|

市場調查報告書

商品編碼

1443879

政府雲端:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Government Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

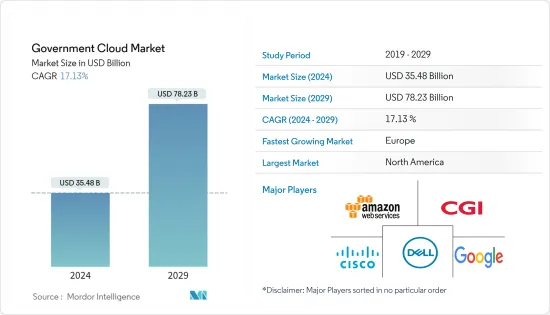

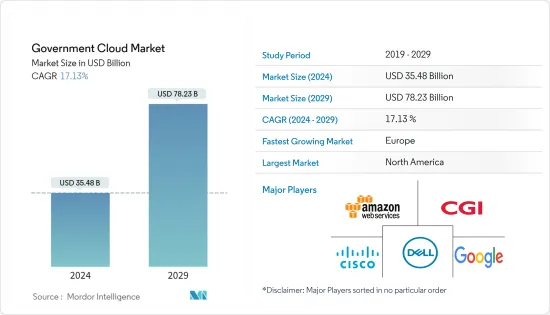

政府雲端市場規模預計2024年為354.8億美元,預計2029年將達到782.3億美元,市場估算與預測期間(2024-2029年)年複合成長率為17.13,預計成長% 。

政務雲是指專門為政府機構建構的虛擬和雲端處理系統。該全球計劃旨在確定和開發支援全球聯邦政府營運、財務、戰略和 IT 目標的雲端解決方案。

主要亮點

- 由於人口普查資料增加(人口持續成長)、新政策和舉措、與其他地區的合作以及新業務激增導致資料增加,政府數據生成不斷增加。基於實體硬體的遺留系統效率低並且可能會耗盡空間。這就是為什麼需要政府雲端。

- 此外,透過利用雲端功能,政府可以為公民創建更快、更具可擴展性的應用程式和服務。雲端原生安全服務使政府機構能夠提高安全性、實現現代化和安全部署,並透過雲端原生自動擴展功能實現高彈性。

- 基於當地法律、政策和策略,政府雲正在許多國家興起。例如,美國GovCloud舉措支援根據既定標準採用雲端處理系統,特別關注安全性。該計劃制定了多項指南,包括聯邦雲端處理策略和 NIST雲端處理技術藍圖。

- 各地區政府政策是對市場的主要限制。歐盟、美國、新加坡和印度政府要求政府資料儲存在本地資料中心。此類法規有利於當地企業,但給跨國公司帶來了額外的財務負擔。

- 隨著COVID-19的爆發,雲端基礎的服務和工具的適應促使政府機構實施遠端工作訪問,並在各國封鎖期間提高了對安全問題的認知。政府機構的雲端市場預計將大幅成長。

政務雲市場趨勢

對更大雲端儲存能力的需求有助於成長

- 各種數位資料在全球範圍內不斷急劇增加。世界各國政府都需要有效管理這些資料,這對他們促進創新和為公民的福利和福祉制定規定的能力提出了挑戰。據 Global Datasphere 稱,到 2025 年,數位資料將達到 175 Zetta位元組 。政府機構正在創建大量資料,增加了對雲端基礎的儲存的需求。

- 雲端儲存需求和採用率是由所有政府部門對低成本資料備份、儲存和保護的需求不斷成長,以及對管理行動技術使用增加所產生的資料的需求不斷成長所推動的。這是有利的。

- 此外,隨著銀行業資料外洩數量的增加,政府銀行正在採用雲端儲存。雲端儲存允許將資料儲存在銀行本身或第三方控制和擁有的位置,從而提高最終用戶的安全性。雲端儲存的採用預計在預測期內將會增加。

- 由於產生大量資料,雲端解決方案市場公司目前面臨開發廉價方法來儲存和處理資料的壓力。例如,去年7月,塔塔通訊推出了IZOTM Financial Cloud,這是一個為滿足印度當局要求的銀行、企業和工業資料隱私、保護合規性和安全標準而客製化的社群雲端平台。

歐洲將經歷最大的成長

- 歐盟委員會於 2012 年發布了第一個雲端處理戰略。目的是加速和擴大雲端處理在所有經濟領域的使用。歐洲大陸 36% 的企業目前使用雲端服務2,2020 年直接雲端投資估計為 540 億歐元(56,360 億美元),預計明年將翻倍。

