|

市場調查報告書

商品編碼

1443941

智慧辦公室:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Office - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

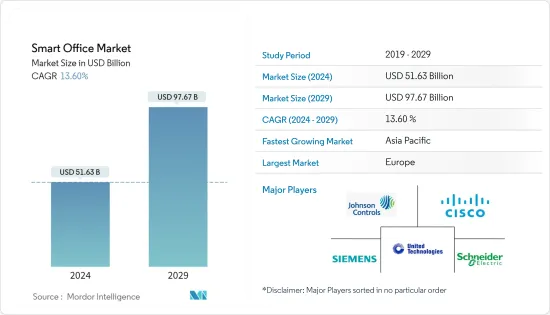

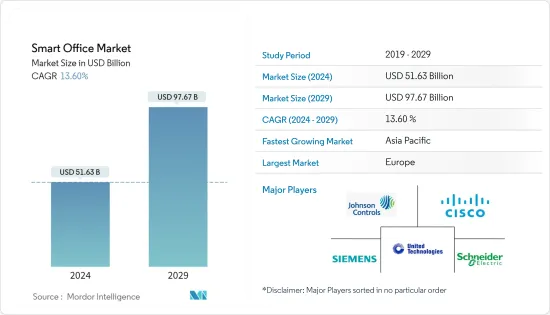

智慧辦公市場規模預計2024年為516.3億美元,預計到2029年將達到976.7億美元,在預測期內(2024-2029年)年複合成長率為13.60%成長。

該市場主要是由智慧辦公室解決方案、提高能源效率的感測器網路、有利的政府法規、創新辦公產品物聯網的進步以及職場對安全和安保系統不斷成長的需求等不斷成長的需求所推動的。

主要亮點

- 智慧城市的概念為物聯網在能源、廢棄物和基礎設施領域展現了巨大的前景。智慧家庭作為智慧城市的重要組成部分,具有許多優勢。目前正在進行的多個智慧城市計劃和舉措預計將於 2025 年完成。預計全球將有約30個智慧城市,其中50%預計位於北美和歐洲。

- 據經合組織稱,這些努力得到了全球投資的支持,預計從2010年到2030年,全球投資將達到約1.8兆美元(用於城市的所有基礎設施計劃)。對數位化基礎設施的投資預計將增加保護這些資產的需求。

- 此外,受全球網路普及不斷提高的影響,在提供更多奢華的商業場所建立更現代化的基礎設施,推動了市場的成長。例如,資料報告顯示,截至2022年4月,超過50億人在使用網際網路,佔全球人口的63.1%。

- COVID-19 的爆發使公司能夠為職場提供先進且技術現代化的設備。隨著公司轉向智慧混合運作模式,對智慧工作場所的需求不斷增加。這些公司專注於透過實體和虛擬空間、人員和技術無縫整合工作,從而獲得更好、更快的結果。

- 監測室內空氣品質是疫情引發的主要問題之一。人工智慧驅動的佔用感測器和信標收集有關職場人數以及一天中不同時間不同空間使用情況的資料。由於它們與主系統相連,因此基礎技術可確保有效利用工作空間和能源,同時降低二氧化碳水平並減少排放。透過使用智慧空氣清淨器,公司可以最大限度地降低空氣傳播病毒的風險,同時提高員工安全並實現永續性目標。

智慧辦公室市場趨勢

能源管理系統預計將佔據最大佔有率

- 能源管理系統因其更集中和易於使用而在世界各地廣泛使用。此外,它在能源使用追蹤方面的廣泛應用正在獲得一些公司的認可。此外,它還有助於提高雇主和工人的生產力、便利性和效率。

- 人們越來越認知到建築物在氣候變遷中日益重要的作用,這正在改變投資者和業主的偏好,促使他們提高設施的性能以保持競爭力,特別是在商業辦公室領域。例如,美國的建築物消耗了全國近四分之三的電力,並佔所有溫室氣體排放的39%。

