|

市場調查報告書

商品編碼

1444225

水凝膠 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Hydrogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

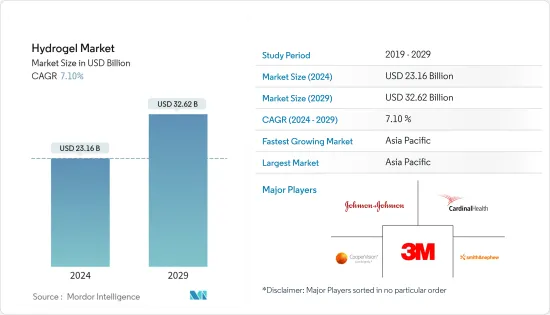

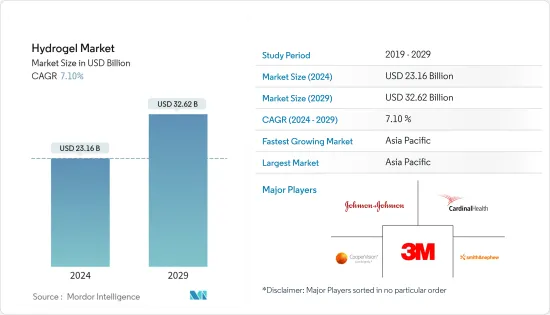

水凝膠市場規模預計2024年為231.6億美元,預計到2029年將達到326.2億美元,在預測期內(2024-2029年)年複合成長率為7.10%成長。

COVID-19大流行對水凝膠領域造成了打擊。由於全球封鎖和各國政府實施的嚴格監管,大多數生產基地被關閉,造成毀滅性打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 短期內,水凝膠在醫療保健行業的應用不斷增加以及農業行業的快速採用預計將推動市場成長。

- 然而,水凝膠的高製造成本預計將阻礙市場成長。

- 水凝膠新應用領域的出現以及生物醫學和個人護理領域對水凝膠的認知和採用不斷增強,將為所研究的市場帶來好兆頭。

- 亞太地區在全球水凝膠市場中佔據主要佔有率,預計在預測期內將以最快的年複合成長率發展。

水凝膠市場趨勢

個人護理和衛生領域主導市場

- 水凝膠因其柔軟、類似組織的物理特性、優異的吸水性、良好的透氧滲透性、良好的生物相容性以及用於額外傳輸通道的微孔結構而適用於衛生用品。

- 衛生產品旨在製造更薄的墊片,在負載下具有更高的吸收性、更高的膨脹壓力和更強的吸力。因此,它們的特性使水凝膠成為最合適的選擇。

- 世界衛生組織、世界銀行集團和聯合國兒童基金會等多個政府機構正在提高人們對衛生重要性的認知,特別是對婦女和少女來說月經衛生管理 (MHM)。

- 世界銀行集團在印度 Swachh Bharath 使命下啟動了一項旗艦衛生工作。這項活動旨在提高社區(包括男孩和男性)的認知,並打破有關月經的禁忌。

- 此外,隨著電商銷售額的飆升,個人護理行業預計年輕的獨立品牌數量也會激增,並與寶潔等個人護理行業的一些最大的參與者展開激烈的競爭。曾經。 Revlon Inc.、Oriflame Cosmetics Global SA、雅芳公司、雅詩蘭黛公司和聯合利華。

- 個人保健產品市場由歐萊雅、寶潔、聯合利華和資生堂等幾家主要企業主導。歐萊雅的化妝品和個人護理品銷售額是所有公司中最高的,預計該公司 2022 年的銷售額約為 419.5 億美元。

- 據歐洲個人護理協會稱,5億歐洲消費者每天使用化妝品和個人保健產品來保護自己的健康、提高幸福感並增強自尊。它們的範圍包括止汗劑、香水、化妝品、洗髮精、肥皂、防曬油等。

- 奧貝羅表示,在美國,個人護理產業預計2022年將成長2.95%,這一成長預計將超過2023年,達到422億美元。預計將刺激國內水凝膠市場的需求。

- 由於所有這些因素,全球個人護理和衛生產品可能會在預測期內推動對水凝膠的需求。

亞太地區主導市場

- 由於中國、印度和日本等國家的個人護理和衛生、農業、製藥和醫療保健行業的成長,亞太地區在全球市場佔有率佔據主導地位。

- 根據ECHEMI預計,2022年中國醫藥產業與前一年同期比較增約17%。胃腸藥和代謝藥物約佔全國醫藥市場總量的14%。

- 中國不斷壯大和老化的中產階級、收入的增加和都市化進程的加速正在推動該國的藥品銷售。根據CEIC資料,2022年6月中國藥品銷售收益為2,239.46億美元,而2022年4月為1,460.41億美元。該國擁有龐大且多元化的國內製藥業,由約 5,000 家製造商和許多中小型製藥公司組成。 ~有規模的公司。