- 在整個歐洲保持邊緣和雲端技術的創新和主權採用需要增加邊緣和雲端設施的密度,引導歐洲市場採用雲端原生5G並建立工業本地5G網路。我們計劃實現這一目標。這是為了利用網路設備供應商的國際競爭力和通訊業者的全球足跡,將行動網路轉變為廣泛分佈的全球雲端邊緣節點網路。

- 此外,歐盟計劃在未來七年內投資100億歐元(104.4億美元)創建一個可以與亞馬遜、谷歌和阿里巴巴等跨國公司競爭的國家雲端處理市場。這些因素可能會在預測期內推動政府雲端市場的發展。

- 各個垂直行業廣泛採用政府雲端來從遠端端點存取有關用戶日誌、政策和系統的大量公民資料,這將推動全部區域的市場成長,這是主要因素之一。

政務雲產業概況

政府雲端市場集中,微軟、OracleNEC、IBM、Google等大公司為政府提供雲端解決方案與服務。由於現有供應商擁有強大的立足點,進入該市場的障礙很高。

Telangana 政府將資訊科技 (IT) 工作負載轉移到雲端,以加速其電子化治理計劃,為33 個部門和289 個組織提供更快、更可靠的公民服務,並實現更高的營運效率,並決定降低IT 成本。

2022 年 1 月,戴爾技術透過引入多重雲端功能擴展其產品組合,加速其多重雲端之旅,無論應用程式和資料駐留在何處,都能提供一致的體驗。我們還透過新的產品和資源擴大了對開發人員營運 (DevOps) 的支持,幫助您選擇合適的雲端環境以及戴爾基礎設施的安全性、支援和可預測成本。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究定義和假設

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 業界亮點-波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

第5章市場動態

第6章 市場促進因素

- 大容量儲存需求帶動市場需求

- 對資料透明度的需求擴大了市場

第7章 市場限制因素

- 雲端運算技能差距阻礙市場成長

第8章市場區隔

- 按部署模型

- 公共雲端

- 私有雲端

- 混合雲

- 按交貨方式

- 基礎設施即即服務

- 平台即即服務

- 基於服務的軟體

- 按用途

- 伺服器和儲存

- 災難復原/資料備份

- 安全性和合規性

- 分析

- 內容管理

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第9章 競爭形勢

- 公司簡介

- Amazon Web Services Inc.

- CGI Inc.

- Cisco Systems Inc.

- Dell Inc.

- Google Inc.

- IBM Corporation

- Microsoft Corporation

- NetApp Inc.

- Oracle Corporation

- Rackspace Inc.

- Salesforce.com Inc.

- VMWare Inc.

第10章投資分析

第11章 市場機會及未來趨勢

The Government Cloud Market size is estimated at USD 35.48 billion in 2024, and is expected to reach USD 78.23 billion by 2029, growing at a CAGR of 17.13% during the forecast period (2024-2029).

Government cloud refers to virtualization and cloud computing systems explicitly created for governmental entities. This global program aims to identify and develop cloud solutions supporting global federal governments' operational, financial, strategic, and IT goals.

Key Highlights

- Government data generation is increasing due to growing census data (constant population growth), new policies and initiatives, cooperation with other regions, and increased GDP due to the mushrooming of new businesses. Physical hardware-based legacy systems are inefficient and may run out of room. Government cloud is therefore required.

- Moreover, governments may create more swiftly and scalable applications and services for citizens by utilizing cloud capabilities. Agencies can use cloud-native security services to improve security, modernize and secure their deployment, and achieve higher resilience through cloud-native auto-scaling capabilities.

- Based on their national and local laws, policies, and tactics, government clouds are emerging in numerous nations. For instance, the GovCloud initiative in the US supports the adoption of cloud computing systems following established standards, with a particular emphasis on security. This program has produced several guidelines, including the Federal Cloud Computing Strategy and the NIST Cloud Computing Technology Roadmap.

- Government policies across different regions have been a major restraining factor for the market. The governments in the EU, US, Singapore, and India have mandated that the data from government agencies be saved in local data centers. These regulations have benefitted the local players but have exerted additional financial strain on global companies.

- With the outbreak of COVID-19, the government cloud market is expected to witness significant growth as cloud-based services and tools are increasingly adapted due to government organizations deploying remote work access and rising awareness of security issues amid lockdowns in various countries.

Government Cloud Market Trends

Need for Greater Cloud Storage Capabilities to witness growth

- Digital data of all kinds are constantly growing dramatically on a global scale. The requirement for governments worldwide to manage such data effectively is posing challenges to their capacity to foster innovation and make provisions for the welfare and happiness of their citizens. According to Global Datasphere, 175 zettabytes of digital data will exist by 2025. Government agencies are producing large amounts of data, increasing the demand for cloud-based storage.

