|

市場調查報告書

商品編碼

1444123

超快雷射:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Ultrafast Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

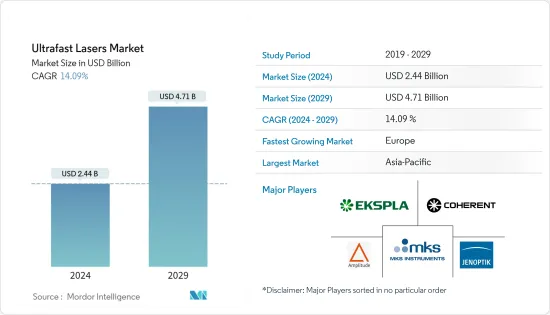

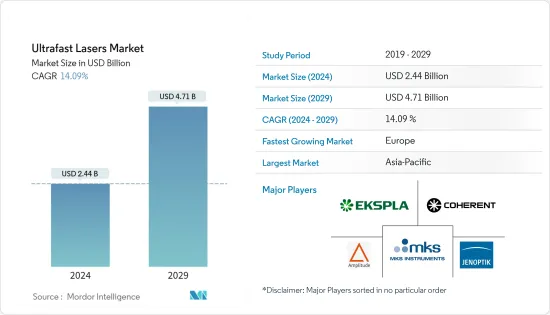

超快雷射器市場規模預計到 2024 年為 24.4 億美元,預計到 2029 年將達到 47.1 億美元,預測期內(2024-2029 年)年複合成長率為 14.09%。

COVID-19 的爆發以及由此產生的世界各地的封鎖法規影響了工業活動。世界各地許多行業的供應鏈和製造業務都受到了干擾。封鎖的其他影響包括製造過程中使用的原料短缺、勞動力短缺、價格波動(可能導致最終產品的生產成本如此之高,以至於可能超出預算)以及交付問題。

主要亮點

- 超快或超短脈衝雷射具有更嚴格的公差、更高的尺寸精度和更少的後處理步驟等優點,是汽車、消費性電器產品和醫療設備等行業的重要製造工具。

- 該行業正在從雷射切割技術轉向超快雷射技術,以提高加工精度並實現產品的早期行銷。儘管雷射(通常以振盪器和放大器的形式)設備往往具有較高的初始成本,但提高的製程精度可降低營運成本和整體生產時間,從而促進其在材料加工應用中的採用。

- 這些雷射有皮秒和飛秒版本,在醫療設備和軍事製造領域也越來越受歡迎。例如,導管和支架是用超快雷射製造的。全部區域對醫療設備雷射打標的強制要求是超快雷射需求量大的另一個原因。

- 消費性電器產品、汽車、醫療保健、網路、電訊和計算等行業的技術進步產生了對小型、堅固的電子設備的需求。這種攜帶式電子設備要求零件具有精確的尺寸精度。預計這將增加對開發具有精確尺寸精度的組件所需的製造材料的需求。

- 由於製造複雜性相對降低,有多種替代技術可供選擇,並廣泛應用於材料加工等應用。例如,準分子雷射可產生各種波長的高能量紫外線輻射,廣泛應用於微電子、醫療、汽車和其他工業應用等微加工應用。超快雷射可以加工光學透明的聚合物材料,但由於成本高,通常使用準分子雷射。其他替代技術包括 Q 開關雷射、連續波 (CW) 和奈秒脈衝等。

- COVID-19 大流行以及隨後世界各地的封鎖規定影響了工業活動,並擾亂了世界各地的製造業務和供應鏈。封鎖的其他影響包括製造過程中使用的原料供應不足、勞動力短缺、價格波動(可能使最終產品的生產成本更高且超出預算)以及交付問題。

超快雷射市場趨勢

電器產品需求預計將大幅成長

- 電子製造業仍然是一個非常活躍的行業。該行業主要是由消費性電器產品行業不斷成長的需求和快節奏的技術發展所推動的,迫使OEM不斷將新產品推向市場。消費性電器產品供應商嚴重依賴電子製造商將其產品推向市場,從而提供更低的成本、更快的量產時間、品質、更快的上市時間和彈性等優勢。根據消費者科技協會的數據,美國消費科技銷售額成長了 7.5%,近期達到 4,870 億美元。

- 此外,美國的消費性電器產品(CE)零售收益一直在穩步成長。根據消費者科技協會預測, 年終,美國消費性電子零售額預計將達到5,050億美元。此外,智慧型手機在消費性電子產品領域創造了最多的零售收益,2022 年收益達 747 億美元。

- 當今市場上的大多數電子設備都在小型化,需要更嚴格的尺寸公差以將組件安裝在越來越小的外形尺寸內,從而推動了超快雷射市場的成長。電子製造過程需要檢查更精細元件的功能以提高精度。

