|

市場調查報告書

商品編碼

1444051

汽車暖通空調:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

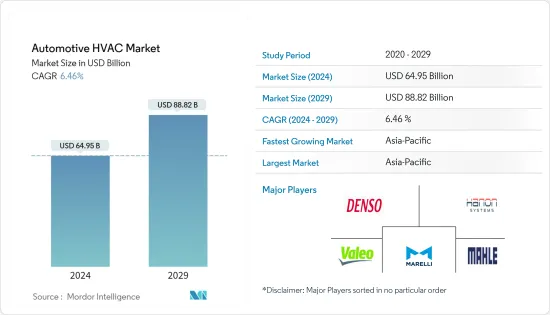

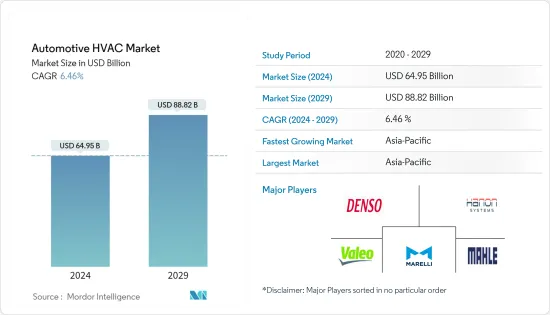

2024年汽車HVAC市場規模預計為649.5億美元,預計到2029年將達到888.2億美元,預測期內(2024-2029年)複合年成長率為6.46%。

汽車用品和供應鏈市場受到 COVID-19 的嚴重影響。汽車暖通空調系統市場受到疫情爆發的影響。 2020年小客車和商用車銷量下降以及整車及零件生產設施暫時停產的主要原因是地方政府採取了嚴格的封鎖措施。

從長遠來看,透過採用 HVAC 系統對熱舒適性和提高安全性的需求不斷成長,預計將推動汽車 HVAC 市場的成長。系統尺寸和重量的減小可能會支持未來幾年的市場成長。電子設備、感測器和自動氣候控制功能的低成本整合正在增加 HVAC 裝置在小客車中的採用。車輛電動程度的提高可能會促使先進的舒適性和安全性功能更多地整合到車輛中。

對創新和研發舉措的大量投資預計將增強參與者的產品和技術能力。此外,採用環保冷媒和生產更便宜的暖通空調系統為汽車暖通空調市場的參與者提供了利潤豐厚的成長機會。領先的公司正在其車輛中安裝先進的暖通空調系統,以幫助對抗車內的顆粒物。

由於中國、印度和日本等國家的汽車生產水準較高,亞太地區預計將成為汽車暖通空調市場最大的部分。預計北美將在未來幾年為製造商創造新的成長前景。歐洲市場表現出緩慢但穩定的成長,預計未來五年將達到危機前的水平。

汽車暖通空調市場趨勢

小客車提供長期動力

小客車銷售一直是所有車型暖通空調市場的主要動力。 2021 年全球汽車銷量約 6,670 萬輛,而 2020 年為 6,380 萬輛。全球大流行影響了世界各地的經濟活動,包括世界各地的汽車銷售,多個國家實施了嚴格的封鎖措施以阻止病毒的傳播。受此影響,2020年汽車銷量較2019年下降14.8%。由於這些車輛的銷售,OEM的當前產品配備了先進的 HVAC 和氣候控制系統,整合到所提供的車型中。例如:

- 2022年10月,Polestar在全球市場推出三款電動SUV車型。這款SUV配備了先進的空調系統,即使在長途旅行中也能為乘客提供舒適感。

全球汽車領域的研發不斷加強,市場相關人員的技術能力不斷提升。這些市場相關人員正在引入汽車暖通空調領域的先進技術來開發新產品,使其在市場上更具競爭力。市場上的競爭對手正在開發符合嚴格的政府排放氣體法規的環保產品。能源效率是推動暖通空調系統發展的另一個參數。製造商擴大利用綠色技術來開發環保且節能的汽車暖通空調系統。例如,

- 2021年11月,馬瑞利公司開發了室內空氣品質(IAQ)淨化系統,可殺死車輛和室內環境中的細菌和病毒。該系統利用 UV-A 和 UV-C 光與二氧化鈦 (TiO2) 過濾器結合,消滅空氣中的細菌和病毒,包括 COVID-19,在 15 分鐘內有效率超過 99%。

市場相關人員參與併購以擴大其在市場上的影響力。例如,Denso與豐田合作開發了普銳斯,混合技術。此外,對全球暖化的日益擔憂也對汽車暖通空調市場產生了一些影響。因此,世界上許多國家已開始採取措施減少碳排放,這可能會減少該行業的暖通空調需求。

亞太地區預計將出現高成長

由於主要汽車製造商鄰近、大規模汽車生產以及印度、韓國和中國等製造國汽車需求的激增,亞太市場可能會顯著發展。政府需要採取行動重振汽車業務,以推動明年的市場發展。例如,印度政府透過汽車產業的課程來鼓勵外國投資,為市場帶來新的創新。

