|

市場調查報告書

商品編碼

1441637

機器人 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

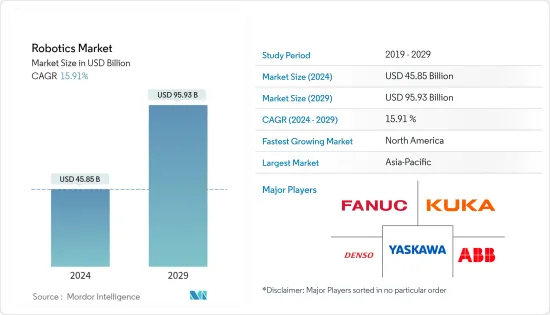

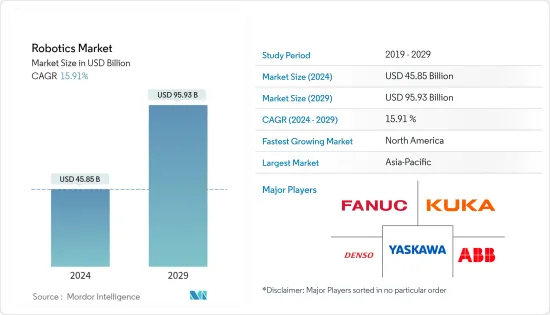

2024年機器人市場規模預計為458.5億美元,預計到2029年將達到959.3億美元,在預測期內(2024-2029年)CAGR為15.91%。

主要亮點

- 由於需求增加,人們對機器人領域進行了大量投資。國際機器人聯合會報告稱,新汽車生產設施的投資和工業設施的現代化推動了對機器人的需求。

- 例如,2022年8月,現代汽車集團投資4億美元建立波士頓動力人工智慧研究所,以推動人工智慧和機器人技術的發展。該公司的目標是“在人工智慧、機器人和智慧機器方面取得根本性進步”,資源集中在認知人工智慧、運動人工智慧和有機硬體設計上,每個學科都有助於先進機器能力的進步。

- 機器人已被納入製造過程中,以提高生產率並提高相應車輛的品質。例如,福特汽車公司在印度的薩南德工廠僱用了約 450 台機器人來為汽車噴漆和執行車身製造任務。此外,Maruti Suzuki India 的一家工廠僱用了約 5,000 台機器人。

- 數位化和工業 4.0 革命要求各行業使用更先進的自動化解決方案(例如機器人和控制系統)來增強生產流程,從而鼓勵了各行業的自動化發展。機器人技術利用工業 4.0 的幾個關鍵要素,包括連接和資料。西門子和谷歌雲端最近建立了合作夥伴關係,將Google雲端的資料雲和人工智慧/機器學習技術與西門子的工廠自動化解決方案整合起來。

- 此外,2022 年 3 月,三菱開發了一種機器人系統,可以像人類一樣快速工作,並透過語音命令進行控制。新系統使用三菱電機的Maisart AI技術(例如高精度語音辨識)來啟動工作任務,之後操作員可以根據需要微調機器人的動作。

- 全球許多企業正在利用機器人技術實現倉庫自動化,以節省勞動成本。例如,近年來,運作的工業機器人數量達到約3,800台(千台)。阿里巴巴還在其一個倉庫升級了機器人勞動力,大幅減少了 70% 的勞動力,為高技能勞動力提供了機會。

- 遏止 COVID-19 需要利用各種機器人技術,例如清潔和消毒服務機器人。未感染需求的增加為服務機器人開啟了這個新領域。因此,大多數製造商註冊了新的消毒機器人。此外,多家製造公司報告因採用工業機器人而受益。例如,寶潔公司發現,在其生產線上添加機器人可以讓更多的工人繼續工作並生產更多的產品。

機器人市場趨勢

服務機器人技術預計將顯著成長

- 隨著醫療機器人系統輔助手術的增加,市場產品創新率將進一步提高。 2022 年 8 月,莫哈利馬克斯超級專科醫院在其醫院推出了印度最先進的技術之一—達文西 Xi 手術機器人。革命性的達文西 Xi 手術機器人的推出是醫療保健提供者以患者為中心的另一個舉措,旨在使患者能夠獲得優質的醫療保健服務。

- 此外,根據 NIOSH 的數據,醫護人員從事的是美國最危險的工業工作,非致命性職業傷害和疾病的數量也最多。據估計,全球約有 6,000 台手術機器人執行了 100 萬台手術。市場價值60億美元。一個基本系統的成本為 200 萬美元。麻省理工學院和密西根大學等知名組織正在研究向醫療領域提供小型緊湊型機器人的技術。

