|

市場調查報告書

商品編碼

1444131

智慧採礦:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Mining - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

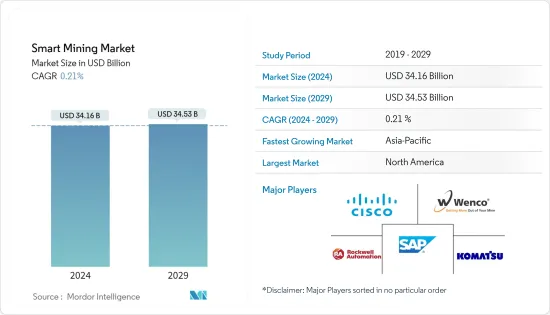

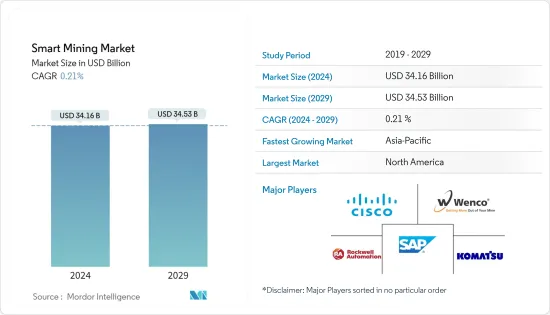

智慧礦業市場規模預計2024年為341.6億美元,預計到2029年將達到345.3億美元,在預測期內(2024-2029年)年複合成長率為0.21%成長。

採礦涉及多個流程,包括礦用卡車、挖土機、鑽孔機、輸送機、運輸和物流等設備的資源分配管理。為了確保一切有效運作並更快完成,您需要一個能夠簡化和自動化這些複雜流程的系統。

主要亮點

- 採礦涉及許多流程,包括資源分配和設備管理,如礦用卡車、挖土機、鑽孔機、輸送機、運輸和物流。為了確保一切有效運作並更快完成,您需要一個能夠簡化甚至自動化這些複雜流程的系統。

- 無線採礦感測器網路是礦山監測發展的最新一步。許多現代化的地下礦場都配備了各種岩土和其他監測設備。

- 採礦業的數位化可能比其他行業晚一些,但它正在迅速迎頭趕上。如今,礦業公司擴大採用各種數位解決方案。許多公司正在實現業務自動化,透過添加設備感測器並採用整合網路傳輸資料,從實體領域轉向數位領域。儘管取得了這些進展,但這些步驟只是開始。

- 近年來,全球礦場營運成本大幅上升,導致新興國家薪資支出增加。例如,根據阿根廷經濟部的數據,與2020年第二季度相比,2021年第二季度阿根廷採礦和採石業的工資支出增加了超過3553.8億阿根廷盧比(22.1億美元)。1,188.6 億盧比(7.4億美元)

- 持續的COVID-19疫情和國際貿易限制影響了智慧礦業市場的業務運作。然而,由於對原料運輸有嚴格的規定,邊境的重新開放預計將有助於解決運輸和物流問題。

智慧礦業市場趨勢

資料管理和分析軟體預計將呈現最高成長

- 資料是寶貴的資產。自動採礦設備每天都會產生大量有用資料。一些供應商正在將資料與智慧分析、人工智慧、機器學習和自動化相結合,以提高營運安全性和生產力。

- 礦業公司可以透過收集和利用來自資料來源的巨量資料、使用現代資料分析進行分析並實施結果來獲取即時價值並增加收益。借助可靠的資料,礦業公司可以提高產量、降低業務效率並更快地應對風險。

- 世界經濟論壇估計,未來十年採礦業數位轉型帶來的價值可能超過 3,200 億美元。 Inter Systems IRIS 是用於採礦業務的下一代數位轉型軟體,可與目前的硬體和軟體程式無縫整合。即時提供整體設備效率 (OEE) 等可自訂的關鍵績效指標 (KPI),當資料等級和 KPI 接近預設閾值時,您會立即收到通知。

- 巨量資料是一項有前景的技術,有潛力改變採礦業。資訊和通訊技術的快速進步促進了這一點。儘管進行了多次實施嘗試,但採礦業的巨量資料管理(BDM)仍面臨基本問題。

- 巨量資料分析和巨量資料管理可以創建一個可以在採礦業隨著時間的推移而發展的智慧基礎設施。因此,該分析預計將顯著提高資產利用率、提高生產力並解決物料流延遲問題。

北美佔據主要市場佔有率

- 北美地區對智慧礦業市場貢獻顯著,其中美國和加拿大佔據主要市場佔有率。美國環保署開發了圖形來幫助有毒物質排放清單資料的使用者更好地了解採礦作業和相關的 TRI 可報告化學品排放。金屬採礦業每年處理大量材料。該行業報告稱,在有毒物排放清單計劃涵蓋的工業部門中,TRI 涵蓋的化學品總排放量最高。該領域影響公眾看到的 TRI資料,並推動了幾個重要的國家和地方趨勢。

