|

市場調查報告書

商品編碼

1444110

生質塑膠:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Bioplastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

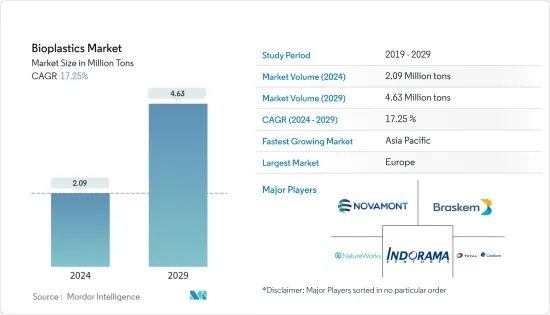

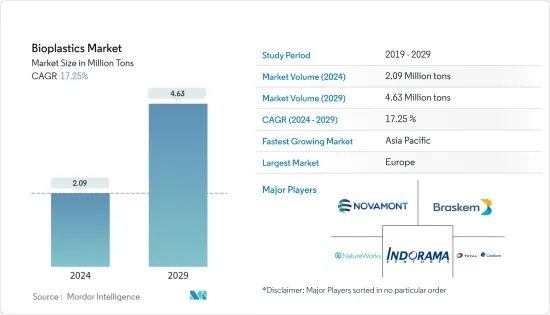

預計2024年生質塑膠市場規模為209萬噸,預計2029年將達到463萬噸,在預測期(2024-2029年)年複合成長率為17.25%。

由於 COVID-19 爆發,國家封鎖擾亂了世界各地的製造活動和供應鏈,生產停頓對 2020 年的市場產生了影響。然而,情況在 2021 年開始復甦,恢復了預測期內市場的成長軌跡。

主要亮點

- 推動市場研究的關鍵因素是環境問題,推動了有利於生質塑膠的模式轉移。此外,包裝需求的成長預計將推動市場成長。

- 然而,更便宜的替代品的可用性可能會阻礙市場成長。

- 電子業使用量的增加可能會為市場帶來新的成長機會。

- 歐洲佔據最高的市場佔有率,預計在預測期內將主導市場。

生質塑膠市場趨勢

軟質包裝可望主導市場

- 生質塑膠用於軟包裝,因為它們天然無害且易於分解。

- 用於食品、藥品、飲料瓶等包裝薄膜。它也用於包裝非食品產品,例如餐巾紙和紙巾、廁所用衛生紙、尿布、衛生棉、用於食品包裝的紙板和塗佈紙以及用於製造杯子和盤子的塗佈紙板。此外,它也用於軟性鬆散填充包裝。

- 由玉米粉製成的生質塑膠正在應用於軟性鬆散填充包裝。

- 聚乳酸(PLA)主要用於食品包裝,聚對苯二甲酸乙二酯(PET)、生物聚乙烯和生物聚丙烯主要用作包裝薄膜。

- 根據Packmedia預計,2021年全球軟性加工包裝市場規模預估為1,020億美元,與前一年同期比較增8%。

- 據Packmedia稱,美國、中亞和東亞各佔28%的市場佔有率。在歐洲層面,銷售額成長約+6.4%,銷售成長+1.6%。 2022年的成長前景分別為2.9%和2%,與歐洲相似。

- 全球包裝產業正在成長。亞太地區擁有最重要的生質塑膠製造能力,佔 45%。此外,消費者意識的提高以及中國、印度和日本等國家政府的嚴格禁令正在推動該地區生質塑膠的消費。因此,預計上述因素將在預測期內對市場產生正面影響。

歐洲主導市場

- 歐洲主導整個生質塑膠市場,大部分需求來自德國、法國、義大利和英國。

- 德國食品和飲料行業的特點是中小企業部門,擁有超過 6,000 家公司。 2021年食品和飲料市場收益預計為32.22億美元。預計預測期內市場將以每年6.83%的速度成長,推動國內軟硬包裝產業和生質塑膠消費。

- 根據聯邦統計局的數據,德國農業國內生產總值(GDP)從2021年第三季的74.1億歐元(約86.1億美元)上升至76.4億歐元(約88.8億美元)。 2021 年。

- 法國擁有歐洲最大的農業部門。該公司是全球農業市場的領先生產商,生產甜菜、葡萄酒、牛奶、牛肉和小牛肉、穀物和油籽。然而,該國遭受了嚴重乾旱。據法國主要農業聯盟FNSEA稱,由於法國春季和夏季的酷熱和少雨,44萬個農場中有14,000個農場提出了賠償申請。