2022年4月,中國小客車產量達99.6萬輛,銷量達96.5萬輛。產銷量與前一年同期比較分別下降41.9%和43.4%。 2022年1月至4月小客車產量也與前一年同期比較下降2.6%至64.94億輛。

中國是最大的市場之一,對這些汽車暖通空調系統的需求貢獻巨大。印度、中國和亞太地區其他國家對小客車的需求不斷成長,是人們對舒適性和安全性日益成長的偏好的結果。預計這些因素將有助於該地區的市場成長。消費者擴大尋找具有相當舒適性的高規格汽車。此外,泰國和馬來西亞等國的外國公司汽車產量正在迅速增加。

根據中國汽車流通協會(CADA)統計,2021年8月國內豪華車經銷商銷量27.8萬輛,較去年與前一年同期比較下降9.4%。另外還有100萬台。 2021年,BMW以815,691輛的銷量支持中國高階汽車銷售。這使得寶馬成為中國最暢銷的豪華汽車製造商。同樣,賓士和奧迪的豪華車銷售也出現下滑。

考慮到這些因素和持續的需求,預計市場在預測期內將呈現高成長率。

汽車暖通空調產業概況

汽車暖通空調市場整合,全球頂尖企業佔大部分市場佔有率。併購、與區域暖通空調設備製造商結盟以及與汽車製造商建立和鞏固聯盟是塑造市場競爭形勢的一些驅動力。例如:

- 2021 年 11 月,Hanon Systems 在匈牙利開設了兩個新工廠:位於佩奇的新待開發區生產工廠和位於雷札格的建築擴建工廠。該工廠將提供 22,464平方公尺的製造空間,並配備用於成型、硬焊、焊接、彎曲、組裝和測試汽車空調(A/C) 線的設備。

- 2021 年 8 月,法雷奧推出了一款新型法雷奧熱泵,其三分之二的能源需求來自周圍空氣,限制了從汽車電池獲取能源的需求,並使用天然冷媒。與配備傳統加熱系統的電動車相比,配備該設備的電動車在 -15 度C下的運行時間最多可延長 30%。

- 2021年2月,先前宣布的海立國際(香港)有限公司與Marelli Corporation KK合資成立的海立馬瑞利控股公司(Highly Marelli Holdings)成立。海瑞馬瑞利致力於在壓縮機電動、熱泵系統、供暖、通風和空調(“HVAC”)以及電動壓縮機(“EDC”)系統領域為其客戶和供應商提供世界一流的解決方案。會去的

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(市場規模、金額)

- 依技術類型

- 手動/半自動

- 自動的

- 依車型

- 小客車

- 商用車

- 依地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Valeo Group

- Denso Corporation

- Mahle GmbH

- Marelli Corporation

- Sanden Corporation

- Keihin Corporation

- Japan Climate Systems Corporation

- Mitsubishi Heavy Industries Ltd

- Hanon Systems Corp.

- Samvardhana Motherson Group

- Hella GmbH & KGaA

第7章市場機會與未來趨勢

The Automotive HVAC Market size is estimated at USD 64.95 billion in 2024, and is expected to reach USD 88.82 billion by 2029, growing at a CAGR of 6.46% during the forecast period (2024-2029).

The automotive goods and supply chain market were drastically impacted by COVID-19. The automotive HVAC system market was affected due to the outbreak of the pandemic. The decline in passenger car and commercial vehicle sales in 2020 and the temporary shutdown of vehicle and component production facilities were primarily attributed to the stringent lockdown measures prevailed by regional governments.

The regional markets were exposed to several challenges in terms of supply chain and raw material sources which got highlighted during the same period. Although 2021 has marked itself as the year of transition where the auto sector revamped its production units, and with the decline in the cases, production facilities are back in operation, and vehicle sales have increased across major geographies creating a positive outlook for the HVAC component manufacturing and sales.

Over the long term, a rise in demand for thermal comfort and an increase in safety due to the adoption of HVAC systems are expected to boost the growth of the automotive HVAC market. A reduction in system size and weight of the system may support the growth of the market over the coming years. The integration of electronics, sensors, and automated climate control features at a lesser cost is translating into greater adoption of HVAC units in passenger vehicles. Rising vehicle electrification is likely to increase the integration of advanced comfort and safety features in vehicles.

Technological innovations and substantial investments in R&D initiatives are poised to enhance players' offerings and technological capabilities. Furthermore, the adoption of eco-friendly refrigerants and the production of cheaper HVAC systems provide lucrative growth opportunities for the players operating in the automotive HVAC market. Major players are introducing advanced HVAC system in vehicle which help to fight against fine particulates in vehicle cabin.

The Asia-Pacific region is expected to be the largest segment in the automotive HVAC market owing to the large vehicle production levels in countries such as China, India, and Japan. North America is forecasted to create new growth prospects for the manufacturers in the coming years. The European market is showing slow but steady growth and is expected to reach pre-meltdown levels over the period of the next five years.

Automotive HVAC Market Trends

Passenger Car to Provide Longer Term Momentum

Passenger car sales have deeply driven the market of HVAC across all car models. In 2021, global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales across the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower when compared to 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive steering sensor market growth in the forecast period. Owing to these vehicle sales, the present offering by OEM carries advanced HVAC and climate control systems integrated into their offered models. For instance:

- In October 2022, Polestar introduced its 3 electric SUV models in the global market. The SUV is equipped with an advanced climate control system to provide passenger comfort during long-duration journeys.

