|

市場調查報告書

商品編碼

1443891

量子點:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Quantum Dots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

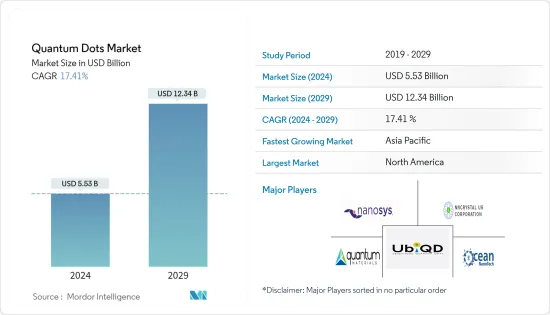

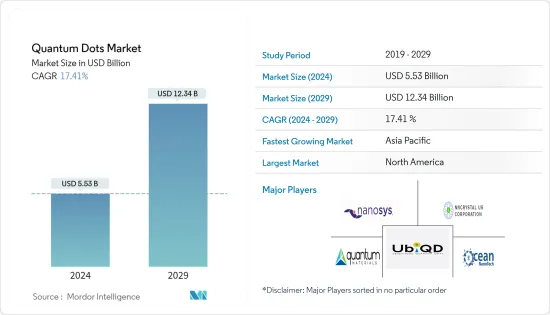

量子點市場規模預計2024年為55.3億美元,預計到2029年將達到123.4億美元,在預測期內(2024-2029年)年複合成長率為17.41%成長。

量子點因其理想的發射特性和奈米級尺寸而成為探測等離子體裝置的理想選擇。量子點(QD)可以用作量子電腦的構建塊,因為它們可以根據需要一次發射一個光子。對具有更好性能和高解析度的最佳化設備的需求不斷成長,以及對小型化技術的需求不斷成長,是所研究市場成長的關鍵驅動力。

主要亮點

- 鎘基量子點已成為一種趨勢,具有寬紫外線激發、明亮的光致發光(PL)、窄發射和高光穩定性等優點。因此,鎘基量子點在電致發光(EL)和光伏(PV)裝置、生物成像、感測器和催化製氫等方面具有應用前景。

- 高品質顯示設備對量子點的需求是市場的關鍵驅動力。量子點的廣泛實用化是量子點增強薄膜 (QDEF) 層,可改善液晶電視中的 LED 背光。量子點可用於去除所有中間色以產生純色,從而創造更寬的色域。此外,它還提高了液晶電視的能源效率。

- 對節能解決方案的需求正在推動市場發展。基於奈米材料的白光發光二極體(LED) 表現出創紀錄的每瓦 105 流明的發光效率。隨著進一步的發展,新型 LED 的效率可以達到每瓦 200 流明以上,並且在量子點的幫助下,有望成為家庭和辦公室的節能光源。

- 2022年6月,北京工業的研究人員開發了鈣鈦礦量子點(PQD)微陣列,以增強量子點的顏色轉換過程,用於LED、microLED、近場顯示器和其他設備。這種組裝策略克服了噴墨列印生產的傳統量子點顏色轉換(QDCC)像素面臨的通用問題,即像素太薄導致點無法實現有效的顏色轉換。

- 此外,由於其物理尺寸較大,量子點無法擴散穿過細胞膜,這在生物應用中可能是潛在的缺點。輸送過程對細胞來說是危險的,甚至會破壞它們。在某些情況下,量子點可能對細胞有毒且不適合生物應用,這是市場的重要限制。

- 新型冠狀病毒感染疾病(COVID-19) 的全球爆發對市場成長產生了負面影響,由於 COVID-19 傳播對經濟的影響,企業的業務營運和收益放緩和不確定性。這預計將導致銷售下降。花費在新技術上並推遲或取消新技術解決方案的評估和實施。

- 此外,量子點主要應用於電視、顯示器、智慧型手機等顯示產品。隨著感染疾病COVID-19 世界的開放,混合工作文化預計將推動對創新顯示產品的需求,從而導致預測期內對量子點的需求增加。

量子點(QD)市場趨勢

LED 的普及推動市場成長

- 量子點在顯示器中的應用具有多種優勢,包括顯色性、高照明效率、低成本和大規模生產能力。此外,它們對環境友好,在顯示和固態照明應用中引起了極大的關注,特別是基於 QD 的 LED,它表現出高效率和偏振能力。

