|

市場調查報告書

商品編碼

1444002

木地板 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Wooden Decking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

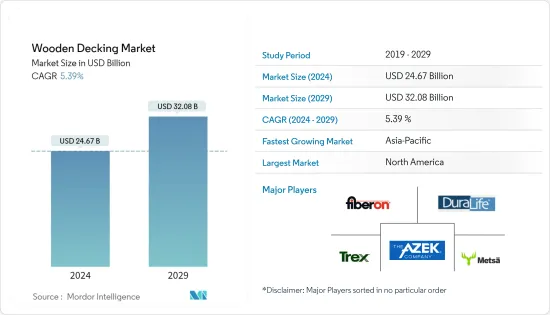

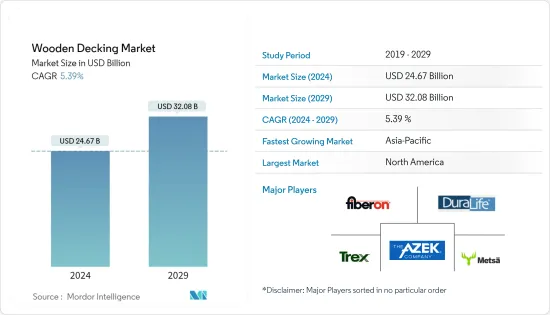

2024年木製地板市場規模估計為246.7億美元,預計到2029年將達到320.8億美元,在預測期內(2024-2029年)CAGR為5.39%。

2020年,受新冠肺炎(COVID-19)疫情影響,大多數基礎設施項目在一定時期內停工。因此,對木地板的需求大幅減少。然而,自限制解除以來,該行業一直在良好復甦。全球建築業投資的成長和有利的政府政策一直引領 2021 年和 2022 年的市場復甦。

主要亮點

- 從長遠來看,已開發國家改建和翻新活動的增加以及對住房和豪華基礎設施的需求可能會刺激市場需求。

- 另一方面,複合地板的替代品預計將阻礙市場的成長。

- 為增強性能而進行的木材改質可能會在未來幾年為市場創造機會。

- 在預測期內,亞太地區的CAGR可能最高。

木地板市場趨勢

增加住宅領域的使用

- 木地板用於住宅領域,用於建築物的新建以及維修和翻新。它在住宅建築中有多種用途,例如覆層和壁板、通道、游泳池甲板和地板。全球住宅項目不斷成長的需求預計將在預測期內推動木質地板市場。

- 全球範圍內,住房供應嚴重不足。這為投資者和開發商提供了巨大的機會,可以採用替代的施工方法和新的合作夥伴關係來推動發展。

- 由於中國和印度住房建設市場的不斷擴大,預計亞太地區的住房成長將達到最高。預計到 2030 年,這兩個地區將佔全球中產階級的 43.3% 以上。

- 此外,預計未來六年印度將在住房領域投資約 1.3 兆美元。預計將建造 6000 萬套新住房。到 2024 年,經濟適用房的供應量預計將增加 70% 左右。印度政府的「到 2022 年為所有人提供住房」也是該行業的重大遊戲規則改變者。該計劃旨在2022年為城市貧困人口建設超過2000萬套保障性住房,將有力推動住房建設。

- 該國的人口結構預計將繼續刺激住宅建設的成長。家庭收入水準的提高,加上人口從農村遷移到城市地區,預計將繼續推動該國住宅建築業的需求。

- 根據哈佛住房研究聯合中心估計,光是美國人每年在住宅翻新和維修上的花費就超過 4000 億美元,預計這將為該國的木地板創造一個重要的市場。

- 同樣,阿拉伯聯合大公國在杜拜新成長走廊 Al Furjan 的中心地帶正在建造一個交通極其便利的住宅廣場。 Azizi Developments一直致力於開發該廣場,其中包括16套豪華頂層公寓、46套一居室單元、86套兩居室住宅和286套工作室。

- 德國擁有歐洲最重要的建築業。該國的建築業一直在緩慢成長,主要是由新住宅建設活動的增加所推動的。

- 由於所有這些因素,木地板市場在預測期內可能會在全球範圍內成長。

北美地區預計將主導市場

- 北美是全球最大的經濟體之一,其中美國和加拿大處於領先地位。

- 美國是世界上最大、最強大的經濟體。住宅建築業佔據美國最重要的市場。 COVID-19 大流行引發了對遠離擁擠城市的地區的住房需求,居家辦公的員工決定投資家居裝修項目。

- 根據美國人口普查局的數據,2022 年 7 月美國住宅建築業的價值為 9,297 億美元,而 2021 年 7 月為 8,155 億美元,成長了 14%。老化的房屋標誌著不斷成長的改造市場,因為舊建築通常需要添加新的設施或維修/更換舊零件。該國房價上漲也鼓勵屋主在房屋裝修上投入更多資金。

