|

市場調查報告書

商品編碼

1443908

實驗室化學品:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Laboratory Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

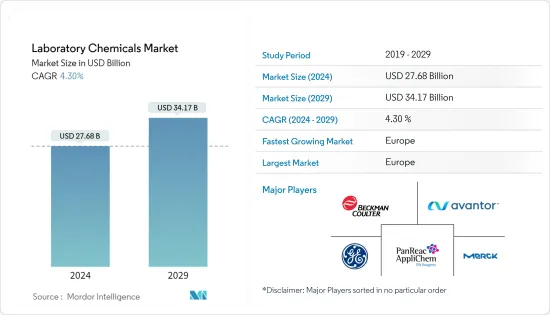

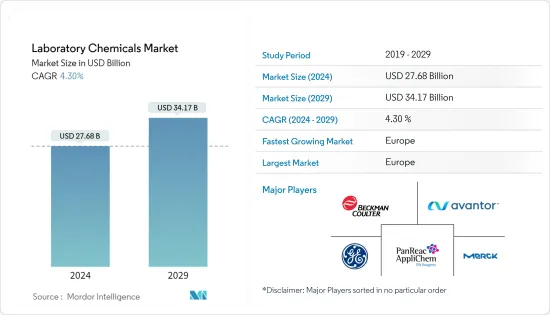

實驗室化學品市場規模預計到 2024 年為 276.8 億美元,預計到 2029 年將達到 341.7 億美元,在預測期內(2024-2029 年)增加 43 億美元,年複合成長率為 %。

冠狀病毒感染疾病(COVID-19)的爆發對2020年的市場產生了負面影響。然而,自那時以來,市場已達到疫情前的水平,預計在預測期內將穩定成長。

主要亮點

- 實驗室化學品市場是由生物和化學科學領域的研發活動的成長以及污水處理中的使用量的增加所推動的。

- 然而,實驗室化學品替代品的可用性可能會阻礙市場成長。

- 細胞培養、重組 DNA、生物療法和奈米材料開發等技術的進步預計將成為未來的市場機會。

- 由於研發活動的增加,預計歐洲地區將主導市場。

實驗室化學品市場趨勢

工業應用展現出更高的成長潛力

- 實驗室化學品廣泛用於各種工業製程,從溴化到許多低溫反應。

- 最常見的實驗室化學過程包括醯氯製備、羧基化、離子交換反應、硝化、Suzuki 偶聯和 Williamson 醚合成。

- 這些化學物質對於生產各種商業產品的結晶和蒸餾過程至關重要。

- 農業產量的增加增加了全球市場對硫酸的需求。到 2026 年,最不開發中國家的可用熱量預計將達到平均每天 2,450 大卡,其他新興國家將超過 3,000 大卡。預計這將增加全球市場對作物的需求,進而可能增加對農業研究的需求,並增加化學製造中對實驗室化學品的需求。

- 目前,美國擁有全球最大的醫療設備產業。根據美國商務部國際貿易管理局 (ITA) 的 SelectUSA 計劃,該國的醫療設備醫療設備是全球最大的,估計價值 1,560 億美元。

- 根據美國公佈的資料。根據 CMS 的數據,醫療保健支出預計在預測期內將大幅增加。

- 為了職業安全、職業安全和事故預防,研發部門不斷增加投資,以開發永續對環境風險較小的新化學品。因此,由於工業部門需求的成長,實驗室化學品的需求預計也會增加。

歐洲地區預計將主導市場

- 多年來,義大利工業發生了巨大變化,變得更加面向國際市場並更具競爭力。

- 義大利擁有世界上最大的化學品市場之一。該國的化學品收入在歐盟排名第三,佔該地區化學品銷售額的11%以上。義大利不僅是主要的化學品生產國,也是國際主要的化學品出口國。

- 其重點主要集中在中高技術領域(製藥、機械、化工等)。即使在傳統領域,義大利工業也非常注重創新,專利申請的快速成長就證明了這一點。

- 近年來,義大利醫藥工業在生產、投資和貿易方面都有顯著成長。 CDMO(合約開發製造組織)是義大利製藥業的主要結構,它透過將生產階段外包給第三方設施來實現產量的高速成長。

