|

市場調查報告書

商品編碼

1444173

BPM(業務流程管理):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Business Process Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

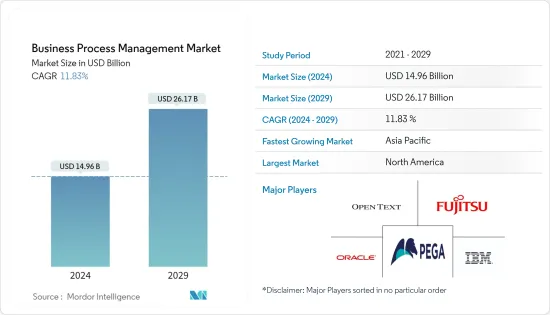

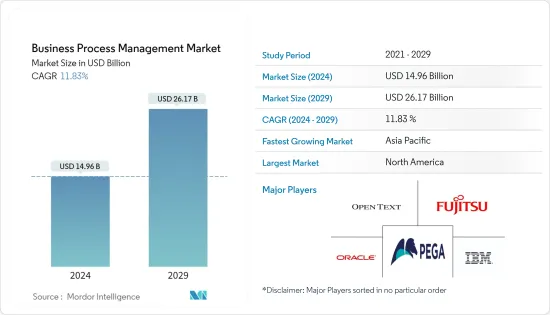

BPM(業務流程管理)市場規模預計到 2024 年為 149.6 億美元,預計到 2029 年將達到 261.7 億美元,在預測期內(2024-2029 年)成長至 118.3 億美元。年複合成長率為%。

主要亮點

- 近年來,BPM 由於其提高生產力和顯著降低成本的潛力而受到廣泛關注。這些是由制定和管理營運業務流程的特定流程設計所驅動的通用軟體系統。

- BPM 是一個系統化流程,可最佳化組織完成任務、服務客戶和收益的方法。業務流程是幫助組織實現其目標的活動或一組操作,例如增加收益或促進員工隊伍的多樣性。 BPM 分析業務流程,對其在多種場景中的行為方式進行建模,並不斷提高實施變更、監控新方法以及產生所需業務目標和結果的能力。Masu。

- 市場也見證了使企業(最終用戶)能夠建立應用程式的趨勢。受訪的市場中大多數供應商都提供低程式碼應用程式開發功能。低程式碼應用程式的開發已成為一項重大進步,因為 BPM 平台需要整合所有協作功能,例如內容和文件共用、內部通訊、人力資源管理和問題管理。

- 例如,IBM 的智慧型 BPM 套件 (iBPMS) 為 BPM 軟體提供了人工智慧 (AI) 等附加功能。它主要旨在幫助企業動態自動化其工作流程。這些套件通常支援雲,並提供低程式碼工具,使開發人員能夠快速輕鬆地建立工作流程解決方案。

- BPM 市場的主要趨勢之一涉及向低程式碼平台提供者的轉變。這一發展預計將導致 BPM 市場進一步分散。

- 一些被確定為企業選擇標準的用例包括數位業務最佳化和轉型、自助智慧業務流程自動化和自適應案例管理。

- 市場主要企業專注於策略合作,並透過向市場推出新解決方案來改善服務。例如,今年OpenText透過完全子公司OpenText UK Holding Limited(Bidco)宣布,已以每股532便士的價格承包(收購)了Micro Focus已已發行和擬發行的總股本。 ,這意味著企業價值約為60億美元。

- 今年,TIBCO 宣布推出 TIBCO CloudTM EBX,這是一個創新且強大的主資料管理 (MDM) 軟體即服務 (SaaS) 解決方案。 TIBCO Cloud EBX 允許客戶從任何地方管理業務資料,例如主數據、參考資料和元資料。作為 SaaS 產品,EBX 為客戶提供對雲端原生 MDM 功能的自助訪問,以實現更快、更智慧的實施。該解決方案是 TIBCO CloudTM Passport 的一部分。這種新的基於消費的費率方案提供了對單一模型中所有 TIBCO SaaS業務的靈活 FinOps 存取。

- BPM的需求與各產業的流程自動化需求直接相關,因此隨著全球流程自動化需求的增加,對BPM解決方案的需求也隨之增加。這些因素有助於組織和供應商專注於進入 BPM 市場,因為核心能力會帶來組織的整體發展。

- COVID-19 的爆發暴露了供應網路的脆弱性。脆弱的生態系統包括對大多數 IT 公司至關重要的 IT 服務提供者。此外,在家工作的要求要求服務供應商確保其關鍵任務業務客戶擁有工具和技術來提高所提供服務的速度、安全性、品質和整體有效性,已開始推動市場成長。

