|

市場調查報告書

商品編碼

1444087

電氣外殼(電氣機殼):市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Electrical Enclosures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

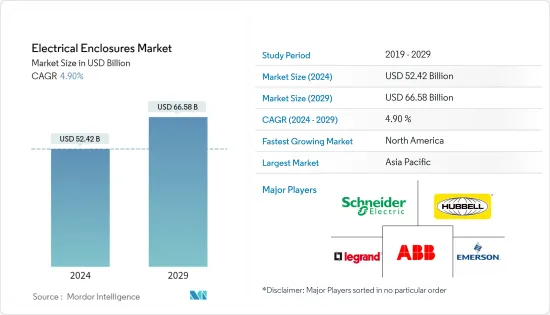

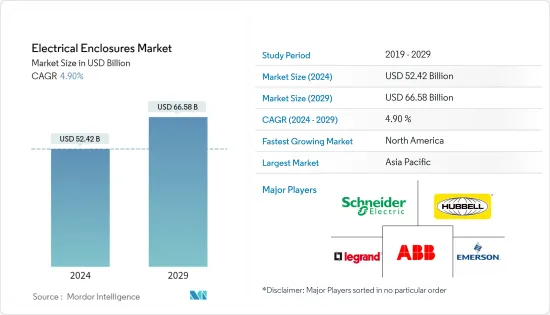

電氣外殼(Electrical 機殼)市場規模預計到 2024 年為 524.2 億美元,預計到 2029 年將達到 665.8 億美元,在預測期內(2024-2029 年)複合年成長率為 4.90%。

隨著電力和工業基礎設施的增加,保護職場和勞動力的需求也隨之增加,促使工業設備安全標準的採用。這使得電氣外殼成為工業和住宅應用中的重要元件。

主要亮點

- 全球能源消耗持續大幅增加,隨著世界互聯趨勢的加速,電力需求也隨之增加。據英國石油公司稱,冰島是世界上人均電力消耗量最高的國家,2021年人均用電量為52.98兆瓦時。這是由於該國存在能源密集型工業。類似的案例進一步增加了對電氣外殼的需求。

- 太陽能和風力發電使用敏感的電氣元件和電池,當暴露在自然環境中時可能會導致系統故障。因此,出於安全目的,電氣外殼在很大程度上被用於能源產出領域。

- 工業和工廠自動化的接受使得更多的機械、電子機械和固態設備、零件和控制裝置進入市場,這些設備、零件和控制設備出於安全和美觀的目的而必須密封,從而促進了市場成長。因此,許多國家在全球範圍內推出了嚴格的安全法規,這項參數極大地推動了電氣外殼市場的成長。

- 例如,緬因州建築安全聯盟、安全工程和緬因州勞工部職場場所安全與健康部門將於 2022 年 8 月合作,促進職場安全與健康,並為全州的建築雇主和工人提供安全保障.提供有關健康風險的資訊。該聯盟透過減少和最大限度地減少與施工相關的風險(例如跌倒、與物體碰撞造成的傷害、電擊以及被機械或車輛纏繞)來保護工人。

- 市場正在見證製造商的各種發展,各級供應商都在繼續開發電池保護外殼的複合解決方案。例如,2022 年 3 月,總部位於墨西哥的 Automotive Tier 1 Katcon 開發了多材料工具箱,用於經濟高效擴充性的電動車電池外殼設計。

- COVID-19 大流行使各行業的電氣外殼採用變得更加複雜。標準操作程序已經改變,帶來了社交距離和非接觸式操作的獨特課題。組織被迫限制勞動力並應對不斷成長的需求。由於多個行業倒閉,市場受到負面影響。然而,隨著限制的放鬆和行業的運作開放,市場開始獲得動力。

電氣外殼市場趨勢

能源電力終端用戶產業佔主要佔有率

- 與石化燃料和核能相關的環境問題正在促使太陽能和風力發電等替代能源的興起。太陽能風力發電能被認為是安全、無污染的可再生能源。世界各國都在採用這項技術。

- 太陽能和風力發電使用敏感的電氣元件和電池,當暴露在自然環境中時可能會導致系統故障。因此,出於安全目的,電氣外殼在很大程度上被用於能源產出領域。

- 風能和太陽能設備需要抗震保護、EMC屏蔽、電子冷卻、安全、耐腐蝕、功率轉換和多部件系統整合,這些都是透過電氣外殼來實現的。

- 在引入配電機殼以保護太陽能發電場、風電場和發電廠的電氣和電子零件和系統的同時,政府法規也支持引入再生能源來源,因此對配電機殼的需求不斷增加。

- 各地區正在製定各種措施來生產再生能源來源,進一步增加了對電氣外殼的需求。例如,2021年8月,印度政府提案了一套規則,即《2021年電力規則草案》,透過開放綠色能源來推廣可再生能源。提案規則旨在透過解決與綠色能源產業相關的各種問題來促進更快地採用再生能源。

