|

市場調查報告書

商品編碼

1444020

纖維水泥 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Fiber Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

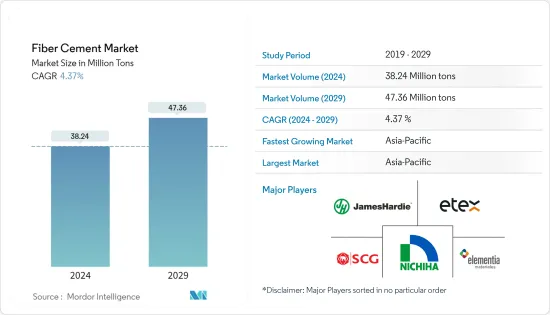

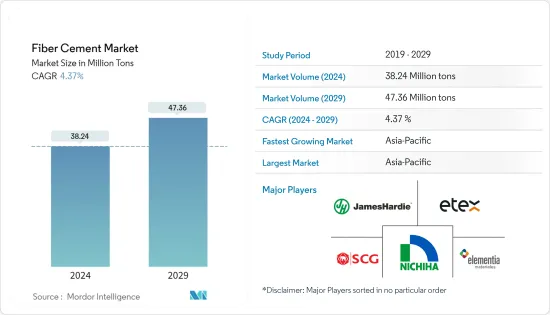

纖維水泥市場規模預計到2024年為3824萬噸,預計到2029年將達到4736萬噸,在預測期內(2024-2029年)CAGR為4.37%。

由於政府的禁令和限制,2020年和2021年上半年Covid-19大流行的零星爆發極大地限制了全球建築業,從而限制了纖維水泥市場的成長。住宅房地產受到的打擊最嚴重,因為主要城市的嚴格封鎖措施導致房屋登記暫停和房屋貸款支付緩慢。然而,自限制解除以來,該行業一直在良好復甦。過去兩年,房屋銷售的增加、新項目的推出以及對新辦公室和商業空間的需求不斷增加一直引領著市場復甦。

主要亮點

- 從中期來看,全球不斷成長的住宅建設是促進所研究市場成長的主要促進因素。此外,纖維水泥具有眾多優勢,例如使用壽命長、是普通水泥的永續替代品、強度高且與油漆相容性高,這些都促使建築材料製造商越來越精確地使用纖維水泥他們所承擔的項目中的產品。

- 另一方面,木材、金屬和乙烯基等替代產品的供應是預計在預測期內抑制目標產業成長的關鍵因素。

- 儘管如此,纖維水泥在歐洲木框架領域的滲透率不斷提高,以及印度纖維水泥日益取代低階膠合板領域等因素可能很快就會為全球市場創造利潤豐厚的成長機會。

- 預計亞太地區將在預測期內主導市場。這一成長歸因於該地區住宅和商業領域的充分發展,更加重視低收入人群的住房建設,從而促使外部和內部住宅應用對纖維水泥的需求旺盛。

纖維水泥市場趨勢

住宅最終用戶產業的需求不斷成長

- 住宅產業是纖維水泥的主要最終用戶產業,纖維水泥用於住宅建築中的內部覆層,包括隔間牆、窗台、天花板和地板以及瓷磚背板。

- 纖維水泥產品因其具有混凝土耐磨、抗紫外線、防火、防蟲防藻、耐腐蝕、美觀等多種優點,在住宅產業中廣泛使用。此外,纖維水泥產品安裝簡單、維護成本低、耐用且具有成本效益,並且具有低噪音滲透和低熱效應,使其成為世界各地經濟適用房的首選材料。

- 中產階級住房的建築概念隨著虛擬實境、擴增實境、機器學習等新興建築技術的發展而不斷發展。由於這些技術的進步,人們能夠以最佳成本建造房屋並享受舒適感。公寓、平房和別墅等住宅物業在新興國家越來越受歡迎,這主要是由城市化推動的。

- 北美、亞太和歐洲等地區的住宅建設近年來穩定成長。在亞太地區,印度、中國、印尼、新加坡和越南等國家的住宅建設正在增加。然而,在住宅需求旺盛的推動下,北美和歐洲的住宅建設正在成長。