- 在大流行後的情況下,數位化和新技術的不斷採用將推動市場成長。 BPM 有助於最佳化,並允許公司實施支援應用案例的新解決方案。

BPM 市場趨勢

BFSI 產業預計將推動市場成長

- 銀行、金融服務和保險業對 BPM 的需求非常大。隨著該行業發出經濟和金融危機的訊號,金融機構正在依靠技術工具來幫助最佳化資源和流程。

- 現今的數位優先客戶需要觸手可及的金融服務。不斷變化的客戶期望迫使銀行在所有數位平台上提供服務。入職流程沒有什麼不同。強大的 BPM 系統可協助銀行最佳化和自動化端到端入職流程,消除流程瓶頸,加速直通案例的處理,並將傳輸給適當的知識員工。它可以幫助您專業地管理情況。

- 今年,華為推出了基於Temenos開放平台的數位銀行業務2.0解決方案,與客戶和主要金融產業合作夥伴會面,創建雲端原生架構,以實現業務敏捷性和產業創新。

- 銀行和金融機構的IT基礎設施必須定期更新,因為多個核心銀行業務系統可能會發生衝突並阻礙有效決策。這使得兩個混合實體之間難以實現成本效率和適當整合。此外,IBM 的一項研究顯示,超過 50% 的銀行和金融組織執行長專注於簡化其產品和業務,以有效管理複雜性。我做到了。

- 此外,Software AG 已成功使用 ARIS 進行 ING 集團的業務流程建模和客戶旅程地圖。該公司一直利用這一點來遵守 GDPR,並針對潛在的風險管理能力建立了一個試點。

- 此外,零售銀行業務也受益於先進技術的引入,因為該行業影響了金融科技和技術市場形勢。 EFMA 最近對零售銀行業務的一項調查發現,去年銀行和信用社更有可能在產品敏捷性 (32%)、數位行銷 (31%) 和數位管道遷移 (29%) 方面進行合作。將。降低成本 (28%)。這使得銀行家需要處理來自客戶和自動化流程的大量資料。

北美佔據主要市場佔有率

- 銀行、金融服務和保險業對 BPM 提出了很高的要求。隨著該行業發出經濟和金融危機的訊號,金融機構正在依靠技術工具來幫助最佳化資源和流程。

- 銀行和金融機構的IT基礎設施必須定期更新,因為多個核心銀行業務系統可能會發生衝突並阻礙有效決策。這使得兩個混合實體之間難以實現成本效率和適當整合。此外,IBM 的一項研究顯示,超過 50% 的銀行和金融組織執行長專注於簡化其產品和業務,以有效管理複雜性。我做到了。

- BPM 工具可讓銀行實現貸款、開戶、接收各方付款、風險管理、客戶查詢、申訴和支援流程等自動化。因此,全球多家銀行正轉向 BPM。例如,塞爾維亞市場領先的銀行之一塞爾維亞興業銀行採用 IBM 的 Business Process Manager 和 IBM Application Connect Enterprise 來更好地服務其客戶。

- 此外,Software AG 已成功使用 ARIS 進行 ING 集團的業務流程建模和客戶旅程地圖。該公司一直利用這一點來遵守 GDPR,並針對潛在的風險管理能力建立了一個試點。

BPM產業概述

由於區域和國際參與者的存在,BPM 市場競爭非常激烈。為了在競爭激烈的市場中維持自己的地位,企業紛紛進行併購、收購和產品創新。市場的最新發展包括:

TIBCO ModelOps 於 2022 年 7 月發布。這使企業能夠自信地隨時隨地、更快地大規模部署人工智慧模型。該公司創新分析服務的新增功能為客戶簡化並擴展了雲端基礎的分析模型的管理、部署、監控和管治。

2022 年 7 月,Comindware Inc. 宣布了在美國加速數位轉型和長期數位基礎設施建設的一個重要里程碑。

2022 年 3 月,Pegasystems 宣布推出低程式碼功能 Pega Infinity,這是一個旨在改進低程式碼選項的平台。這是 Pega Infinity 軟體包的 8.7 版。這包括低程式碼、自動化、人工智慧 (AI) 和雲端架構更新。 Pega 核心軟體套件的全新智慧低程式碼升級可幫助品牌加速創新並改善員工和客戶體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對 BPM 市場的影響

第5章市場動態

- 市場促進因素

- 對低程式碼系統的需求

- 提高可預測任務的效率(自適應案例管理)

- 跨製造領域的機器人和人工智慧

- 市場挑戰

- 自動化成本高且投資報酬率變低的提案

- 整合失敗

第6章市場區隔

- 按發展

- 雲

- 本地

- 按解決方案

- 流程改善

- 流程自動化

- 內容/文件管理

- 個案管理

- 其他(最佳化管理/應用整合)

- 按最終用戶產業

- 銀行、金融服務和保險 (BFSI)

- 政府/國防

- 衛生保健

- 資訊科技/通訊

- 零售

- 製造業

- 其他(能源、教育等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Open Text Corporation

- Oracle

- Software AG

- Tibco Software Inc.