- 2000 年至 2009 年間在美國建造的自住住宅佔房屋存量的 16%。然而,超過一半的自住房屋建於1980年之前,其中約38%建於1970年之前,嚴重推高了舊房改造的需求。此外,鑑於政府為提高能源效率所採取的各種支持措施,現有住房的改造應繼續表現良好。這將進一步為該地區的木地板市場創造大量機會。

- 據加拿大建築協會稱,建築業是重要的雇主之一(約 140 萬),也是國家經濟成功的重要貢獻者。該行業由 70% 的中小企業 (SME) 組成。該產業對國家GDP的貢獻率約為7.5%。

- 由於低利率和對空間的高需求,加拿大所有類型的住宅建築行業都在蓬勃發展,從單戶住宅到高層公寓大樓。租賃公寓行業也面臨著容納不斷成長的城市人口的巨大需求。

- 此外,家庭收入的增加、加拿大疫苗接種工作的進展以及全球經濟的復甦推動了 2021 年市場的成長。

- 作為「投資加拿大計畫」的一部分,政府宣布計劃在 2028 年投資近 1,400 億美元用於重大基礎設施開發。

- 加拿大(尤其是多倫多)出現了摩天大樓建設熱潮。預計到 2025 年將有超過 30 棟高層建築竣工,另有 50 棟此類建築正處於多倫多的提案和規劃階段。

- 在墨西哥,中產階級人口的增加和經濟適用房建設投資的增加預計將增加未來幾年對住宅建築的需求。

- 由於所有這些因素,預計該地區的木地板市場在預測期內將穩定成長。

木地板產業概況

木質地板市場本質上是分散的。一些主要公司包括 The AZEK Company LLC、Trex Company Inc.、DuraLife Decking and Railing Systems、Fiberon 和 Metsa Wood(排名不分先後)。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 改建和翻新活動增加

- 已開發國家對住房和豪華基礎設施的需求

- 限制

- 更換為複合地板

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場價值規模)

- 依類型

- 壓力處理木材

- 紅木

- 熱帶硬木

- 雪松

- 木塑複合材料(WPC)

- 其他類型(熱改質木材、乙醯化木材)

- 依應用

- 欄桿

- 地面

- 牆

- 其他應用

- 依最終用戶產業

- 住宅

- 非住宅

- 依地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- Deck Solutions LLC

- Deckorators Inc.

- DuraLife Decking and Railing Systems

- Fiberon

- Humboldt Sawmill Company LLC

- Kebony AS

- Mendocino Forest Products Company LLC

- Metsa Wood

- NeoTimber

- Shubh Composites

- Tecnodeck (Mitera Group)

- The AZEK Company LLC

- Thermory

- Trex Company Inc.

- United Construction Products Inc. (BISON Innovative Products)

第 7 章:市場機會與未來趨勢

- 木材改質以增強性能

The Wooden Decking Market size is estimated at USD 24.67 billion in 2024, and is expected to reach USD 32.08 billion by 2029, growing at a CAGR of 5.39% during the forecast period (2024-2029).

In 2020, due to the COVID-19 pandemic, most infrastructure projects were shut down for a specified period. Owing to this, the demand for wooden decking was reduced drastically. However, the sector has been recovering well since restrictions were lifted. Growing investments in the construction sector globally and favorable government policies have been leading the market recovery in 2021 and 2022.

Key Highlights

- Over the long term, an increase in remodeling and refurbishment activities and the demand for housing and lavish infrastructure in developed nations will likely stimulate the market demand.

- On the flip side, replacement by composite decking is expected to hinder the market's growth.

- Wood modification for enhanced properties is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is likely to witness the highest CAGR during the forecast period.

Wooden Decking Market Trends

Increasing Usage in the Residential Sector

- Wooden decking is used in the residential sector, both for new construction and repair and refurbishment in buildings. It is used for various purposes in residential construction, such as cladding and siding, pathways, swimming pool decks, and flooring. The increasing demand for residential projects worldwide is expected to drive the wooden decking market over the forecast period.

- Globally, there has been a significant undersupply to meet the demand for housing. This presented a substantial opportunity for investors and developers to embrace alternative construction methods and new partnerships to bring forward development.

- The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India. These two regions are expected to represent over 43.3% of the global middle class by 2030.

- Furthermore, India is expected to witness an investment of around USD 1.3 trillion in housing over the next six years. It is anticipated to witness the construction of 60 million new homes. The availability of affordable housing is expected to rise by around 70% in 2024. The Indian government's 'Housing for All by 2022' is also a significant game-changer for the industry. This initiative aims to build more than 20 million affordable homes for the urban poor by 2022. This will provide a substantial boost to housing construction.

