|

市場調查報告書

商品編碼

1443984

變頻驅動器 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Variable Frequency Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

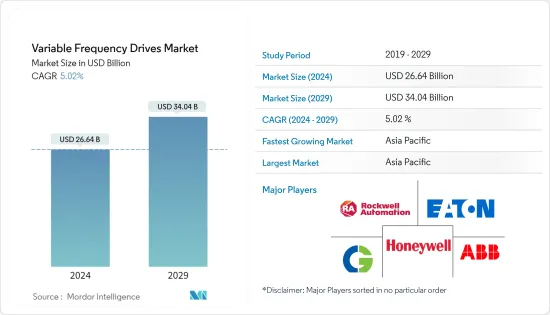

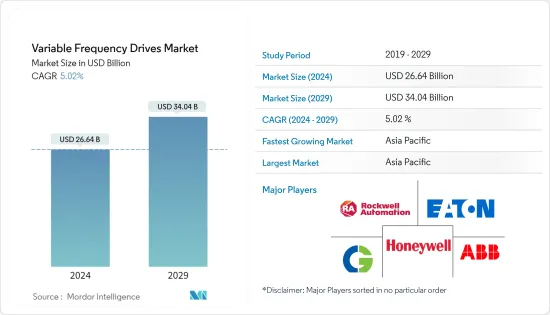

2024年,變頻驅動器市場規模預計為266.4億美元,預計到2029年將達到340.4億美元,在預測期內(2024-2029年)CAGR為5.02%。

用於監控馬達速度的變頻驅動器因其能夠最佳化各個行業的能源使用而獲得了相當大的關注。除了能源效率之外,變頻器的普及還可以歸因於它們能夠在整個生命週期內分散式使用,從而延長馬達壽命並減少維護,從而避免在相同參數下持續使用。

主要亮點

- 該市場的特點是各種政府指令著重於提高工業部門的能源效率。 HVAC 系統,特別是冷水機組(VFD 的關鍵部署者),因其環保性而越來越受到政府機構的審查。隨著時間的推移,它們已被正規化,以符合更新的政策。

- 中國、日本、印度、巴西和韓國等新興經濟體的快速工業化促進了創新和高效工業設備的採用。例如,根據中國國家統計局的數據,2021年,中國工業生產比上年成長約9.6%。中國的目標是到 2025 年實現汽車產量從 2018 年的 2230 萬輛增至 3500 萬輛。隨著最近的稅收優惠和「中國製造 2025」計劃的實施,中國的製造單位預計將快速成長。這為該國的AMH設備市場提供了多個機會。

- 能源效率一直是聯邦監管機構和產業組織關注的重點。根據國際能源總署的數據,電動馬達消耗了電力產業 40% 的能源。當這些馬達在離心負載服務中與 VFD 一起部署時,其效率會提高。由於電力電子技術的進步,變頻器的性能有望提高,有助於節省能源。

- 在現有馬達中添加 VFD 會帶來一些技術問題,這為各行業眾多參與者的採用設置了障礙。將驅動器與現有馬達整合後,馬達軸的速度降低,導致軸驅動風扇的冷卻效果減弱。 VFD 馬達中的轉子非常敏感,可能會因頻繁旋轉而損壞,這種情況是由於強烈的動態煞車而發生的。當轉子以這種方式停止時,轉子的熱膨脹會產生將轉子軸拉離定子的力,從而導致軸承故障。當 VSD 沒有充分冷卻時,通常會發生這種情況。

- 疫情期間,由於辦公室關閉和工業部門活動完全停止,電力業受到的牽引力減弱。隨著後 COVID-19 時期工業和辦公室的重新開放,預計該行業對節能設備的需求將不斷增加,從而產生對 VFD 的輔助需求。 COVID-19 大流行後,能源和電力產業受到了多項新法規的影響,這凸顯了製定應急計畫以節省能源以邁向永續未來的必要性。預計這些指令將在預測期內推動市場的成長。

變頻驅動 (VFD) 市場趨勢

快速工業化和主要垂直產業擴大使用 VFD 來推動市場發展

- 製造業自動化的興起推動了市場的成長。例如,根據國際機器人聯合會的數據,工業機器人的年度安裝量從2019 年的382,000 台增加到2020 年的384,000 台。根據IFR 預測,全球採用率預計將大幅增加,到2020 年,全球工廠將有518,000 台工業機器人投入使用。2024 年。

