|

市場調查報告書

商品編碼

1444016

丙烯酸 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Acrylic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

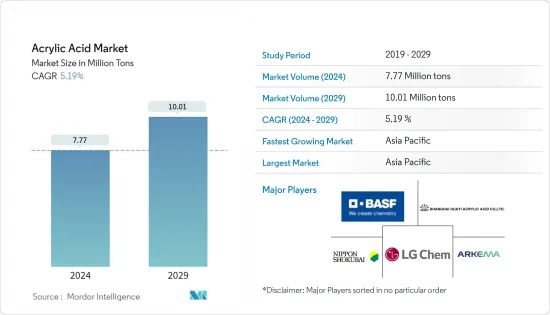

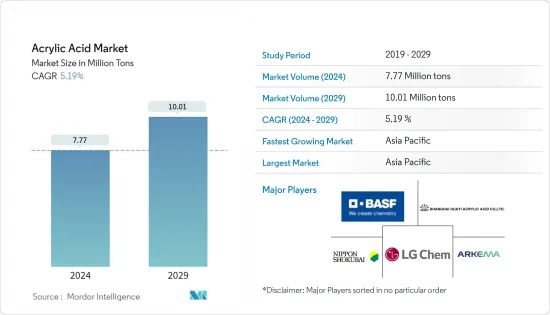

丙烯酸市場規模預計2024年為777萬噸,預計2029年將達到1,001萬噸,在預測期間(2024-2029年)CAGR為5.19%。

市場受到 COVID-19 大流行的負面影響。然而,2021年,由於人們對個人衛生和清潔環境的認知和意識增強,對洗衣護理產品的需求增加。丙烯酸用於生產液體洗衣粉,刺激了丙烯酸市場的需求。

主要亮點

- 短期內,丙烯酸類高吸水性聚合物的應用不斷增加以及化學合成的使用不斷增加預計將推動市場的成長。

- 與丙烯酸相關的健康危害可能會阻礙市場的成長。

- 對生物基聚合物的需求不斷成長可能會成為預測期內市場成長的機會。

- 亞太地區佔據最大的市場佔有率,並且很可能在預測期內主導市場。

丙烯酸市場趨勢

增加油漆和塗料應用中的使用量

- 丙烯酸擴大用於製造丙烯酸酯,其用於各種應用,包括油漆和塗料。

- 丙烯酸用於建築塗料、原始設備製造商產品的面漆,包括汽車 (OEM) 和修補漆以及特殊用途塗料。

- 丙烯酸粉末塗料已作為透明塗層應用於車身上。儘管它是許多應用的理想解決方案,但固化是在烤箱中的高溫下實現的。因此,它並不普遍適用(例如,木材和塑膠的塗漆)。

- 建築塗料旨在保護和裝飾表面特徵,用於覆蓋建築物和房屋。大多數指定用於特定用途,例如屋頂塗料、牆面塗料或甲板飾面。每種建築塗料無論使用何種用途,都必須提供一定的裝飾性、耐用性和保護性功能。

- 大多數屋主喜歡在客廳和臥室牆壁上使用自己選擇的顏色。丙烯酸塗料是首選,因為它們在顏色和色調方面提供多種選擇。絕大多數天花板都漆成純白色,這樣可以反射房間內的大部分環境光,讓住戶感覺房間寬敞、輕鬆。地下室磚石牆常會滲水。

- 2022 年 5 月,Grasim Industries(Aditya Birla Group)計劃在 2025 會計年度為其塗料業務投資 1,000 億印度盧比(約 12.0947 億美元)。 2021 年 1 月,該公司宣布計劃在未來三年內斥資 500 億印度盧比(約 6.0473 億美元)進軍塗料業務。該公司可能會在 2024 會計年度第四季之前投產一家年產能為 13.32 億公升 (MLPA) 的塗料廠。

- 根據日本經濟產業省統計,2021年日本合成樹脂塗料產量約101萬噸,塗料產量龐大。整體而言,2021年塗料產量增加至近153萬噸,而2020年為150萬噸。

- 根據美國塗料協會(Coatings Tech)統計,2020年美國油漆塗料產業產值達252.1億美元,預計到2022年將達到280.6億美元。2020 年產業產量為13.37 億加侖,預計到2022 年將達到14.16 億加侖。這可能會增加該國油漆和塗料行業對丙烯酸的需求。

- 總體而言,在經歷了最初的復甦期之後,預計該地區丙烯酸需求將出現中高速成長。

預計亞太地區將主導市場

- 由於中國、印度和日本等國家的高需求,亞太地區主導了市場。

- 中國是亞太地區最大的丙烯酸消費國,預計其需求在預測期內將成長。由於建築和基礎設施領域的投資不斷成長,中國對黏合劑、油漆和塗料的需求也在大幅增加。

- 此外,中國是全球個人衛生用品的主要消費國之一。該國對個人衛生產品的需求歸因於嬰兒人口眾多和可支配收入的增加,促使個人和衛生護理支出增加。因此,預計在預測期內將提振丙烯酸市場。

