|

市場調查報告書

商品編碼

1444177

農業消毒劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Agricultural Disinfectants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

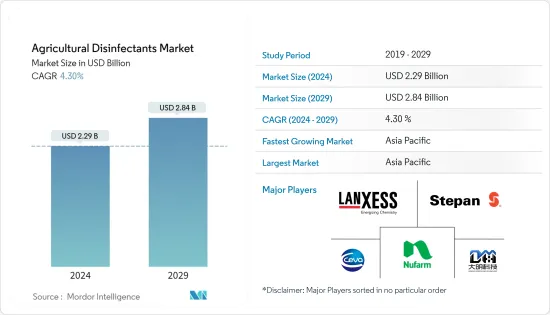

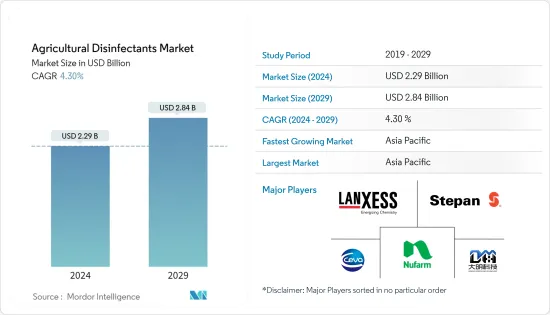

農業消毒劑市場規模預計到2024年為22.9億美元,預計到2029年將達到28.4億美元,在預測期內(2024-2029年)增加43億美元,年複合成長率為%。

COVID-19 大流行迫使許多公司暫時關閉部分製造工廠並限制人員流動,對生產投入需求產生負面影響。運輸限制也為該行業帶來了物流挑戰。

農業消毒劑是用來保護作物和牲畜的重要成分。適當的消毒對於保護作物和牲畜免受有害疾病是必要的。它也用於對植物和牲畜中的微生物進行滅菌。

亞太地區是農業消毒劑市場中最大的地理區域。由於畜牧業產量的增加以及人們對在農業中實施生物安全程序的必要性的認知的提高,預計該地區將成為世界上成長最快的地區。

整體市場受到保護耕地面積增加和畜牧生產中抗生素禁用的推動,這增加了對生物安全的需求。

農業消毒劑市場趨勢

保護地栽培面積

各種保護性栽培系統,例如室內農業、垂直農業和水耕,也可以減少作物的生物脅迫,例如害蟲和病原體的侵襲。因此,保護性耕作帶來了一些好處,例如作物幾乎沒有或沒有農藥殘留。雖然保護地栽培可以最大限度地減少作物病原體感染的機會,但 100% 害蟲和病原體控制需要保持保護地栽培設施免受建築材料和設備傳播的病原體的影響。您將需要。在種植前階段,必須使用消毒劑對保護地栽培設施和設備進行消毒,以便在作物生長階段清除害蟲和病原體。全球保護性種植面積的增加預計將對市場成長產生正面影響。

亞太地區主導整個市場

亞太地區已成為整個農業消毒劑市佔率最高的地區。畜牧業產量的增加和畜牧場數量的增加,加上保護性耕作的日益普及,正在推動亞太地區農業消毒劑市場的發展。缺乏對農業遺體科學消毒實踐的認知以及最終用戶行業的快速成長等挑戰預計將在預測期內推動該地區的市場。

農業消毒劑產業概況

農業消毒劑市場適度分散,有多家區域和地方參與者。為各種非農業任務提供消毒劑的公司也很重要。在市場上營運的公司旨在透過增加銷售額來實現有機成長。我們也參與併購、合資和聯盟等策略性措施。該行業的主要企業包括朗盛公司、Stepan公司、Nufarm有限公司、山東大明消毒科技和Ceva Sante Animale Group。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 化學類型