- 飛秒雷射擴大應用於手持電子產品。行動電話、記憶體晶片、微處理器和顯示面板都是高度複雜的組件,由多種材料、多個極薄的層和最少的功能製成。這些組件需要高精度、先進的製造流程以及經濟地大量生產的能力。

- 超快雷射的脈衝持續時間非常短,可以在不產生熱量的情況下進行熱微加工。它們在先進顯示器修復過程中的使用越來越多,催生了新一代快速、緊湊、多波長超快雷射。

- 例如,超快雷射器製造商 Spark Lasers 提供 DIADEM,這是一種緊湊型高能超快雷射器,適用於先進微加工應用,具有短飛秒脈衝寬度,可在 30W 和高達 1MHz 下提供超過 40μJ 的功率。此雷射器專為嚴格的電子製造和植入式醫療設備設計。

- 多種工業流程都採用高精度、超快的雷射加工。這包括選擇性層燒蝕(燒蝕速率通常可達到每個脈衝 30 nm 的精確度),以及切割寬度小於 2 μm 的高精度薄膜電晶體電極切割。這些製程需要開發先進且靈活的光束整形技術,能夠為具有可變幾何形狀和小至 2 μm x 2 μm 尺寸的樣品提供均勻的平頂光束。

- Amplitude Group 等公司為 Tangor UV、Tangerine 和 Yuja 等消費性電子產品提供各種飛秒雷射。這些產品採用的光學技術為注重品質的結果設定了新標準。實現高重複率和峰均功率比。以無與倫比的精度加工所有材料,包括加工 PCB、半導體和軟性電子材料以及切割玻璃。

亞太地區預計將佔據重要市場佔有率

- 由於汽車和電子產業對飛秒光纖雷射的需求不斷增加,亞太地區超快雷射市場正在顯著成長。由於技術進步和大量電子原始設備OEM的存在,該地區,尤其是日本和中國等國家,預計在預測期內將顯著成長。

- 亞太地區是雷射技術開發領域公認的領導者,擁有Thorlabs Inc.、武漢華鐳精密雷射和Amplitude Laser等眾多市場參與者。這些產品是市場相關人員為實現利潤最大化和獲得競爭優勢而做出的努力之一,同時滿足對增強型超快雷射設備不斷成長的需求。政府在國防和醫療服務製造業方面加大力度,促使公司為各種工業應用開發超快雷射。

- 工業應用包括用於製造從機械到航太設備等工業產品的超快雷射。工業領域中的超快雷射用於加熱硬化、熔化焊接和塗層以及去除材料以進行鑽孔和切割。用於材料製造的飛秒雷射加工正在引起人們的注意。超快雷射已成為表面處理的業界標準。

- 眾多的製造業以及對產品品質和精度的日益關注是推動亞太地區超快雷射需求的關鍵因素。此外,對工業和消費品的需求不斷成長,使製造業成為亞洲經濟體的重要產業之一。

- 研究經費、設備採購資金和合約等幾個支持因素正在推動該地區對超快雷射的需求。近日,Chromacity與Photonteck簽署了在中國供應和銷售超快雷射的協議。 Photonteck 推進了 Chromacity 的固定波長飛秒雷射和皮秒光學參量振盪器 (OPO) 產品線,用於成像和感測應用。

超快雷射產業概況

由於存在多個參與者,超快雷射市場競爭非常激烈。市場似乎適度集中。市場上的供應商正在透過大量的研發投資和合作夥伴關係推出新產品,從而顯著推動市場的成長。除了技術投資之外,公司還進行收購作為成長策略。該市場由 Coherent、Trumpf、Jenoptik 和 Lumentum 等雷射/光電巨頭組成。

- 2022 年 2 月,業納宣布與 Accretech 建立策略夥伴關係。自2022年2月1日起,兩家公司將結合各自的經濟和技術力,為整個日本產業創造付加。由此,業納也獲得了強大的經銷合作夥伴。

- 2022年1月,光轉換推出CRONUS-2P和CRONUS-3P,涵蓋顯微鏡專用飛秒雷射光源。應用包括功能神經成像、光遺傳學和使用中等重複率三光子激發和快速高重複率雙光子成像的深度成像。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 需要提高尺寸精度

- 政府下令推廣超快雷射器

- 市場限制因素

- 製造複雜性阻礙市場成長

第6章市場區隔

- 依雷射類型

- 固體雷射

- 光纖雷射

- 按最終用戶

- 家用電器

- 藥品

- 車

- 航太和國防

- 調查

- 按脈衝持續時間

- 皮秒

- 飛秒

- 按用途

- 材料加工和微細加工

- 醫學和生物成像

- 其他用途(與研究相關的用途)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Amplitude Group

- Coherent Inc.

