|

市場調查報告書

商品編碼

1444119

二苯基甲烷二異氰酸酯(MDI):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Methylene Diphenyl Di-isocyanate (MDI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

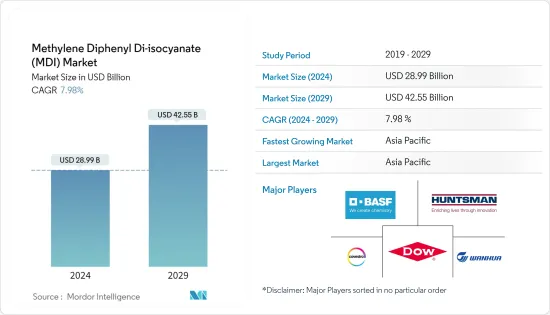

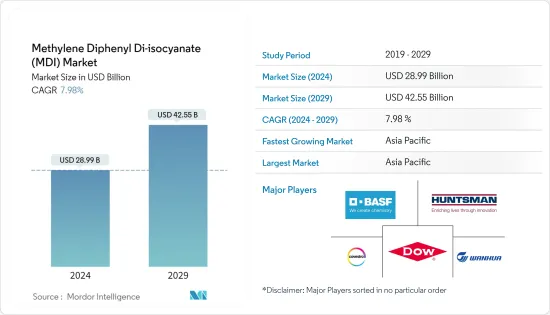

二苯基甲烷二異氰酸酯市場規模預計2024年為289.9億美元,預計到2029年將達到425.5億美元,在預測期內(2024-2029年)成長7.98%。年複合成長率為

該市場在 2020 年從 COVID-19 大流行中恢復過來後,在 2021 年錄得成長。建築、汽車等各個終端使用者產業的 MDI 消費量增加。在這些最終用戶產業中,MDI 用於多種應用,例如 PU 泡棉、塗料、黏劑、合成橡膠和黏合劑。

主要亮點

- 短期內,建設產業隔熱材料對聚氨酯的需求不斷成長,預計將推動市場成長。

- 相反,與 MDI 及其有害影響相關的嚴格法規可能會成為所研究市場成長的障礙。

- 無光氣 MDI 製造流程預計將為市場成長提供利潤豐厚的機會。

- 亞太地區在全球市場中佔據主導地位,其中中國、日本和韓國等國家的消費量最大,在預測期內可能會呈現出最高的年複合成長率。

二苯基甲烷二異氰酸酯市場趨勢

建築業預計將主導市場

- 建設業是 MDI 市場最大的最終用戶行業,MDI 用於各種住宅、商業和工業應用。

- 最大的應用之一是使用硬質 PU 泡棉作為牆壁和屋頂隔熱材料、隔熱板以及門窗周圍空間的間隙填充材。聚異矽酸酯板材主要用於屋頂和牆壁隔熱材料,佔建築應用中硬質 PU 泡沫總量的大部分。

- 一些硬質 PU 泡棉可用於密封間隙並覆蓋不規則形狀。此類發泡體包括噴霧泡沫、現場澆注泡沫和單組分發泡體。硬質 PU 泡棉的環境效益非常顯著,包括提高能源效率和減輕計劃重量。

- 防護塗層是 PU 在建築和施工中最常見的用途之一。它們用於製造木地板、地下室、建築物、橋樑和許多其他商業和消費品。

- PU黏劑代表了 PU 材料在終端用戶產業的另一個巨大市場。 PU黏劑具有固化時間快、黏合強度高和耐候性良好的特點,可用於屋頂、地板、牆板和門窗安裝。

- 2021年全球建築業價值約7.3兆美元。由於政府為遏制新的 COVID-19感染疾病傳播而實施的封鎖期間建設活動暫時停止,全球建築業的價值在 2020 年下降。