- 影響市場的一個重要趨勢是對智慧製造實踐的關注。印度品牌股權基金會 (IBEF) 表示,印度政府制定了雄心勃勃的目標,即到 2025 年將製造業產出佔國內生產毛額 (GDP) 的比重從 16% 提高到 25%。智慧先進製造和快速轉型中心 (SAMARTH) Udyog Bharat 4.0 計畫旨在提高印度製造業對工業 4.0 的認知,並使利益相關者能夠應對與自動化物料搬運相關的課題。

- 隨著工業4.0、物聯網和智慧製造實踐的全球影響,製造業正走向自動化。 VFD 非常適合這一不斷發展的趨勢。

- 市場也越來越重視流程最佳化。 VFD 可以減少石油和天然氣行業的停機時間,因為燃氣渦輪機需要頻繁維護,而 VFD 和馬達則需要很少的維護。這可以提高產量、降低維護費用並提高生產率,從而鼓勵各種石油和天然氣公司採用變頻器。

- 著眼於變頻器的節能效益,各國政府與變頻器及相關產品製造商合作,在多個產業安裝,這推動了所研究市場的成長。例如,丹佛斯與加爾各答地鐵公司 (KMRC) 和欽奈地鐵公司 (CMRL) 合作,提供各種驅動解決方案。

- VFD 正在應用於多種新應用。具有電網介面的應用(例如變頻器和抽水蓄能)均採用 VFD。碳捕獲、氫氣生產和運輸等新產業預計也將依賴變頻器。

亞太地區預計將成為成長最快的市場

- 由於主要在發電和石油和天然氣行業的業務不斷增加,以及在建立製造設施方面的大膽支出,預計變頻驅動器市場將在中國佔據重要佔有率。

- 中國對基礎設施擴張的關注已轉化為眾多製造業和工業部門的外國直接投資。中國政府的積極支持,催生了更多的加值產業,實現了整體產業的成長,包括風能和太陽能、電信、汽車、石化加工和鋼鐵生產等中國工業部門,這些都是中國工業成長的主要貢獻者。其經濟的進步。因此,這些產業對變頻驅動器的需求影響最大。因此,中國仍是變頻器利潤最高的市場。

- 隨著能源價格的上漲,印度 VFD 產業正在進入成長階段,因此需要節能和高效運作的馬達控制系統和驅動器。最終用戶意識到額外的驅動優勢,例如增強的製程控制性能、最小化的維護要求以及延長的馬達和設備壽命,刺激了 VFD 的採用。

- 日本的住宅空調市場是全球最大的市場之一。此外,由於對熱舒適性和社會文化偏好的期望,日本空調的擁有量很高。該國的可再生能源發電正在以驚人的速度進行。這需要整合到現有的國家電網中,從而引入額外的電力基礎設施,這可能最終會推動變頻驅動器產業的發展。

- 過去幾年,亞太國家政府機構在能源消耗方面持續進行監管。這可能為未來5-7年的變頻驅動產業帶來良好的成長機會。

變頻驅動 (VFD) 產業概覽

由於市場上存在許多大大小小的參與者,變頻驅動器市場競爭非常激烈。市場對節能設備的需求不斷成長,因此市場上的國際參與者正在迅速擴大其足跡,而本地供應商發現很難在品質、安全性和價格方面與主要參與者競爭。這一因素正在加劇市場競爭。一些主要參與者包括伊頓公司、ABB 有限公司和霍尼韋爾國際公司。

- 2022 年 4 月 - ABB 推出了最新的緊湊型全整合設計中壓 VFD ACS1000i,具有整合輸入變壓器、輸入接觸器和輔助電源,以滿足水利和電力行業空間有限的需求。風冷 ACS 1000i - 額定功率為 315 kW 至 1800 kW,電壓等級 3.3、4.0/4.16、6.0/6.6 kV - 採用內置輸入變壓器和輸入接觸器的標準驅動櫃,同時保持其姊妹產品的緊湊設計驅動器,ACS 1000。傳統的水冷式ACS 1000 VFD 仍可用於更高的功率位準。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 技術簡介

- 依類型

- 交流驅動器

- 直流驅動器

- 依類型

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 主要垂直行業的快速工業化和 VFD 的使用增加

- 對能源效率不斷成長的需求

- 市場限制

- 設備的技術問題

- 設備成本高

- 網路安全疑慮

第 6 章:市場區隔

- 依電壓類型

- 低電壓

- 中高壓

- 依最終用戶產業

- 基礎設施

- 食品加工

- 能源與電力

- 採礦和金屬

- 紙漿和造紙

- 其他最終用戶產業

- 依地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 印度

- 日本

- 亞太其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第 7 章:競爭格局

- 公司簡介

- Eaton Corporation

- ABB Ltd (GE Industrial)

- Crompton Greaves Ltd

- Honeywell International Inc.