- 隨著LED在照明市場的普及,由於量子點在高效能和色彩飽和顯示器生產的應用,量子點市場也不斷成長。量子點在LED電視等家用電器中的應用,可以吸收和發射比世界上任何其他顯示技術亮四倍的純色光,這增加了其在消費電器產品領域的受歡迎程度。幾家主要照明公司正在開發使用 QD 的產品應用,以透過 LED 產生自然光。

- 在農業中,可以生產光轉換塗層,預計將提高溫室果樹的產量和成熟率。荷蘭農民擴大採用室內農業,使用帶有 LED 燈的先進溫室,在更小的空間中更快地種植更多作物。

- 在紅外線區域具有量子和功率轉換效率的膠體 QD LED 已被證明能夠整合到無機太陽能電池中,這可能會帶來更高的效率。此外,這些因素催生了量子點的許多應用,例如監視、夜視、環境監測和光譜學。

- 此外,綠色 LED 的光輸出顯著降低通常會導致健身追蹤器等客戶應用的效率問題和高成本。量子點 (QD)發光二極體(QLED) 具有獨特且對未來顯示器有吸引力的特性,包括窄頻寬下的高色純度、低工作電壓下的高電致發光(EL) 亮度以及易於加工性。我們提供此外,QLED極薄、透明、彈性、節能,且製造成本低得多,吸引了各大顯示器製造商的注意。

- 例如,三星最近宣布推出 Neo QLED 和 MicroLED 電視,作為其基於 LCD 的 QLED 面板技術的下一步。同樣,LG 和 OnePlus 等其他顯示器製造商預計也會追隨這一趨勢,這有望推動所研究市場的成長。

亞太地區將經歷顯著成長

- 預計在預測期內,量子點市場將成為亞太地區最高的成長率。亞太市場的成長可歸因於消費者對採用技術先進產品的趨勢以及各大學和組織參與QD技術的研發,特別是在顯示器市場。

- 由於量子基材料的製造成本較低,考慮到客戶的價格敏感度以及三星和LG公司等重要電子公司的存在,預計亞太地區量子點市場的市值將激增。

- 此外,由於太陽能應用需求的快速成長,光電子也成為亞太市場的重要成長因素。量子點獨特的光學特性,如發光持久性、高量子產率、窄發射頻寬和視覺穩定性,使其成為照明解決方案和顯示器的合適材料。

- 未來幾年,亞太地區,尤其是中國,對量子點(QD)顯示器的需求可能會大幅增加,預計將推動量子點市場的發展。電視、顯示器和智慧型手機行業支出的增加以及新產品的推出正在增加 QD(量子點)顯示器的採用,並可能推動量子點市場的成長。

量子點 (QD) 產業概覽

量子點市場高度分散。領先的公司採取了各種策略,如擴張、新產品發布、合資、協議、合作和收購,以擴大他們在這個市場的足跡。市場主要企業包括 Nanosys Inc.、NN-Labs LLC、Ocean NanoTech、Quantum Materials Corporation、Osram Licht AG、Nanoco Group、Nanophotonica Inc. 等。每家公司都利用策略合作活動來增加其市場佔有率並提高盈利。

2022年4月,UbiQD的量子點技術與SWM的專業知識結合,共同開發了用於發電窗戶的下一代量子點中階。根據美國能源局,建築物用電量佔全國用電量的 76%。 UbiQD 的「發射太陽能聚光器技術」將螢光量子點放置在中階中的兩塊玻璃之間,提供多種顏色選擇的謹慎色調。量子點部分吸收陽光並將其轉化為近紅外線光,這些近紅外光被隱藏在窗框內的太陽能電池收集並轉化為電能。

2022 年 2 月,Nnaosys 與 Smartkem 合作,共同開發用於先進顯示器的新一代低成本解決方案印刷 microLED 和量子點材料。兩家公司將使用 SmartKem 的高性能有機半導體配方的解決方案印刷顯示器與使用 Nanosys 的 microLED 和量子點 nanoLED 技術的 TFT中階材料相結合,創造出堅固、靈活且輕巧的新型低功耗顯示器。應該建立一個顯示。關於設備、製程和材料準備的初步檢驗工作已經進行。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- COVID-19 對量子點市場的影響

第5章市場動態

- 市場促進因素

- 高品質顯示設備對量子點的需求

- 節能解決方案的需求

- 市場挑戰

- 生物應用中的細胞毒性

第6章市場區隔

- 按類型

- III-V族半導體

- II-VI-半導體

- 矽(Si)

- 按用途

- 光電及光學元件

- 藥品

- 農業

- 替代能源

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Nanosys Inc.