北美地區預計將顯著成長

- 工業自動化和智慧家庭整合的成長預計將顯著推動該地區的電氣外殼市場,這主要是由於美國是工業自動化的早期採用者。

- 2021 年約 61% 的發電量來自石化燃料。石化燃料中約19%的能源來自核能,約20%來自再生能源來源。美國能源資訊署估計,2021 年小型太陽能系統將額外發電 490 億度。該地區的監管機構在刺激電氣外殼需求方面發揮關鍵作用。

- 由於安全問題和節能意識的增強,智慧家庭在北美變得越來越普及。由於消費者尋求清潔環境的行為,智慧設備的技術進步以及這些設備進入許多家庭預計將為電氣外殼市場帶來機會。

- 此類工廠的不斷增加以及與之相關的嚴格法規預計將呈指數級擴大北美地區的電子外殼市場。美國能源局(DOE) 最近宣布,將投資 6,100 萬美元用於 10 個先導計畫,這些項目將引入新技術,將數千個住宅和職場轉變為節能建築。

電氣外殼產業概況

電子外殼市場適度分散。工業4.0和各地區不斷增加的能源消耗為電子機殼市場創造了機會。市場參與者正在採取產品創新、併購和策略合作夥伴關係等關鍵策略,以擴大產品系列擴大其地理覆蓋範圍。市場參與者包括 ABB Ltd、艾默生電氣和施耐德電氣 SE。

2022 年 7 月 -Schneider Electric宣布推出 PrismaSet S,這是一系列新的機櫃,使商業和工業建築中的配電裝置與住宅裝置相媲美,並提高了對硬應用的耐受性。 PrismaSet S 支持Schneider Electric透過在製造過程中使用一些回收塑膠材料來提高永續性的承諾。

2022 年 3 月 - 麥格納國際公司宣布將擴大其在加拿大的電池外殼業務,以支持福特馬達的新業務。新工廠佔地 17 萬平方英尺,預計將創造多達 150 個新就業崗位,並為福特 F-150 照明生產電池外殼。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 業界亮點-波特五力

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 不斷成長的電力基礎設施發展

- 工業自動化的採用率不斷提高

- 市場限制因素

- 品質和安全問題

第6章市場區隔

- 依材質

- 金屬

- 非金屬

- 依最終用戶產業

- 能源/電力

- 工業(汽車/製造)

- 製程工業

- 其他(交通、基礎建設、通訊)

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Schneider Electric SE

- Legrand SA

- Hubbell Inc.

- Emerson Electric Co.

- ABB Ltd

- Eaton Corporation

- Eldon Holding AB

- AZZ Inc.

- Austin Electrical Enclosures

- Siemens AG

- Pentair PLC

- Rittal GmbH &Co. Kg.

- Adalet(Scott Fetzer Company)

第8章投資分析

第9章市場機會與未來趨勢

The Electrical Enclosures Market size is estimated at USD 52.42 billion in 2024, and is expected to reach USD 66.58 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Owing to the increasing power and industrial infrastructure, the need for protection of the workplace and workforce is also increasing, which has led to the adoption of safety standards for the equipment in the industries. It has made electrical enclosures a crucial element in industrial and residential applications.

Key Highlights

- Global energy consumption continues to grow significantly, as electricity demand is increasing as the trend for an ever-connected world accelerates. According to BP, Iceland has the largest per capita electricity consumption worldwide, averaging 52.98 megawatt-hours per person in 2021. It is due to the presence of energy-intensive industries in the country. Such instances are further driving the demand for electrical enclosures.

- Power generated from solar and wind sources uses sensitive electrical components and batteries that, if exposed to the elements, cause a system failure. Therefore, the energy generation sector uses electrical enclosures significantly for safety purposes.

- The acceptance of industrial and factory automation allows the entry of more mechanical, electromechanical, and solid-state devices, components, and controls that need to be enclosed for safety and aesthetic purposes, thereby driving the market growth. As a result, many countries have implemented stringent safety regulations globally, and this parameter is significantly driving the growth of the electrical enclosures market.

- For instance, the Construction Safety Alliance of Maine, SafetyWorks, and the Workplace Safety and Health Division of the Maine Department of Labor joined forces in August 2022 to promote workplace safety and health and inform construction employers and workers in the state about safety and health risks.The alliance will safeguard workers by lowering and minimizing exposure to construction-related risks like falls, injuries from being struck by objects, electrocution, and getting entangled in or between machinery and vehicles.

- The market is witnessing various developments as fabricators, and tier suppliers continue to develop composite solutions for protective battery enclosures. For instance, in March 2022, Mexico-based automotive tier 1 Katcon developed a multi-material toolbox for cost-effective, scalable EV battery enclosure design.

