|

市場調查報告書

商品編碼

1443905

軟性顯示器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Flexible Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

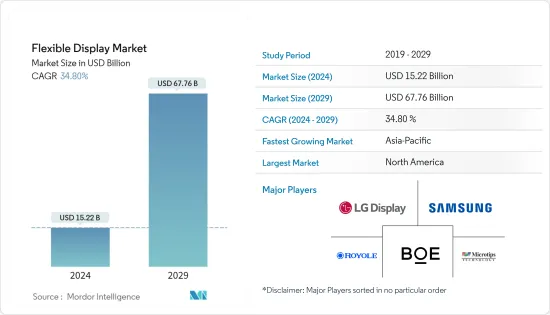

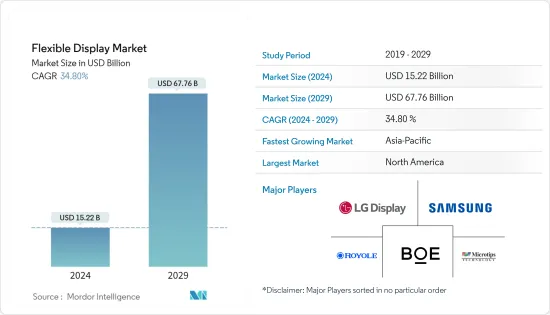

預計2024年軟性顯示器市場規模為152.2億美元,預計2029年將達到677.6億美元,預測期間(2024-2029年)年複合成長率為34.80%。

智慧型手機和穿戴式裝置、連網型技術和其他智慧家庭產品的需求不斷成長是推動軟性顯示器技術需求的主要因素。

主要亮點

- 與傳統顯示技術相比,軟性顯示器具有許多優勢。輕質、可彎曲、超薄、防碎、不易破碎、方攜帶帶、低能耗。雖然曲面顯示器在視角和影像品質深度方面比平面顯示器有了顯著改進,但它們與軟性和可折疊顯示器不同。

- 軟性顯示器最重要的優點是耐用性。由於螢幕可以彎曲和操縱,因此它比目前使用的固體玻璃結構更能吸收跌落和碰撞的衝擊力。未來軟性顯示器的其他潛在應用包括整合到服裝中,根據周圍環境立即改變顏色或圖案。這一潛力的實現預計將顯著增加對軟性顯示器的需求。

- 智慧型手機市場正在推動全球對軟性螢幕的需求。因此,各個供應商都加大了對智慧型手機領域的關注。除此之外,該供應商還致力於增加其在電視和電腦(筆記型電腦和桌上型電腦螢幕)領域的影響力,並相應地創新其產品。例如,2021年1月,TCL華星在CES 2021上發表了兩款創新產品:6.7吋AMOLED可捲動顯示器和17吋印刷OLED捲動顯示器。

- OLED 顯示器類型由於其簡單的設計、出色的影像品質和有限的彈性而最近變得流行。 OLED 螢幕不需要背光,可以做得很薄並模製成特定的形狀。目前,OLED 顯示器類型對於電視和電腦顯示器等大螢幕來說價格昂貴。然而,該細分市場仍享有規模經濟。

- 預計最初的市場需求將來自亞太地區、北美和歐洲消費電子產業的新興國家,而軟性 OLED 顯示器的採用將推動市場的發展。軟性OLED被認為是下一代智慧型手機市場的最佳解決方案之一,即使在需求較低的市場,這種顯示技術也正在贏得市場佔有率。

- 然而,可用性初始階段的成本和承受能力問題、複雜的製造流程、季節性需求模式和不確定的經濟前景可能會阻礙預測期內的市場成長。

- 冠狀病毒感染疾病(COVID-19)對市場產生了負面影響,特別是在大流行的早期階段,因為各國實施的封鎖措施擾亂了行動電話和顯示器生產的供應鏈。然而,隨著智慧型手機、筆記型電腦等產品的高需求帶動消費性電子市場快速復甦,軟性顯示器市場預計在預測期內將進一步成長。

軟性顯示器市場趨勢

軟性顯示器在智慧型手機和平板電腦的採用迅速成長

- 儘管軟性顯示器的採用仍處於早期階段,但該技術因其具有許多優勢而被視為智慧型手機行業的下一個重大事件。例如,您可以在觀看影片內容時快速增加設備的尺寸,然後根據需要縮小尺寸以適合您的口袋。