- 預計中國的人口結構將有利於住房建設活動。人口的成長引發了公共和私營部門對經濟適用住宅區的投資。根據中國國家統計局的數據,中國房屋開工量從 2022 年 7 月的 76,066.76 萬平方公尺躍升至 8 月的 8,5,062 萬平方公尺。

- 美國正在大規模進行新房屋建設和房屋翻新。根據美國人口普查局和美國住房和城市發展部發布的統計數據,2022年8月住房竣工量經季節調整後的年成長率為1,342,000套。該價值較 2021 年 8 月的 1,302,000 套成長了 3.1%。單戶住宅竣工率成長了 0.4%,2022 年 8 月為 1,017,000 套,而 2022 年 7 月為 1,013,000 套。

- 德國擁有歐洲最大的建築業。德國聯邦統計局報告稱,2021 年該國住宅存量達到 4,310 萬套,比上一年成長 0.7%(即 28 萬套住宅),比 2011 年住宅總數成長 6.0%。2021年,德國住宅建築業獲得的建築許可數量連續第三次成長,達到12.9萬套。

- 為了滿足沙烏地阿拉伯的住房需求,政府於2022年9月宣布,打算根據其2030年願景計劃,投資1.1兆美元建造555,000套住宅單元。

- 考慮到上述所有事實和因素,住宅建築應用中纖維水泥的使用和需求預計在預測期內將會成長。

亞太地區將主導市場

- 亞太地區以龐大的市場佔有率主導全球市場,預計在預測期內將保持其主導地位。亞太國家各類建築活動對纖維水泥的大量消耗是推動目標產業成長的主要因素。

- 亞太地區的建築業是世界上最大的,並且由於人口成長、中產階級收入增加和城市化而以健康的速度成長。

- 中國的主要推動力是在經濟成長的支持下,住宅和商業建築領域的充分發展。在內地,香港房管局推出多項措施推動廉租房建設。官員的目標是到 2030 年提供 301,000 套公共住宅。

- 此外,未來七年,印度可能會在住房方面投資約1.3兆美元,其中可能會建造6,000萬套新房屋。預計到 2024 年,該國經濟適用房的供應率將增加 70% 左右。印度政府的「到 2022 年為所有人提供住房」也是該行業的重大遊戲規則改變者。該計劃旨在到2022年底為城市貧困人口建設超過2000萬套保障性住房,將大大促進住房建設。預計這將為未來幾年該國纖維水泥市場的成長提供各種機會。

- 此外,智慧城市任務是印度政府承擔的另一個重大項目,將在全國建造100多個智慧城市,以實現印度快速城市化。該國的工商業基礎設施已成為高成長產業之一。印度政府一直在製定舉措,例如放寬建築業吸引外國直接投資流入的規則,以加快全國的發展。

- 日本正在興建許多豪華公寓和住宅區。例如,三菱州立大學正在建造日本最高的建築,該建築將包括 50 套豪華公寓,每個公寓每月可產生 43,000 美元的租金。該項目正在東京車站附近建設,預計將於 2027 年竣工。

- 泰國是最大的遊客中心之一,在購物中心、豪華酒店等的擴建和建設上投入巨資。芭堤雅萬豪侯爵酒店是泰國在建項目中最大的項目,預計將於 2024 年投入營運, 900多間客房。新的馬奎斯萬豪酒店將成為雙酒店開發項目的一部分,其中還包括擁有 398 間客房的 JW 萬豪酒店和芭堤雅海灘水療度假村。到 2027 年,萬豪可能會在泰國曼谷和芭堤雅新增 4 家旗下三個品牌的酒店。萬豪在泰國的投資組合包括 45 家酒店和度假村,其中包括 Asset World Corporation 旗下的 9 家酒店。

- 所有上述因素都可能在預測時間內推動亞太纖維水泥市場的成長。

纖維水泥產業概況

全球纖維水泥市場本質上是部分分散的,沒有參與者佔據所研究市場的重要佔有率。一些主要公司包括 James Hardie Building Products Inc.、Etex Group、NICHIHA、SCG 和 Elementia Materiales。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 全球住宅建設不斷成長