- NN-Labs LLC

- Quantum Materials Corporation

- UbiQD Inc.

- Ocean NanoTech

- Osram Licht AG

- Nanoco Group

- Nanophotonica Inc.

- Navillum Nanotechnologies

- Quantum Solutions Inc.

第8章投資分析

第9章市場的未來

The Quantum Dots Market size is estimated at USD 5.53 billion in 2024, and is expected to reach USD 12.34 billion by 2029, growing at a CAGR of 17.41% during the forecast period (2024-2029).

Quantum dots are an ideal choice for probing plasmonic devices because of their desirable emission properties and nanoscopic size. Quantum dots (QDs) can be used as the building blocks of quantum computers because they can emit photons one by one on demand. The rising demand for optimized devices with better performance and high resolution and an increase in demand for miniaturized technology are the key driving factors for the growth of the market studied.

Key Highlights

- Cadmium-based QDs are in trend, which have the advantage of broad UV excitation, bright photoluminescence (PL), narrow emission, and high photostability. Thus, Cadmium-based QDs have applications in electroluminescence (EL) and photovoltaic (PV) devices, bio-imaging, sensors, and catalytic hydrogen production.

- The demand for quantum dots in high-quality display devices is a crucial driver for the market. A widespread practical application of QDs is in the quantum dot enhancement film (QDEF) layer, which improves the LED backlighting in LCD televisions. By using quantum dots, one can get rid of all the in-between colors and generate pure colors, thus, creating a much wider color gamut. Additionally, enhanced energy efficiency can be achieved for the LCD TV.

- Demand for energy-efficient solutions is driving the market. Nanomaterial-based white-light-emitting diodes (LEDs) exhibit a record luminous efficiency of 105 lumens per watt. With further development, the new LEDs can reach efficiencies of over 200 lumens per watt, making them a promising energy-efficient lighting source for homes and offices with the help of quantum dots.

- In June 2022, to enhance the color conversion process of quantum dots for use in LEDs, micro-LEDs, near-field displays, and other devices, researchers from the Beijing Institute of Technology developed perovskite quantum dot (PQD) microarrays. The assembly strategy aims to overcome a common problem facing conventional quantum dot color conversion (QDCC) pixels fabricated by inkjet printing: the pixels' thinness prevents the dots from achieving efficient color conversion.

- Moreover, the quantum dots may have a potential drawback when used in biological applications due to their large physical size, owing to which they cannot diffuse across cellular membranes. The delivery process may be dangerous for the cell and even destroy it. In other cases, a QD may be toxic for the cell and inappropriate for any biological application, which is a key restraint for the market.

- The global outbreak of COVID-19 has adversely affected the growth of the market as businesses experienced downturns or uncertainty in their business operations and revenue because of the economic effects resulting from the spread of COVID-19, which is expected to lead them to decrease their spending on new technologies and delay or cancel assessment and implementation of new technology solutions.

- Furthermore, quantum dots are primarily used in the display products such as TV, monitor, and smartphones. As the world is opening up post-COVID-19, it is expected that the hybrid work culture to drive the demand for innovative display products, in turn increasing the demand for quantum dots during the forecast period.

Quantum Dots (QD) Market Trends

LED Penetration to Enhance the Market Growth

- Quantum dots exhibit several advantages, including color rendering, high illumination efficiency, low cost, and capacity for mass production, in terms of their use in displays. Furthermore, they are environmentally friendly, attracting considerable attention in the display and solid-state lighting applications, especially QDs-based LEDs that exhibit high efficiency and polarization features.

- With increasing LED penetration in the lighting market, the quantum dots market is growing due to the application of quantum dots in manufacturing high-efficiency and color-saturated displays. It is increasingly becoming popular in the consumer electronics segment owing to QDs' applications in appliances, such as LED TVs, which absorb and emit light in pure colors, as much as four times brighter than any other display technology in the world. Several major lighting companies are developing product applications using QDs to create more natural light for LEDs.

- In agriculture, it is possible to produce light-converting coatings, expected to increase yield and the speed of ripening of fruit plants in greenhouses. Dutch farmers are increasingly adopting indoor farming, and they can grow more crops faster and in a smaller space with advanced greenhouses using LED lights.

- With quantum and power conversion efficiencies in the infrared range, Colloidal QD LED has proven that it can also be integrated into inorganic solar cells, which may lead to even higher efficiencies. Additionally, such factors have triggered many applications for QDs, including surveillance, night vision, environmental monitoring, and spectroscopy.

