|

市場調查報告書

商品編碼

1443947

基於 MEMS 的振盪器:市場佔有率分析、行業趨勢和統計數據、成長預測 (2024-2029)MEMS-based Oscillator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

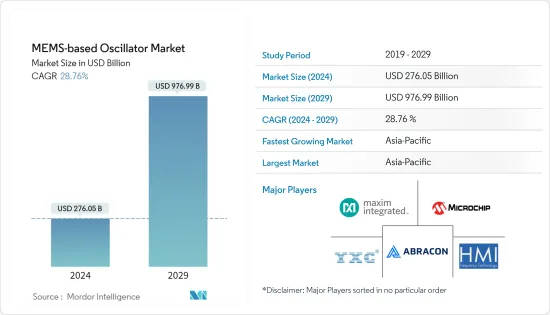

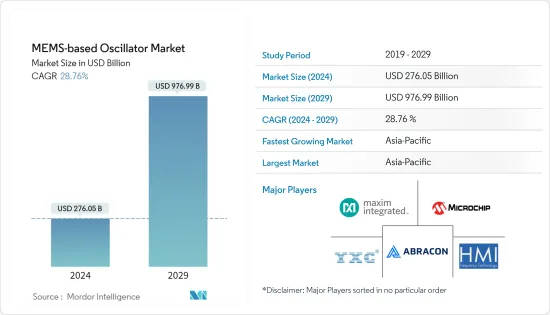

基於MEMS的振盪器市場規模預計到2024年為2760.5億美元,預計到2029年將達到9769.9億美元,在預測期內(2024-2029年)成長28.76%。年複合成長率為

由於全球最終用途產業對產品的需求不斷增加,基於 MEMS 的振盪器市場正在加速發展。

主要亮點

- 基於 MEMS 的振盪器是一種計時設備,有助於創建可用於測量瞬時的高度穩定的參考頻率。這些比較頻率經常用於管理資訊交流、評估計時、描述無線電頻率和訂購電子設備。

- MEMS 和矽基技術可在較寬的頻率範圍內運作,不易受到頻率跳躍的影響,並且更能抵抗機械衝擊、振動和溫度變化。因此,該技術有助於開發緊湊、穩健、高效能和可程式設計的定時解決方案。

- 例如,Microchip 基於矽 MEMS 的振盪器 DSC1001 提供寬範圍的電源電壓和溫度,包括 1MHz 至 150MHz,電源電壓為 1.8 至 3.3 VDC,溫度範圍高達 -40°C 至 105°C。此裝置提供低抖動和 10ppm 的穩定性能。

- 開發基於 MEMS 的振盪器所涉及的高昂研發成本往往會限制活躍在市場上的公司數量,這可能會減少基於 MEMS 的振盪器的開發。市場上的老牌企業正在投入大量的研究和開發工作來設計和開發下一代矽計時系統解決方案。

- COVID-19的感染疾病嚴重影響了頻率控制設備的生產,導致汽車、消費電器產品和航太行業的成品出貨延遲。一家知名半導體工廠關閉,供應鏈受到嚴重影響。然而,由於微流體和壓力與 COVID-19 疾病相關,例如呼吸診斷和其他研究新型 COVID-19 疾病患者監測的研究工具,基於 MEMS 的振盪器設備正在受益。

基於 MEMS 的振盪器市場趨勢

消費性電器產品產業佔據主要市場佔有率

- 振盪器是一種電子電路,利用振動晶體(壓電材料)的機械共振來產生特定頻率的電訊號。基於 MEMS 的振盪器是基於可程式設計架構的完整計時系統。此外,由於電子設備的功能改進、性能提高和小型化,預計需求將會更大。振盪器對振盪進行調節,振盪是基於能量變化的兩個物體之間的週期性波動。電腦、智慧型手錶、行動系統和許多其他設備都使用基於 MEMS 的振盪器。

- 可攜式和穿戴式電子產品的興起增加了降低所有電子元件(尤其是振盪器)的能耗和占地面積的需求。基於電子機械系統 (MEMS) 技術的振盪器將精確的頻率產生與低功耗結合在一起,使其在時脈電路中越來越受歡迎。

- 基於 MEMS 的振盪器集低功耗、小尺寸、高性能和實體穩健性於一體,極具吸引力,使其成為眾多應用的理想選擇,尤其是可攜式和穿戴式電子產品。此外,行動電話、電腦、手錶、收音機和許多其他設備的成功依賴於電子振盪器,這些振盪器以精確的頻率提供輸出以產生定時脈衝並同步事件。

- 此外,泰藝科技也將在2022年5月推出超低電流晶振OZ-D和OY-D,電流消耗僅為1.4μA,低功耗設計、小尺寸,可應用於廣泛的應用領域。 ,且準確度高。用於穿戴式裝置和物聯網 (IoT) 裝置。

- MEMS 計時技術的創新極大地有助於節省穿戴式應用的實體空間和功耗,同時提高可靠性。由於該細分市場屬於消費者類別,因此這種情況下的成本構成了重大挑戰。此外,隨著 5G 網路部署的出現,尤其是在消費市場,家用電子電器對更緊湊、具有高頻能力、具有更低時序斜率的基於 MEMS 的振盪器的需求預計將會增加。

