|

市場調查報告書

商品編碼

1444085

防水透氣紡織品:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Waterproof Breathable Textiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

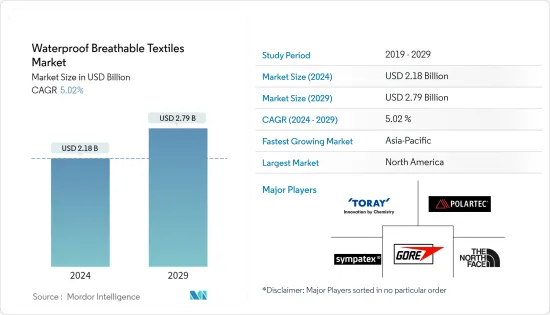

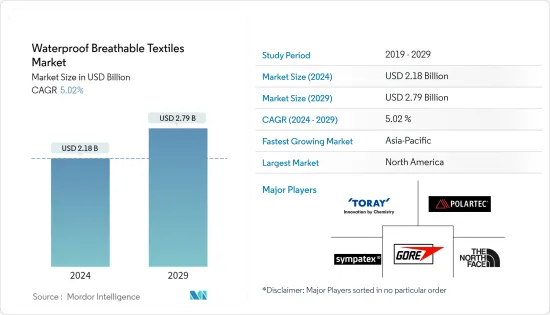

2024年防水透氣紡織品市場規模估計為21.8億美元,預計到2029年將達到27.9億美元,在預測期間(2024-2029年)以5.02%的複合年增長率增長。

由於全球供應鏈中斷,冠狀病毒感染疾病(COVID-19)大流行影響了防水透氣紡織品市場。疫情期間,許多主要負責供應紡織品、紡織品等原料的工廠都關閉了。然而,隨著主要終端用戶產業恢復營運,市場在 2021 年顯著復甦。

主要亮點

- 短期內,運動服和運動服行業需求的成長預計將推動防水透氣紡織品市場的成長。

- 另一方面,不含 PTFE 和 PFAS 原料的使用量不斷增加正在阻礙市場成長。

- 醫療保健產業的潛在用途可能代表預測期內的機會。

- 預計北美將在預測期內主導市場。

防水透氣紡織品市場趨勢

運動服和運動服領域預計將出現高成長

- 以聚四氟乙烯為基礎的防水透氣紡織品已用於各種運動服和運動服應用,例如健行靴、跑鞋、運動夾克、工作鞋、帽子、手套、背包以及其他服飾和工作服。

- 此外,以聚氨酯、聚酯纖維為基底的防水透氣聚酯布料用於製造各種夾克、外套、戶外服、工作服等。

- 防水和透氣的紡織品用於慢跑者、徒步旅行者等運動服和運動服的設計,因為它們有助於乾燥服裝類和控制汗水。

- 全球休閒市場預計將以7%的速度成長,從2021年的2,770億美元成長到2026年的3,810億美元,對防水透氣紡織品的需求預計將增加。

- 在印度,根據青年事務和體育部的數據,印度政府透過 Khelo India 計畫在 2021-22 會計年度的體育支出達 83.9 億盧比(約 1.12 億美元)。此類支出和體育計劃可能會支持所研究市場的成長。

- 因此,體育產業對防水透氣紡織品的好處的認知不斷增強,將在預測期內進一步推動防水透氣紡織品市場的發展。

亞太地區成長最快

- 預計亞太地區將以最快的速度成長。防水透氣紡織品擴大應用於運動服/運動服、防護衣、普通服飾和家用紡織品等應用行業。

- 中國已成為運動服裝、配件和鞋類極具吸引力的市場。由於人事費用上升,跨國公司正在將業務轉移到中國境外。運動服和運動服在這個國家的需求量很大。根據國際貿易管理局預測,到2024年,中國運動服飾市場規模預計將達到828億美元,年增率為11%。

- 中國計劃於2023年舉辦2022年亞運。根據亞奧理事會(OCA)消息,奧運會將於2023年9月23日至10月8日在杭州舉行。亞運會通常會吸引來自全部區域的10,000 多名運動員。參與度的增加預計將有利於運動和運動服的需求,從而使所研究的市場受益。

- 印度越來越傾向全球健身趨勢。由於生活方式的改變,人們的健康意識越來越強。現在人們正在添加新的健康方法來維持健康的生活方式。印度運動服裝市場以男士運動服裝和裝備為主,其次是女士市場,兒童市場佔比較少。

- 由於消費能力的增強和生活水準的提高,該國的一般服飾和家用紡織品正在經歷成長。此外,該國不斷增加的建設和重建活動預計將進一步增加對家用紡織品的需求。

- 因此,在預測期內,對運動服/運動服、防護衣、普通服飾、家用紡織品和醫用紡織品的需求不斷成長可能會推動亞太地區防水透氣紡織品市場的成長。

防水透氣紡織業概況

全球防水透氣紡織品市場分為多個部分。研究市場的主要企業包括(排名不分先後)WL Gore & Associates Inc.、Toray Industries Inc.、Polartec、THE NORTH FACE、A VF COMPANY 和 SympaTex Technologies GmbH。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 作為防護衣的防水透氣紡織品的需求不斷增加

- 運動服和運動服產業的需求不斷成長

- 抑制因素

- 增加不含 PTFE 和 PFAS 原料的使用

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 依原料分

- 聚四氟乙烯 (PTFE)

- 聚酯纖維

- 聚氨酯

- 其他

- 依紡織

- 高密度布料

- 膜

- 塗層

- 依用途

- 運動服/運動服

- 防護衣/軍用

- 一般服飾、家用紡織品

- 其他

- 依地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- FORMOSA TAFFETA Co. Ltd

- HeiQ Materials AG

- Helly Hansen

- Henderson Textiles

- PERTEX

- Polartec

- Schoeller Switzerland

- Stotz &Co. AG

- SympaTex Technologies GmbH

- Teijin Group

- THE NORTH FACE, A VF COMPANY

- Toray Industries Inc.