- 此外,它還提高了設備的美觀性和功能性。例如,軟性顯示器可以為客戶在行動裝置上提供更好的多工處理能力。對於智慧型手機來說,折疊式顯示器可能會消除對平板電腦作為輔助設備的需求。顯示器是智慧型手機的視覺輸出表面,旨在承受彎曲、彎曲和扭曲。

- 各種研究人員正在努力提高軟性顯示器的可靠性和成本效率,從而促進新型顯示器的開發。例如,2021年4月,TCL開發了一種折疊捲概念,利用折疊式鉸鏈和從手機擴展到平板電腦的擴展機制,將6.87英寸行動電話變成10英寸平板電腦。該公司還展示了一款採用兩個鉸鏈的三折折疊式概念的智慧型手機設備(最大為 10 吋平板電腦)。這是一個獨特的概念,針對完全不同的用戶群。

- OLED 是一種新興的顯示技術,擴大應用於許多行動裝置。 OLED 是顯示器產業最新一代的技術,與老式 LED 和 LCD 相比,可提供卓越的性能和增強的光學特性。此外,三星、摩托羅拉和 LG 等智慧型手機製造商也擴大使用這些軟性 OLED 顯示器。

- 隨著智慧型手機用戶的增加,預計該行業將為軟性顯示器提供商創造重大機會。例如,根據愛立信的數據,截至年終,智慧型手機用戶約為63億,約佔所有行動電話用戶的77%。到 2027 年,這一數字預計將達到 78 億。

預計亞太地區將佔據重要市場佔有率

- 亞太地區正在成為軟性顯示器發展的領先地區,特別是在消費性電器產品產業。該地區國家,特別是東亞(中國、台灣、日本、韓國、新加坡)國家正在經歷穩定成長,主要與軟性顯示器有關。

- 隨著各行業的最終用戶強調高品質顯示器的重要性,亞太地區對 OLED 顯示器的需求不斷增加。材料技術的進步進一步促進了軟性顯示器和軟性電子產品產品新應用的開發,預計這些應用將在預測期內佔據市場需求和收益的重要佔有率。

- 區域市場受到市場參與者整合的推動,導致許多先進的顯示技術主導市場。此外,亞洲國家是顯示器製造晶圓代工廠的所在地,使該地區在市場上佔據主導地位。

- 亞太軟性顯示器市場的新興企業正在為其技術申請專利,這可能會加劇市場競爭。三星和 LG Display 等亞太地區領先的軟性顯示器製造商正在大力投資加強其生產設施,以推出新產品。

- 智慧型手錶等穿戴式裝置的出現也有望為市場提供需求產生動力。據思科系統公司稱,亞洲連網穿戴裝置數量預計將從 2021 年的 2.582 億台增至 2022 年的 3.11 億台。預計此類趨勢將支持預測期內的市場成長。

軟性顯示器行業概況

軟性顯示器市場適度分散,有許多地區和全球參與者。汽車應用中的軟性螢幕以及智慧型手機和電視的日益普及正在為軟性顯示器市場創造利潤豐厚的機會。為了進一步加強其在市場上的影響力,供應商正在增加研發支出,以使他們的技術更加可靠和更具成本效益。該市場的主要企業包括 LG Display、三星電子和京東方科技Group Limited。

- 2022年2月,京東方宣布開發出螢幕內支援的OLED軟性「N」形折疊式顯示技術,可實現向內和向外折疊式。據該公司介紹,該顯示器原型機採用了原始尺寸的 12.3 英寸軟性 AMOLED 顯示螢幕,可向外折疊至 8.6 英寸尺寸,向內折疊至可攜式5.6 英寸尺寸,具有性別差異。

- 2022年1月,軟性顯示器公司柔宇科技與領先的機器人公司CIOT達成策略夥伴關係。作為協議的一部分,CIOT將從柔宇科技採購感測器、軟性顯示器以及軟硬體整合解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵意強度

- 替代產品的威脅

- 產業價值鏈分析

- 技術簡介

- 新型冠狀病毒感染疾病對市場生態系的影響

第5章市場動態

- 市場促進因素

- 消費性電器產品創新

- 對更高影像品質的需求不斷成長

- 市場限制因素

- 更高的研發成本和高度活躍的市場

- 市場機會

第6章市場區隔

- 按顯示類型

- OLED

- 液晶

- EPD(電子紙顯示器)

- 其他顯示類型(LED)

