|

市場調查報告書

商品編碼

1444092

包裝自動化:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

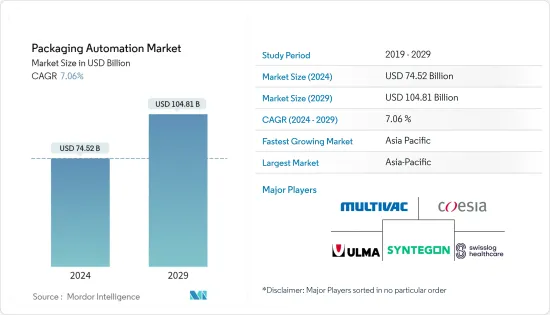

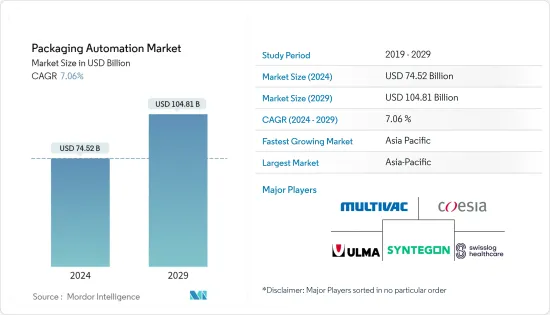

2024 年包裝自動化市場規模估計為 745.2 億美元,預計到 2029 年將達到 1048.1 億美元,在預測期間(2024-2029 年)以 7.06% 的複合年增長率增長。

主要亮點

- 自動化提高了二次包裝作業的效率和生產率。自動化系統可以比手動流程更快、更準確地處理紙箱組裝、裝箱、堆疊和貼標籤等重複性任務。其結果是提高了吞吐量並減少了勞動力需求。本公司專注於滿足客戶需求,提供創新、全面的包裝解決方案。與此結合,2023年5月,醫療、製藥、食品領域的包裝機製造商Ulma Packaging推出了一款小型包裝機。這包括初級和二級包裝、處理整個包裝過程的全自動生產線、產品裝載和最終碼垛,適合希望實施自動化包裝或最佳化工廠佔地面積的客戶。

- 包裝產業的自動化解決方案正在穩步成長,並為公司帶來多種好處。此外,為了促進最終用戶行業的包裝自動化,包裝器材製造商正在推出與其機器相關的計劃。例如,2022 年 8 月,Maxpack Machinery LLC 推出了 Leap by Max Pack,這是一款允許買家分期付款的創新包裝器材。 Leap 是 Maxpack 針對「先買後付」高成長區隔市場的舉措。自動化機器以優質捆綁銷售,付款期限為 18 個月,無利息、擔保或信用要求。

- 自動化和機器人技術將使釀酒廠和消費品行業的其他公司受益。雖然許多消費品公司已經實施了包裝和加工線自動化,但釀酒廠需要更快地採用這些技術。然而,自動化在釀酒行業的潛在好處包括提高生產效率、提高產品品質和一致性、增強安全性和衛生、資料驅動的見解等等。

- 包裝自動化系統的好處是顯著的,並且正在推動市場的發展。儘管如此,所需的初始資本較高,限制了較小組織的採用。此外,中國生產成本上升以及人民幣兌美元升值也促使投資者尋求其他製造目的地。然而,製造商應關注高品質生產和環保製造法規。隨著技術的發展,完全自動化的設施將需要數年的時間來調整和發展。另一方面,適應動態自動化的不利或延遲的努力包括對以地區為基礎成長的限制。

- COVID-19 大流行迫使包裝行業相關人員重新思考經營模式。電子商務的增加不僅是經銷商的負擔,也是製造商的負擔。製造商也在產品的包裝上投入了金錢和精力。此外, 感染疾病-19 加速了機器人包裝自動化流程的採用,例如環繞式包裝。

包裝自動化市場趨勢

食品工業呈現強勁成長

- 食品業的包裝自動化是簡化業務、確保產品品質和滿足不斷成長的消費者需求的重要方面。食品包裝過程自動化可顯著提高效率和生產力。自動化系統可以處理填充、密封、貼標和堆疊操作,從而實現更快、更一致的包裝操作。這提高了生產力並減少了勞動力需求。