- 氯化季銨鹽

- 二氧化氫和哌氧乙酸

- 次氯酸鹽和鹵素

- 其他

- 型態

- 液體

- 粉末

- 目的

- 表面

- 空氣

- 水殺菌

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Lanxess AG

- Neogen Corporation

- Nufarm Limited

- Stepan Company

- Zoetis Services LLC

- Ceva Sante Animale Group

- Corteva Agri Science

- Thymox Technology

- Entaco NV

- Bayer Cropscience AG

第7章市場機會與未來趨勢

第 8 章 評估 COVID-19 對市場的影響

The Agricultural Disinfectants Market size is estimated at USD 2.29 billion in 2024, and is expected to reach USD 2.84 billion by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

The COVID-19 pandemic forced many companies to temporarily close some of their manufacturing plants and placed restrictions on human movement, thus negatively impacting the demand for production inputs. Restrictions on transportation also led to logistics challenges in the industry.

Agricultural disinfectants are vital components used for crop and livestock protection. Proper disinfection is required to protect crops and livestock from harmful diseases. They are also used to sterilize microorganisms in plants and livestock. Agricultural disinfectants are

The Asia-Pacific region was the largest geographical segment of the agricultural disinfectants market. It is also projected to be the fastest-growing region globally, owing to the increasing livestock production and improved awareness about the need for the adoption of biosafety procedures in agriculture.

The overall market is driven by the increasing area under protected cultivation and the ban on antibiotics in livestock production, which, in turn, is driving the need for biosafety.

Agricultural Disinfectants Market Trends

Growing Area Under Protected Cultivation

Various systems of protected cultivation, such as indoor farming, vertical farming, and hydroponics, also reduce biotic stresses on crops, such as attacks by pests and pathogens. Thus, protected cultivation has provided benefits such as crops with little or no pesticide residues. While the susceptibility of crops attacked by pathogens is minimal in protected cultivation, maintaining the protected cultivation facility to be free from pathogens borne from the construction material and equipment has become necessary to have 100% pest and pathogen control. Disinfectants are essential in sanitizing the protected cultivation facilities and equipment in the pre-planting stage to enable the crop to be free of pests and pathogens in its growth stage. The increased area under protected cultivation globally is expected to positively influence the market's growth.

Asia-Pacific Dominates the Overall Market

Asia-Pacific emerged as the region with the highest share in the overall agricultural disinfectants market. The increased production of livestock and the growth in the number of livestock farms, coupled with the increased penetration of protected cultivation, are driving the market for agricultural disinfectants in Asia-Pacific. Challenges, such as lack of awareness about scientific disinfection practices in agricultural remains and the sheer growth of the end-user industries, are expected to drive the market in the region over the forecast period.

Agricultural Disinfectants Industry Overview

The agricultural disinfectants market is moderately fragmented, with the presence of several regional and local players. There is also a significant presence of companies that offer disinfectants for multiple operations apart from agriculture. Companies operating in the market are looking for organic growth through increasing sales. They are also involved in strategic moves, such as mergers and acquisitions, joint ventures, and collaborations. The major players in the industry are Lanxess AG, Stepan Company, Nufarm Limited, Shandong Daming Disinfection Technology Co. Ltd, and Ceva Sante Animale Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Type

- 5.1.1 Quaternary Ammonium Chloride Salts

- 5.1.2 Hydrogen Dioxide and Pyeroxyacetic Acid

- 5.1.3 Hypochlorites and Halogens

- 5.1.4 Other Chemical Types

- 5.2 Form

- 5.2.1 Liquid

- 5.2.2 Powder

- 5.3 Application

- 5.3.1 Surface

- 5.3.2 Aerial

- 5.3.3 Water Sanitizing

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Lanxess AG

- 6.3.2 Neogen Corporation

- 6.3.3 Nufarm Limited

- 6.3.4 Stepan Company

- 6.3.5 Zoetis Services LLC

- 6.3.6 Ceva Sante Animale Group

- 6.3.7 Corteva Agri Science

- 6.3.8 Thymox Technology

- 6.3.9 Entaco NV

- 6.3.10 Bayer Cropscience AG