|

市場調查報告書

商品編碼

1444147

腈綸:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Acrylic Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

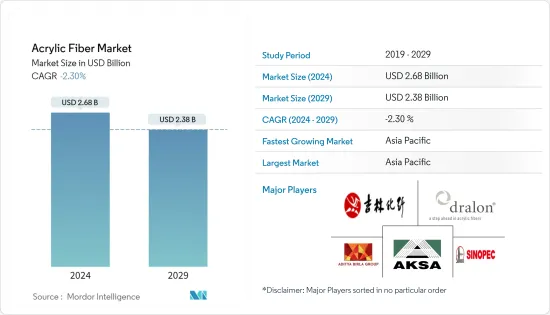

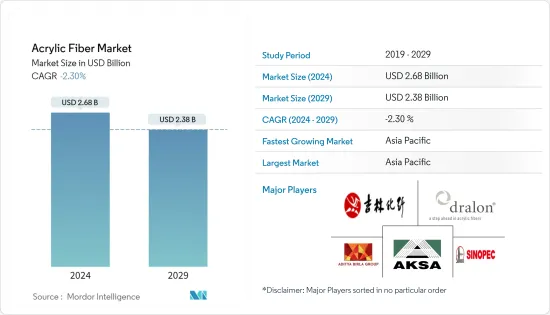

2024年腈綸市場規模預計為26.8億美元,預計2029年將下降至23.8億美元。

2021 年,市場受到 COVID-19 的負面影響,因為疫情導致企業、產品和製造設施放緩,導致經濟活動減少。然而,市場在預測期內不會復甦。

主要亮點

- 從中期來看,推動所研究市場成長的主要因素包括對服裝使用的高需求。

- 另一方面,聚酯等替代品的出現以及全球對丙烯酸纖維生產的嚴格監管預計將阻礙市場成長。

- 從形狀來看,長絲細分市場佔據最大的市場佔有率,預計在預測期內將成長。

- 由於東南亞國協和印度的高需求,亞太地區主導了腈綸纖維市場。

腈綸纖維市場趨勢

羊毛細分市場佔據主導地位

- 羊毛在服裝類中的使用可以追溯到古代。羊毛具有抗皺、吸濕、保暖等優良能。羊毛的一個主要特徵是它能夠隨著時間的推移從變形中恢復。因此,由這些纖維製成的服裝類很有吸引力。

- 由 100% 羊毛纖維機織或針織的布料可用於服裝,如毛衣、連帽衫、靴子、靴子內襯、帽子、手套、運動服、地毯、毯子、滾刷、室內裝飾、塊毯和防護衣。成為製造標準。

- 大多數丙烯酸纖維用於製造非常流行的羊毛和丙烯酸混紡織品。 55% 羊毛和 45% 丙烯酸纖維的混合物用於製造圓形針織產品。這種混合物特別用於運動服的生產,具有易於護理、耐用、外觀保持、色彩造型和偏好等特點。

- 根據您的要求,有多種混合物在世界各地廣泛使用。 50/50 和 70/30 腈綸羊毛混紡很受歡迎,因為它們便宜、美觀且易於加工。根據 TextileExchange.org 統計,2021 年羊毛纖維產量為 103 萬噸。

- 因此,羊毛產業對丙烯酸纖維的需求不斷增加可能會主導市場。

中國將主導亞太地區

- 中國是全球最大的腈綸生產國,佔全球腈綸產量的30%以上。中國紡織業多年來規模不斷擴大,主要得益於東南亞國協、歐洲、美國、日本等國內外市場的需求。

- 伊朗、印度、越南、巴基斯坦和阿拉伯聯合大公國是中國腈綸纖維出口的最大市場。該國也從日本、德國、泰國、韓國和土耳其等國家進口丙烯酸纖維。

- 2021年,我國腈綸進口總合7.5萬噸,較2020年的6.8萬噸增加10.3%。 2021年的增加主要是由於3月至5月的增加,期間增加了約7,800噸。服裝和家居應用的需求不斷成長可能會推動丙烯酸纖維市場的發展。

- 中國是全球最大的紡織品生產國和出口國,以金額為準計算約佔世界紡織品出口總額的43%。因此,中國服飾的成長可望提振腈綸市場。

- 因此,所有這些市場趨勢預計將在預測期內提振中國腈綸市場的需求。

腈綸纖維產業概況

腈綸纖維市場本質上是整合的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 服裝應用需求高

- 線上購買推動了對最終用途產品的需求

- 抑制因素

- 聚酯等替代品的可用性

- 世界各地對丙烯酸纖維生產的嚴格規定

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(市場規模、數量)

- 型態

- 訂書釘

- 燈絲

- 混合

- 羊毛

- 棉布

- 其他(纖維素)

- 目的

- 服飾

- 家居家具

- 產業

- 其他(室內裝潢)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 土耳其

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業採取的策略

- 公司簡介

- Aditya Birla Management Corporation Pvt. Ltd

- Aksa Akrilik Kimya Sanayii AS

- China Petrochemical Corporation

- Dralon

- FORMOSA PLASTIICS CORPORATIION

- Goonvean Fibres

- Indian Acrylics Limited

- Japan Exlan Co. Ltd

- Jiangsu Zhongxin Resources Group

- Jilin Chemical Fiber Group Co. Ltd

- Kaltex

- KANEKA CORPORATION

- Mitsubishi Chemical Corporation

- Pasupati Acrylon Ltd

- PetroChina Company Limited

- Polyacryl Iran Corp.

- Polymir

- SDF

- SGL Carbon

- Taekwang Industrial Co. Ltd

- TORAY INDUSTRIES INC.