- 自動化正在改變許多行業的遊戲規則,食品和飲料加工和包裝也不例外。機器人解決方案可用於任何包裝生產線,從簡單的拾放操作到罐頭、袋子和包裝袋製造等複雜的流程。自動化徹底改變了該行業的包裝方式,從而提高了生產力、降低了價格並提高了品質。即使是便宜的糖果也要經歷許多使用最先進的機械包裝食品的階段。

- 此外,機器製造商正在關注基於控制的協作。 2023 年 5 月 Rotzinger(瑞士食品、飲料和化妝品行業OEM包裝器材製造商和設備製造商)與工業無線自動化供應商 CoreTigo 於上個月在 Interpack 上宣佈建立有趣的基於控制的合作夥伴關係。將 CoreTigo 的 IO-Link 無線產品和技術與 Rotzinger 最先進的包裝設備相整合,創造出新的複雜功能,從而實現最大的彈性、吞吐量和永續性。

- 此外,食品公司增加研發支出來增強產品並引入自動化,透過規模經濟、延長保存期限和降低成本來提高產品衛生和盈利能力,從而促使包裝自動化程度的提高,預計將得到推廣。根據金寶湯2022年年報,該公司的研發支出從2021年的8,400萬美元增加至2022年的8,700萬美元。所有這些因素預計將支持市場成長。

亞太地區獲得主要市場佔有率

- 近年來,包裝產業不斷擴大。有吸引力的尖端產品是眾多製造設施、環保材料的引入以及對研發的日益重視的結果。所有這些都是在國內生產且價格低廉。此外,「印度製造」等政府計劃預計將有助於推動這些計劃。

- 此外,食品和飲料支出的增加以及對包裝解決方案的需求增加對製造商快速回應客戶需求提出了課題。勞動力短缺和提高生產力的需求進一步鼓勵企業在食品業實施包裝自動化。此外,漢陽包裝也採取創新方法,引進Delta機器人來滿足日益成長的需求。他們使用羅克韋爾架構。 CompactLogix 5370 L3 控制器依賴一個控制平台來實現從機器人控制到索引和運輸的整個系統。因此,漢陽包裝透過單一通用控制平台、共用網路和設計環境提高了生產力和效率,並降低了成本。

- 2022年7月,工業供應鏈和電子商務紙質包裝解決方案供應商Ranpak推出了“Flap'it!”一種高效設備,可自動包裝各種小物品。內部翻蓋和整合式角落緩衝墊可將物品固定指定。此解決方案會自動調整到物體的高度。確保您的產品在運輸過程中受到保護,減少成本、損壞和退貨。

- 此外,2022年4月,全球包裝領導者TricorBraun宣布同意收購Pro-Pac Packaging Limited的完全子公司PB Packaging(「PB」)。 PB 是澳洲領先的塑膠和玻璃包裝供應商之一,為您的剛性包裝需求提供一站式解決方案,為醫療保健、工業、食品和汽車行業的客戶提供服務。透過此次收購,TricorBraun 將獲得該公司的自動化包裝解決方案,包括 CAD/CAM 設計、創新包裝工具以及自動化吹塑和射出成型服務。

包裝自動化產業概況

包裝自動化市場較為分散,眾多廠商佔據市場佔有率。主要企業之間的創新和合作正在進一步推動市場成長。

- 2022 年 3 月 - ULMA Packaging 宣布其機器配備了 BETTER-SEAL,這是一種創新系統,可改善單一材料解決方案的密封性。這項功能的增加標誌著公司的創新策略和環保工作向前邁出了一步。

- 2022 年 1 月 - 莫迪維克宣布收購 Brookmule 在 TVI 的全部股份。 TVI 是一家配料機供應商,自 2017 年 1 月起成為莫迪維克集團的一部分。此次收購是進一步鞏固莫迪維克作為包裝和加工解決方案完整供應商地位的重要因素。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 二次包裝自動化案例數量增加

- 各行業越來越多採用自動化解決方案

- 市場課題/限制

- 高資本成本和網路安全問題

第6章市場區隔

- 依產品類型

- 填充

- 標籤

- 箱式包裝

- 套袋

- 碼垛

- 封蓋

- 包裹

- 其他

- 依最終用戶

- 食品

- 飲料

- 藥品

- 個人護理、洗護用品

- 工業/化學產品

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Multivac Group

- Coesia Spa

- ULMA Packaging

- Syntegon Technology

- Swisslog Healthcare

- Rockwell Automation Inc.

