|

市場調查報告書

商品編碼

1444231

ADAS(進階駕駛輔助系統):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Advanced Driver Assistance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

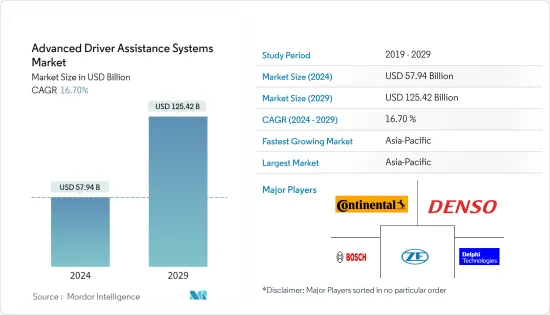

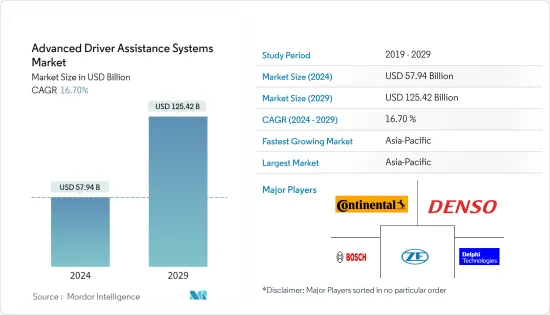

ADAS(高級駕駛輔助系統)市場規模預計到2024年為579.4億美元,預計到2029年將達到1254.2億美元,在預測期內(2024-2029年)將以16.70%的年複合成長率成長。

COVID-19 大流行對所研究的市場產生了負面影響,封鎖和貿易限制導致全球供應鏈中斷和汽車生產暫停。然而,隨著限制的放鬆,參與者開始專注於減輕此類風險和發展,以在預測期內產生市場動力。

人們對乘員舒適性和安全性的認知不斷提高,以及政府法規對安全功能的強制要求,預計將增加具有整合 ADAS 功能的車輛的產量,從而推動市場需求。此外,自動駕駛或自動駕駛車輛的接受度不斷提高,進一步推動了市場的成長。全球汽車產業的趨勢也在快速變化。

中價格分佈汽車配備了根據消費者喜好設計和製造的基本零件。對配備先進安全功能的中小型車輛的需求持續成長預計也將推動汽車 ADAS 市場的成長。

老牌和新興市場參與企業正在美國、印度、中國、德國和法國等目標國家創造新的收益來源,亞太地區、北美和歐洲的需求預計將成長。此外,當地需求是由政府法規驅動的。

ADAS 市場趨勢

ADAS 部署因法規而增加

世界各國政府都致力於制定多項立法政策和法規來監控使用者並鼓勵消費者註意自己的車輛,以減少道路交通事故的發生,而交通事故在一些國家正在上升。我們正在提案政策,要求和鼓勵消費者註意自己的車輛。安裝 ADAS 組件。例如,印度政府已經對摩托車強制要求配備ABS,重點是提高車輛安全性。目前,

- 印度致力於在 2022 年至 2023 年強制車輛安裝電子穩定控制 (ESC) 和自動緊急煞車 (AEB)。此外,為了減少該國的事故數量,道路運輸和公路部宣布目前正在努力強制汽車實施 ADAS。

隨著中國、印度和美國等國家有關 ADAS 要求的法規收緊,例如強制所有車輛安裝停車系統輔助系統,汽車製造商正在努力將這些功能涵蓋大多數車輛中。 ADAS 功能過去僅適用於豪華車,但現在也已引入其他汽車領域。這些系統也可作為非豪華汽車的選配設備。這些功能也正在商用車中實現。

- 截至2022年中期,所有進入歐盟市場的新車可能需要配備先進的安全系統。繼 2021 年 3 月與歐洲議會達成協議後,理事會通過了有關一般機動車輛安全以及保護車輛乘員和弱勢道路使用者的法規,旨在大幅減少道路事故造成的死亡和受傷人數。被採用。此外,政府支持的汽車安全評級組織 Euro NCAP 可能會要求汽車配備駕駛員監控系統,以便從 2023 年或 2024 年起達到五星級安全評級。

一些政府專注於為在其地區營運的車輛強制規定特定的 ADAS 功能,而另一些政府則正在為 ADAS 功能及其相關規範制定標準,以提高車輛性能。

- 中國政府最近也專門針對 ADAS 發布了三項新標準,反映出 ADAS 在現代車輛中的應用日益廣泛。第一個新標準是關於 ADAS 術語和定義的 GB/T 39263-2020。該標準提供了各種系統的定義,這些系統分為兩類。資訊支援系統和控制支援系統。

亞太地區預計將成為成長最快的市場

中國是全球最大的汽車市場之一,2020年小客車銷量超過2,017萬輛,較去年同期下降5.89%。儘管發生了新冠疫情,中國仍然是世界領先的汽車市場之一。這是預測技術在中國汽車市場立足的絕佳機會。中國政府正在重點關注多種先進的車輛技術,例如 ADAS 功能以及電動車。