- 德國醫藥市場被世界領先的醫藥製造公司視為最有前途的子部門,這些公司正在向德國擴張,以鞏固其在全球市場的地位。例如,2022年8月,全球重要製藥公司拜耳投資2.8698億美元在其位於德國勒沃庫森的工廠開發Solida-1藥品生產設施。該工廠計劃於 2024 年開始運作,專注於生產治療癌症和心血管疾病的藥物。

- 愛爾蘭是著名的製藥中心,佔全球藥品產量的 5% 以上。愛爾蘭製藥業多年來的發展以世界上最大的九家製藥公司的存在為標誌,其中愛爾蘭能夠生產世界銷售額前十名的製藥公司中的七家。此外,該產業還受惠於 10 年間投資約 80 億美元建設新設施。

- 義大利有超過5000家製藥公司,主要企業包括Menarini、Chiesi、Angelini、Bracco、Recordati和Alfasigma。為因應市場需求的逐步持續成長,這些企業近十年來維持產值持續成長。

- 受惠於稅收優惠,義大利製造業開始維修各類生產工廠,尤其是與工業4.0技術相關的工廠。所有這些發展預計將在預測期內增加對實驗室化學品的需求。

實驗室化學品行業概況

由於全球和本地公司的存在,實驗室化學品市場預計將部分分散。實驗室化學品市場公認的主要公司包括(排名不分先後)ITW Reagents Division、Merck KGaA、Beckman Coulter Inc.、General Electric 和 Avantor Inc. 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大生物和化學領域的研發活動

- 污水處理用量增加

- 其他司機

- 抑制因素

- 實驗室化學品替代品的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 類型

- 分子生物學

- 細胞激素和趨化素測試

- 碳水化合物分析

- 免疫化學

- 細胞/組織培養

- 環境測試

- 生物化學

- 其他類型

- 目的

- 工業的

- 學術/教育

- 政府

- 醫療保健(製藥)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Avantor Inc.

- BD BioScience

- Beckman Coulter Inc.

- BiosYnth SRL

- Carlo Erba Reagents SRL

- GE Healthcare

- ITW Reagents Division

- Merck KGaA

- Meridian Life Science Inc.

- Mitsubishi Rayon Co. Ltd

- Morphisto GmbH

- PerkinElmer Inc.

- R&D Systems

- Sigma-Aldrich Corp.

- UJIFILM Wako Chemicals

第7章市場機會與未來趨勢

- 細胞培養、重組DNA和生物治療等技術的進步

- 增加奈米材料開發的研究活動

The Laboratory Chemicals Market size is estimated at USD 27.68 billion in 2024, and is expected to reach USD 34.17 billion by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

The COVID-19 outbreak negatively impacted the market in 2020. However, the market has since reached pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- The laboratory chemicals market is driven by growing R&D activities in the field of biological and chemical sciences and increasing usage in wastewater treatment.

- However, the availability of substitutes for laboratory chemicals is likely to hinder the market's growth.

- Advancements in technologies, such as cell culture, recombinant DNA, and biotherapeutics, and the development of nanomaterials are projected to act as an opportunity for the market in the future.

- Due to increasing research and development activities, Europe region is expected to dominate the market.

Laboratory Chemicals Market Trends

Industrial Application to Witness the Higher Potential Growth

- Laboratory chemicals are extensively used in various industrial processes, ranging from bromination to numerous cryogenic reactions.

- Some of the most common laboratory chemical processes include acid chloride preparations, carboxylation, ion-exchange reactions, nitration, Suzuki coupling, and Williamson's ether synthesis.

- These chemicals are essential to manufacture various commercial products in re-crystallization and distillation processes.

- Increasing agricultural output is boosting the demand for sulphuric acid in the global market. By 2026, calorie availability is projected to reach 2,450 kcal on average in least-developed countries and exceed 3,000 kcal per day in other developing countries. This is expected to increase the demand for crops in the global market, which, in turn, may increase the demand for agricultural research, thus, driving up the need for laboratory chemicals in chemical manufacturing.

- Currently, the United States is the largest medical device industry in the world. According to SelectUSA, a program by The International Trade Administration (ITA), US Department of Commerce, the medical devices market in the country is the largest medical devices market in the world, which is valued at USD 156 billion and is estimated to reach USD 208 billion by 2023.

- As per data published by the United States; CMS (Office of the Actuary), healthcare expenditure is expected to increase significantly during the forecast period.