The augmenting research and developments in the automotive sector across the world are set to enhance the technological capabilities of the market players. These market players are introducing advanced technologies in automotive HVAC to develop new products that impart a competitive edge in the market. The competitors in the market are developing eco-friendly products to fall in line with the stringent government regulations regarding emissions. Energy efficacy is the other parameter driving growth in HVAC systems. Manufacturers are increasingly using green technologies to develop eco-friendly and energy-efficient automotive HVAC systems. For Instance,

- In November 2021, Marelli Corporation has developed an Indoor Air Quality (IAQ) Purification System, which kills bacteria and viruses in vehicles and indoor environments. The system utilizes UV-A and UV-C light combined with a titanium dioxide (TiO2) filter to destroy airborne bacteria and viruses, including COVID-19, with greater than 99% effectiveness within 15 minutes.

Market players are involved in mergers and acquisitions to expand their market presence. For instance, Denso collaborated with Toyota to develop Prius, a hybrid technology promoting safety, fuel efficiency, and green technology in vehicles. Furthermore, growing concerns about global warming have slightly impacted the automotive HVAC market. Consequently, many nations worldwide have started taking measures to reduce their carbon footprints which might reduce the HVAC deman in the segment.

High Growth Anticipated in the Asia-Pacific Region

The Asia-Pacific market is probably going to observe huge development attributable to the nearness of key automotive makers, vast scale generation of vehicles, and spiraling vehicle requests in the manufacturing countries, like India, South Korea, and China. Government activities to restore the automotive business are required to drive the market during the forthcoming year. For example, the Government of India is encouraging foreign investments through programmed courses in the automotive area to bring new innovations to market.

In April 2022, Chinese passenger car production reached 996,000 units with sales registering 965,000 units. This accounts the downfall of 41.9% and 43.4% respectively in production and sales compared to previous year. In 2022, January to April, passenger car production also decreased with 2.6% year-on-year registering 6,494 million units.

China is one of the largest markets and contributes significantly to the demand for these automotive HVAC systems. The increasing demand for passenger vehicles from India, China, and their other counterparts in the Asia-Pacific region is a result of the growing preferences of people for comfort and safety. These factors are expected to contribute to the market growth in the region. Consumers are aligning toward high-specification vehicles that offer par comfort features. In addition, there is an upsurge in vehicle production by foreign companies in countries, including Thailand and Malaysia.

According to the China Automobile Dealers Association (CADA), the luxury car dealers in the country sold 278,000 vehicles in August 2021, an 9.4% decrease year-on-year. In addition, llion units. In 2021, BMW backed up China's premium segment car sales registering 815, 691 units. This made BMW to become China's top selling luxury car maker. On similar lines Mercedes Benz and Audi witnessed decline in their premium car sales.

Considering these factors and ongoing demand, market is anticpated to witness high growth rate during the forecast period.

Automotive HVAC Industry Overview

The automotive HVAC market is consolidated, with the top global players accounting for most of the market share. The major companies in the air-conditioning market include MAHLE GmbH, DENSO Corporation, Mitsubishi Heavy Industries Ltd, and Hanon Systems. Mergers and acquisitions, partnerships with regional HVAC equipment manufacturers, and establishing and ensuring tie-ups with car manufacturers are some of the dynamics shaping the market's competitive landscape. For instance:

- In November 2021, Hanon System inaugurated its two new establishments in Hungary - a new greenfield production facility in Pecs and a building expansion in Retsag. The facility provides 22,464 square meters of manufacturing space and accommodates equipment including forming, brazing, welding and bending, assembly lines and testing for automotive air conditioning (A/C) lines.

- In August 2021, Valeo announced New Valeo heat pump that procures two-thirds of its energy demand from the ambient air, thereby limiting the need to draw energy from the onboard batteries, and uses a natural refrigerant. EVs equipped with the device can travel up to 30% further at -15°C than those fitted with more conventional heating systems.

- In February 2021, Highly Marelli Holdings Co., Ltd., a previously announced joint venture between Highly International (Hong Kong) Limited and Marelli Corporation K.K., has been formed. Highly Marelli will concentrate on providing world-class solutions for clients and suppliers in the areas of compressor electrification, heat pump systems, heating, ventilation, and air conditioning ("HVAC") and electric driven compressor ("EDC") systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Technology Type

- 5.1.1 Manual/Semi-automatic HVAC

- 5.1.2 Automatic HVAC

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Valeo Group

- 6.2.2 Denso Corporation

- 6.2.3 Mahle GmbH

- 6.2.4 Marelli Corporation

- 6.2.5 Sanden Corporation

- 6.2.6 Keihin Corporation

- 6.2.7 Japan Climate Systems Corporation

- 6.2.8 Mitsubishi Heavy Industries Ltd

- 6.2.9 Hanon Systems Corp.

- 6.2.10 Samvardhana Motherson Group

- 6.2.11 Hella GmbH & KGaA