因此,該地區的主要汽車製造商正在透過新的 2 級和 3 級 ADAS 功能更新其產品組合。例如,長城汽車旗下哈佛品牌於2021年5月推出了一款全新緊湊型SUV“赤兔”,搭載1.5L渦輪增壓引擎(最大輸出135kW,最大扭矩275Nm)搭配7速濕式雙離合器變速箱。此外,該車還配備了Level 2 ADAS系統,根據版本不同功能也不同。

印度正逐步進入以自動駕駛和人工智慧為主導的汽車產業,新產品不斷推出,ADAS市場具有潛力和機會。例如,

- 2021年,Morris Garage推出了新款Gloster SUV,該車配備了基於預測技術的最新ADAS功能,包括自動緊急煞車、自動停車輔助、盲點碰撞警報和車道偏離警告。

- MG Hector 於 2021 年推出了另一款 SUV Aster。 Aster 是一款經濟實惠的緊湊型 SUV,具有 2 級 ADAS 功能,例如主動車距控制巡航系統、自動緊急煞車、盲點偵測、車道維持輔助和車道偏離警告。

所有其他科技公司現在都全力致力於開發該市場獨有的聯網汽車解決方案並分享收益。

ADAS行業概況

研究市場的主要企業包括大陸集團、羅伯特博世有限公司、奧托立夫公司、電裝公司和德爾福汽車公司等公司。主要企業之間不斷擴大的合作夥伴關係,以及這些積極的產品創新、合作等,表明市場的顯著成長,預計將在預測期內產生積極的市場前景。例如,

- 特種半導體製造領域的全球領導者 GlobalFoundries (GF) 將於 2021 年 3 月與博世合作開發下一代汽車雷達。博世將使用格芯的 22FDX RF 解決方案開發用於汽車ADAS 應用的毫米波汽車系統晶片。

- 2021 年 9 月,採埃孚推出了新一代中程雷達,支援先進的 ADAS 安全功能,並為中國東風風神逸軒 MAX 上配備的採埃孚 coASSIST 半自動系統提供動力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(市場規模、金額、十億美元)

- 按類型

- 停車輔助系統

- 主動式轉向頭燈

- 夜視系統

- 盲點偵測

- 先進的自動緊急煞車系統

- 碰撞警報

- 打瞌睡鬧鐘

- 交通標誌識別

- 車道偏離警示

- 主動車距控制巡航系統

- 依技術

- 雷達

- 騎士

- 相機

- 按車型

- 小客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 其他地區

- 巴西

- 阿根廷

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他地區

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Aisin Seiki Co. Ltd

- Delphi Automotive

- DENSO Corporation

- Infineon Technologies

- Magna International

- WABCO Vehicle Control Services

- Continental AG

- ZF Friedrichshafen AG

- Mobileye

- Hella KGAA Hueck &Co

- Robert Bosch GmbH

- Valeo SA

- Hyundai Mobis

- Autoliv Inc.

第7章市場機會與未來趨勢

The Advanced Driver Assistance Systems Market size is estimated at USD 57.94 billion in 2024, and is expected to reach USD 125.42 billion by 2029, growing at a CAGR of 16.70% during the forecast period (2024-2029).

The COVID-19 pandemic had a negative impact on the market studied as lockdowns and trade restrictions led to supply chain disruptions and a halt of vehicle production across the world. However, as restrictions eased, players started focusing on mitigating such risks and developments to create momentum in the market during the forecast period.

Growing production of vehicles with integrated ADAS features in the wake of rising awareness toward comfort and safety of passengers and government regulations mandating safety features are expected to drive demand in the market. Moreover, the rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market. The dynamics of the global automotive industry are also changing rapidly.

Mid-price segment cars are equipped with basic components that have been designed and manufactured according to consumer preferences. A consistent increase in the demand for compact and mid-sized automobiles equipped with advanced safety features is also expected to propel the growth of the automotive ADAS market.

Established and emerging market participants are generating new sources of revenue in target countries, such as the U.S., India, China, Germany, and France, expected to enhance demand across Asia-Pacific, North America, and Europe. Further, demand in the regions is driven by government regulations.

Advanced Driver Assistance systems Market Trends

Increase in Adoption of ADAS Due to Regulations

Governments across the globe are focusing on designing several legislative policies and regulations to monitor the users and are proposing policies mandating and encouraging consumers to install ADAS components in vehicles to mitigate rising road accidents across several countries. For instance, the Indian government has already mandated a requirement for ABS on motorcycles with a focus on improving vehicle safety. Currently,

- India is working to make Electronic Stability Control (ESC) and Autonomous Emergency Braking (AEB) mandatory in cars by 2022-2023. Moreover, in an effort to lower the number of accidents in the nation, the Ministry of Road Transport and Highways announced that it is now working on making ADAS (advanced driver assistance systems) essential for automobiles.