- Occupational and industrial safety and disaster prevention have led to increasing investments in the R&D department to formulate new chemicals that are equally sustainable and less hazardous to the environment.

- Hence, growing demand from the industrial sector is expected to increase the demand for laboratory chemicals.

Europe Region is Expected to Dominate the Market

- The Italian industry has changed significantly over the years, orienting itself toward international markets and strengthening its competitiveness.

- Italy has one of the world's largest chemical marketplaces. The country has the third-largest chemical revenue in the European Union, accounting for above 11% of regional chemical sales. Aside from being a major chemical producer, Italy is also a major chemical exporter internationally.

- Its focus has been mainly on medium to high-technology sectors (such as pharmaceuticals, mechanics, and the chemical industry). Even in the traditional sectors, the Italian industry focused on strong innovation, as evidenced by the sharp increase in patent applications.

- The Italian pharmaceutical industry has grown considerably in production, investments, and trade over recent years. CDMO (Contract Development Manufacturing Organization) is the main structure of the Italian pharmaceutical industry, which functions by outsourcing production stages to third-party facilities, thereby enabling high production growth.

- The pharmaceutical market in Germany is identified as a top-prospect sub-sector by world-leading pharmaceutical manufacturing companies, which are expanding into the country to strengthen their position in the global market. For instance,

- In August 2022, the critical global pharmaceutical player, Bayer, is undergoing the development of the Solida-1 pharmaceutical production facility at its site in Leverkusen in, Germany, for an investment of USD 286.98 million. The facility, which is expected to come on stream in 2024, shall be dedicated to producing drugs for treating cancer and cardiovascular diseases.

- Ireland is a prominent pharmaceutical location contributing to more than 5% of global pharmaceutical production. The growth in Ireland's pharmaceutical sector over the years is marked by the presence of 9 of the world's largest pharmaceutical companies, enabling the country to produce 7 of the top 10 selling drugs globally. Further, the sector has benefitted from around USD 8 billion investment in setting up new facilities over the 10 years.

- Italy boasts over 5,000 pharmaceutical companies, with top players including Menarini, Chiesi, Angelini, Bracco, Recordati, and Alfasigma, among others. Responding to the gradual and continuous rise in market demand, these companies have maintained continued growth in production value through the last decade.

- The Italian manufacturing sector has started renovating various production plants, particularly concerning Industry 4.0 technologies, supported by tax incentives.

- All such developments are expected to boost the demand for laboratory chemicals during the forecast period.

Laboratory Chemicals Industry Overview

The laboratory chemicals market is estimated to be partially fragmented, with the presence of global and local players. Major recognized players in the laboratory chemicals market (not in any particular order) include ITW Reagents Division, Merck KGaA, Beckman Coulter Inc., General Electric, and Avantor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing R&D Activities in the Field of Biological and Chemical Sciences

- 4.1.2 Increasing Usage in Wastewater Treatment

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Laboratory Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Molecular Biology

- 5.1.2 Cytokine and Chemokine Testing

- 5.1.3 Carbohydrate Analysis

- 5.1.4 Immunochemistry

- 5.1.5 Cell/Tissue Culture

- 5.1.6 Environmental Testing

- 5.1.7 Biochemistry

- 5.1.8 Other Types

- 5.2 Application

- 5.2.1 Industrial

- 5.2.2 Academia/Educational

- 5.2.3 Government

- 5.2.4 Healthcare (Pharmaceutical)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avantor Inc.

- 6.4.2 BD BioScience

- 6.4.3 Beckman Coulter Inc.

- 6.4.4 BiosYnth SRL

- 6.4.5 Carlo Erba Reagents SRL

- 6.4.6 GE Healthcare

- 6.4.7 ITW Reagents Division

- 6.4.8 Merck KGaA

- 6.4.9 Meridian Life Science Inc.

- 6.4.10 Mitsubishi Rayon Co. Ltd

- 6.4.11 Morphisto GmbH

- 6.4.12 PerkinElmer Inc.

- 6.4.13 R&D Systems

- 6.4.14 Sigma-Aldrich Corp.

- 6.4.15 UJIFILM Wako Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Technologies, such as Cell Culture, Recombinant DNA, and Biotherapeutics

- 7.2 Increasing Research Activities for Development of Nanomaterials