- 中國以其工業化和製造業而聞名,廣泛需要油漆和塗料。該國使用油漆和塗料的一些主要行業是汽車、工業和建築業等。中國佔全球塗料市場的四分之一以上。根據中國塗料工業協會統計,近年來該產業成長了7%,帶動了丙烯酸在塗料應用市場的發展。

- 中國有近萬家塗料生產商。大多數全球領先的塗料製造商,如立邦塗料、阿克蘇諾貝爾、中國船舶塗料、PPG工業、BAF SE和艾仕得塗料,都在中國設有製造基地。油漆和塗料公司在該國的投資不斷增加。這可能會刺激用於製造汽車油漆和塗料的丙烯酸市場。

- 杜邦等公司在黏合劑產業投資約 3,000 萬美元,在華東地區江蘇省張家港市建立了新的製造工廠。該公司的新工廠生產黏合劑,為運輸業的客戶提供服務,主要支持兩大產業趨勢:車輛電氣化應用和輕量化。該設施於 2021 年第三季開始施工,預計將於 2023 年初投入營運。

- 印度油漆和塗料業務的一些主要參與者包括亞洲塗料 (Asian Paints)、伯傑塗料 (Berger Paints)、關西 Nerolac 和阿克蘇諾貝爾印度 (Akzo Nobel India)。近期,多家公司宣布擴大產能,可能會增加國內油漆和塗料配方對丙烯酸的需求。

- 丙烯酸用於成人和女性衛生用品。在印度,缺乏經期衛生一直是個課題。根據聯合國教科文組織和 Whisper 統計,截至 2021 年 4 月,印度有 2,300 萬名女孩因缺乏經期衛生和意識而輟學。印度約有 4 億經期女性,其中不到 20% 使用衛生棉。在城市地區,這一數字僅高達 52%。

- 因此,由於這些因素,亞太地區可能在預測期內主導丙烯酸市場。

丙烯酸產業概況

丙烯酸市場本質上是整合的。該市場的主要參與者包括巴斯夫、阿科瑪、日本觸媒、LG 化學和上海華誼丙烯酸等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 高吸水性聚合物的應用不斷增加

- 增加化學合成中的使用

- 限制

- 丙烯酸對健康的危害

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場規模依數量計算)

- 依衍生性商品

- 丙烯酸甲酯

- 丙烯酸丁酯

- 丙烯酸乙酯

- 丙烯酸2-乙基己酯

- 冰丙烯酸

- 高吸水性聚合物

- 依應用

- 油漆和塗料

- 黏合劑和密封劑

- 界面活性劑

- 衛生用品

- 紡織品

- 其他應用

- 依地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 東協國家

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 合併、收購、合資、合作和協議

- 市佔率(%)分析

- 領先企業採取的策略

- 公司簡介

- Arkema

- BASF SE

- China Petroleum & Chemical Corporation (SINOPEC)

- Dow

- Formosa Plastics Corporation

- LG Chem

- Merck KGaA

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO. LTD

- Sasol

- Shanghai Huayi Acrylic Acid Co. Ltd

- Satellite Chemical Co. Ltd

- Wanhua

第 7 章:市場機會與未來趨勢

- 對生物基聚合物的需求不斷增加

The Acrylic Acid Market size is estimated at 7.77 Million tons in 2024, and is expected to reach 10.01 Million tons by 2029, growing at a CAGR of 5.19% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic. However, in 2021, the demand for laundry care products increased due to the increased awareness and consciousness regarding personal hygiene and clean surroundings. Acrylic acid is used to produce liquid laundry detergent, stimulating the demand for the acrylic acid market.

Key Highlights

- Over the short term, the rising applications of acrylic acid-based super absorbent polymers and the increasing use of chemical synthesis are expected to drive the growth of the market.

- Health hazards associated with acrylic acid may hinder the growth of the market.

- The rising demand for bio-based polymers is likely to act as an opportunity for the growth of the market during the forecast period.

- The Asia-Pacific accounted for the largest market share, and it is likely to dominate the market during the forecast period.

Acrylic Acid Market Trends

Increasing Usage in Paints and Coatings Application

- Acrylic acid is increasingly used to make acrylate esters, which are used in various applications, including paints and coatings.

- Acrylics are used in architectural coatings, finishes for products for original equipment manufacturers, including automotive (OEM) and refinishes, and special-purpose coatings.

- Acrylic powder coatings have been introduced as clear coats on car bodies. Although it is an ideal solution for many applications, curing is achieved at a high temperature in an oven. It is, therefore, not universally applicable (e.g., painting of wood and plastics).

- Architectural coatings are meant to protect and decorate surface features and are used to coat buildings and homes. Most are designated for specific uses, such as roof coatings, wall paints, or deck finishes. Each architectural coating must provide certain decorative, durable, and protective functions despite their use.