- 按基板材質

- 玻璃

- 塑膠

- 其他基板

- 按用途

- 智慧型手機和平板電腦

- 智慧穿戴

- 電視數位電子看板系統

- 個人電腦和筆記型電腦

- 其他應用(車輛、大眾交通工具、智慧家電)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭形勢

- 公司簡介

- LG Display Co. Ltd

- Samsung Electronics Co. Ltd

- ROYOLE Corporation

- e-ink Holdings

- BOE Technology Group Co. Ltd

- Guangzhou Oed Technologies Co. Ltd

- FlexEnable Technology Limited

- Chunghwa Picture Tubes Ltd

- Huawei Technologies Co. Ltd

- Sharp Corporation

- Plastic Logic

- Innolux Corporation

- AU Optronics Corp.

- TCL Electronics Holdings Limited

- Microtips Technology

第8章投資分析

第9章市場的未來

The Flexible Display Market size is estimated at USD 15.22 billion in 2024, and is expected to reach USD 67.76 billion by 2029, growing at a CAGR of 34.80% during the forecast period (2024-2029).

The growing demand for smartphones and wearable devices, and the increasing demand for connected technologies and other smart home products, are major factors driving the demand for flexible display technology.

Key Highlights

- Flexible displays offer various advantages over conventional display technologies. They are lightweight, bendable, ultra-thin, shatter-proof, unbreakable, portable, and have low energy consumption. Although curved displays offer notable improvements over flat displays regarding viewing angle and depth of picture quality, they differ from flexible and foldable ones.

- The most significant advantage of flexible displays is their durability. Since this screen can be bent and manipulated, it tends to absorb fall and collision impact better than solid glass structures currently in application. Other potential applications of flexible displays in the future include the integration in clothing that changes color or pattern instantly as per the surroundings. The realization of this potential is expected to boost the demand for flexible displays significantly.

- The smartphone market drives the global demand for flexible screens. As a result, various vendors are increasing their focus on the smartphone segment. Apart from this, vendors are also focusing on enhancing their presence in the TV and computer (Laptops and Desktop screens) segment and innovating their product offerings accordingly. For instance, in January 2021, TCL CSOT launched two innovative products, a 6.7-inch AMOLED Rollable Display and a 17-inch Printed OLED Scrolling Display, at CES 2021.

- OLED display type has recently gained popularity due to its simplified design, better image quality, and limited flexibility. OLED screens do not involve backlighting and can be thinned and molded into specific shapes. OLED display types are currently expensive for large screens, such as televisions and computer monitors. However, they still gain benefits for economies of scale in this segment.

- Initial market demand is expected from emerging economies in the consumer electronics segment of APAC, North America and Europe, thereby driving the market due to the adoption of flexible OLED displays. As the flexible OLED is considered one of the best solutions for the next-generation smartphone market, this display technology is gaining shares even in a market with lesser demand.

- However, higher cost and affordability issues in the initial stage of availability, complex manufacturing processes, seasonal demand patterns, and uncertain economic outlook might hinder the market growth during the forecast period.

- COVID-19 had a detrimental influence on the market, especially during the initial phase of the pandemic as lockdown measures imposed across various countries disrupted the supply chain for phone and display production. However, with the consumer electronics market recovering quickly, driven by high demand for products such as smartphones, laptops, and so on, the flexible display market is expected to grow further during the forecast period.

Flexible Display Market Trends

Adoption of Flexible Display to Grow Significantly in Smartphones and Tablets

- Although the adoption of flexible displays is still in the nascent stage, the technology is considered the next big thing for the smartphone industry, as the technology offers many benefits. For example, it lets the user quickly increase the size of the device when watching video content and makes it smaller to fit in their pocket when needed.

- Additionally, it also provides more aesthetics and functionality to the device. For instance, flexible displays can give customers better multitasking capabilities on mobile devices. In the case of smartphones, foldable displays can eliminate the need for a tablet as a secondary device in some cases. The display is a visual output surface designed to withstand being folded, bent, and twisted in smartphones.

- Various researchers have been working on making flexible displays reliable and cost-effective, leading to the development of new displays. For instance, in April 2021, TCL developed a Fold 'n' Roll concept that transforms a 6.87-inch phone into a 10-inch tablet, using a folding hinge and extendable mechanism to expand from phone to tablet. The company also showcased the Tri-Fold foldable concept smartphone device (up to 10-inch tablet) that relies on two hinges, which is a unique concept and targets an entirely different user group.