- 印度是全球製藥業的重要且不斷成長的參與者。據PIB India稱,印度是全球領先的學名藥供應國之一,佔全球供應量的20%。印度藥品出口到200多個國家,其中美國是主要市場。

- 印度藥品出口促進委員會 (Pharmexcil) 總幹事表示,2021-22 會計年度,印度出口了價值 17,504 億印度盧比(246.2 億美元)的藥品,其中包括活性原料藥成分/藥物中間體。此外,2022年4月至10月,印度藥品出口成長4.22%,達145.7億美元。上一會計年度同期出口額為139.8億美元。

- 此外,根據印度品牌股權基金會的數據,到 2030 年,印度製藥業預計將達到 1,300 億美元。相較之下,到年終,全球藥品生產收益預計將達到近1兆美元。

- 因此,由於上述因素,預計未來幾年對水凝膠的需求將會增加。

水凝膠產業概況

水凝膠市場較為分散,少數公司佔了相當大的市場。市場的主要企業包括(排名不分先後)3M、Johnson & Johnson Services、Cardinal Health、CooperVision 和 Smith & Nephew。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 醫療保健產業的應用不斷增加

- 農業產業採用率迅速增加

- 其他司機

- 抑制因素

- 水凝膠生產成本高

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 消費者議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 結構

- 非晶質

- 半結晶

- 結晶

- 材料

- 聚丙烯酸酯

- 聚丙烯醯胺

- 矽膠

- 其他材料(瓊脂、明膠、PVP、PEG)

- 最終用戶產業

- 個人護理和衛生

- 製藥和醫療保健

- 食品

- 農業

- 其他最終用戶產業(法醫學和研究)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- 3M

- Ambu A/S

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Bausch Health Companies Inc.

- Cardinal Health

- Coloplast Corp.

- ConvaTec Inc.

- CooperVision

- DSM

- Essity Health &Medical

- HOYA Corporation

- Integra LifeSciences Corporation

- Johnson &Johnson Medical Limited

- Molnlycke Health Care AB

- Medtronic

- Novartis AG

- PAUL HARTMANN Pty Ltd.

- SEIKAGAKU CORPORATION

- Sekisui Kasei Co. Ltd.

- Smith &Nephew

第7章市場機會與未來趨勢

- 新應用領域的出現

- 生物醫學和個人護理領域對水凝膠的認知和採用不斷提高

- 其他機會

The Hydrogel Market size is estimated at USD 23.16 billion in 2024, and is expected to reach USD 32.62 billion by 2029, growing at a CAGR of 7.10% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the hydrogel sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, the increasing application of hydrogel in the healthcare industry and the surge in adoption in the agriculture industry are expected to drive the market's growth.

- However, the high production cost of hydrogel is expected to hinder the market's growth.

- The emergence of a new application area for hydrogel and rising awareness and adoption of hydrogel in the biomedical and personal care sector will act as an opportunity for the market studied.

- The Asia-Pacific region dominated the global hydrogel market with a significant share, and it is expected to register the fastest CAGR during the forecast period.

Hydrogel Market Trends

Personal Care and Hygiene Segment to Dominate the Market

- Hydrogel is suitable for hygiene products due to its soft and tissue-like physical properties, superior water absorption, good oxygen permeability, superior biocompatibility, and micro-porous structure for additional transport channels.

- Hygiene products aim to make thinner pads with higher absorbency under load, increased swelling pressure, and increased suction power. Hence, the hydrogel is the most suitable option due to its properties.

- Several government organizations, such as the World Health Organization, World Bank Group, and UNICEF, are raising awareness about the importance of hygiene, especially menstrual hygiene management (MHM) for women and adolescent girls.

- The World Bank Group initiated a flagship sanitation operation under the Swachh Bharath Mission in India. This operation aims to increase awareness among the community, including boys and men, to break the taboo around menstruation.

- Further, the personal care industry is also expected to observe a surge in the number of young and independent brands, as e-commerce sales are surging and providing stiff competition to some of the major companies in the personal care industry, including Procter & Gamble, Revlon Inc. Oriflame Cosmetics Global SA, The Avon Company, The Estee Lauder Companies Inc., and Unilever.