- 纖維水泥的優點

- 限制

- 替代方案的存在

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場規模依數量計算)

- 應用

- 壁板

- 屋頂

- 包層

- 成型與修整

- 其他應用

- 最終用戶產業

- 住宅

- 非住宅

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 領先企業採取的策略

- 公司簡介

- American Fiber Cement Corporation

- Cembrit Holding A/S (Swisspearl Group AG)

- CenturyPly

- CSR Limited

- Elementia Materials

- Etex Group

- Everest Industries Limited

- James Hardie Industries PLC

- NICHIHA Co. Ltd

- Saint-Gobain

- SCG

- Toray Industries Inc.

- TPI Polene Public Company Limited

第 7 章:市場機會與未來趨勢

The Fiber Cement Market size is estimated at 38.24 Million tons in 2024, and is expected to reach 47.36 Million tons by 2029, growing at a CAGR of 4.37% during the forecast period (2024-2029).

The sporadic outbreak of the COVID-19 pandemic in 2020 and the first half of 2021 drastically curtailed the global construction sector due to imposed government bans and restrictions, thereby limiting the growth of the fiber cement market. Residential real estate was the worst hit as strict lockdown measures across major cities resulted in the suspension of home registrations and slow home loan disbursements. However, the sector has been recovering well since restrictions were lifted. An increase in house sales, new project launches, and increasing demand for new offices and commercial spaces have been leading the market recovery over the last two years.

Key Highlights

- Over the medium term, the rising residential construction across the world is the major driving factor augmenting the growth of the market studied. Furthermore, a plethora of advantages offered by fiber cement, such as exhibiting long service life, representing a sustainable alternative to regular cement, and demonstrating high strength and compatibility to paints, are propelling the construction materials manufacturers to increasingly become more precise in including fiber cement products in the projects they have undertaken.

- On the flip side, the availability of alternative products such as wood, metals, and vinyl is the key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, factors like the increasing penetration of fiber cement in the timber frame segment in Europe and the growing replacement of the low-end plywood segment with fiber cement in India are likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific is expected to dominate the market during the forecast period. This growth is attributed to the ample developments in the region's residential and commercial sectors with a higher focus on housing construction for the low-income population which leads to bullish demand for fiber cement in external and internal residential applications.

Fiber Cement Market Trends

Increasing Demand from the Residential End-user Industry

- The residential industry is the major end-user industry for fiber cement which is used for internal claddings, including partition walls, windowsills, ceilings and floors, and tile backer boards in residential construction.

- The widespread use of fiber cement products in the residential industry is due to the various advantages, such as wear and tear resistance to concrete, UV resistance, fire resistance, pest and algae resistance, corrosion-free, aesthetically appealing, and others. In addition, fiber cement products are simple to install, low-maintenance, durable, and cost-effective, as well as offer low noise penetration, and low heating effects which make them the preferred material in affordable housing around the world.

- Architecture ideas for middle-class housing are evolving, along with emerging technologies in construction, like virtual reality, augmented reality, machine learning, etc. Due to such technological advancements, people are able to construct houses at optimal costs and enjoy comfort. Residential properties such as apartments, bungalows, and villas are gaining popularity in emerging nations and are mainly driven by urbanization.

- Residential construction in regions, such as North America, Asia-Pacific, and Europe, has been witnessing steady growth in recent times. In Asia-Pacific, residential construction is increasing in countries, including India, China, Indonesia, Singapore, and Vietnam, among others. Whereas, North America and Europe are witnessing growth in residential construction, widely driven by a high demand for residential houses.

- China's demographics are expected to favor housing construction activities. The growing population has triggered investments in affordable residential colonies by both the public and private sectors. As per the National Bureau of Statistics of China, housing starts in China jumped to 85062 Ten Thousand Square meters in August from 76066.76 Ten Thousand Square meters in July of 2022.

- The United States is going massive in new home construction and home refurbishment. As per the statistics released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, an increase in housing completions in August 2022 was recorded at a seasonally adjusted annual rate of 1,342,000. The value showed an increase of 3.1% from 1,302,000, the value obtained in August 2021. The single-family housing completions registered a 0.4% increase in rate which stood at 1,017,000 in August 2022 while the July 2022 rate was 1,013,000.