- Most homeowners prefer to use the color of their choice for the living room and bedroom walls. Acrylic paints are the preferred choice as they offer a wide variety of choices in terms of color and shade. A vast majority of ceilings are painted flat white so that they may reflect the majority of the ambient light in the room, to make the resident feel that the room is spacious and relaxed. Basement masonry walls can often weep water.

- In May 2022, Grasim Industries (Aditya Birla Group) planned to invest INR 10,000 crore (~USD 1209.47 million) for its paint business by FY2025. In January 2021, the company announced plans to enter the paints business with INR 5,000 crore (~USD 604.73 million) in the next three years. The company will likely commission a paint plant with a production capacity of 1,332 million liters per annum (MLPA) by Q4 FY2024.

- According to the Ministry of Economy, Trade, and Industry (Japan), the production volume of synthetic resin paints in Japan amounted to approximately 1.01 million metric tons in 2021, making up an enormous production volume of paints. Overall, paints' production volume increased to nearly 1.53 million metric tons in 2021, compared to 1.50 million metric tons in 2020.

- According to the American Coatings Association (Coatings Tech), the paints and coatings industry in the US accounted for USD 25.21 billion in 2020, and it was expected to reach USD 28.06 billion by 2022. Similarly, in terms of volume, the paints and coatings industry stood at 1,337 million gallons in 2020, and was expected to reach 1,416 million gallons by 2022. This is likely to enhance the demand for acrylic acid from the paints and coatings sector in the country.

- Overall, the demand for acrylic acid is expected to witness moderate to high growth in the region after the initial recovery period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific dominated the market due to the high demand from countries like China, India, and Japan.

- China is the largest consumer of acrylic acid in the Asia-Pacific region, and its demand is expected to grow during the forecast period. The demand for adhesives, paints, and coatings in China is also increasing significantly due to the growing investments in the construction and infrastructure sectors.

- Additionally, China is one of the major consumers of personal hygiene products globally. The country's demand for personal hygiene products is attributed to a large infant population and increasing disposable income, leading to increased spending on personal and hygiene care. Thus, it is anticipated to boost the market for acrylic acid during the forecast period.

- China is known for its industrialization and manufacturing sector, where paints and coatings are widely required. Some of the major sectors where paints and coatings are used in the country are the automotive, industrial, and construction sectors, among others. China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has been registering a growth of 7% in recent years, driving the acrylic acid market in coatings application.

- Nearly 10,000 coatings manufacturers are located in China. Most leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BAF SE, and Axalta Coatings, have manufacturing bases in China. Paints and coatings companies have been increasingly growing investments in the country. This is likely to fuel the market for acrylic acid used to manufacture automotive paints and coatings.

- Companies like DuPont invested approximately USD 30 million in the adhesive sector to build a new manufacturing facility in East China in Zhangjiagang, Jiangsu Province. The company's new facility produces adhesives to serve customers in the transportation industry, primarily supporting two mega-industry trends: vehicle electrification applications and lightweight. Construction began in Q3 2021, and the facility is expected to be operational by early 2023.

- Some key players operating in the paints and coatings business in India are Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel India. Recently, various companies have announced their capacity expansions, which are likely to boost the demand for acrylic acid from paints and coatings formulations in the country.

- Acrylic acid is used in adult and female hygiene products. In India, the lack of menstrual hygiene has always been a challenge. As of April 2021, according to UNESCO and Whisper, 23 million girls have dropped out of school due to a lack of menstrual hygiene and awareness in India. Out of a total of ~40 crore menstruating women in India, less than 20% use sanitary pads. In urban areas, this number only goes up to 52%.

- Hence, dueto these factors, the Asia-Pacific region is likely to dominate the acrylic acid market during the forecast period.

Acrylic Acid Industry Overview

The acrylic acid market is consolidated in nature. Some major players in the market include BASF SE, Arkema, NIPPON SHOKUBAI CO. LTD, LG Chem, and Shanghai Huayi Acrylic Acid Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications of Super Absorbent Polymers

- 4.1.2 Increasing Usage in Chemical Synthesis

- 4.2 Restraints

- 4.2.1 Health Hazards of Acrylic Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Derivative

- 5.1.1 Methyl Acrylate

- 5.1.2 Butyl Acrylate

- 5.1.3 Ethyl Acrylate

- 5.1.4 2-Ethylhexyl Acrylate

- 5.1.5 Glacial Acrylic Acid

- 5.1.6 Superabsorbent Polymer

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Surfactants

- 5.2.4 Sanitary Products

- 5.2.5 Textiles

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.4 Dow

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 LG Chem

- 6.4.7 Merck KGaA

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 NIPPON SHOKUBAI CO. LTD

- 6.4.10 Sasol

- 6.4.11 Shanghai Huayi Acrylic Acid Co. Ltd

- 6.4.12 Satellite Chemical Co. Ltd

- 6.4.13 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polymers