- 此外,根據美國人口普查局的數據,2021年建築支出達到1.59兆美元,較2020年增加8.2%,增加了MDI在各種建築應用的消耗量。

- 因此,建設產業的所有上述因素都可能對未來幾年所研究市場的需求產生重大影響。

亞太地區預計將主導市場

- 亞太地區主導了全球市場佔有率。中國、印度和日本等國家建築、家具、電子和汽車等行業需求的增加導致該地區 MDI 的使用量增加。

- 在亞太地區,中國是MDI的主要市場。中國是全球最大的聚氨酯產品生產國和消費國,MDI主要用於聚氨酯。

- 根據國際貿易局統計,中國是全球最大的汽車生產和銷售市場。根據OICA記者研究,2021年全國汽車產量達2,608萬輛,比2020年的2,523萬輛增加3%。

- 中國也擁有全球最大的建築市場,佔全球建築投資總額的20%。到 2030 年,預計光是該國就將在建築上花費近 13 兆美元。

- OICA報告顯示,2021年印度汽車產量成長30%。印度汽車製造商協會 (SIAM) 的報告顯示,2021 年印度小客車和輕型汽車產量為 4,399,112 輛。

- 印度擁有 2,500 多家裝飾塗料製造商和 800 多家工業塗料製造商。對油漆和塗料的需求增加促使企業增加國內產能。預計這將進一步增加國內對二苯基甲烷二異氰酸酯(MDI)的需求。

- 日本是電子工業最大的國家之一。 2021年產值達10.95兆日圓(800億美元)。電子產品產量已超過 COVID-19 之前的水平,這對於所研究的市場來說是一個積極的訊號。

- 因此,所有上述因素都可能對未來幾年亞太市場的需求產生重大影響。

二苯基甲烷二異氰酸酯產業概況

二苯基甲烷二異氰酸酯(MDI)市場本質上是整合的,主要企業佔據了市場的主要佔有率。市場的主要企業包括(排名不分先後)萬華化學、BASF、科思創、陶氏化學和亨斯曼公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設產業隔熱材料對PU的需求不斷成長

- 擴大應用範圍

- 抑制因素

- MDI相關嚴格規定

- MDI 的毒性作用

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 生產過程分析

- 技術授權和專利分析

- 價格趨勢場景

- 監理政策分析

第5章市場區隔

- 目的

- 硬質泡沫

- 形式靈活

- 塗層

- 合成橡膠

- 黏劑和密封劑

- 其他用途

- 最終用戶產業

- 建造

- 家具/室內裝飾

- 電子設備及家用電器

- 車

- 鞋類

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業採取的策略

- 公司簡介

- BASF SE

- Covestro AG

- Dow

- Hexion

- Huntsman Corporation

- Kumho Mitsui Chemicals Corp.

- Sadara

- Shanghai Lianheng Isocyanate Co. Ltd

- Sumitomo Chemical Co. Ltd

- Tosoh Corporation

- Wanhua

- Chongqing ChangFeng Chemical Co. Ltd

- KAROON Petrochemical Company

第7章市場機會與未來趨勢

- 無光氣MDI製造程序

The Methylene Diphenyl Di-isocyanate Market size is estimated at USD 28.99 billion in 2024, and is expected to reach USD 42.55 billion by 2029, growing at a CAGR of 7.98% during the forecast period (2024-2029).

The market witnessed growth in 2021 after recovering from the COVID-19 pandemic in 2020. The consumption of MDI has increased in various end-user industries, such as construction, automotive, and others. In these end-user industries, MDI is used in various applications, including PU foam, coatings, adhesives, elastomers, and binders.

Key Highlights

- Over the short term, the growing demand for PU in insulation in the construction industry is expected to drive the market's growth.

- On the flip side, stringent regulations associated with MDI and the toxic effects of MDI may act as barriers to the growth of the market studied.

- The phosgene-free MDI production process is expected to offer lucrative opportunities for the growth of the market.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries like China, Japan, and South Korea, and it is likely to witness the highest CAGR during the forecast period.

Methylene Diphenyl Diisocyanate Market Trends

The Construction Segment is Expected to Dominate the Market

- Construction is the largest end-user industry for the MDI market, where it is used in various household, commercial, and industrial applications.

- One of the largest applications is the usage of rigid PU foam as wall and roof insulation, insulated panels, and gap fillers for the space around doors and windows. Polyiso laminate board stock, used primarily in roofing and wall insulation, accounts for the majority share of total rigid PU foam in construction applications.

- Some rigid PU foams can be applied to seal gaps and cover irregular shapes. Such foams include spray, pour-in-place, and one-component foams. The environmental benefits of rigid PU foam are significant and include increased energy efficiency and reduced project weight.