亞太地區預計將成為成長最快的市場

- 由於中國、日本、印度和韓國等國家的存在,亞太地區正成為一個主要的區域市場。這個區域外組織的基礎包括對健身活動、智慧型手錶和醫療監視器/設備等穿戴式科技不斷成長的需求。這一因素表明亞太地區基於 MEMS 的振盪器市場具有巨大的成長潛力。地區。

- 此外,該地區主導穿戴裝置的興起正在變得越來越流行。

- 豐富的原料供應以及較低的設置和人事費用也有助於企業在該地區建立研發和生產中心。例如,總部位於京都的電子製造商京瓷於 2021 年 1 月宣布,將在鹿兒島縣霧島的國分園區建立一個新的研發中心。

- 市場上的營運商也正在採取各種成長策略,例如收購和整合、新產品供應、合作、夥伴關係和業務擴張,以滿足市場需求並擴大客戶群。

基於 MEMS 的振盪器產業概述

基於 MEMS 的振盪器市場擁有具有後向和向前整合以及顯著產生收入能力的大型供應商。研究的市場高度整合,供應商越來越投入研發,以獲得技術力和相對於其他公司的競爭優勢。供應商競爭的是技術和質量,而不是價格。此外,大多數製造商依賴第三方代晶圓代工廠和組裝能力來製造和組裝其產品,導致對第三方代晶圓代工廠和組裝能力的激烈競爭。

2022 年 9 月:SiTime Corporation 推出基於該公司先進 MEMS 技術的專有汽車振盪器系列。重新設計的差分振盪器的耐用性提高了 10 倍,即使在惡劣的工作條件和溫度下也能確保 ADAS 的可靠性。最新汽車振盪器 AEC-Q100 SiT9396/7 的推出使 SiTime 的可用市場 (SAM) 增加了 5000 萬美元。

2022 年 7 月:Abracon LLC(Abracon)宣布 Genstar Capital 已收購該公司。 Genstar 是一家私募股權公司,專注於投資工業、金融服務、醫療保健和軟體產業的目標領域。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

- 採用基於 MEMS 的振盪器的重要考慮因素

第5章市場動態

- 市場促進因素

- 矽基製造與封裝技術的進步

- 市場挑戰

- 複雜的設計增加了研發成本

- 市場機會

- 5G的出現創造了對更好的計時設備的需求

第6章市場區隔

- 按類型

- 溫度補償振盪器 (TCXO)

- 頻譜振盪器 (SSXO)

- 電壓調節器振盪器 (VCXO)

- 數控振盪器 (DCXO)

- 其他類型

- 按最終用戶產業

- 車

- 航太和國防

- 家用電器

- 資訊科技和電信

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- Maxim Integrated Products Inc.(Analog Devices Inc.)

- Microchip Technology Inc.

- HMI Frequency Technology

- Shenzhen Yangxing Technology Co. Ltd

- Abracon LLC

- TXC Corporation

- SiTime Corporation

- Daishinku Corporation

- Rakon Limited

第8章投資分析

第9章市場的未來

The MEMS-based Oscillator Market size is estimated at USD 276.05 billion in 2024, and is expected to reach USD 976.99 billion by 2029, growing at a CAGR of 28.76% during the forecast period (2024-2029).

The MEMS oscillator market is accelerated due to increased demand for products from end-use industries worldwide.

Key Highlights

- MEMS oscillators are a class of timing apparatus that help create extremely stable reference frequencies that can measure moments. In order to manage information exchange, assess the timing, describe radio frequencies, and place orders for electronic devices, these comparison frequencies are frequently used.

- MEMS and silicon-based technologies also operate over a broad frequency range, are less sensitive to frequency jumps, and are highly resistant to mechanical shock, vibration, and temperature changes. As a result, this technology has been helpful for developing small-sized timing solutions that are also robust, high-performing, and programmable.

- For instance, the silicon MEMS-based oscillator DSC1001 from Microchip offers a broad range of supply voltages and temperatures, including 1MHz to 150MHz with supply voltages between 1.8 and 3.3 VDC and temperature ranges up to -40C to 105C. The device offers jitter and stability performance as low as 10ppm.

- The high R&D costs involved in the development of MEMS oscillator is poised to limit the number of companies operating in the market, which may lead to fewer developments of MEMS oscillators. The established players in the market put significant R&D efforts into designing and developing next-generation silicon timing systems solutions.

- The COVID-19 outbreak had a significant impact on the production of frequency control devices, causing delays in the shipping of finished goods across the automotive, consumer electronics, and aerospace industries. Due to the closure of well-known semiconductor factories, the supply chain was severely harmed. However, as microfluidics and pressure are connected to COVID-19, including respiratory diagnostics and other research tools to study COVID-19 patient monitoring, MEMS-based oscillator devices for medical monitoring applications have benefited.