- Ekspla(EKSMA group)

- MKS Instruments Inc.(Newport Corp. and Femtolasers Productions)

- JENOPTIK Laser GmbH

- TRUMPF Group

- Novanta(Laser Quantum Ltd.)

- Lumentum Holdings

- Aisin Seiki(IMRA America Inc.)

- IPG Photonics

- NKT Photonics

- Light Conversion Ltd

第8章投資分析

第9章市場的未來

The Ultrafast Lasers Market size is estimated at USD 2.44 billion in 2024, and is expected to reach USD 4.71 billion by 2029, growing at a CAGR of 14.09% during the forecast period (2024-2029).

The COVID-19 outbreak and the consequent lockdown restrictions worldwide affected industrial activities. Many industries witnessed a disruption in supply chain and manufacturing operations worldwide. Some other effects of lockdown include a lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, shipping problems, and others.

Key Highlights

- Ultrafast or ultrashort pulse lasers are critical manufacturing tools across industries, such as automobile, consumer electronics, and medical devices, due to advantages like tighter tolerances, enhanced dimensional accuracy, and elimination of post-processing steps.

- Industries move from laser-cut technology to ultrafast laser technology for machining accuracy, enabling earlier marketing of their products. Although laser (usually in the form of oscillators and amplifiers) equipment tends to have high initial costs, the improvement in process precision decreases the operating cost and overall time for production, which drives its adoption in material processing applications.

- Available in the picosecond and femtosecond variants, these lasers also gain traction in the medical and military equipment manufacturing sectors. For instance, catheters and stents are made with ultrafast lasers. Mandates for laser marking for medical devices across regions are another reason for the growing demand for ultrafast lasers.

- Technological advancements in industries such as consumer electronics, automobiles, healthcare, networking and telecom, and computing created the need for small and robust electronic devices. Such portable electronic equipment demands precise dimensional accuracy for components. This is expected to augment the demand for the fabrication materials needed to develop components with precise dimensional accuracy.

- Various alternate technologies are available and widely used for applications, such as material processing, owing to the reduced manufacturing complexities involved in the comparison. For instance, Excimer lasers, which produce high-energy UV radiation in various wavelengths, have been widely used for micromachining applications such as microelectronics, medical, automotive, and other industrial applications. Although ultrafast lasers can process optically transparent polymer materials, excimer lasers are more used owing to the costs involved. Other alternative technologies include Q-switched lasers, continuous wave (CW), nanosecond pulsed, among others.

- The COVID-19 pandemic and the subsequent lockdown restrictions around the globe impacted industrial activities, disrupting manufacturing operations and supply chains around the globe. Some other effects of lockdown include a lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, shipping problems, and so on.

Ultrafast Lasers Market Trends

Demand from Consumer Electronics is Expected to Witness Significant Growth

- The electronics manufacturing segment remains a highly dynamic sector. The sector is primarily driven by the increasing demand from the consumer electronics sector and fast-paced technological developments, which pressure OEMs to continuously introduce new products in the market. Consumer electronics providers largely depend on electronic manufacturers that offer benefits, such as cost savings, reduced time-to-volume, quality, reduced time-to-market, and flexibility, to provide their products in the market. According to Consumer Technology Association, Consumer Technology Sales in the United States increased by 7.5% and reached USD 487 billion recently.

- Further, Consumer electronics (CE) retail revenue in the United States is steadily increasing. According to the Consumer Technology Association, consumer electronics retail sales in the United States will reach USD 505 billion by the end of 2022. Furthermore, smartphones generated the most retail revenue in the consumer electronics sector, accounting for USD 74.7 billion in revenue in 2022.

- Most of the electronic devices in the market nowadays are miniaturized and demand tighter dimensional tolerances so that the components can fit inside ever-smaller form factors, driving the growth of the ultrafast laser market. The electronic manufacturing process needs the inspection of the tinier component features and improved accuracy.

- A growing application for femtosecond lasers is in the field of handheld electronics. Mobile phones, memory chips, microprocessors, and display panels are incredibly sophisticated components comprising various materials, multiple layers of extremely low thicknesses, and minimal features. These components require high-precision and advanced manufacturing processes and the ability to be economically produced in large quantities.

- Due to the very short pulse duration, ultrafast lasers enable thermal micromachining without any heat generation. Their increasing use in the advanced display repair process has led to a new generation of high-speed, compact, multi-wavelength ultrafast lasers.

- For instance, Spark Lasers, an Ultrafast lasers manufacturer, offers DIADEM, a compact, high-energy ultrafast laser for advanced micro-machining applications with short femtosecond pulse widths that deliver over 40µJ at 30W and up to 1MHz. This laser has been designed for demanding electronics manufacturing and implantable medical devices.