- 礦業公司需要軟體解決方案來管理礦產探勘和生產,最佳化人力資源和設備的使用,並遵守環境、健康和安全法規。

- 2022 年 6 月,拜登-哈里斯政府在聯邦與州合作夥伴關係上投資了超過 7,400 萬美元,以繪製關鍵礦產地圖。這項投資是基於美國地質調查局 (USGS) 全球測繪資源舉措(Global MRI),該計畫將支持可能存在重要礦物的區域的測繪、地球科學資料收集、科學解釋和資料。該投資將分配給30個州支持保護。

- 這些投資將加深我們對國家關鍵礦產資源的了解,並永續生產,從電子產品到消費性電子產品,再到風力發電機和電池等清潔能源技術。這是確保高供應。

- 隨著網際網路的進步,該地區最著名的公司正在專注於提供即時分析。思科互聯採礦提供採礦和生產流程每個步驟的即時可見性,使您能夠準確監控生產、設備、工人位置和安全性。

智慧礦山產業概況

智慧礦業市場本質上競爭非常激烈。該市場高度集中,企業規模各異。市場主要企業有思科系統公司、Wenco International Mining Systems Ltd、SAP SE、羅克韋爾自動化公司、小松礦業公司(Joy Global)、Symboticware Inc.、ABB Ltd等。公司透過建立多個合作夥伴關係、投資計劃以及將新產品推向市場來擴大市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力:波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間敵對的強度

- 替代品的威脅

- 產業價值鏈分析

- 評估 COVID-19 對智慧採礦市場的影響

第5章市場動態

- 市場促進因素

- 多個大型採礦設施更常採用無線監控和集中式解決方案

- 結合技術進步與各種數位轉型實踐

- 市場挑戰/限制

- 營運和成本挑戰仍然是新興地區關注的問題

- 工人安全與健康

第6章市場區隔

- 按解決方案

- 智慧控制系統

- 智慧資產管理

- 安全保障系統

- 資料管理與分析軟體

- 監視系統

- 其他解決方案

- 按服務類型

- 系統整合

- 諮詢服務

- 工程與維護

- 按採礦類型

- 地下採礦

- 露天採礦

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Wenco International Mining Systems Ltd

- SAP SE

- Rockwell Automation Inc.

- Komatsu Mining Corporation(Joy Global)

- Symboticware Inc.

- ABB Ltd

- Trimble Inc.

- IBM Corporation

- Epiroc AB

- MineExcellence

- Metso Outotec OYJ

第8章投資分析

第9章市場的未來

The Smart Mining Market size is estimated at USD 34.16 billion in 2024, and is expected to reach USD 34.53 billion by 2029, growing at a CAGR of 0.21% during the forecast period (2024-2029).

Mining involves many processes, including resource allocation management of equipment, such as mining trucks, excavators, drills, conveyor belts, transportation and logistics, and more. To ensure that everything runs efficiently and finishes faster, these complex processes require a system to simplify and automate them.

Key Highlights

- Mining involves many processes, including resource allocation and equipment management, such as mining trucks, excavators, drills, conveyor belts, transportation, and logistics. To make sure that everything runs efficiently and finishes faster, these complex processes require a system to simplify and even automate them.

- Wireless mining sensor networks are the latest step in the evolution of mine monitoring. To continually monitor the geological and geo-mechanical factors inside underground mines and assess potential safety and productivity risks posed by rapid or out-of-safe-range changes, many modern underground mines install a variety of geotechnical and other monitoring instruments.

- Digitalization may have come a little later to mining than other sectors, but it is quickly catching up. Mining companies have recently adopted a growing range of digital solutions. Many have mechanized their operations, moved from the physical to the digital realm by adding equipment sensors, and adopted unified networks to transmit data. Despite this progress, these steps are only the beginning.

- Mining operational costs have risen dramatically, and salary expenditures increased in emerging countries in recent years globally. For instance, according to the Ministry of Economy Argentina, salary expenditure in the mining and quarrying sector in Argentina increased to over ARS 355.38 Billion (USD 2.21 Billion) in Q2 2021 and by ARS 118.86 Billion (USD 0.74 Billion) compared to Q2 2020.

- The ongoing COVID-19 outbreak and restrictions on international trade affected business operations in the smart mining market. However, due to strict regulations in the transportation of raw materials, the reopening of country borders is expected to assist in resolving transport and logistic issues.