- Protective coatings are one of the most popular applications of PUs in building and construction. They are used in the production of wood floors, basements, buildings, bridges, and many other commercial and consumer products.

- PU adhesives represent another large market for PU materials in this end-user industry. Owing to their fast cure time, bond strength, and weather resistance, PU adhesives are used in roofing, flooring, wallboard, and window/door installations.

- The global construction industry was valued at about USD 7.3 trillion in 2021, The value of the global construction industry declined in 2020 as construction activities were temporarily paused during the government-imposed lockdown to curb the spread of new COVID-19 cases.

- Moreover, in 2021, according to the US Census Bureau, construction spending amounted to USD 1,590 billion, witnessing a growth rate of 8.2% compared to 2020, thereby increasing the consumption of MDI from various construction applications.

- Therefore, all the aforementioned factors from the construction industry are likely to significantly impact the demand in the studied market in the years to come.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region dominated the global market share. With the increasing demand from industries such as construction, furniture, electronic appliances, and automotive in countries like China, India, and Japan, the usage of MDI is increasing in the region.

- In Asia-Pacific, China provides the major market for MDI. MDI is primarily used for polyurethane in China, and the country is the world's largest producer and consumer of polyurethane products.

- According to the International Trade Administration, China is the world's biggest automobile market in terms of both production and sales. In 2021, as per the OICA correspondent's survey, the automotive production in the country reached 26.08 million, which increased by 3%, compared to 25.23 million vehicles produced in 2020.

- Also, China has the largest building market in the world, making up 20% of all construction investments globally. The country alone is expected to spend nearly USD 13 trillion on buildings by 2030

- According to reports by the OICA, automotive production in India witnessed a 30% growth in 2021. As per the reports by the Society of Indian Automobile Manufacturers, SIAM, the country produced 4,399,112 units of passenger cars and light vehicles in 2021.

- India is home to over 2,500 decorative coatings and 800 industrial coatings manufacturers. . This increasing demand for paints and coatings has been prompting companies to increase their production capacities in the country. This is further expected to increase the demand for methylene diphenyl di-isocyanate (MDI) in the country.

- Japan is one of the largest countries in the electronics industry. The production value in 2021 reached JPY 10.95 trillion (USD 80000 million). Electronics production increased to more than pre-COVID-19 levels, which is a positive sign for the market studied.

- Therefore, all the above-mentioned factors are likely to significantly impact the demand in the market in the Asia-Pacific region in the years to come.

Methylene Diphenyl Diisocyanate Industry Overview

The methylene diphenyl di-isocyanate (MDI) market is consolidated in nature,with top players accounting for a major share of the market. Some of the key players in the market include Wanhua Chemical Co. Ltd, BASF SE, Covestro AG, Dow, and Huntsman Corporation (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for PU in Insulation in the Construction Industry

- 4.1.2 Expanding Scope of Application

- 4.2 Restraints

- 4.2.1 Stringent Regulations Associated with MDI

- 4.2.2 Toxic Effects of MDI

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Process Analysis

- 4.6 Technology Licensing and Patent Analysis

- 4.7 Price Trend Scenario

- 4.8 Regulatory Policy Analysis

5 Market Segmentation (Market Size in Volume)

- 5.1 Application

- 5.1.1 Rigid Foam

- 5.1.2 Flexible Foam

- 5.1.3 Coatings

- 5.1.4 Elastomers

- 5.1.5 Adhesive and Sealants

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Furniture and Interiors

- 5.2.3 Electronics and Appliances

- 5.2.4 Automotive

- 5.2.5 Footwear

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Hexion

- 6.4.5 Huntsman Corporation

- 6.4.6 Kumho Mitsui Chemicals Corp.

- 6.4.7 Sadara

- 6.4.8 Shanghai Lianheng Isocyanate Co. Ltd

- 6.4.9 Sumitomo Chemical Co. Ltd

- 6.4.10 Tosoh Corporation

- 6.4.11 Wanhua

- 6.4.12 Chongqing ChangFeng Chemical Co. Ltd

- 6.4.13 KAROON Petrochemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Phosgene-free MDI Production Process