- WL Gore &Associates Inc.

- Wujiang Sunfeng Textile Co. Ltd

第7章市場機會與未來趨勢

The Waterproof Breathable Textiles Market size is estimated at USD 2.18 billion in 2024, and is expected to reach USD 2.79 billion by 2029, growing at a CAGR of 5.02% during the forecast period (2024-2029).

The COVID-19 pandemic affected the waterproof breathable textile market due to global supply chain disruptions. During the pandemic, many factories responsible for raw material supply, mainly textiles and fabrics, were shut down. However, with the resumption of operations in major end-user industries, the market recovered significantly in 2021.

Key Highlights

- Over the short term, growing demand from the sportswear and activewear industry is expected to boost the market growth of waterproof breathable textiles.

- On the flip side, the increasing usage of PTFE and PFAS-free raw materials is hindering the market's growth.

- Potential usage in the healthcare industry will likely act as an opportunity in the forecast period.

- North America is expected to dominate the market during the forecast period.

Waterproof Breathable Textiles Market Trends

Sportswear and Activewear Segment Expected to Witness High Growth

- Polytetrafluoroethylene-based waterproof breathable textiles are used in various sportswear and activewear applications, including trekking boots, running shoes, sports jackets, work shoes, caps, gloves, backpacks, other sports clothing, and workwear.

- Also, polyurethane and polyester-based waterproof breathable polyester fabrics are used in manufacturing various jackets, outerwear, outdoor clothing, and workwear.

- Waterproof breathable textiles are used to design sportswear and activewear like joggers and hikers as they help dry clothes and manage sweat.

- The global athleisure market is expected to grow from USD 277 billion in 2021 to USD 381 billion in 2026, with a growth rate of 7%, which is anticipated to enhance the demand for waterproof-breathable fabrics.

- In India, according to the Ministry of Youth Affairs and Sports, the expenditure on sports by the Indian government in FY 2021-22 accounted for INR 8.39 billion (~USD 0.112 billion) through the Khelo India scheme. Such expenditures and sports schemes are likely to support the growth of the studied market.

- Hence, the increasing awareness about the benefits of waterproof breathable textiles in the sports industry shall further boost the waterproof breathable textiles market over the forecast period.

Asia-Pacific to Register the Highest Growth

- The Asia-Pacific region is expected to grow at the fastest rate. The waterproofing breathable textile is increasingly used in the application industries such as sportswear and activewear, protective clothing, general clothing, and home textile.

- China has been an attractive market for athletic apparel, accessories, and footwear. Multinational companies are shifting their operations outside China due to rising labor costs; the country has a high demand for sportswear and activewear. According to International Trade Administration, the China sportswear market is expected to reach USD 82.8 billion by 2024, growing at an annual rate of 11%.

- China will be hosting the 2022 Asian Games in 2023. The games will take place in Hangzhou from September 23 to October 8th, 2023, as per the Olympic Council of Asia (OCA). The Asian Games generally attract more than 10,000 athletes across the region. Increased participation is projected to benefit the demand for sports and activewear, thereby benefiting the market studied.

- India is increasingly inclining toward the global fitness trend. The changing lifestyle has promoted health consciousness among people. The population is now adding new health regimes to maintain a healthy lifestyle. The sportswear market in India is dominated by sportswear and gear for men, followed by a market for women and a smaller share for kids.

- The country's general clothing and home textile is witnessing growth owing to rising spending power coupled with improved standards of living. In addition, the country's increasing construction and redevelopment activities are further anticipated to fuel the demand for home textiles.

- Therefore, the expanding demand for sportswear and activewear, protective clothing, general clothing, home textile, and medical textiles are likely to promote the growth of the waterproof breathable textile market over the forecast period in the Asia-Pacific region.

Waterproof Breathable Textiles Industry Overview

The global waterproof breathable textile market is partly fragmented. The major players in the market studied include W. L. Gore & Associates Inc., Toray Industries Inc., Polartec, THE NORTH FACE, A VF COMPANY, and SympaTex Technologies GmbH (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Demand For Waterproof Breathable Textiles as Protective Wear

- 4.1.2 Growing Demand from Sportswear and Activewear Industry

- 4.2 Restraints

- 4.2.1 Increasing Usage of PTFE-free And PFAS-free Raw Materials

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Raw Material

- 5.1.1 Poly Tetra Fluoro Ethylene (PTFE)

- 5.1.2 Polyester

- 5.1.3 Polyurethane

- 5.1.4 Other Raw Materials

- 5.2 By Textile

- 5.2.1 Densely Woven

- 5.2.2 Membrane

- 5.2.3 Coated

- 5.3 By Application

- 5.3.1 Sportswear and Activewear

- 5.3.2 Protective and Military

- 5.3.3 General Clothing and Home Textile

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 FORMOSA TAFFETA Co. Ltd

- 6.4.2 HeiQ Materials AG

- 6.4.3 Helly Hansen

- 6.4.4 Henderson Textiles

- 6.4.5 PERTEX

- 6.4.6 Polartec

- 6.4.7 Schoeller Switzerland

- 6.4.8 Stotz & Co. AG

- 6.4.9 SympaTex Technologies GmbH

- 6.4.10 Teijin Group

- 6.4.11 THE NORTH FACE, A VF COMPANY

- 6.4.12 Toray Industries Inc.

- 6.4.13 W.L. Gore & Associates Inc.

- 6.4.14 Wujiang Sunfeng Textile Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Usage in the Healthcare Industry