- Sealed Air Corporation

- Mitsubishi Electric Corporation

- Automated Packaging System LLC(Sealed Air Corporation)

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 51884

The Packaging Automation Market size is estimated at USD 74.52 billion in 2024, and is expected to reach USD 104.81 billion by 2029, growing at a CAGR of 7.06% during the forecast period (2024-2029).

Key Highlights

- Automation offers improved efficiency and productivity in secondary packaging operations. Automated systems can handle repetitive tasks, such as carton erecting, case packing, palletizing, and labeling, faster and more accurately than manual processes. It resulted in higher throughput and reduced labor requirements. Companies focus on catering to customers' needs to offer them innovative and comprehensive packaging solutions. In line with the same, in May 2023, ULMA Packaging, a packaging machine manufacturer for the medical/pharmaceutical and food sectors, showcased its compact packaging equipment. It includes primary and secondary packaging, fully automated lines that handle the entire packaging process, product loading, and final palletizing for customers looking to introduce automatic packaging or optimize the footprint of their factories.

- Automation solutions in the packaging industry are steadily increasing, providing several benefits to businesses. Additionally, to promote packaging automation among end users industries, packaging machinery manufacturers are launching schemes with their machinery. For instance, in Aug 2022, Maxpack Machinery LLC launched Leap by Max Pack, revolutionary packaging machinery which allows the buyer to pay over time. Leap is Maxpack's take on the high-growth segment of Buy Now, Pay Later. The automation machinery is sold as premium bundles with a payment duration of 18 monthly payments with no interest, guarantees, or credit requirements.

- Automation and robotics can benefit wineries and other businesses in the consumer-packaged goods industry. While many CPG companies already embraced automation in their packaging and processing lines, wineries need to adopt these technologies faster. However, the potential advantages of automation in the winery industry include increased production efficiency, improved product quality and consistency, enhanced safety and hygiene, and data-driven insights, among others.

- The advantages of packaging automation systems are significant and drive the market. Still, the requirement of higher initial capital restricts smaller organizations from adopting it. Additionally, investors are looking at alternate manufacturing destinations with the rising cost of production in China and the strengthening of the Yuan against the Dollar. However, manufacturers need to focus on quality production and environment-friendly manufacturing regulations. With the growing technology, a fully automated facility takes years to adjust and evolve. Meanwhile, unfavorable or delayed initiatives on dynamic automation adaption include limited growth on a regional basis.

- The COVID-19 pandemic forced the players in the packaging industry to rethink their business models. The increased e-commerce does not put a strain on distribution companies but also manufacturers. Manufacturers also put their money and efforts into packaging that goes with their products. Additionally, COVID accelerated the adoption of robotic packaging automation processes like wraparound packaging.

Packaging Automation Market Trends

Food Industry to Show Significant Growth

- Packaging automation in the food industry is an essential aspect of streamlining operations, ensuring product quality, and meeting the increasing demands of consumers. Automation in food packaging processes can significantly increase efficiency and productivity. Automated systems can handle filling, sealing, labeling, and palletizing tasks, allowing faster and more consistent packaging operations. It leads to higher production rates and reduced labor requirements.

- In many sectors, automation changed the game, and the processing and packaging of food and beverages are no exception. Robotics solutions are available for all packaging lines, from straightforward pick and drop operations to intricate processes like can, pouch, or packet manufacturing. Automation completely changed how packaging is done in this business, resulting in more productivity, lower prices, and better quality. Even cheap candies go through many food packaging stages using cutting-edge machinery.

- Additionally, Machinery manufacturers are focusing on controls-based collaboration. In May 2023, Rotzinger, a Swiss OEM packaging machinery manufacturer, a maker of equipment for food, beverage, and cosmetic industries, and CoreTigo, a supplier of industrial wireless automation, presented an intriguing controls-based partnership at Interpack last month. With the integration of CoreTigo's IO-Link wireless products and technology into Rotzinger's cutting-edge packaging equipment, new and sophisticated capabilities are created that are driving maximum flexibility, throughput, and sustainability.