MEMS-Based Oscillator Market Trends

The Consumer Electronics Segment Holds Significant Market Share

- Oscillators are electronic circuits that develop an electrical signal of a particular frequency by utilizing the vibrating crystal's (piezoelectric material) mechanical resonance. MEMS oscillators are complete timing systems based on a programmable architecture. It further witnesses significant demand aided by improved functionality, enhanced performance, and electronic device miniaturization. An oscillator works on the regulations of oscillation, a periodic fluctuation between two things based on energy changes. Computers, smartwatches, mobile systems, and many other devices use MEMS oscillators.

- The rise in portable and wearable electronics drives the need to reduce the energy consumption and footprint of all electronic components, especially oscillators. Oscillators based on Micro-Electro-Mechanical Systems (MEMS) technology combine accurate frequency generation with low power consumption and are becoming increasingly popular in clock circuits.

- MEMS oscillators offer an appealing combination of low power consumption, small size, high performance, and physical robustness, making them ideal for numerous applications, specifically in portable and wearable electronics. Further, cell phones, computers, watches, radios, and many other devices depend on their success on an electronic oscillator that delivers the output with a precise frequency to develop timing pulses and synchronize events.

- Moreover, in May 2022, TAITIEN launched ultra-low current crystal oscillators, OZ-D and OY-D, with current consumption of only 1.4μA, featuring a low power consumption design, small size, and high precision, that can be widely used in wearable gadgets and the Internet of Things (IoT) devices.

- Innovations across MEMS timing technology significantly contribute to physical space and power savings in wearable applications while improving reliability. Cost in such cases presents significant challenges as the segment falls into the consumer category. Further, with the advent of 5G network rollouts, particularly in consumer markets, the demand for compacter, higher frequency enabled, less timing slop-based MEMS oscillators for consumer electronics is expected to grow.

Asia-Pacific is Expected to be the Fastest Growing Market

- The Asia-Pacific is becoming a primary regional market, owing to the presence of countries such as China, Japan, India, and South Korea. The foundation of organizations based out of the region includes the rising demand for wearable technology such as fitness activities, smart watches, medical monitors/devices, etc. This factor indicates the considerable growth potential for the MEMS-based Oscillator Market in the Asia-Pacific region.

- In addition, intelligent wearables in the region are becoming fashionable as consumption upgrade is gaining momentum and tech-savvy consumers are willing to pay for such gadgets to embrace a more convenient and tech-driven life.

- The abundant availability of raw materials and the low establishment and labor costs have also helped companies launch their R&D and production centers in the region. For instance, Kyocera, a Kyoto, Japan-based electronics manufacturer, announced the construction of a new research and development center in January 2021 at its Kokubu campus in Kirishima City, Kagoshima, Japan.

- Players operating in the market have also adopted various growth strategies, such as acquisitions and integrations, new product offerings, collaborations, partnerships, and business expansions to accommodate the market's needs and expand their customer base.

MEMS-Based Oscillator Industry Overview

The MEMS-based oscillator market has large-scale vendors capable of backward and forward integration and significant revenue generation capabilities. The market studied is highly consolidated, and vendors increasingly spend on R&D to gain technological capabilities and a competitive edge over other enterprises. The vendors are competing on technology and quality but not on price. Also, there is significant competition for third-party foundry and assembly capacity as most manufacturers depend on this capacity's availability to manufacture and assemble their products.

In September 2022: SiTime Corporation unveiled a unique automotive oscillator series based on the company's sophisticated MEMS technology. The redesigned differential oscillators are ten times more durable and assure ADAS reliability in harsh driving conditions and temperatures. The debut of the newest automotive oscillator, AEC-Q100 SiT9396/7, extends the SiTime serviced available market (SAM) by USD 50 million.

In July 2022: Abracon LLC (Abracon) announced that Genstar Capital had acquired it. Genstar is a private equity firm focused on investments in targeted segments of the industrials, financial services, healthcare, and software industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Key Considerations for Adopting MEMS Oscillators

5 MARKET DYANAMICS

- 5.1 Market Drivers

- 5.1.1 Advancement in Silicon-based Manufacturing and Packaging Techniques

- 5.2 Market Challenges

- 5.2.1 Complex Designs Leading to High R&D Costs

- 5.3 Market Opportunities

- 5.3.1 Emergence of 5G creating Demand for Better Timing Devices

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Temperature Compensated Oscillator (TCXO)

- 6.1.2 Spread Spectrum Oscillator (SSXO)

- 6.1.3 Voltage Control Oscillator (VCXO)

- 6.1.4 Digitally Controlled Oscillator (DCXO)

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Consumer Electronics

- 6.2.4 IT and Telecom

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Maxim Integrated Products Inc. (Analog Devices Inc.)

- 7.1.2 Microchip Technology Inc.

- 7.1.3 HMI Frequency Technology

- 7.1.4 Shenzhen Yangxing Technology Co. Ltd

- 7.1.5 Abracon LLC

- 7.1.6 TXC Corporation

- 7.1.7 SiTime Corporation

- 7.1.8 Daishinku Corporation

- 7.1.9 Rakon Limited