Smart Mining Market Trends

Data Management and Analytics Software is Expected to Show Highest Growth

- Data is a valuable asset. Every day, automated mining equipment produces enormous amounts of useful data. Several vendors combine data with intelligent analytics, AI, machine learning, and automation to improve the security and productivity of operations.

- Mining companies can unlock immediate value and increase revenues by gathering and utilizing big data from data sources, analyzing the same with contemporary data analytics, and putting the results into practice. With reliable data, the mining industry can increase output, decrease operational inefficiencies, and respond to risks more quickly.

- The World Economic Forum estimates the mining industry's value due to digital transformation initiatives may exceed USD 320.0 billion in the following ten years. The next-generation digital transformation software for mining operations, Inter Systems IRIS, integrates seamlessly with current hardware and software programs. It provides customizable Key Performance Indicators (KPIs) delivered in real-time, such as Overall Equipment Effectiveness (OEE), and instant notifications when data levels and KPIs get close to predetermined thresholds.

- Big data is a promising technology that has the potential to change the mining industry. It is fueled by rapid advancements in information and communication technology. Big data management (BDM) in the mining sector continues to have fundamental issues, despite numerous attempts to implement it.

- Big data analytics and big data management can create intelligent infrastructure that can develop over time in the mining industry. Thus, analytics is expected to significantly enhance asset utilization, raise productivity, and address material flow delays.

North America to Hold Major Market Share

- The North American region is a significant contributor to the smart mining market, with the United States and Canada taking up major market shares. The Environmental Protection Agency of the United States developed a graphic to provide users of Toxic Release Inventory data with a better understanding of mining operations and related TRI-reportable chemical releases. The metal mining sector handles large volumes of material each year. This sector reports the most significant total quantity of releases of TRI-covered chemicals of any industry sector covered by the Toxic Release Inventory Program. This sector influences the TRI data viewed by the public, driving several significant national and local trends.

- Mining companies need software solutions to manage the exploration and production of minerals, optimize human resources and equipment use, and comply with environmental, health, and safety regulations.

- In June 2022, the Biden-Harris administration invested over USD 74 million in Federal-State partnerships to map critical minerals. This investment will be distributed in 30 states to support mapping, geoscience data collection, scientific interpretation, and data preservation of areas with potential for critical minerals under the US Geological Survey (USGS) Earth Mapping Resources Initiative, or Earth MRI.

- These investments improve the understanding of domestic critical mineral resources, a crucial step in securing a sustainable and reliable supply of the essential minerals that power numerous industries, from electronics to household appliances and clean energy technologies like wind turbines and batteries.

- With the internet advancement, the region's most notable players focus on providing real-time analysis. Cisco Connected Mining enables real-time insight into each step of the mining and production process and accurate monitoring of output, equipment, worker location, and security.

Smart Mining Industry Overview

The smart mining market is very competitive in nature. The market is highly concentrated due to various small and large players. The major players in the market are Cisco Systems Inc., Wenco International Mining Systems Ltd, SAP SE, Rockwell Automation Inc., Komatsu Mining Corporation (Joy Global), Symboticware Inc., ABB Ltd, and many more. The companies are increasing their market share by forming multiple partnerships, investing in projects, and launching new products in the market.

- March 2022 - Komatsu Mining Corporation officially opened its new Wacol, Brisbane distribution center, which includes an Innovation Hub. The Innovation Hub features a variety of interactive exhibits exhibiting the most innovative advancements in mining, quarrying, and construction equipment and solutions. The featured exhibits include mining automation, Komatsu SmartConstruction, digital services, sustainability, and supply chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness: Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Smart Mining Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Wireless Monitoring and Centralized Solutions among Several Large Mining Installations

- 5.1.2 Technological Advancements and Convergence of Various Digital Transformation Practices

- 5.2 Market Challenges/Restraints

- 5.2.1 Operational and Cost Challenges Remain a Concern in Emerging Regions

- 5.2.2 Workers Safety and Health

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Smart Control System

- 6.1.2 Smart Asset Management

- 6.1.3 Safety and Security System

- 6.1.4 Data Management and Analytics Software

- 6.1.5 Monitoring System

- 6.1.6 Other Solutions

- 6.2 By Service Type

- 6.2.1 System Integration

- 6.2.2 Consulting Service

- 6.2.3 Engineering and Maintenance

- 6.3 By Mining Type

- 6.3.1 Underground Mining

- 6.3.2 Surface Mining

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Wenco International Mining Systems Ltd

- 7.1.3 SAP SE

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Komatsu Mining Corporation (Joy Global)

- 7.1.6 Symboticware Inc.

- 7.1.7 ABB Ltd

- 7.1.8 Trimble Inc.

- 7.1.9 IBM Corporation

- 7.1.10 Epiroc AB

- 7.1.11 MineExcellence

- 7.1.12 Metso Outotec OYJ