- Fujitsu

- Ultimus Inc.

- BP Logix Inc.

- Pegasystems Inc.

- Appian

- Signavio GmbH

- ASG Technologies Group Inc.

- Kissflow Inc.

- Nintex UK Ltd

- CMW Lab

第8章投資分析

第9章 未來市場展望

The Business Process Management Market size is estimated at USD 14.96 billion in 2024, and is expected to reach USD 26.17 billion by 2029, growing at a CAGR of 11.83% during the forecast period (2024-2029).

Key Highlights

- In recent years, business process management (BPM) has received considerable attention due to its potential to increase productivity and significantly reduce costs. These are generic software systems driven by specific process designs that enact and manage operational business processes.

- Business process management (BPM) is a systematic process of optimizing organizations' approaches to complete tasks, provide customers, and earn revenue. A business process is an activity or series of operations that assist an organization in achieving its objectives, such as raising revenues or boosting workforce diversity. BPM analyses a business process, models how it operates in multiple scenarios, implements modifications, monitors the new approach, and continuously improves its ability to produce desired business objectives and results.

- The market also witnessed trends concerning enabling the companies (end users) to build their applications. Most of the vendors in the market studied are leading to Low-code App Development capabilities. With BPM platforms required to integrate all the collaboration functionalities, like content and file sharing, internal communication, personnel management, and issue management, among others, the development of low-code applications has been a significant breakthrough.

- For instance, IBM's Intelligent business process management suites (iBPMS) offer business process management (BPM) software with additional capabilities, such as artificial intelligence (AI). It is mainly designed to assist companies in the dynamic automation of workflows. These suites are often cloud-enabled and provide low-code tools that help developers create workflow solutions quickly and easily.

- One of the significant trends in the BPM market includes the transition towards positioning themselves as low-code platform providers. This development is expected to increase the fragmentation of the BPM market.

- A few use cases identified as enterprise selection criteria include digital business optimization and transformation, self-service intelligent business process automation, and adaptive case management.

- The key players in the market are focusing on strategic collaborations and improving their services by launching new solutions into the market. For instance, this year, OpenText announced that it had signed a deal for the total issued and to be issued share capital of Micro Focus for 532 pence per share (the acquisition) through its wholly-owned subsidiary, OpenText UK Holding Limited (Bidco), implying an enterprise value of approximately USD 6.0 billion.

- This year, TIBCO announced the availability of TIBCO CloudTM EBX, an innovative and powerful master data management (MDM) software-as-a-service (SaaS) solution. TIBCO Cloud EBX allows customers to manage business data from anywhere, including the master, reference, and metadata. As a SaaS product, EBX now provides customers with self-service access to cloud-native MDM features for faster and wiser implementation. The solution is part of the TIBCO CloudTM Passport. This new consumption-based pricing plan offers flexible FinOps (financial operations) access to all TIBCO SaaS capabilities under a single model.

- As the demand for business process management is directly related to the need for process automation in different sectors, the higher the demand for process automation around the world, the higher the demand for business process management solutions. These factors help organizations and vendors focus on entering the business process management market, as their core competency results in organizations' overall growth.

- The fragility of supply networks has been exposed with the commencement of COVID-19. The fragile ecosystem includes providers of vital IT services for most IT firms. Furthermore, work-from-home mandates have prompted service providers to guarantee that mission-critical enterprise customers have the tools and technology to improve the speed, security, quality, and overall efficacy of services supplied, promoting the market growth.

- In the post-pandemic scenario, increasing the adoption of digitalization and new technologies drives growth in the market. BPM helps optimize and allows businesses to implement new solutions to support application cases.

Business Process Management (BPM) Market Trends

BFSI Industry is Expected to Drive the Market Growth

- The banking, financial service, and insurance sectors significantly demand BPM. As the industry is indicative of economic and financial crises, financial entities rely on technological tools to help them optimize their resources and processes.

- Today's digital-first customers demand financial services to be at their fingertips. Because of changing client expectations, banks are forced to make their services available across all digital platforms. And the onboarding process is no different. A solid BPM system may help banks optimize and automate their end-to-end onboarding process, eliminate process bottlenecks, accelerate the processing of straight-through cases, and manage exceptional circumstances expertly by forwarding them to the appropriate knowledge worker.

- During this year, Huawei launched the Digital Banking 2.0 solution, built on the Temenos open platform, and met with customers and leading financial sector partners to discuss establishing a cloud-native architecture to achieve business agility and industry innovation.