- Additionally, a significant drop in light output exhibited by green LEDs has often been the cause of efficiency problems and high costs in customer applications, such as fitness trackers. Quantum dot (QD) lightemitting diodes (QLEDs) offer unique and attractive characteristics for future displays, including high color purity with narrow bandwidths, high electroluminescence (EL) brightness at low operating voltages, and easy processability. Furthermore, QLEDs can also be very thin, transparent, and flexible, and are also energy efficient and cost much less to manufacture, attracting the attention of significant display manufacturers.

- For instance, recently, Samsung unveiled Neo QLED and MicroLED TVs as its next step in the LCD-based QLED panel technology. Similarly, other display manufacturers such as LG and One Plus are expected to follow the trend, which is expected to drive the growth of the market studied.

Asia-Pacific to Witness a Significant Growth Rate

- The quantum dots market is expected to register the highest growth rate for the Asia-Pacific region during the forecast period. The market's growth in the Asia-Pacific region can be attributed to the inclination of consumers toward adopting technologically advanced products and the involvement of various universities and organizations in the R&D of QD technology, specifically in the display market.

- Due to the low manufacturing cost of quantum-based materials, the quantum dots market is expected to witness an upsurge in its market value in the Asia Pacific region, considering the price sensitivity of customers and the presence of critical electronics companies such as Samsung and LG Corporation.

- Furthermore, with the surging demand for solar energy applications, optoelectronics is also an essential growth factor for the Asian-Pacific region's market. Unique optical properties, such as emission tenability, high quantum yield, narrow emission band, and visual stability, make quantum dots the preferred material for lighting solutions and displays.

- In the following years, there is likely to be a significant increase in demand for quantum dots (QD) displays in the Asia-Pacific region, especially in China, which is expected to drive the quantum dots market. With the introduction of new products, rising expenditures of the TV, monitor, and smartphone industries are increasing the adoption of QD (Quantum Dots) displays, which may enhance the growth of the quantum dots market.

Quantum Dots (QD) Industry Overview

The Quantum Dots market is highly fragmented. The major players have used various strategies, such as expansions, new product launches, joint ventures, agreements, partnerships, and acquisitions, to increase their footprints in this market. Key players in the market are Nanosys Inc., NN-Labs LLC, Ocean NanoTech, Quantum Materials Corporation, Osram Licht AG, Nanoco Group, Nanophotonica Inc., and many more. The businesses are leveraging strategic collaborative actions to improve their market percentage and enhance profitability.

In April 2022, UbiQD's quantum dot technology collaborated with SWM's domain expertise to co-develop next-generation quantum dot interlayers for electricity-producing windows. According to the US Department of Energy, buildings account for 76% of domestic electricity use. UbiQD's 'luminescent solar concentrator technology deploys fluorescent quantum dots between two sheets of glass within the interlayer to provide a modest tint with various color options. The Quantum Dots partially absorb sunlight and convert it into near-IR light harvested into electricity by solar cells hidden in the window frame.

In February 2022, Nnaosys partnered with Smartkem to work together on a new generation of low-cost solution printed microLED and quantum dot materials for advanced displays. Both companies believe combining solution printed displays using SmartKem's high-performance organic semiconductor formulations with TFT interlayer materials using Nanosys's microLED and quantum dot nano-led technologies should create a new low-power class of robust, flexible, lightweight displays. Initial validation work on the equipment, processes, and materials readiness has already occurred.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Quantum Dots Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Quantum Dots in High-quality Display Devices

- 5.1.2 Demand for Energy-efficient Solutions

- 5.2 Market Challenges

- 5.2.1 Toxicity of Cells in Biological Applications

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 III-V-semiconductors

- 6.1.2 II-VI- semiconductors

- 6.1.3 Silicon (Si)

- 6.2 By Application

- 6.2.1 Optoelectronics and Optical Components

- 6.2.2 Medicine

- 6.2.3 Agriculture

- 6.2.4 Alternative Energy

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nanosys Inc.

- 7.1.2 NN-Labs LLC

- 7.1.3 Quantum Materials Corporation

- 7.1.4 UbiQD Inc.

- 7.1.5 Ocean NanoTech

- 7.1.6 Osram Licht AG

- 7.1.7 Nanoco Group

- 7.1.8 Nanophotonica Inc.

- 7.1.9 Navillum Nanotechnologies

- 7.1.10 Quantum Solutions Inc.