- 此外,勞工統計局顯示有 2,384,600 名建築清潔工和清潔工。公司平均每年支出約 600 億美元。這還不包括保險金額,因為清潔業是工傷人數最多的行業之一,因此保險金額變得昂貴。出於顯而易見的原因,諸如此類的因素增加了對清潔機器人的需求。

- 人口老化是機器人在家庭醫療保健和援助應用中部署大幅增加的主要促進因素之一。例如,根據聯合國的資料,全球65歲以上人口預計將增加181%,到2050年可能佔總人口的16%。

- 現代汽車集團最近推出了用於工業現場安全的機器人工廠安全服務機器人,並宣佈在起亞起亞韓國工廠進行試點運行。該機器人基於波士頓動力公司的Dynamics Spot四足機器人,具有人工智慧(AI)、自主導航、遠端操作技術以及該集團機器人實驗室為各種工業任務開發的計算有效載荷。

- 根據 IFR 2022,家庭任務機器人構成了最大的消費機器人類別。最近售出近 1,900 萬套(+12%)。吸塵等室內家用地板清潔機器人是目前使用最多的應用。這些發展可能會進一步推動未來市場的成長。

- 此外,位於班加羅爾的新創公司 ANSCER Robotics 開發了世界上第一個自主移動機器人 (AMR)“大腦”,使機器人技術普及到每個人,並在印度倉儲展 (IWS) 上首次推出了其 AMR 系列,該活動在新德里的Pragati Maidan 舉行。

亞太地區預計將佔據主要市場佔有率

- 由於機器人的大量採用,預計亞太地區將佔據重要的市場佔有率。此外,由於電子和汽車製造業的大規模部署,韓國和中國在機器人技術的採用方面佔據主導地位。

- 日本政府宣布提供資金用於開發老年護理機器人,以填補到2025 年約38 萬名技術工人的估計缺口。此外,到2050 年,日本政府的目標是確保在日本銷售的所有新車均為電動或混合動力汽車。該國打算提供補貼,以加速私營部門電動車電池和馬達的發展。預計這也將推動在不久的將來在他們的住所採用老年護理機器人。

- 此外,2022 年 10 月,Robotex India 與 BMC Software India Pvt. 合作。有限公司宣布推出多項舉措,以加強印度的 STEM 教育生態系統。透過「打造你的第一個機器人」產業,BMC Software 旨在為浦那公立學校的 250 名女性學習者提供擴大就業能力和彌合性別鴻溝所需的技術技能。這些舉措可能會進一步推動未來研究市場的成長。

- 作為全球汽車市場的重要參與者,中國的汽車工業一直在顯著擴張。中國政府將包括汽車零件產業在內的國家汽車工業視為國家主要支柱產業之一。到2025年,中國中央政府預計全國汽車產量將達3,500萬輛。

- 由於該地區面臨人口老化,政府組織計劃在勞動力中更多地依賴機器人。例如,住房發展局(新加坡)打算採用自動無人機或機器人來識別公共住宅街區的哪些部分需要清潔。主要目的是透過僅關注髒區域來減少清潔所需的水。

- 此外,人工智慧科技公司Ubtech Robotics 在CES 2021 上推出了Adibot UV-C 消毒機器人。Adibot 機器人消毒系統旨在提供針對COVID-19 的醫院級解決方案,將Ubtech 的機器人技術和人工智慧與UV-C相結合透過去活化有害病原體的 DNA 和 RNA 來消毒目標表面和空氣的技術。

機器人產業概況

全球機器人市場相對分散,主要市場參與者包括 ABB Ltd.、Yaskawa Electric Corporation、Denso Corporation、Fanuc Corporation 和 Kuka AG。市場供應商正致力於擴大海外客戶群。兩家公司正在利用戰略合作計劃來提高市場佔有率和盈利能力。

2022年10月,ABB推出了有史以來最小的工業機器人,為更快、更靈活和高品質生產穿戴式智慧型裝置提供了獨特的可能性。憑藉其緊湊的尺寸、一流的有效負載和無與倫比的精度,新型 IRB 1010 使電子製造商能夠透過自動化擴大其設備生產,包括高級手錶、耳機、感測器和健康追蹤器。

2022年2月,全球最大的工業機器人製造商之一安川Motoman推出了HC10DTP和HC20DTP等兩款新型協作機器人,各有六軸。該公司將它們描述為「高度可靠的機器人,豐富了安川 HC 系列產品線的簡單功能」。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 宏觀趨勢對市場的影響

- 工業生態系中協作機器人的演變

第 5 章:市場動態

- 市場促進因素

- 工業 4.0 的到來推動自動化

- 日益重視安全

- 石油和天然氣產業的需求

- 市場限制

- 安裝成本高

第 6 章:市場區隔

- 依類型

- 工業的

- 服務

- 依最終用戶

- 工業機器人的最終用戶

- 汽車

- 食品與飲料

- 電子產品

- 工業機器人的其他最終用戶

- 服務機器人的最終用戶

- 後勤

- 軍事與國防

- 醫療保健

- 服務機器人的其他最終用戶

- 工業機器人的最終用戶

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- ABB Ltd

- Yaskawa Electric Corporation

- Denso Corporation

- Fanuc Corporation

- Kuka AG

- Kawasaki Heavy Industries Ltd.