- Demographics in the country are expected to continue to spur growth in residential construction. Rising household income levels, combined with the population migrating from rural to urban areas, are expected to continue to drive demand for the residential construction sector in the country.

- According to the Harvard Joint Center for Housing Studies, it is estimated that Americans alone spend more than USD 400 billion a year on residential renovations and repairs, which is expected to create a significant market for wooden decking in the country.

- Similarly, the United Arab Emirates has an exceptionally well-connected residential plaza under construction in the heart of Dubai's new growth corridor, Al Furjan. Azizi Developments has been engaged in developing the plaza, which includes 16 luxurious penthouses, 46 one-bedroom units, 86 two-bedroom residences, and 286 studios.

- Germany has the most significant construction industry in Europe. The construction industry in the country has been growing at a slow pace, majorly driven by increasing new residential construction activities.

- Owing to all these factors, the wooden decking market will likely grow globally during the forecast period.

North America Region is Expected to Dominate the Market

- North America is one of the largest economies globally, with the United States and Canada in the leading positions.

- The United States is the world's largest and most powerful economy. The residential construction sector accounts for the most significant market share in the United States. The COVID-19 pandemic created a demand for housing in areas away from crowded cities, and homebound employees decided to invest in home improvement projects.

- As per the United States Census Bureau, the residential construction industry in the United States was valued at USD 929.7 billion in July 2022 compared to USD 815.5 billion in July 2021, registering a growth of 14%. The aging houses signal a growing remodeling market, as old structures normally need to add new amenities or repair/replace old components. Rising home prices in the country have also encouraged homeowners to spend more on home improvements.

- Owner-occupied homes constructed in the United States between 2000 and 2009 make up 16% of the housing stock. However, more than half of the owner-occupied homes were built before 1980, with around 38% built before 1970, severely driving up the need to remodel old houses. Also, the renovation of existing housing should continue to perform well, given the various government support measures for energy efficiency improvements. This will further create considerable opportunities for the wooden decking market in the region.

- According to the Canadian Construction Association, the construction sector is one of the prominent employers (around 1.4 million) and a significant contributor to the country's economic success. The industry comprises 70% of small and medium-sized enterprises (SMEs). The industry contributes around 7.5% of the country's GDP.

- The residential construction sector is booming in Canada for all housing types, ranging from single-family homes to high-rise apartment blocks, due to the low-interest rates and high demand for space. The rental apartment sector is also witnessing significant demand for accommodating the growing urban population.

- Additionally, an increase in household income, progress in Canada's vaccination drive, and a recovery in the global economy enabled the market's growth in 2021.

- As part of the 'Investing in Canada Plan,' the government announced plans to invest nearly USD 140 billion for significant infrastructure developments by 2028.

- There has been a boom in constructing skyscrapers in Canada (especially in Toronto). Over 30 high-rise buildings are expected to be completed by 2025, and another 50 such buildings are in Toronto's proposal and planning phases.

- In Mexico, the rising middle-class population and growing investments in affordable housing construction are expected to increase the demand for residential buildings in the coming years.

- Due to all such factors, the market for wooden decking in the region is expected to have steady growth during the forecast period.

Wooden Decking Industry Overview

The wooden decking market is fragmented in nature. Some major companies include The AZEK Company LLC, Trex Company Inc., DuraLife Decking and Railing Systems, Fiberon, and Metsa Wood (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Remodeling and Refurbishment Activities

- 4.1.2 Demand for Housing and Lavish Infrastructure in Developed Nations

- 4.2 Restraints

- 4.2.1 Replacement by Composite Decking

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Pressure-treated Wood

- 5.1.2 RedWood

- 5.1.3 Tropical Hardwood

- 5.1.4 Cedar

- 5.1.5 Wood-Plastic Composites (WPC)

- 5.1.6 Other Types (Thermally Modified Wood, Acetylated Wood)

- 5.2 By Application

- 5.2.1 Railing

- 5.2.2 Floor

- 5.2.3 Wall

- 5.2.4 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Deck Solutions LLC

- 6.4.2 Deckorators Inc.

- 6.4.3 DuraLife Decking and Railing Systems

- 6.4.4 Fiberon

- 6.4.5 Humboldt Sawmill Company LLC

- 6.4.6 Kebony AS

- 6.4.7 Mendocino Forest Products Company LLC

- 6.4.8 Metsa Wood

- 6.4.9 NeoTimber

- 6.4.10 Shubh Composites

- 6.4.11 Tecnodeck (Mitera Group)

- 6.4.12 The AZEK Company LLC

- 6.4.13 Thermory

- 6.4.14 Trex Company Inc.

- 6.4.15 United Construction Products Inc. (BISON Innovative Products)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Wood Modification for Enhanced Properties