|

市場調查報告書

商品編碼

1443967

結構性黏著劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Structural Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

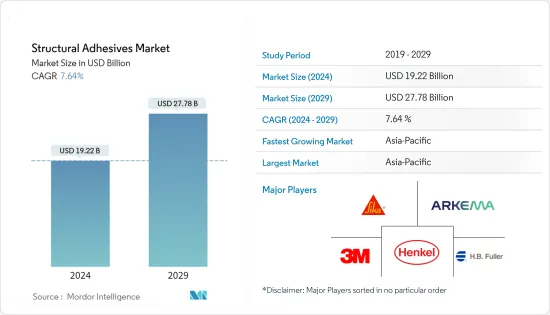

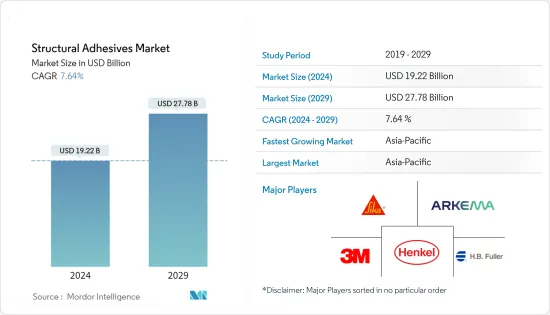

結構性黏著劑市場規模預計到2024年為192.2億美元,預計到2029年將達到277.8億美元,在預測期內(2024-2029年)年複合成長率為7.64%,預計將會成長。

2020 年市場受到 COVID-19 的負面影響。然而,由於建築、汽車和風力發電等各個最終用戶產業的消費增加,2021年出現顯著反彈。

主要亮點

- 短期內,新興經濟體投資的增加以及全球建築和汽車行業需求的增加可能會推動市場研究。

- 然而,日益成長的環境和健康擔憂預計將阻礙市場成長。

- 增加對水下結構性黏著劑的研究可能是未來市場成長的機會。

- 亞太地區主導市場,其中以中國消費最為突出。

結構性黏著劑市場趨勢

建設產業需求增加

- 在建築領域,結構性黏著劑用於黏合能夠承受載荷和應力的材料。這些黏劑具有優異的抗衝擊性、斷裂韌性和結構彈性,而不影響黏合強度。

- 在建築領域,結構性黏著劑為混凝土、承載能力材料、鋁和鋼等金屬、塑膠、工程木材等提供耐久性。除了耐用之外,結構性黏著劑還能節能且美觀。它還減少了維護需求。這些特性延長了建築建築幕牆和橋樑的生命週期。

- 建設產業使用的結構性黏著劑有丙烯酸結構性黏著劑、鋼筋黏劑、錨固黏劑、注射黏劑、碳纖維加強黏劑、吊掛黏劑、矽膠結構性黏著劑等。

- 隨著全球建設活動的活性化,預計在預測期內對結構性黏著劑的需求將會增加。 2021年全球建築市場價值約7.2兆美元,2022年可能呈現3.6%的成長率。

- 亞太地區的建築業是世界上最大的,並且由於人口成長、中等收入群體的成長和都市化而正在以健康的速度擴張。此外,由於中國和印度的住宅建築市場不斷擴大,亞太地區預計將出現最高的成長。根據中國國家統計局的數據,2021 年中國建築業產值為25.92 兆元(約4.3 兆美元),而2020 年為23.27 兆元(約合3.62 兆美元)。此後有所增加。

- 美國在北美建設產業中佔有很大佔有率。加拿大和墨西哥也對建築業做出了重大貢獻。根據美國人口普查局的數據,2021 年該國新建設將達到 16,264.44 億美元,高於 2020 年的 14,995.7 億美元。

- 因此,所有上述因素都可能對所研究市場的需求產生重大影響。

亞太地區主導市場

- 2021年全球結構性黏著劑市場由亞太地區主導。中國是世界上最大的結構性黏著劑消費國之一。

- 根據中國2022年1月公佈的五年計劃,預計2022年中國建設產業將成長6%左右。中國計劃增加裝配式建築的建設,以減少建築工地的污染和廢棄物。

- 此外,據國家發展和改革委員會稱,中國政府已核准了26 個基礎設施計劃,預計投資額約為 1,420 億美元。這些計劃目前正在進行中,預計將於 2023 年完成。

- 中國是世界上最大的汽車製造國。根據OICA統計,2021年中國汽車產量達2,608萬輛,比2020年的2,523萬輛成長3%。汽車產量的增加預計將推動結構性黏著劑的需求,特別是在高階汽車製造領域。

- 此外,根據斯德哥爾摩國際和平研究所 (SIPRI) 的數據,中國是僅次於美國的世界第二大軍費開支國,2021 年的軍事開支預計將達到 2,930 億美元。與 2020 年相比,成長了 4.7%。中國的2021年預算是其第十四個五年計畫的第一個預算,該計畫將持續到2025年。

- 印度龐大的建築業預計到2022年將成為世界第三大建築市場。印度政府實施的各種政策,例如智慧城市計劃和2022年普及住宅,預計將為低迷的建設產業帶來動力。

- 汽車和航太部門是結構性黏著劑的其他重要使用者。根據 OICA 的數據,2021 年印度生產了約 4,399,112 輛汽車,比 2020 年的 3,381,819 輛成長了 30%。

- 上述因素預計將影響預測期內亞太地區結構性黏著劑的需求。

結構性黏著劑產業概況

全球結構性黏著劑市場本質上是部分分散的,國內外參與者眾多。主要參與者包括(排名不分先後)Henkel AG &Co.KGaA、Sika AG、3M、HB Fuller Company 和 Arkema。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 加大對亞太地區新興經濟體的投資

- 全球建築和汽車產業的需求增加

- 抑制因素

- 日益成長的環境和健康問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 環氧樹脂

- 聚氨酯

- 丙烯酸纖維

- 氰基丙烯酸酯

- 甲基丙烯酸甲酯

- 其他樹脂類型

- 按最終用戶產業

- 建築學

- 車

- 航太

- 風力發電

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 合併、收購、合資、合夥和協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema

- Bondloc UK Ltd

- DuPont

- Engineered Bonding Solutions LLC

- Forgeway Ltd

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- LG Chem

- Parker Hannifin Corp.