- 2021年,法國生產了約1,351,308輛汽車,較2020年成長3%。

- 義大利的包裝工業是世界上最大的包裝工業之一。該國有近 7,000 家大大小小的包裝公司。超級市場零售的重要性日益提高以及消費者購買習慣的改變正在增加對國內包裝材料的需求。此外,出口增加了對包裝材料的需求。

- 2021年前三季汽車總產量達600,586輛,其中義大利汽車產量較2020第一季第三季成長20%。此外,2021年汽車整體產量約795,856輛,較2020年成長2%,銷量約777,165輛。電動車的日益普及預計將在未來幾年支持整個產業的成長。

- 英國是歐洲第四大塑膠消費國。該國被譽為先進和改性塑膠開發領域最具創新性和最先進的國家之一。然而,由於人們越來越意識到基於石油的非生物分解生質塑膠。

- 英國是歐洲最大的高階消費性電子產品市場,擁有約 18,000 家英國電子公司。根據國際貿易部統計,英國電子業每年為當地經濟貢獻約160億英鎊(約218.6億美元)。

- 因此,預計該地區的市場狀況將在整個預測期內推動生質塑膠的需求。

生質塑膠產業概述

生質塑膠市場分散。市場上的主要企業包括(排名不分先後)Braskem、Novamont SpA、NatureWorks LLC、Indorama Ventures Public Company Limited 和 Total Corbion PLA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 促進模式轉移的環境因素

- 包裝材料對生質塑膠的需求不斷成長

- 抑制因素

- 更便宜的替代品的可用性

- 產業價值鏈

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第5章市場區隔

- 類型

- 生物基生物分解性材料

- 澱粉型

- 聚乳酸(PLA)

- 聚羥基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 其他生物來源的生物分解性材料

- 生物基非生物分解材料

- 生物聚對苯二甲酸乙二酯(PET)

- 生物聚乙烯

- 生物聚醯胺

- 生物聚對苯二甲酸丙二醇Terephthalate

- 其他非生物分解材料

- 生物基生物分解性材料

- 目的

- 軟包裝

- 硬質包裝

- 汽車及組裝業務

- 農業和園藝

- 建造

- 紡織品

- 電氣和電子

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業採取的策略

- 公司簡介(概述、財務**、產品和服務、最新發展)

- Trinseo

- Arkema

- BASF SE

- BIOTEC

- Braskem

- Danimer Scientific

- Rodenburg Biopolymers

- Futerro

- Indorama Ventures Public Company Limited

- Minima

- Natureworks LLC

- Novamont SpA

- Total Corbion PLA

第7章市場機會與未來趨勢

The Bioplastics Market size is estimated at 2.09 Million tons in 2024, and is expected to reach 4.63 Million tons by 2029, growing at a CAGR of 17.25% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe disrupted manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- A significant factor driving the market studied is the environmental issues encouraging a paradigm shift to promote bioplastics. Additionally, the growing demand for packaging will likely favor the market's growth.

- However, the cheaper alternatives availability is likely to hamper the market's growth.

- Growing use in the electronics industry will likely provide new growth opportunities for the market.

- Europe accounts for the highest market share and is expected to dominate the market during the forecast period.

Bioplastics Market Trends

Flexible Packaging is Expected to Dominate the Market

- Bioplastics are used in flexible packaging as they are not harmful to nature and are easily degradable.

- They are used in packaging films for food items, medicines, beverage bottles, and packaging films. It is also used in packaging non-food products, such as napkins and tissues, toilet paper, nappies, sanitary towels, cardboard and coat paper for food wrapping paper, and coated cardboard to make cups and plates. Moreover, they are used in flexible and loose-fill packaging.

- Bioplastics made of cornstarch have applications in flexible and loose-fill packaging.

- Polylactic acid (PLA) is used mainly in packaging food items, while bio polyethylene terephthalate (PET), bio polyethylene, and bio polypropylene are majorly used as packaging films.

- According to Packmedia, in 2021, the world market for flexible converter packaging was estimated at USD 102 billion, up 8% from the previous year.

- According to Packmedia, the United States and Central and East Asia each share 28% of the market. At the European level, growth is around +6.4% for sales and +1.6% in volume. Growth prospects for 2022, again at the European level, are 2.9% and 2%, respectively.

- The global packaging industry is growing. Asia-Pacific includes the most significant manufacturing capacity for bioplastics, i.e., 45%. Moreover, the increasing awareness among consumers and the government's strict ban in countries like China, India, and Japan have promoted bioplastic consumption in the region.

