13 T&K TOKA Corporation

- 6.4.14 Tokyo Printing Ink Mfg Co. Ltd

- 6.4.15 Toyo Ink SC Holdings Co. Ltd

- 6.4.16 Wikoff Color Corporation

- 6.4.17 Yip's Chemical Holdings Limited

- 6.4.18 Zeller+Gmelin

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Bio-based and UV-curable Inks

- 7.2 Other Opportunities