- Sika AG

- RS Industrial

第7章 市場機會及未來趨勢

- 水下結構性黏著劑生長的研究

The Structural Adhesives Market size is estimated at USD 19.22 billion in 2024, and is expected to reach USD 27.78 billion by 2029, growing at a CAGR of 7.64% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. However, it recovered significantly in 2021, owing to rising consumption from various end-user industries, such as construction, automotive, and wind energy.

Key Highlights

- Over the short term, the increasing investments in developing Asia-Pacific economies and increasing demand from the global construction and automotive sectors may drive the market studied.

- However, growing environmental and health concerns are expected to hinder the growth of the studied market.

- The growing research on underwater structural adhesives is likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the market, with the most significant consumption recorded in China.

Structural Adhesives Market Trends

Increasing Demand from the Construction Industry

- In the construction sector, structural adhesives are used to bond materials to withstand loads or stresses. These adhesives offer good impact resistance, fracture toughness, and structural flexibility without affecting bond strength.

- In the construction sector, structural adhesives provide durability to concrete, load-bearing materials, metals such as aluminum and steel, plastics, engineered woods, etc. Apart from durability, structural adhesives are energy-efficient and aesthetically appealing. They also reduce the need for maintenance. These characteristics extend the life cycle of building facades and bridges.

- Some essential structural adhesives used in the construction industry include acrylic structural adhesives, steel glue, anchor glue, pouring glue, carbon fiber reinforcement glue, dry-hanging adhesives, and silicone structural adhesives.

- With growing construction activity worldwide, the demand for structural adhesives is projected to increase during the forecast period. The global construction market was valued at around USD 7.2 trillion in 2021 and is likely to witness a growth rate of 3.6% in 2022.

- The construction sector in the Asia-Pacific region is the largest in the world and is expanding at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization. The highest growth for housing is also expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India. According to the National Bureau of Statistics of China, the output value of the construction works in the country in 2021 was CNY 25.92 trillion (~USD 4.03 trillion), increasing from CNY 23.27 trillion (~ USD 3.62 trillion) in 2020.

- The United States occupies a significant share of the North American construction industry. Canada and Mexico also contribute significantly to the construction sector. According to the US Census Bureau, the value of new construction put in place in the country accounted for USD 1,626,444 million in 2021, increasing from USD 1,499,570 million in 2020.

- Therefore, all the factors mentioned above are likely to impact the demand in the market studied significantly.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global structural adhesives market in 2021. China is one of the world's largest consumers of structural adhesives.

- According to China's Five-Year Plan, unveiled in January 2022, the country's construction industry is estimated to register a growth rate of approximately 6% in 2022. China plans to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites.

- Moreover, as per the National Development and Reform Commission, the Chinese government approved 26 infrastructure projects with an estimated investment of around USD 142 billion. These projects are in progress and are estimated to be completed by 2023.

- China is the largest manufacturer of automobiles in the world. According to the OICA, the automotive production in the country reached 26.08 million in 2021, which increased by 3% compared to 25.23 million vehicles produced in 2020. The increase in automotive production is estimated to drive the demand for structural adhesives, especially in the high-end vehicle manufacturing sector.

- Furthermore, as per the Stockholm International Peace Research Institute (SIPRI), China, the world's second-largest spender on the military after the United States, allocated an estimated USD 293 billion to its military in 2021. This was an increase of 4.7% compared to 2020. The 2021 Chinese budget was the first under the 14th Five-Year Plan, which runs until 2025.

- India's massive construction sector is expected to become the world's third-largest construction market by 2022. Various policies implemented by the Indian government, such as the Smart Cities project and Housing for all by 2022, are expected to prove an impetus to the slowing construction industry.

- The automotive and aerospace sectors are the other significant users of structural adhesives. According to OICA, around 4,399,112 vehicles were produced in India in 2021, which increased by 30% compared to 3,381,819 units in 2020.

- The factors above are expected to affect the demand for structural adhesives in the Asia-Pacific region over the forecast period.

Structural Adhesives Industry Overview

The global structural adhesives market is partially fragmented in nature, with the presence of various international and domestic players. Some of the major players include Henkel AG & Co. KGaA, Sika AG, 3M, H.B. Fuller Company, and Arkema (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Investments in Developing Economies in Asia-Pacific

- 4.1.2 Increasing Demand from the Global Construction and Automotive Sectors

- 4.2 Restraints

- 4.2.1 Growing Environmental and Health Concerns

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Cyanoacrylate

- 5.1.5 Methyl Methacrylate

- 5.1.6 Other Resin Types

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive

- 5.2.3 Aerospace

- 5.2.4 Wind Energy

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Bondloc UK Ltd

- 6.4.4 DuPont

- 6.4.5 Engineered Bonding Solutions LLC

- 6.4.6 Forgeway Ltd

- 6.4.7 H. B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Illinois Tool Works Inc.

- 6.4.11 LG Chem

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 Sika AG

- 6.4.14 RS Industrial

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research on Underwater Structural Adhesives