- Rockwell Automations Inc.

- Hitachi Group

- Siemens AG

- Mitsubishi Corporation

- Toshiba Corporation

- Schneider Electric SE

- Johnson Controls Inc.

- Nidec Corporation

- Danfoss AS

第 8 章:投資分析

第 9 章:市場機會與未來趨勢

The Variable Frequency Drives Market size is estimated at USD 26.64 billion in 2024, and is expected to reach USD 34.04 billion by 2029, growing at a CAGR of 5.02% during the forecast period (2024-2029).

The variable frequency drives used to monitor the speed of motors have gained considerable traction due to their power to optimize energy usage in various industries. Apart from energy efficiency, the popularity of VFDs can also be attributed to their capacity to improve motor life and reduce maintenance by allowing distributed use across the life cycle, relieving it from constant use under the same parameters.

Key Highlights

- The market is characterized by various government directives focusing on making the industrial sector more energy efficient. The HVAC systems, especially chillers, a key deployer of VFD, are increasingly scrutinized by government bodies for their eco-friendliness. They have been regularized with time to comply with the updated policies.

- Rapid industrialization in emerging economies like China, Japan, India, Brazil, and South Korea has boosted innovations and the adoption of efficient industrial equipment. For instance, according to the National Bureau of Statistics of China, in 2021, China's industrial production increased by about 9.6% compared to the previous year. China aims to achieve an automobile output of up to 35 million units by 2025, from 22.3 million units in 2018. With the recent tax incentives and the 'Made in China 2025' initiative, manufacturing units in the country are expected to increase rapidly. This provides several opportunities for the AMH equipment market in the country.

- Energy efficiency has been of key focus for federal regulators and industry organizations. According to the International Energy Agency, electric motors consume 40% of the energy used in power industries. When these motors are deployed with VFDs in centrifugal load service, their efficiency increases. Due to the technological improvements in power electronics technology, the performance of VFDs is expected to improve, helping conserve energy.

- The addition of VFDs in existing motors gives rise to several technical problems, which have created a barrier to adoption among numerous players in various industries. After integrating the drive with an existing motor, the speed of the motor shaft reduces, causing decreased cooling from the shaft-driven fan. The rotors in the VFD motors are very sensitive and can get damaged by frequent spinning, which occurs because of aggressive dynamic braking. When the rotors are stopped this way, the thermal expansion of the rotor produces a force that pulls the rotor shaft away from the stator, leading to bearing failure. This usually occurs when the VSD is not adequately cooled.

- During the pandemic, the power sector received less traction with the shutting down of offices and the complete halt of activities in the industrial sector. With the reopening of the industries and offices in the post-COVID-19 period, the industry is anticipated to witness increasing demand for energy-efficient devices, creating an ancillary demand for VFDs. The energy and power sector has been exposed to several new regulations post the COVID-19 pandemic, highlighting the need for contingency plans to save energy to move toward a sustainable future. These directives are expected to propel the growth of the market over the forecast period.

Variable Frequency Drive (VFD) Market Trends

Rapid Industrialization and Increased Use of VFDs Across Major Vertical Industries to Drive the Market

- The rise of automation in the manufacturing sector has driven the growth of the market. For instance, according to the International Federation of Robotics, the annual installation of industrial robots increased from 382,000 in 2019 to 384,000 in 2020. According to the IFR forecasts, global adoption is expected to increase significantly, with 518,000 industrial robots operational across factories worldwide by 2024.

- A significant trend impacting the market is the focus on smart manufacturing practices. According to the India Brand Equity Foundation (IBEF), the Government of India set an ambitious target of increasing manufacturing output contribution to 25% of the Gross Domestic Product (GDP) by 2025 from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to enhance awareness about Industry 4.0 within the Indian manufacturing industry and enable stakeholders to address challenges related to automation material handling.

- With the global impact of Industry 4.0, IoT, and smart manufacturing practices, the manufacturing industry is moving toward automation. VFDs are a right fit with this evolving trend.

- The market is also witnessing an increased focus on process optimization. A VFD reduces downtime in the oil and gas industry because the gas turbines require frequent maintenance, while VFDs and motors require very little maintenance. This enables more production, lowers maintenance expense, and improves productivity, thus encouraging various oil and gas companies to incorporate VFDs.