- Germany has the largest construction sector in Europe. The German Federal Statistical Office reports the stock of dwellings reaching 43.1 million in 2021 in the country, showing an increase of 0.7% (i.e., 280,000 dwellings) from the previous year and 6.0% in comparison to the total dwellings in 2011. The total number of building permits achieved by Germany's residential construction sector rose consecutively for the third time in 2021, reaching 129 thousand units.

- To meet the housing needs of Saudi Arabia, the government, in September 2022, announced its intention to build 555,000 residential units with an investment of USD 1.1 trillion under its Vision 2030 program.

- Considering all the above facts and factors, the usage and demand of fiber cement for residential construction applications are expected to grow in the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the worldwide market with a significant market share and is projected to maintain its dominance during the forecast period. The significantly large consumption of fiber cement across all types of construction activities in Asia-Pacific countries is the primary factor driving the growth of the target industry.

- The construction sector in the Asia-Pacific region is the largest in the world and is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization.

- China is majorly driven by ample developments in the residential and commercial construction sectors, supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- Furthermore, India is likely to witness an investment of around USD 1.3 trillion in housing, over the next seven years, during which, it is likely to witness the construction of 60 million new homes. The rate of availability of affordable housing is expected to rise by around 70%, in 2024 in the country. The Indian government's 'Housing for All by 2022' is also a major game-changer for the industry. This initiative aims to build more than 20 million affordable homes for the urban poor by the end of 2022. This will provide a significant boost to housing construction. This is expected to provide various opportunities for the growth of the fiber cement market in the country in the coming years.

- Furthermore, the smart cities mission is another major project undertaken by the government of India, which will construct more than 100 smart cities all over the country to achieve rapid urbanization in the country. Industrial and commercial infrastructure in the country has emerged as one of the high-growth sectors. The Indian government has been formulating initiatives like easing the rules to attract FDI inflow in the construction sector to expedite development across the nation.

- Many luxury apartments and residential complexes are under construction in Japan. For instance, Mitsubishi State is constructing Japan's tallest building, which is to comprise 50 luxury apartments, each of which will be able to generate USD 43,000 per month of rent. The project is being built near the Tokyo station and will reach completion by 2027.

- Thailand is one of the largest hubs for tourists and has been witnessing huge investments in the expansion and construction of malls, luxury hotels, etc. The Pattaya Marriott Marquis Hotel is the largest project in Thailand's pipeline, which may be in operation by 2024, with over 900 guest rooms. This new Marriott Marquis will be part of a dual-property development, which will also include the 398-room JW Marriott and the Pattaya Beach Resort & Spa. Marriott may add four new hotels under three of its brands across Bangkok and Pattaya in Thailand by 2027. Marriott's portfolio in Thailand includes 45 hotels and resorts, including nine properties with Asset World Corporation.

- All the above-mentioned factors are likely to fuel the growth of the Asia-Pacific fiber cement market over the forecast time frame.

Fiber Cement Industry Overview

The global fiber cement market is partially fragmented in nature, with no players capturing a significant share of the market studied. Some of the major companies are James Hardie Building Products Inc., Etex Group, NICHIHA Co., Ltd, SCG, and Elementia Materiales.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Residential Construction Across the World

- 4.1.2 Advantages Offered by Fiber Cement

- 4.2 Restraints

- 4.2.1 Presence of Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Siding

- 5.1.2 Roofing

- 5.1.3 Cladding

- 5.1.4 Molding and Trimming

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Non-residential

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Fiber Cement Corporation

- 6.4.2 Cembrit Holding A/S (Swisspearl Group AG)

- 6.4.3 CenturyPly

- 6.4.4 CSR Limited

- 6.4.5 Elementia Materials

- 6.4.6 Etex Group

- 6.4.7 Everest Industries Limited

- 6.4.8 James Hardie Industries PLC

- 6.4.9 NICHIHA Co. Ltd

- 6.4.10 Saint-Gobain

- 6.4.11 SCG

- 6.4.12 Toray Industries Inc.

- 6.4.13 TPI Polene Public Company Limited