Due to an increase in regulations on ADAS requirements, like mandatory installation of parking system assistance in all cars in China, India, the United States, etc., the automakers are making efforts to include these features in most of their cars. The ADAS features, which were only available in premium cars, are now being brought to other car segments as well. These systems are being offered as optional equipment in cars other than high-end vehicles. These features are being included in commercial vehicles as well.

- As of mid-2022, all new cars put on the EU market may have to be equipped with advanced safety systems. Following an agreement with the European Parliament in March 2021, the council adopted a regulation on the general safety of motor vehicles and the protection of vehicle occupants and vulnerable road users in a bid to significantly reduce the number of road casualties. Additionally, Euro NCAP, a government-backed group that rates cars for safety, may require cars to have a driver-monitoring system in order to earn a five-star safety rating starting in 2023 or 2024.

Some governments are focusing on mandating certain ADAS features across vehicles operating in their region others are focusing on designing and implementing standards for ADAS features and their associated specifications to improve the performance of the vehicle.

- Reflecting the increasing availability of advanced driver assistance systems (ADAS) on modern vehicles, the Chinese government has also recently published three new standards, which specifically cover advanced driver assistance systems. The first of these new standards is GB/T 39263-2020 on terms and definitions for advanced driver assistance systems (ADAS). The standard specifies definitions for a wide variety of different systems, which are split into two categories; information assistance systems and control assistance systems.

Asia-Pacific is Expected to be the Fastest Growing Market

China is one of the largest automotive markets in the world, and more than 20.17 million passenger cars were sold in the country in 2020 and recorded a 5.89% of yearly decline in sales compared to 2019. Despite the pandemic, China is still one of the largest sellers of automobiles, which is a great opportunity for predictive technology to make its place in the Chinese automobile market. The Chinese government is focusing on several advanced vehicles technology, like ADAS features, along with electric mobility.

With that, major automakers in the region are updating their portfolio with the introduction of the new level 2 and level 3 ADAS features. For instance, In May 2021, the HAVAL brand of Great Wall Motor Co. Ltd launched the new Chitu compact SUV, and it is equipped with a 1.5L turbocharged engine (maximum power output of 135kW, peak torque of 275Nm) in combination with a 7-speed wet dual-clutch transmission. In addition, the vehicle includes a Level 2 ADAS system, with varying functions depending on the version.

India has a potential and opportunity for ADAS market as India is stepping gradually into the autonomous and artificial intelligence-oriented automotive industry along with many new product launches. For instance,

- In 2021, Morris Garage launched its new SUV Gloster, which is equipped with the latest ADAS features based on predictive technology such as automatic emergency brake, automatic parking assist, blind spot detection, forward collision warning, and lane departure warning.

- MG Hector, in 2021 has launched another SUV, the Astor, an affordable compact SUV with level-2 ADAS features such as Adaptive Cruise Control, Automatic Emergency Braking, Blind Spot Detection, Lane-keeping Assist, and Lane Departure Warning.

Currently, every other technology company is putting its fingers in for the creation of connected car solutions unique to this market and a share of the revenue.

Advanced Driver Assistance systems Industry Overview

Companies such as Continental AG, Robert Bosch GmbH, Autoliv Inc., Denso Corporation, and Delphi Automotive PLC are some of the major players in the market studied. The growing partnership between the major players is witnessing major growth for the market besides these active product innovations, collaborations, etc., anticipated to create a positive outlook for the market during the forecast period. For instance,

- In March 2021, GlobalFoundries (GF), a global leader in specialty semiconductor manufacturing, will partner with Bosch to develop a next-generation automotive radar. Bosch will use GF's 22FDX RF solution to develop a millimeter-wave automotive radar system-on-chip for automotive ADAS applications.

- In September 2021, ZF launched its next-generation mid-range radar to support advanced ADAS safety functions and enhance the available ZF coASSIST semi-automated system on the Dongfeng Aeolus Yixuan MAX in China.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD billion)

- 5.1 By Type

- 5.1.1 Parking Assist System

- 5.1.2 Adaptive Front-lighting

- 5.1.3 Night Vision System

- 5.1.4 Blind Spot Detection

- 5.1.5 Advanced Automatic Emergency Braking System

- 5.1.6 Collision Warning

- 5.1.7 Driver Drowsiness Alert

- 5.1.8 Traffic Sign Recognition

- 5.1.9 Lane Departure Warning

- 5.1.10 Adaptive Cruise Control

- 5.2 By Technology

- 5.2.1 Radar

- 5.2.2 LiDAR

- 5.2.3 Camera

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Saudi Arabia

- 5.4.4.4 United Arab Emirates

- 5.4.4.5 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Aisin Seiki Co. Ltd

- 6.2.2 Delphi Automotive

- 6.2.3 DENSO Corporation

- 6.2.4 Infineon Technologies

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Continental AG

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Mobileye

- 6.2.10 Hella KGAA Hueck & Co

- 6.2.11 Robert Bosch GmbH

- 6.2.12 Valeo SA

- 6.2.13 Hyundai Mobis

- 6.2.14 Autoliv Inc.