- 組織擴大採用 EMS 來最佳化能源消耗、利用動態定價並控制需求,從而降低整體成本。大型企業需要多種形式的能源來運作各種業務,例如為通訊網路、現代電腦設備、資料設備和光纖傳輸網路供電。

- 主要由於 COVID-19 大流行的爆發,邊緣人工智慧等現代創新在已開發國家和新興國家都變得非常受歡迎。靈活的工作環境和輪班制的流行促進了智慧建築管理運動的發展。建築管理系統 (BMS) 也越來越受到邊緣人工智慧的青睞,以提高居住者的舒適度、減少能源消耗並提高安全性。

- 此外,全球技術領導者不斷創新預計將在預測期內支持市場擴張。例如,三星電子於 2022 年 4 月與 ABB 建立合作,擴大三星 SmartThings 在住宅和其他結構中的使用。

北美佔有很大佔有率

- 北美地區憑藉豐富的技術基礎設施在全球智慧辦公市場佔據主導地位。因此,在北美已開發國家,智慧辦公產業預計在未來幾年將呈現良好的發展速度。例如,美國在世界經濟論壇的整體基礎設施發展方面排名第13位。

- 網路監控在該地區已廣泛應用,多家市場製造商提供基於網路監控和安全資料的安全和存取控制解決方案。根據 CompTIA 的數據,54% 的美國參與者將網路監控視為其 2021 年安全政策的一部分。

- 美國是世界上最早採用物聯網(IoT)等新興技術的國家之一,該技術正在涵蓋包括智慧辦公室在內的多個產業。物聯網領域(尤其是辦公室)的技術進步,加上對安保和安全系統的需求不斷成長,預計將推動美國市場的成長。

- 此外,消費者技術協會報告稱,物聯網消費設備在智慧型手機中的普及正在增加,這正在擴大美國的智慧工作場所市場。例如,GSMA Intelligence 預測,到 2025 年,北美的物聯網連線數將超過 54 億個。

- 推動智慧建築採用的因素之一是政府法規在整合創新技術時有利於辦公部門。此外,未來的市場開拓預計將得到政府和企業進一步重大投資的支持,以使辦公結構更適合員工。

智慧辦公室產業概況

智慧辦公市場競爭激烈,由幾個主要企業組成。這些公司利用策略合作舉措和創新來增加市場佔有率和盈利。主要公司包括江森自控國際有限公司、思科系統公司、聯合技術公司、西門子公司和施耐德電氣公司。

Arthur 是一家領先的虛擬實境 (VR) 辦公室供應商,使公司能夠建立具有創新、真正現實和協作環境的大型虛擬工作場所,該公司於 2022 年 10 月宣布,虛擬辦公室宣佈在我們的平台上添加“New Realities” 。在亞瑟的虛擬職場中,新現實升級支援早期的混合實境 (MR) 功能。這些功能允許使用者將真實的辦公桌和電腦傳輸到VR並享受世界穿越功能。

2022年9月,華為推出了下一代HUAWEI IdeaHub S2,這是業界首款運行HarmonyOS的智慧型設備,旨在徹底改變沙烏地阿拉伯組織的協作和連接。 HUAWEI IdeaHub S2 的自備會議 (BYOM)架構讓您隨時隨地提供創新、智慧的會議體驗,為您的組織提升消費者價值和服務效率。

2022 年 9 月,TD SYNNEX 宣佈在 Azure 上推出 IAconnects MobiusFlow 即點即用。這簡化了部署系統(包括硬體、應用程式和基礎設施)來運作智慧建築的困難過程。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

第5章市場動態

- 市場促進因素

- 人們越來越關注辦公空間的能源效率

- 快速發展的商業基礎設施

- 市場限制因素

- 與物聯網和智慧設備相關的安全問題

- 舊建築維修成本上升

- 評估 COVID-19 對產業的影響

第6章市場區隔

- 產品

- 安全和存取控制系統

- 能源管理系統

- 智慧暖通空調控制系統

- 音訊和視訊會議系統

- 消防安全管理體系

- 其他產品

- 建築類型

- 復古裝修

- 新建築

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Johnson Controls International PLC

- Cisco Systems Inc.

