|

市場調查報告書

商品編碼

1444038

消泡劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Defoamers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

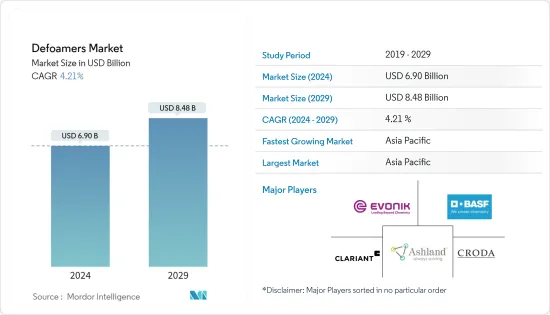

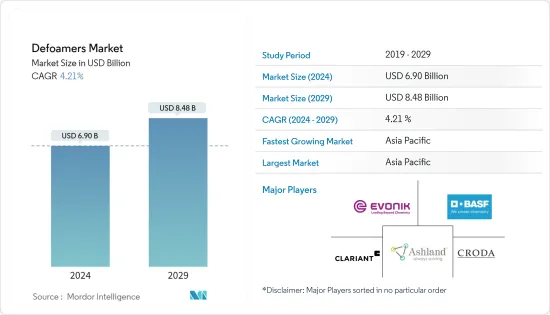

消泡劑市場規模預計2024年為69億美元,預計到2029年將達到84.8億美元,在預測期內(2024-2029年)將以複合年成長率4.21%成長。

冠狀病毒感染疾病(COVID-19)的爆發對消泡劑產業造成了沉重打擊。由於全球封鎖和各國政府實施的嚴格監管,大多數生產基地被關閉,造成毀滅性打擊。儘管如此,業務已從 2021 年開始復甦,預計未來幾年將大幅成長。

主要亮點

- 短期內,全球化學工業的顯著成長是推動所研究市場成長的關鍵因素之一。

- 相反,與產品相關的副作用預計將阻礙預測期內消泡劑市場的成長。

- 然而,對環境友善消泡劑的需求不斷成長可能為所研究的市場創造利潤豐厚的成長機會。

- 預計亞太地區將主導市場,並且在預測期內也將見證最高的複合年成長率。

消泡劑市場趨勢

水和廢水處理領域推動市場成長

- 消泡劑應用於工業和都市廢水處理技術。使用消泡劑可以提高生產能力、產量並降低營運成本,從而使這些製程受益。

- 污水處理系統中的泡沫可能是由生物活動、機械作用、化學污染、進水中的界面活性劑或某些聚合物處理引起的。因此,消泡劑可減少污水處理廠中泡沫形成對健康的危害。

- 據世界衛生組織稱,由於中國城市人口的成長,預計到2030年,中國70%的人口將居住在城市。隨著城市人口的增加,他們也面臨污水和污泥的湧入。目前,中國80%的污泥被不當傾倒,隨著城市中心競相透過改善污水處理廠來減少污染,這個環境問題正變得越來越有爭議。

- 墨西哥水處理產業預計將錄得健康成長。例如,根據國家水委員會(CONAGUA)編制的最新國家清單,墨西哥有2,786座工廠,裝置容量為196.7 m3 s1,處理流量為144.7 m3 s1。國內正在進行的研究表明,政府主要關注以都市區為主的都市污水處理廠的發展,這有可能擴大市場。

- 在瑞典,儘管大多數家庭都連接到市政污水處理廠,但仍有約 100 萬人使用私人污水處理廠。瑞典在多個領域進行研究和開發,包括加強污水淨化和污水源分類系統,以實現有效的水資源管理。例如,Veidekke於2022年3月簽署了一份在瑞典斯德哥爾摩Sikkla興建和安裝污水處理廠的合約。該合約授予了總部位於斯德哥爾摩的 Vatten 和 Avfor 公司。這是一份以合作協定進行計劃的建設合約。初始合約價值約為1.53億美元。該計劃預計將於2027年完工。因此,預計這將為水和廢水處理領域的消泡劑市場帶來上升的需求。

- 預計中國將為所研究市場的成長做出重大貢獻。例如,上海白龍港污水處理設施是亞洲最大的污水處理設施,也是世界上最大的污水處理設施之一。它處理約 360 萬人排放的污水。