- The market for personal care products is dominated by a few key players, such as L'Oreal, Procter & Gamble, Unilever, and Shiseido Co., Ltd. L'Oreal has the highest cosmetics and personal care sales among the companies, and the company generated sales of around USD 41.95 billion in 2022.

- According to Cosmetic Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, shampoos, soaps, and sunscreens, to many others.

- Oberlo stated that, in the United States, the personal care industry grew by 2.95% in 2022, and this growth is expected to outpace in 2023 to reach USD 42.2 billion. This is expected to stimulate the demand for the hydrogel market in the country.

- Owing to all these factors, the personal care and hygiene products in the world may drive the demand for hydrogel during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share due to the growing personal care and hygiene, agriculture, pharmaceuticals, and healthcare sectors in countries such as China, India, and Japan.

- The pharmaceutical industry in China was anticipated to grow by about 17% year-on-year in 2022 stated by ECHEMI. Digestive and metabolic drugs account for around 14% of the total pharmaceutical market of the country.

- The growing middle-class and aging population in China, rising incomes, and increasing urbanization drive pharmaceutical sales in the country. According to CEIC Data, the pharmaceutical sales revenue in China in June 2022 accounted for USD 223,946 million, up compared to USD 146,041 million in April 2022. The country has a large and diverse domestic drug industry, comprising around 5,000 manufacturers and many small or medium-sized companies.

- In the global pharmaceuticals sector, India is a prominent and expanding player. According to PIB India, India is one of the world's major suppliers of generic medicines, accounting for 20% of the global supply by volume. Indian drugs are exported to more than 200 countries, with the United States being the key market.

- According to the Director General of the Pharmaceutical Export Promotion Council of India (Pharmexcil), India exported INR 1,75,040 crore (USD 24.62 billion) worth of pharmaceutical products, including bulk drugs/drug intermediates, in FY2021-22. Furthermore, India's pharmaceutical exports increased by 4.22% from April to October 2022, reaching USD 14.57 billion. The exports were valued at USD 13.98 billion during the same period in the previous fiscal.

- Further, according to Indian Brand Equity Foundation, by 2030, the Indian Pharma industry is expected to reach USD 130 billion. In contrast, global pharmaceutical production's revenue is forecasted to reach nearly USD 1 trillion by the end of 2023.

- Therefore, the abovementioned factors are expected to increase the demand for hydrogel in the coming years.

Hydrogel Industry Overview

The hydrogel market is fragmented, with a few players holding a considerable share in the market. Some of the market's key players (not in any particular order) include 3M, Johnson & Johnson Services, Inc., Cardinal Health, CooperVision, and Smith & Nephew.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Healthcare Industry

- 4.1.2 Surge in Adoption in Agriculture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Production Cost of Hydrogel

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Structure

- 5.1.1 Amorphous

- 5.1.2 Semi-crystalline

- 5.1.3 Crystalline

- 5.2 Material

- 5.2.1 Polyacrylate

- 5.2.2 Polyacrylamide

- 5.2.3 Silicone

- 5.2.4 Other Materials (Agar, Gelatin, PVP, and PEG)

- 5.3 End-user Industry

- 5.3.1 Personal Care and Hygiene

- 5.3.2 Pharmaceuticals and Healthcare

- 5.3.3 Food

- 5.3.4 Agriculture

- 5.3.5 Other End-user Industries (Forensics and Research)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ambu A/S

- 6.4.3 Ashland

- 6.4.4 Axelgaard Manufacturing Co., Ltd.

- 6.4.5 Bausch Health Companies Inc.

- 6.4.6 Cardinal Health

- 6.4.7 Coloplast Corp.

- 6.4.8 ConvaTec Inc.

- 6.4.9 CooperVision

- 6.4.10 DSM

- 6.4.11 Essity Health & Medical

- 6.4.12 HOYA Corporation

- 6.4.13 Integra LifeSciences Corporation

- 6.4.14 Johnson & Johnson Medical Limited

- 6.4.15 Molnlycke Health Care AB

- 6.4.16 Medtronic

- 6.4.17 Novartis AG

- 6.4.18 PAUL HARTMANN Pty Ltd.

- 6.4.19 SEIKAGAKU CORPORATION

- 6.4.20 Sekisui Kasei Co. Ltd.

- 6.4.21 Smith & Nephew

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of New Application Areas

- 7.2 Rising Awareness and Adoption of Hydrogel in Biomedical and Personal Care Sector

- 7.3 Other Opportunities