- OLED is an emerging display technology that is increasingly being used in many mobile devices. OLEDs are the latest generation technology in the display industry and provide superior performance and enhanced optical characteristics compared to older LEDs and LCDs. Furthermore, smartphone manufacturers like Samsung, Motorola, and LG are increasingly using these flexible OLED displays.

- With the number of smartphone users increasing, the industry is expected to create significant opportunities for flexible display providers. For instance, according to Ericsson, at the end of 2021, there were about 6.3 billion smartphone subscribers, accounting for about 77 % of all mobile phone subscriptions. This number is expected to reach 7.8 billion in 2027.

Asia-Pacific is Expected to Hold a Significant Market Share

- The Asia-Pacific is emerging as a leading region for developing flexible displays, particularly in the consumer electronics industry; countries in the region, particularly those in East Asia (China, Taiwan, Japan, South Korea, and Singapore), share a steady growth primarily related to flexible displays.

- OLED displays are witnessing increased demand in the Asia Pacific region as end-users across various industry verticals emphasize the importance of high-quality displays. Advancements in material technologies are further driving the development of new applications of flexible displays and flexible electronics, which are expected to account for a significant share of the market demand and revenues over and beyond the forecast period.

- The regional market is driven by the consolidation of market players, resulting in many advanced display technologies dominating the market. Moreover, Asian countries are the base for display manufacturing foundries, which positions this region in a dominating market position.

- Emerging players in the Asia-Pacific's flexible display market are filing patents for their technology, which is likely to increase the competition in the market. The leading flexible display manufacturers of the Asia-Pacific region, such as Samsung, LG Display, and others, are investing considerably in enhancing their production facilities to introduce new products.

- The emergence of wearables, such as smartwatches, and other devices, are also expected to provide the market with the impetus for demand generation. According to Cisco Systems, the number of connected wearable devices in Asia is expected to reach 311 million in 2022, from 258.2 million in 2021. Such trends are expected to support the market's growth during the forecast period.

Flexible Display Industry Overview

The Flexible Display Market is moderately fragmented, with many regional and global players. Flexible screens in automotive applications, and the growing adoption of smartphones and televisions, provide lucrative opportunities in the flexible display market. To further consolidate their market presence, the vendors are increasing their R&D expenses to make the technology more reliable and cost-effective. Some of the key players in the market are LG Display Co., Samsung Electronics Co. Ltd, and BOE Technology Group Co.

- In February 2022, BOE announced the development of OLED flexible 'N' shaped foldable display technology support in a screen that can achieve internal and external folding. According to the company, the display prototype is equipped with the original size of 12.3 inches of flexible AMOLED display, which after an exterior fold can become 8.6 inches size, and then after an internal folding can become a portable form of 5.6 inches.

- In January 2022, Royole Corporation, a flexible display firm, signed a strategic partnership with CIOT, a leading robotics company. As part of the agreement, CIOT will purchase sensors, flexible display screens, and software and hardware integration solutions from Royole Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of COVID -19 on the Market Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Innovation in Consumer Electronics

- 5.1.2 Increase in Demand for Greater Picture Quality

- 5.2 Market Restraints

- 5.2.1 Higher R&D Cost and Highly Dynamic Market

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Display Type

- 6.1.1 OLED

- 6.1.2 LCD

- 6.1.3 EPD (Electronic Paper Display)

- 6.1.4 Other Display Types (LED)

- 6.2 By Substrate Material

- 6.2.1 Glass

- 6.2.2 Plastic

- 6.2.3 Other Substrate Materials

- 6.3 By Application

- 6.3.1 Smartphones and Tablets

- 6.3.2 Smart Wearables

- 6.3.3 Televisions and Digital Signage Systems

- 6.3.4 Personal Computers and Laptops

- 6.3.5 Other Applications (Vehicle, Public Transport, and Smart Home Appliances)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Display Co. Ltd

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 ROYOLE Corporation

- 7.1.4 e-ink Holdings

- 7.1.5 BOE Technology Group Co. Ltd

- 7.1.6 Guangzhou Oed Technologies Co. Ltd

- 7.1.7 FlexEnable Technology Limited

- 7.1.8 Chunghwa Picture Tubes Ltd

- 7.1.9 Huawei Technologies Co. Ltd

- 7.1.10 Sharp Corporation

- 7.1.11 Plastic Logic

- 7.1.12 Innolux Corporation

- 7.1.13 AU Optronics Corp.

- 7.1.14 TCL Electronics Holdings Limited

- 7.1.15 Microtips Technology