- Thus, the abovementioned factors are expected to impact the market during the forecast period positively.

Europe to Dominate the Market

- Europe dominated the overall bioplastics market, with most of the demand coming from Germany, France, Italy, and the United Kingdom.

- Germany's food and beverage industry are characterized by its small and medium-sized enterprise sector of over 6,000 companies. The revenue in the food and beverage market was estimated at USD 3,222 million in 2021. The market is expected to grow annually by 6.83% during the forecast period, driving the country's flexible and rigid packaging industry and bioplastic consumption.

- According to the Federal Statistical Office, the Gross domestic product (GDP) from agriculture in Germany increased to EUR 7.64 billion (~USD 8.88 billion) in the fourth quarter of 2021 from EUR 7.41 billion (~USD 8.61 billion) in the third quarter of 2021.

- France is home to the largest agricultural sector in Europe. It is among the top producers in the global agriculture market and produces sugar beets, wine, milk, beef and veal, cereals, and oilseeds. However, the country experienced severe droughts. According to France's main agricultural trade union, FNSEA, 14,000 farms out of 440,000 filed compensation claims following the extreme heat and lack of rain that ravaged France during the spring and summer.

- In 2021, France produced about 13,51,308 units of vehicles, which increased by 3% in comparison to 2020.

- Italy's packaging industry is one of the largest in the world. There are nearly 7,000 significant and minor packaging companies active in the country. The growing importance of supermarket retailing and the changing consumer purchasing habits are increasing the packaging demand in the country. Besides, exports are adding to the need for packaging materials.

- The total production of automobiles in the first three quarters of 2021, Italy's automotive production increased by 20% over Q1-Q3 of 2020 and reached 600,586 vehicles. Moreover, the overall vehicle production in 2021 came to about 795,856 units, which increased by 2% compared to 2020, with a volume of about 777,165. The growing popularity of electric vehicles is expected to support the overall industry growth in the upcoming future.

- The United Kingdom is the fourth-largest consumer of plastics in Europe. The country is identified as one of the most innovative and advanced countries in terms of developing advanced and modified plastics. However, the country is focusing on bioplastics due to the increasing awareness about the environmental impact of petroleum-based non-biodegradable plastics.

- The United Kingdom is the largest European market for high-end consumer electronics products, with about 18,000 UK-based electronics companies. According to the Department for International Trade, the electronics sector in the United Kingdom is worth around GBP 16 billion (~USD 21.86 billion) yearly to the local economy.

- Hence, the market scenario in the region is expected to boost the demand for bioplastics throughout the forecast period.

Bioplastics Industry Overview

The bioplastics market is fragmented. Some of the key players in the market (not in any particular order) include Braskem, Novamont SpA, NatureWorks LLC, Indorama Ventures Public Company Limited, and Total Corbion PLA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Factors Encouraging a Paradigm Shift

- 4.1.2 Growing Demand for Bioplastics in Packaging

- 4.2 Restraints

- 4.2.1 Availability of Cheaper Alternatives

- 4.3 Industry Value Chain

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Bio-based Biodegradables

- 5.1.1.1 Starch-based

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Polyhydroxy Alkanoates (PHA)

- 5.1.1.4 Polyesters (PBS, PBAT, and PCL)

- 5.1.1.5 Other Bio-based Biodegradables

- 5.1.2 Bio-based Non-biodegradables

- 5.1.2.1 Bio Polyethylene Terephthalate (PET)

- 5.1.2.2 Bio Polyethylene

- 5.1.2.3 Bio Polyamides

- 5.1.2.4 Bio Polytrimethylene Terephthalate

- 5.1.2.5 Other Non-biodegradables

- 5.1.1 Bio-based Biodegradables

- 5.2 Application

- 5.2.1 Flexible Packaging

- 5.2.2 Rigid Packaging

- 5.2.3 Automotive and Assembly Operations

- 5.2.4 Agriculture and Horticulture

- 5.2.5 Construction

- 5.2.6 Textiles

- 5.2.7 Electrical and Electronics

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials**, Products and Services, and Recent Developments)

- 6.4.1 Trinseo

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 BIOTEC

- 6.4.5 Braskem

- 6.4.6 Danimer Scientific

- 6.4.7 Rodenburg Biopolymers

- 6.4.8 Futerro

- 6.4.9 Indorama Ventures Public Company Limited

- 6.4.10 Minima

- 6.4.11 Natureworks LLC

- 6.4.12 Novamont SpA

- 6.4.13 Total Corbion PLA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use in the Electronics Industry