- The need for and adoption rate of cloud storage are favored by the rise in the need for low-cost data backup, storage, and protection across all government sectors, as well as the requirement to manage the data produced by the increased use of mobile technologies.

- Additionally, due to the growing number of data breaches in the banking industry, government banks are adopting cloud storage, which enables them to save data in a location that is either maintained and owned by the bank itself or by a third party, improving end-user security. Over the projected period, this is anticipated to enhance the adoption of cloud storage.

- Players in the cloud solutions market are currently compelled to develop inexpensive ways to store and handle the data due to the volume of data produced. The government cloud market will grow due to these factors in the future; for instance, In July last year, Tata Communications launched 'IZOTM Financial Cloud,' a community cloud platform tailored to fulfill Indian authorities' demanding data privacy, protection compliance, and security criteria for the banking, enterprises, and industries sectors.

Europea to Witness the Highest Growth

- The European Commission unveiled its first cloud computing strategy in 2012. The goal of the process was to accelerate and broaden the usage of cloud computing in all spheres of the economy. Currently, 36% of the continent's companies use cloud services2, for an estimated €54 billion (USD 5636 Billion) of direct cloud spending in 2020, which is expected to double by next year.

- As the Increased density of edge and cloud facilities is needed to sustain the adoption of innovative and sovereign edge and cloud technologies across the continent, the European market is planning to adopt cloud native 5G and enable industrial local 5G networks, leveraging the global competitiveness of its network equipment providers and the worldwide footprint of its telecommunication operators to transform the mobile network into a global network of widely distributed cloud-edge nodes.

- Moreover, the European Union plans to invest EUR 10 billion(USD 10.44 Billion) over the next seven years to create a domestic cloud computing market that could compete with multinational companies like Amazon, Google, and Alibaba. These factors will boost the government cloud market during the forecast period.

- The widespread adoption of government cloud across various industrial verticals for accessing the excessive amount of citizen data regarding user logs, policies, and systems from remote endpoints is one of the key factors driving the market growth across the region.

Government Cloud Industry Overview

The market for government cloud is concentrated with major giants, such as Microsoft, Oracle NEC, IBM, and Google, providing cloud solutions and services for the government. This market's entry barrier is high since the existing vendors have a strong foothold.

In September 2022 - Amazon Web Services Inc announced that it has joined the government of Telangana for the project to transform its citizen service delivery by advancing its cloud adoption framework as the Telangana state government has decided to migrate its information technology (IT) workloads to the cloud to accelerate its eGovernance plans, and deliver faster and more reliable citizen services through its 33 departments and 289 organizations while achieving high-operational efficiency and reduced IT costs.

In January 2022 - Dell technologies sped Journey to Multi-Cloud with Portfolio Expansion with introduced multi-cloud capabilities that offer a consistent experience wherever applications and data reside, along with also expanding support for developer operations (DevOps) with new offers and resources to help choose the right cloud environment combined with the security, support and predictable cost of Dell infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Definitions and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

6 Market Drivers

- 6.1 Need for Greater Storage Capabilities is Driving the Market Demand

- 6.2 Need for Data Transparency are Expanding the Market

7 Market Restraints

- 7.1 Cloud Computing Skills Gap is Hindering the Market Growth

8 MARKET SEGMENTATION

- 8.1 By Deployment model

- 8.1.1 Public Cloud

- 8.1.2 Private Cloud

- 8.1.3 Hybrid Cloud

- 8.2 By Delivery Mode

- 8.2.1 Infrastructure-as-a-Service

- 8.2.2 Pltaform-as-a-Service

- 8.2.3 Software-as-a-Service

- 8.3 By Application

- 8.3.1 Server and Storage

- 8.3.2 Disaster Recovery/Data Backup

- 8.3.3 Security and Compliance

- 8.3.4 Analytics

- 8.3.5 Content Management

- 8.4 By Geography

- 8.4.1 North America

- 8.4.2 Europe

- 8.4.3 Asia Pacific

- 8.4.4 Latin America

- 8.4.5 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Amazon Web Services Inc.

- 9.1.2 CGI Inc.

- 9.1.3 Cisco Systems Inc.

- 9.1.4 Dell Inc.

- 9.1.5 Google Inc.

- 9.1.6 IBM Corporation

- 9.1.7 Microsoft Corporation

- 9.1.8 NetApp Inc.

- 9.1.9 Oracle Corporation

- 9.1.10 Rackspace Inc.

- 9.1.11 Salesforce.com Inc.

- 9.1.12 VMWare Inc.