- 預計上述因素將在預測期內對消泡劑市場產生重大影響。

亞太地區主導市場

- 由於中國和印度等國家的高需求,亞太地區佔據了主要市場佔有率。

- 由於汽車應用中油漆和塗料行業的需求不斷成長,中國已成為亞太地區最大的消泡劑消費國之一。該國是最大的汽車生產國,在SUV市場成長中佔據最大的市場佔有率。例如,根據OICA的數據,2022年中國汽車產量為27,020,615輛,比2021年成長3%,比2020年成長7%。因此,汽車產量的增加將帶動油漆和塗料領域對消泡劑市場的需求上升。

- 此外,該國也是該地區最大的建築市場。建築業的成長預計將促使油漆和塗料的需求增加,進而可能促進該國消泡劑的成長。 2018年至2022年中國建築業產值顯示產業逐步成長。例如,根據中國國家統計局的數據,2022年中國建築業產值達到高峰約27.63兆元(約4.1兆美元)。

- 中國是世界第二大石油和天然氣消費國,但僅是第六大生產國。中國作為石油消費大國,石油消費量逐年成長,且成長波動。但石油供應仍無法滿足需求,中國主要依賴進口。例如,根據Trading Economy的數據,中國原油進口額(金額)從2023年4月的24,465,029美元(THO)增加到2023年5月的30,302,574美元(THO)。

- 此外,由於政府的支持和舉措,印度的住宅產業正在崛起,需求進一步增加。據印度品牌股權基金會(IBEF)稱,住房與城市發展部(MoHUA)已在2022-2023年預算中撥出98億日元用於建造住宅,並設立基金以完成停滯的計劃,並撥款5000萬美元。

- 由於上述原因,亞太地區可能在預測期內呈現最高成長率。

消泡劑產業概況

消泡劑市場本質上是適度整合的。市場的主要企業包括(排名不分先後)BASF股份公司、禾大國際有限公司、亞什蘭、贏創工業股份公司和科萊恩。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 化學工業的擴展和適應性

- 增加油漆和塗料的產量

- 其他司機

- 抑制因素

- 與產品相關的副作用

- 原料短缺及出貨延誤

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 油性消泡劑

- 乳液消泡劑

- 矽膠消泡劑

- 粉末消泡劑

- 聚合物消泡劑

- 其他

- 最終用戶產業

- 油漆/塗料

- 油和氣

- 紙漿/紙

- 食品與飲品

- 水/污水處理

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)/排名分析

- 主要企業採取的策略

- 公司簡介

- Accepta Water Treatment

- Air Products Inc.

- Aqua-Clear, Inc.

- Ashland

- BASF SE

- BRB International

- Buckman

- CLARIANT

- Croda International Plc

- Dow

- Eastman Chemical Company

- ELEMENTIS PLC

- Elkem ASA

- Evonik Industries AG

- Kemira

- SAN NOPCO LIMITED

- Solvay

- Wacker Chemie AG

第7章市場機會與未來趨勢

第8章 環保消泡劑需求不斷成長

第 9 章 各最終用戶產業對聚合物的需求不斷成長

The Defoamers Market size is estimated at USD 6.90 billion in 2024, and is expected to reach USD 8.48 billion by 2029, growing at a CAGR of 4.21% during the forecast period (2024-2029).

The COVID-19 epidemic harmed the defoamers sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering from 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, significant growth in the chemical industry worldwide is one of the key factors driving the studied market growth.

- On the flip side, side effects associated with the products are expected to hinder the defoamers' market growth during the forecast period.

- Nevertheless, the rising demand for eco-friendly defoamers will likely create lucrative growth opportunities for the studied market.

- The Asia-Pacific is expected to dominate the market and will also witness the highest CAGR during the forecast period.

Defoamers Market Trends

Water and Wastewater Treatment Segment to Drive the Market Growth

- The defoamers find their applications in industrial and municipal wastewater treatment technologies. The applications of defoamers benefit these processes through increased production capacity, output volume, and reduced operational cost.

- The foam in wastewater treatment systems can result from biological activity, mechanical action, chemical contamination, surfactants in the influent, or some polymer treatments. Thus defoamers reduce the health hazard of foam formation in wastewater treatment plants.

- According to WHO, 70% of the nation's population in China is expected to reside in cities by 2030 due to the increase in the urban population throughout the country. As the urban population increases, they also face an influx of wastewater and sludge. Currently, 80% of sludge in China is improperly dumped, an increasingly controversial environmental issue with urban centers scrambling to decrease pollution by improving their wastewater treatment plants (WWTPs).