- Further, increasing R& D spending by food companies to enhance their product and implement automation to improve product hygiene and profit through economies of scale, extended shelf life, and cost reduction are expected to boost packaging automation. According to Campbell Soup's annual report 2022, the company increased its R& D spending to USD 87 million in 2022 from USD 84 million in 2021. All such factors are expected to support market growth.

Asia Pacific to Hold a Major Market Share

- In recent years, the packaging industry expanded. Products that are appealing and cutting-edge are the result of the introduction of numerous manufacturing facilities, eco-friendly materials, and increasing attention to research and development. These are all inexpensively produced locally. Additionally, it is anticipated that government programs like "Make In India" would contribute to advancing these programs.

- Additionally, the increasing spending on food and beverages, coupled with the growing demand for packaging solutions, presents challenges for manufacturers to meet customer requirements promptly. Labor shortages and the need for improved productivity further incentivized companies to adopt packaging automation in the food industry. Additionally, Hanyang Packaging took an innovative approach by installing Delta Robot to keep up with the increasing demand. They used Rockwell Automation Integrated Architecture. CompactLogix 5370 L3 controllers rely on one control platform for the entire system, i.e., from robotics control to indexing and conveyance. As a result, Hanyang Packaging improved productivity and efficiency and reduced costs with a single common control platform, shared network, and design environment.

- In July 2022, Ranpak, a supplier of paper-based packaging solutions for industrial supply chains and e-commerce, introduced "Flap'it!" a highly effective device that automates the packaging of a range of small items. By using inside flaps and corner-integrated cushioning bumpers to keep the goods in place, the Flap'it! The solution automatically adjusts to the height of the object. It guarantees that goods are safeguarded while shipping, lowering expenses, damage, and product returns.

- Moreover, in April 2022, the global packaging leader, TricorBraun, announced that it had agreed to acquire PB Packaging ("PB"), a wholly-owned subsidiary of Pro-Pac Packaging Limited. One of Australia's leading plastic and glass packaging providers, PB is a one-stop shop for rigid packaging needs, serving customers in the healthcare, industrial, food, and automotive industries. Along with this acquisition, TricorBraun will access the company's automation packaging solutions, like CAD/CAM designing, for innovative packaging tools and automatic blow and Injection molding services.

Packaging Automation Industry Overview

The packaging automation market is fragmented, with many players occupying market shares. Innovation and collaboration among the key players are further adding growth in the market.

- March 2022- ULMA Packaging announced that its machines now feature BETTER-SEAL, an innovative system that improves the sealing in mono-material solutions. Adding this feature is a step forward in its innovation strategy and environmental commitment.

- January 2022- MULTIVAC announced the acquisition of the complete holdings of TVI in Bruckmuhl. TVI is a portioning machine provider and part of the MULTIVAC Group since January 2017. This acquisition is an essential component for the further alignment of MULTIVAC as a complete supplier of packaging and processing solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Automation for Secondary Packaging

- 5.1.2 Increasing Adoption of Automation Solutions Across Various Industries

- 5.2 Market Challenges/Restraints

- 5.2.1 High Capital Cost and Cybersecurity Concerns

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Filling

- 6.1.2 Labelling

- 6.1.3 Case Packaging

- 6.1.4 Bagging

- 6.1.5 Palletizing

- 6.1.6 Capping

- 6.1.7 Wrapping

- 6.1.8 Other Product Types

- 6.2 By End-user

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceuticals

- 6.2.4 Personal Care and Toiletries

- 6.2.5 Industrial and Chemicals

- 6.2.6 Other End-users

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 Egypt

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Multivac Group

- 7.1.2 Coesia Spa

- 7.1.3 ULMA Packaging

- 7.1.4 Syntegon Technology

- 7.1.5 Swisslog Healthcare

- 7.1.6 Rockwell Automation Inc.

- 7.1.7 Sealed Air Corporation

- 7.1.8 Mitsubishi Electric Corporation

- 7.1.9 Automated Packaging System LLC (Sealed Air Corporation)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219