- IT infrastructure in banks and financial institutions needs regular updating, as multiple core-banking systems can collide, hampering effective decision-making. Therefore, achieving cost efficiencies or proper integration between the two blended entities becomes challenging. Moreover, an IBM study reveals that over 50% of banking and financial organization CEOs focus on simplifying their products and operations to manage complexity effectively.

- Moreover, Software AG successfully used ARIS for business process modeling and customer journey mapping by ING Group. The company has been using it to comply with GDPR and set up pilots across potential risk management capabilities.

- Additionally, retail banking has benefited from adopting advanced technologies as the same discipline impacted the fintech and technology market landscape. As per a recent EFMA survey on retail banking, it is expected that in the previous year, banks and credit unions may be aligned toward product agility (32%), digital marketing (31%), digital channel migration (29%), and cutting costs (28%). It leads to bank employees dealing with a vast volume of data originating from customers and automated processes.

North America Accounts for a Significant Market Share

- The banking, financial service, and insurance sectors significantly demand BPM. As the industry is indicative of economic and financial crises, financial entities rely on technological tools to help them optimize their resources and processes.

- IT infrastructure in banks and financial institutions needs regular updating, as multiple core-banking systems can collide, hampering effective decision-making. Therefore, achieving cost efficiencies or proper integration between the two blended entities becomes challenging. Moreover, an IBM study reveals that over 50% of banking and financial organization CEOs focus on simplifying their products and operations to manage complexity effectively.

- Business process management tools enable banks to automate lending loans, account opening, getting payment from the parties, risk management, and customer inquiries, complaints, and support processes, to name a few. Therefore, multiple banks globally are shifting to BPM. For instance, Societe Generale Serbia, one of the leading banks in the Serbian market, resorted to deploying IBM's Business Process Manager and IBM Application Connect Enterprise to serve its clients better.

- Moreover, Software AG successfully used ARIS for business process modeling and customer journey mapping by ING Group. The company has been using it to comply with GDPR and set up pilots across potential risk management capabilities.

Business Process Management (BPM) Industry Overview

The business process management market is competitive due to regional and international players' presence. Players are doing mergers and acquisitions and product innovation to maintain their position in the market, which holds an intense rivalry among competitors. Some of the recent developments in the market are:

In July 2022, TIBCO ModelOps was released, allowing enterprises to deploy AI models faster, from anywhere to everywhere, reliably, and at scale. This new addition to the company's game-changing analytics offering simplifies and scales cloud-based analytic model administration, deployment, monitoring, and governance for customers.

In July 2022, Comindware Inc. announced a significant milestone in its commitment to accelerated digital transformation and a long-term digital foundation in the United States. Regarding plans made last year to create an innovation lab, Comindware has confirmed that it has launched a world-class lab to promote the application of low-code, BPM, and related technologies in new corporate solutions and to equip businesses with dependable technology on their way to a sustainable digital future..

In March 2022, Pegasystems launched its low-code capabilities, Pega Infinity, a platform targeting improved low-code options, which is version 8.7 of its Pega Infinity software package. It includes low-code, automation, artificial intelligence (AI), and cloud architecture updates. New intelligent, low-code upgrades to Pega's core software suite help brands innovate faster and improve employee and customer experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the COVID-19 Impact on the Business Process Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Low-code Systems

- 5.1.2 Increasing Efficiency of Predictable Tasks (Adaptive Case Management)

- 5.1.3 Bots and AI Across Manufacturing Domain

- 5.2 Market Challenges

- 5.2.1 Automation Becoming Costly and Low ROI Proposition

- 5.2.2 Integration Failures

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Solution

- 6.2.1 Process Improvement

- 6.2.2 Process Automation

- 6.2.3 Content and Document Management

- 6.2.4 Case Management

- 6.2.5 Other Solutions (Optimization Management and Application Integrations)

- 6.3 By End-User Industry

- 6.3.1 Banking, Financial Services, and Insurance (BFSI)

- 6.3.2 Government and Defense

- 6.3.3 Healthcare

- 6.3.4 IT and Telecommunication

- 6.3.5 Retail

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Industries (Energy, Education, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Open Text Corporation

- 7.1.3 Oracle

- 7.1.4 Software AG

- 7.1.5 Tibco Software Inc.

- 7.1.6 Fujitsu

- 7.1.7 Ultimus Inc.

- 7.1.8 BP Logix Inc.

- 7.1.9 Pegasystems Inc.

- 7.1.10 Appian

- 7.1.11 Signavio GmbH

- 7.1.12 ASG Technologies Group Inc.

- 7.1.13 Kissflow Inc.

- 7.1.14 Nintex UK Ltd

- 7.1.15 CMW Lab