- The Coronavirus pandemic complicated the situation of the adoption of electrical enclosures in various sectors. It has changed the standard operating procedure by bringing in unique challenges of social distancing and contactless operation. Organizations were forced to limit their workforce and deal with the increasing demand. With the shutdown of several industries, the market witnessed a negative impact. Although, with the ease of restrictions and the opening of industries at full capacity, the market has started to gain traction.

Electrical Enclosures Market Trends

Energy and Power End-User Industry to Hold a Significant Share

- Environmental issues related to fossil fuels and nuclear energy are prompting a rise in alternative energy sources, such as solar and wind energy. Solar and wind energy are considered safe, pollution-free renewable energy. Countries around the world are embracing this technology.

- Power generated from solar and wind sources uses sensitive electrical components and batteries that, if exposed to the elements, cause a system failure. Therefore, the energy generation sector uses electrical enclosures significantly for safety purposes.

- Wind and solar energy equipment require seismic protection, EMC shielding, electronics cooling, security, resistance to corrosion, and integration of power conversion and multi-component systems, which are achieved using electrical enclosures.

- As electrical enclosures are deployed to protect the electrical and electronic components and systems of solar, wind, and electrical power plants, government regulations also support the adoption of renewable energy sources, thereby boosting the demand for electrical enclosures.

- Regions are coming up with various initiatives to produce renewable energy sources, further fueling the demand for electrical enclosures. For instance, in August 2021, the Indian Government proposed a set of rules, "Draft Electricity Rules, 2021," for promoting renewable energy through green energy open access. The proposed rules aim to push for faster adoption of renewable power by addressing various concerns related to the green energy sector.

North America Is Expected To Witness Significant Growth Rate

- The growing industrial automation and smart home integration are expected to drive the electrical enclosures market significantly in this region, mainly due to the United States being an early adopter of industrial automation.

- About 61% of electricity generation was from fossil fuels in 2021. About 19% of the energy from fossil fuels was from nuclear energy, and about 20% was from renewable energy sources. The U.S. Energy Information Administration estimates an additional 49 billion kWh of electricity generation from small-scale solar photovoltaic systems in 2021. The regulating bodies in the region have been the prime players in stimulating the demand for electrical enclosures.

- There is a significant penetration of smart homes in North America owing to growing security concerns and awareness of energy conservation. The technological advancements in smart devices and the adoption of those devices into many households are expected to act as opportunities for the electrical enclosures market, owing to the consumer behavior of having a clean environment.

- The increasing establishment of such plants and the stringent rules associated with them are expected to drive the electronic enclosures market exponentially in the North American region. The U.S. Department of Energy (DOE) recently announced USD 61 million for ten pilot projects to deploy new technology for transforming thousands of homes and workplaces into energy-efficient buildings.

Electrical Enclosures Industry Overview

The electronic enclosure market is moderately fragmented. Industry 4.0 and the increasing energy consumption in different regions provide opportunities in the electronic enclosures market. The players in the market are adopting major strategies, like product innovations, mergers and acquisitions, and strategic partnerships, to widen their product portfolio and expand their geographical reach. Some of the players in the market are ABB Ltd, Emerson Electric, and Schneider Electric SE, among others.

In July 2022 - Schneider Electric announced the launch of PrismaSeT S, a new series of enclosures that makes the installation of electrical distribution in commercial and industrial buildings equivalent to residential in terms of installation but more resistant to hard applications. PrismaSeT S supports Schneider Electric's initiative for being more sustainable by using parts of recycled plastic materials in its manufacturing process.

In March 2022 - Magna International Inc. announced that the company is expanding its battery enclosures operations in Canada to support new business from Ford Motor Company. The new 170,000-square-foot facility is expected to generate up to 150 new jobs and produce battery enclosures for the Ford F-150 Lighting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Power Infrastructure Developments

- 5.1.2 Rising Adoption of Industrial Automation

- 5.2 Market Restraints

- 5.2.1 Quality and Safety Concerns

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Metallic

- 6.1.2 Non-metallic

- 6.2 By End-user Industry

- 6.2.1 Energy and Power

- 6.2.2 Industrial (Automotive and Manufacturing)

- 6.2.3 Process Industries

- 6.2.4 Other End-user Industries (Transportation, Infrastructure, and Telecommunication)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Legrand SA

- 7.1.3 Hubbell Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 ABB Ltd

- 7.1.6 Eaton Corporation

- 7.1.7 Eldon Holding AB

- 7.1.8 AZZ Inc.

- 7.1.9 Austin Electrical Enclosures

- 7.1.10 Siemens AG

- 7.1.11 Pentair PLC

- 7.1.12 Rittal GmbH & Co. Kg.

- 7.1.13 Adalet (Scott Fetzer Company)