- Vardhman Acrylics Ltd

- Yousuf Dewan Companies

第7章市場機會與未來趨勢

The Acrylic Fiber Market size is estimated at USD 2.68 billion in 2024, and is expected to decline to USD 2.38 billion by 2029.

The market was negatively impacted by COVID-19 in 2021, as the pandemic resulted in the slowdown of businesses, products, and manufacturing facilities, resulting in less economic activity. However, the market is excepted to recover during the forecasting period.

Key Highlights

- Over the medium term, the major factor driving the growth of the market studied includes the high demand for the use of apparel.

- On the flip side, the availability of substitutes like polyester and stringent regulations worldwide on the production of acrylic fiber are expected to hinder the growth of the market.

- By form, the filament segment accounted for the largest market share, and it is expected to grow during the forecast period.

- Asia-Pacific dominated the acrylic fiber market due to high demand from the ASEAN countries and India.

Acrylic Fiber Market Trends

Wool Segment to Dominate the Market

- The use of wool for clothing ages back to ancient times. Wool has outstanding properties, such as resistance to wrinkles, moisture absorption, and warmth. A significant feature of wool is its ability to recover from deformation over time. Hence, clothing made from these fibers is attractive.

- Fabrics that are woven or knitted with 100% wool fiber have become a standard in making apparel, like sweaters, hoodies, boots, boot lining, hats, gloves, athletic wear, carpeting, blankets, roller brushes, upholstery, area rugs, protective clothing, wigs, hair extensions.

- The majority of Acrylic Fiber is used to make wool and acrylic blends which are very popular. These blends of 55% wool and 45% acrylic fiber are used to make circular knit goods. This blend is particularly used in making sportswear, which has characteristics like the ease of care, durability, appearance retention, color styling, and palatability.

- Depending on the requirements, there are different blends that are widely used across the world. The 50/50 and 70/30 acrylic wool blends are popular among those that are inexpensive, look good, and are easy to handle. The 50/50 acrylic wool blend is used to make lightweight apparel that has excellent durability and shape retention. The 70/30 acrylic wool blend is used to make slacks. According to TextileExchange.org, 1.03 million tonnes of wool fiber was produced in 2021.

- Hence, increasing demand for acrylic fiber in the wool segment is likely to dominate the market.

China to Dominate the Asia-Pacific Region

- China is the largest producer of acrylic fibers across the world, accounting for a share of more than 30% of the global acrylic fiber production. Owing to the demand from domestic and international markets, primarily from ASEAN countries, Europe, the United States, and Japan, the textile industry in China has expanded over the years.

- Iran, India, Vietnam, Pakistan, and the United Arab Emirates are some of the largest markets where China exports acrylic fibers. The country also imports acrylic fiber from countries like Japan, Germany, Thailand, South Korea, and Turkey.

- In 2021, China's acrylic fiber import volumes totaled 75,000 tons, up 10.3% from 68,000 tons in 2020. The rise in 2021 was mainly attributed to the increase in March-May, up about 7,800 tons during the period. Increased demand from apparel and household furnishing applications may drive the market for acrylic fibers.

- China is the largest textile-producing and exporting country in the world, it holds about 43% share of the world's total textile exports in terms of value. Thus, the growth in China's clothing industry is anticipated to boost the market for acrylic fibers.

- Hence, all such market trends are expected to add to the demand for the acrylic fibers market in China during the forecast period.

Acrylic Fiber Industry Overview

The acrylic fiber market is consolidated in nature. Some of the major players in the market include Aksa Akrilik Kimya Sanayii AS, Dralon, Jilin Chemical Fiber Group Co., Ltd., Aditya Birla Management Corporation Pvt. Ltd, and Sinopec, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Use in Apparels

- 4.1.2 Online Purchasing Drive the Demand for End Use Products

- 4.2 Restraints

- 4.2.1 Availability of Substitutes, like Polyester

- 4.2.2 Stringent Regulations Worldwide on the Production of Acrylic Fiber

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Staple

- 5.1.2 Filament

- 5.2 Blending

- 5.2.1 Wool

- 5.2.2 Cotton

- 5.2.3 Other Blendings (Cellulose)

- 5.3 Application

- 5.3.1 Apparel

- 5.3.2 Household Furnishing

- 5.3.3 Industrial

- 5.3.4 Other Applications (Upholstery)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Turkey

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Management Corporation Pvt. Ltd

- 6.4.2 Aksa Akrilik Kimya Sanayii AS

- 6.4.3 China Petrochemical Corporation

- 6.4.4 Dralon

- 6.4.5 FORMOSA PLASTIICS CORPORATIION

- 6.4.6 Goonvean Fibres

- 6.4.7 Indian Acrylics Limited

- 6.4.8 Japan Exlan Co. Ltd

- 6.4.9 Jiangsu Zhongxin Resources Group

- 6.4.10 Jilin Chemical Fiber Group Co. Ltd

- 6.4.11 Kaltex

- 6.4.12 KANEKA CORPORATION

- 6.4.13 Mitsubishi Chemical Corporation

- 6.4.14 Pasupati Acrylon Ltd

- 6.4.15 PetroChina Company Limited

- 6.4.16 Polyacryl Iran Corp.

- 6.4.17 Polymir

- 6.4.18 SDF

- 6.4.19 SGL Carbon

- 6.4.20 Taekwang Industrial Co. Ltd

- 6.4.21 TORAY INDUSTRIES INC.

- 6.4.22 Vardhman Acrylics Ltd

- 6.4.23 Yousuf Dewan Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Market for Acrylic Paper