- Focusing on the energy-savings benefits of the VFDs, various governments partnered with manufacturers of VFDs and related products for installation in multiple sectors, which is driving the growth of the market studied. For instance, Danfoss partnered with the Kolkata Metro Rail Corporation (KMRC) and Chennai Metro Rail (CMRL) to offer varied drive solutions.

- VFDs are being applied to several new applications. Applications with grid interfaces, like frequency converters and pump storage, employ VFDs. New industries like carbon capture, hydrogen generation, and transportation are also anticipated to rely on VFDs.

Asia-Pacific is Expected to be the Fastest-growing Market

- The variable frequency drives market is anticipated to hold a significant share in China, owing to the increasing operations primarily across power generation and the oil and gas industry, along with bold spending toward establishing manufacturing facilities.

- China's focus on infrastructural expansion has translated into FDI in numerous manufacturing and industrial sectors. Active backing from the Chinese government has empowered a higher number of value-addition industries, achieving overall industry growth, including several Chinese industrial sectors such as wind and solar power, telecommunications, automotive, petrochemical processing, and steel productions, among the top contributors to the progress of its economy. Therefore, these industries have the highest impact on the demand for variable frequency drives. As a result, China continues to be the most profitable market for VFDs.

- The Indian VFD industry is entering a growth phase with increasing energy prices, leading to a necessity for energy and operational-efficient motor control systems and drives. End-user awareness of surplus drive benefits, such as enhanced process control performance, minimized maintenance requirements, and improved motor and equipment life, stimulate VFD adoption.

- The market for residential ACs in Japan is one of the largest worldwide. Furthermore, the ownership of ACs in Japan is high due to expectations of thermal comfort and sociocultural preferences. Renewable energy generation in the country is taking place at a humongous rate. This needs to be integrated into the existing national grid, leading to the introduction of additional electrical infrastructure, which may ultimately drive the variable frequency drives industry.

- There has been continuous regulation enforcement by government bodies within the Asia-Pacific countries in terms of energy consumption in the past few years. This may bring good growth opportunities for the variable frequency drives industry in the next 5-7 years.

Variable Frequency Drive (VFD) Industry Overview

The variable frequency drives market is highly competitive due to the presence of many small and large players in the market. The market is observing a growing need for energy-efficient equipment, owing to which international players in the market are rapidly increasing their footprints, and local vendors are finding it difficult to compete with the major players in terms of quality, safety, and price. This factor is boosting the competition in the market. Some of the key players are Eaton Corporation, ABB Ltd, and Honeywell International Inc.

- April 2022 - ABB introduced the latest compact, fully integrated design medium voltage VFD ACS1000i with an integrated input transformer, input contactor, and auxiliary power supply in response to the space-constrained needs of the water and power industries. The air-cooled ACS 1000i - rated from 315 kW to 1800 kW, voltage classes 3.3, 4.0/4.16, 6.0/6.6 kV - employs a standard drive cabinet with built-in input transformer and input contactor while keeping the compact design of its sister drive, the ACS 1000. The traditional water-cooled ACS 1000 VFD can still be used for higher power levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Technology Snapshot

- 4.4.1 By Type

- 4.4.1.1 AC Drives

- 4.4.1.2 DC Drives

- 4.4.1 By Type

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization and Increased Use of VFDs across Major Vertical Industries

- 5.1.2 Growing Demand for Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Technical Concerns of the Equipment

- 5.2.2 High Cost of the Equipment

- 5.2.3 Cybersecurity Apprehensions

6 MARKET SEGMENTATION

- 6.1 By Voltage Type

- 6.1.1 Low Voltage

- 6.1.2 Medium and High Voltage

- 6.2 By End-user Industry

- 6.2.1 Infrastructure

- 6.2.2 Food Processing

- 6.2.3 Energy and Power

- 6.2.4 Mining and Metals

- 6.2.5 Pulp and Paper

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton Corporation

- 7.1.2 ABB Ltd (GE Industrial)

- 7.1.3 Crompton Greaves Ltd

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automations Inc.

- 7.1.6 Hitachi Group

- 7.1.7 Siemens AG

- 7.1.8 Mitsubishi Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Schneider Electric SE

- 7.1.11 Johnson Controls Inc.

- 7.1.12 Nidec Corporation

- 7.1.13 Danfoss AS