- United Technologies Corp.

- Siemens AG

- Schneider Electric SE

- Koninklijke Philips NV

- Honeywell International Inc.

- ABB Ltd.

- Lutron Electronics Co. Inc.

- Crestron Electronics Inc.

第8章投資分析

第9章市場的未來

The Smart Office Market size is estimated at USD 51.63 billion in 2024, and is expected to reach USD 97.67 billion by 2029, growing at a CAGR of 13.60% during the forecast period (2024-2029).

The market is primarily driven by factors such as the rise in demand for intelligent office solutions, sensor networks for energy efficiency, favorable government regulations, advancement of IoT in innovative office offerings, and the growing need for safety and security systems at the workplace.

Key Highlights

- The concept of smart cities marked a great prospect with the Internet of Things in the energy, waste, and infrastructure sectors. A smart home, a significant part of a smart city, offers several benefits. Several ongoing smart city projects and initiatives are expected to be completed by 2025. It is expected that there will be about 30 global smart cities, and 50% of these are expected to be located in North America and Europe.

- According to the OECD, these steps are supported by global investments, which are expected to be about USD 1.8 trillion from 2010-2030 (for all infrastructure projects in urban cities). The investment in digitized infrastructure is expected to drive the demand for securing those assets.

- Additionally, the construction of more modern infrastructure at business locations, which offers greater luxury, is influenced by the rising worldwide internet penetration, thus boosting the market growth. For instance, data reportal shows more than five billion people used the internet as of April 2022, making up 63.1% of the world's population.

- The COVID-19 outbreak has enabled companies to provide advanced and technologically updated facilities at the workplace. As companies increasingly shift to a smart hybrid working model, the demand for a smart workplace is witnessing growth. These companies are focusing on the seamless integration of work through physical and virtual space, people, and technology which thereby yields better and faster output.

- Monitoring indoor air quality is one key concern emerging from the pandemic. AI-driven occupancy sensors and beacons gather data about the number of people in the workplace, as well as how different spaces are being used at different times. As these are linked to the main system, the underlying technology ensures workspaces and energy are used efficiently, lowering CO2 levels and decreasing emissions simultaneously. With smart air purifiers, companies are minimizing the risk of airborne viruses while making workers feel safer and meeting their sustainability goals simultaneously.

Smart Office Market Trends

Energy Management System Expected to Hold Largest Share

- Energy Management Systems are extensively used around the world due to their improved focus and ease. Additionally, their expanding use for energy use tracking is gaining acceptance throughout several businesses. Additionally, it aids in improving both employers' and workers' productivity, convenience, and efficiency.

- The rising cognizance regarding a building's growing role in climate change is shifting investors' and owners' preferences, thus urging them to improve the performance of their facilities to stay competitive, specifically in the commercial office segment. For instance, buildings in the United States consume nearly three-quarters of the country's electricity and are responsible for 39% of all greenhouse gas emissions.

- Organizations are increasingly adopting EMS for optimization of energy consumption, utilization of dynamic pricing tariffs, and demand control, thus reducing overall costs. Large-scale companies require energy in various forms to perform diverse operations, including powering telecom networks, modern computer equipment, data equipment, and optical transport networks.

- Modern innovations like edge AI have become very popular in both developed and developing countries, primarily due to the COVID-19 pandemic's outbreak. The popularity of flexible work environments and revolving class schedules contributed to the growth of the intelligent buildings management movement. Building management systems (BMS) have also been highlighted by edge AI in order to improve occupant comfort, reduce energy usage, and boost safety.