- Several industrial processes are taking advantage of the high precision of ultrafast laser processing. This includes selective layer ablation, where ablation rates as precise as 30nm per pulse are routinely achieved, and high-precision thin-film transistor electrode cutting, which has a cutting width smaller than 2μm. These processes require developing advanced and flexible beam shaping techniques, allowing the delivery of uniform, flat-top beams with variable shapes to the sample and sizes as small as 2μm 2μm.

- Players like Amplitude Group offer a range of femtosecond lasers for the consumer electronics, such as Tangor UV, Tangerine, and Yuja. These products include optical technology, the new standard for quality-driven results. They offer high repetition rates and peak-to-average power ratio; they can perform on any material with unparalleled precision, whether PCB, operations on semiconductors or flexible electronic materials, glass-cutting, and many others.

Asia Pacific is Expected to Hold a Significant Market Share

- The Ultrafast Laser market has seen significant growth in Asia-Pacific due to augmented demand for femtosecond fiber lasers in the automotive and electronics industries. This region, especially in countries such as Japan and China, is expected to grow considerably during the forecast period due to technological advancements and many electronics OEMs.

- The Asia-Pacific is an established leader in laser technology development with many market players, such as Thorlabs Inc., Wuhan Huaray Precision Laser Co. Ltd, Amplitude Laser, and others. The product offerings are one of the initiatives being taken by the market players for maximizing profit and gaining a competitive edge while fulfilling the ever-rising demand for enhanced ultrafast laser equipment. Companies have developed ultrafast lasers for myriad industrial applications due to increasing government initiatives for manufacturing defense and medical services.

- The industrial application includes ultrafast lasers for manufacturing industrial products ranging from machines to aerospace equipment. Ultrafast laser in the industrial domain is used in heating for hardening, melting for welding and cladding, and removing material for drilling and cutting. Femtosecond laser processing for material manufacturing is gaining traction. For surface processing, ultrafast lasers have become an industry standard.

- Many manufacturing utilities and an increasing focus on product quality and accuracy are significant factors fueling the demand for ultrafast lasers in Asia- Pacific. Moreover, manufacturing is one of the prominent industries in the Asian economy due to the rising need for industrial and consumer products.

- Several supportive factors, including research funding, equipment purchase funding, and agreements, drive the demand for ultrafast lasers in the region. Recently, Chromacity signed a deal with Photonteck to supply and distribute their ultrafast lasers in China. Photonteck will promote Chromacity's range of fixed wavelength femtosecond lasers and picosecond optical parametric oscillators (OPO) for imaging and sensing applications.

Ultrafast Lasers Industry Overview

The Ultrafast Laser market is highly competitive due to multiple players. The market appears to be moderately concentrated. Vendors in the market are involved in new product rollouts with significant R&D investments and partnerships that significantly boost the market growth. In addition to technological investments, companies have acquisitions as their growth strategy. The market consists of laser/photonic giants, such as Coherent, Trumpf, Jenoptik, and Lumentum.

- In February 2022, Jenoptik announced its strategic partnership with Accretech. The companies combined economic and technological strengths to create added value for the entire Japanese industry from February 1, 2022. Jenoptik thus gained another strong distribution partner.

- In January 2022, Light Conversion launched CRONUS-2P and CRONUS-3P microscopy-dedicated femtosecond laser sources covering. Its applications include functional neuroimaging, optogenetics, and deep imaging using medium-repetition-rate three-photon excitation and fast high-repetition-rate two-photon imaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Enhanced Dimensional Accuracy

- 5.1.2 Government Mandates Promoting Adoption of Ultrafast Lasers

- 5.2 Market Restraints

- 5.2.1 Manufacturing Complexities Challenge the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Laser Type

- 6.1.1 Solid State Laser

- 6.1.2 Fiber Laser

- 6.2 By End-User

- 6.2.1 Consumer Electronics

- 6.2.2 Medical

- 6.2.3 Automotive

- 6.2.4 Aerospace and Defense

- 6.2.5 Research

- 6.3 By Pulse Duration

- 6.3.1 Picosecond

- 6.3.2 Femtosecond

- 6.4 By Application

- 6.4.1 Material Processing And Micromachining

- 6.4.2 Medical And Bioimaging

- 6.4.3 Other Applications (Research-related applications)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amplitude Group

- 7.1.2 Coherent Inc.

- 7.1.3 Ekspla (EKSMA group)

- 7.1.4 MKS Instruments Inc. (Newport Corp. and Femtolasers Productions)

- 7.1.5 JENOPTIK Laser GmbH

- 7.1.6 TRUMPF Group

- 7.1.7 Novanta (Laser Quantum Ltd.)

- 7.1.8 Lumentum Holdings

- 7.1.9 Aisin Seiki (IMRA America Inc.)

- 7.1.10 IPG Photonics

- 7.1.11 NKT Photonics

- 7.1.12 Light Conversion Ltd