- The water treatment industry in Mexico is expected to register a healthy growth rate. For instance, according to the latest National Inventory made by the National Water Commission (CONAGUA), there are 2786 plants in Mexico with an installed capacity of 196.7 m3 s1 and a treated flow of 144.7 m3 s1. Ongoing research in the country indicates the government to majorly focus on developing municipal wastewater treatment plants, mostly in the urban areas, which will likely augment the market.

- About 1 million people in Sweden still include private sewage treatment plants despite most homes connected to municipal sewage treatment facilities. Sweden conducts research and development in various areas, including enhanced wastewater purification and source-sorting wastewater systems for effective water resource management. For instance, Veidekke secured a contract to construct and install a wastewater treatment plant in Sickla, Stockholm, Sweden, in March 2022. The contract was awarded by Stockholm Vatten och Avfall. It is an execution contract under which the project will be carried out as a collaborative contract. The initial contract value is around USD 153 million. This project is anticipated to be completed in 2027. Therefore, this is expected to create an upside demand for the defoamers market from the water and wastewater treatment segment.

- China is expected to be the major contributor to the growth of the studied market. For instance, the Bailonggang wastewater treatment plant in Shanghai is the largest in Asia and one of the biggest in the world. It disposes of the wastewater produced by around 3.6 million people.

- The factors above are expected to significantly impact the defoamers market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the major market share, owing to the high demand from countries like China and India.

- Due to increased demand for the paints and coatings industry in automobile applications, China is one of the largest consumers of defoamers in the Asia-Pacific region. The country is the largest producer of automobiles and contains the largest market share in the growth of the SUV market. For instance, according to OICA, in 2022, automobile production in China amounted to 2,70,20,615 units, which showed an increase of 3% compared to 2021 and 7% compared to 2020. Therefore, increasing the production of automobiles is expected to create an upside demand for the defoamers market from the paints and coatings segment.

- Moreover, the country is the largest construction market in the region. The growth in the construction sector is expected to lead to an increase in the demand for paints and coatings and, in turn, is likely to push the growth for defoamers in the country. The output value of construction in China from 2018 to 2022 indicates progressive growth in the industry. For instance, according to the National Bureau of Statistics of China, in 2022, the construction output value in China peaked at around CNY 27.63 trillion (USD 4.10 Trillion).

- China is the world's second-largest consumer of oil and gas but only the sixth-largest producer of the same. As a big oil consumer, China's oil consumption is increasing yearly with fluctuating growth rates. However, the oil supply still cannot meet the demand, and China mainly relies on imports. For instance, according to Trading Economics, imports of Crude Petroleum (value) in China increased to 3,03,02,574 USD THO in May 2023 from 2,44,65,029 USD THO in April of 2023.

- Furthermore, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- Owing to the reasons above, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Defoamers Industry Overview

The Defoamers Market is moderately consolidated in nature. The major players in this market (not in any particular order) include BASF SE, Croda International Plc, Ashland, Evonik Industries AG, and CLARIANT, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion and adaptability in the chemical industry

- 4.1.2 Increasing Paints and Coatings Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Side Effects Associated with the Products

- 4.2.2 Raw Material Shortage and Shipping Delays

- 4.2.3 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Oil-based Defoamer

- 5.1.2 Emulsion Defoamer

- 5.1.3 Silicone-based Defoamer

- 5.1.4 Powder Defoamer

- 5.1.5 Polymer-based Defoamers

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Oil and Gas

- 5.2.3 Pulp and Paper

- 5.2.4 Food and Beverages

- 5.2.5 Water and Wastewater Treatment

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Accepta Water Treatment

- 6.4.2 Air Products Inc.

- 6.4.3 Aqua-Clear, Inc.

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 BRB International

- 6.4.7 Buckman

- 6.4.8 CLARIANT

- 6.4.9 Croda International Plc

- 6.4.10 Dow

- 6.4.11 Eastman Chemical Company

- 6.4.12 ELEMENTIS PLC

- 6.4.13 Elkem ASA

- 6.4.14 Evonik Industries AG

- 6.4.15 Kemira

- 6.4.16 SAN NOPCO LIMITED

- 6.4.17 Solvay

- 6.4.18 Wacker Chemie AG