- Additionally, rising innovations by technology leaders globally are anticipated to support market expansion during the projected period. For instance, Samsung Electronics established cooperation with ABB in April 2022 to expand the use of Samsung SmartThings in houses and other structures.

North America to Hold Significant Share

- The North American region dominates the global market for smart offices because of the greater technological infrastructure. As a result, in the developed nations of North America, the smart office industry is anticipated to show a favorable development rate in the years to come. For instance, in terms of total infrastructure development, the United States is ranked 13th by the World Economic Forum.

- The region is seeing widespread use of network monitoring, with several marketplace manufacturers providing security and entry control solutions based on networking monitoring and security data. As per CompTIA, 54% of participants in the United States see Network Monitoring as a component of their security policy in 2021.

- The United States is one of the early adopters of emerging technology across the world, including the internet of things (IoT), which is incorporated in several industries, including intelligent offices. The technological advancement in the IoT field, particularly for offices, coupled with the rising need for security and safety systems, is anticipated to propel market growth in the United States.

- Additionally, the Consumer Technology Association reports that the IoT consumer device penetration on smartphones is rising, which is expanding the market for smart workplaces in the United States. For instance, GSMA Intelligence predicts that in 2025, there will be more than 5.4 billion IoT connections in the North American region.

- One of the elements propelling the adoption of smart buildings is government rules favorable to the office sector when integrating innovative technology. Furthermore, future market development is anticipated to be supported by the government and companies making more significant investments in office structures to make them more employee-friendly.

Smart Office Industry Overview

The smart office market is highly competitive and consists of several major players. These companies leverage strategic collaborative initiatives and innovation to increase their market share and profitability. Major players include Johnson Controls International PLC, Cisco Systems Inc., United Technologies Corp., Siemens AG, and Schneider Electric SE.

In October 2022, Arthur, a leading virtual reality (VR) office supplier that allows businesses to establish large-scale virtual workplaces with innovative, truly realistic, and collaborative settings, announced the addition of 'New Realities' to its virtual office platform. In Arthur's virtual workplaces, the New Realities upgrade enables the initial generation of Mixed Reality (MR) functionality. These capabilities enable users to transport their actual desk and computer into VR and leverage the global passthrough functionality.

In September 2022, Huawei introduced its Next-Generation HUAWEI IdeaHub S2 - the sector's first intelligent device to operate on HarmonyOS - in an effort to revolutionize cooperation and connectivity for Saudi organizations. HUAWEI IdeaHub S2's Bring Your Own Meeting (BYOM) architecture enables it to provide creative and intelligent meeting experiences anytime and from any location, increasing consumer value and service effectiveness for organizations.

In September 2022, TD SYNNEX revealed the availability of IAconnects MobiusFlow Click-to-Run on Azure, which streamlines the difficult process of deploying a system that includes hardware, application, and infrastructure to operate smart buildings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Energy Efficiency in Office Spaces

- 5.1.2 Rapidly Developing Business Infrastructure

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to IoT and Smart Devices

- 5.2.2 Higher Costs of Refurbishment of Old Buildings

- 5.3 Assessment of the Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Security and Access Control System

- 6.1.2 Energy Management System

- 6.1.3 Smart HVAC Control System

- 6.1.4 Audio-Video Conferencing System

- 6.1.5 Fire and Safety Control System

- 6.1.6 Other Products

- 6.2 Building Type

- 6.2.1 Retrofits

- 6.2.2 New Buildings

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Australia

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls International PLC

- 7.1.2 Cisco Systems Inc.

- 7.1.3 United Technologies Corp.

- 7.1.4 Siemens AG

- 7.1.5 Schneider Electric SE

- 7.1.6 Koninklijke Philips NV

- 7.1.7 Honeywell International Inc.

- 7.1.8 ABB Ltd.

- 7.1.9 Lutron Electronics Co. Inc.

- 7.1.10 Crestron Electronics Inc.