- Toshiba Corporation

- Panasonic Corporation

- Staubli International AG

- Nachi Robotic Systems Inc.

- Yamaha Motor Co. Ltd

- Seiko Epson Corporation

- Comau SpA (Stellantis NV)

- Omron Adept Technologies Inc.

- Intuitive Surgical Inc.

- Stryker Corporation

第 8 章:投資分析

第 9 章:市場的未來

The Robotics Market size is estimated at USD 45.85 billion in 2024, and is expected to reach USD 95.93 billion by 2029, growing at a CAGR of 15.91% during the forecast period (2024-2029).

Key Highlights

- Due to the increased demand, numerous investments in the robotics sector have been made. The International Federation of Robotics reported that the demand for robots was fueled by investments in new car production facilities and the modernization of industrial facilities.

- For instance, in August 2022, Hyundai Motor Group invested USD 400 million in establishing the Boston Dynamics AI Institute to advance AI and robotics. The company's goal is to make "fundamental advances in AI, robotics, and intelligent machines," with resources focused on cognitive AI, athletic AI, and organic hardware design, with each discipline contributing to advancements in advanced machine capabilities.

- Robots have been incorporated into manufacturing processes to increase productivity and improve the quality of the corresponding vehicles. For instance, at its Sanand facility plant in India, Ford Motor Company employs about 450 robots to paint cars and perform body construction tasks. Additionally, one of Maruti Suzuki India's plants employs about 5,000 robots.

- Digitization and the Industry 4.0 revolution have encouraged the growth of automation among industries by requiring them to use more advanced and automated solutions, like robotics and control systems, to enhance their production processes. Robotics utilizes several key elements of Industry 4.0, including connectivity and data. Siemens and Google Cloud recently formed a partnership to integrate Google Cloud's data cloud and artificial intelligence/machine learning technologies with Siemens' factory automation solutions.

- Further, in March 2022, Mitsubishi developed a robotics system that can work as fast as humans and be controlled via voice commands. The new system uses Mitsubishi Electric's Maisart AI technologies, such as high-precision speech recognition, to initiate work tasks, after which operators can fine-tune robot movements as needed.

- Many businesses worldwide are automating their warehouses with robotics to save money on labor costs. For instance, in recent years, the number of operational industrial robots reached about 3800 (in thousand units). Alibaba also upgraded to robotic labor in one of its warehouses, dramatically reducing the labor workforce by 70% and opening up opportunities for a highly-skilled workforce.

- Curbing COVID-19 involved utilizing various robot technologies, such as cleaning and disinfection service robots. Increased uninfected demands opened this new place for service robots. As a result, most manufacturers registered new disinfection robots. Further, multiple manufacturing companies reported being benefitted from adopting industrial robots. For example, Procter & Gamble found that adding robots to its production lines allowed it to keep more workers on the job and produce more goods.

Robotics Market Trends

Service Robotics is Expected to Witness Significant Growth

- As medical Robot systems-assisted surgeries increase, product innovation rates in the market will further increase. In August 2022, Max Super Speciality Hospital, Mohali, launched one of the most advanced technologies in India, the Da Vinci Xi Surgical Robot, at its hospital. The launch of the revolutionary Da Vinci Xi Surgical Robot is yet another patient-centric step taken by healthcare providers to empower patients with access to quality healthcare services.

- Further, according to NIOSH, healthcare workers have the most hazardous industrial jobs in the United States, with the highest number of nonfatal occupational injuries and illnesses. It is estimated that about 6,000 surgical robots perform a million operations globally. The market was worth USD 6 billion. A basic system costs USD 2 million. Reputed organizations like MIT and the University of Michigan are working on the technology to deliver small and compact robots to the medical sector.

- Moreover, the Bureau of Labor Statistics indicates 2,384,600 building janitors and cleaners. Companies are spending about USD 60 billion on average annually. This is exclusive of the insurance amount that has become expensive as the janitorial industry records one of the highest numbers of occupational injuries. Factors like these boost the demand for cleaning robots for apparent reasons.

- The aging population is one of the primary drivers of the significant increase in the deployment of robots in domestic healthcare and assistance applications. For instance, according to data from the United Nations, the global population of people over 65 years is expected to grow by 181% and may account for 16% of the population by 2050.

- Hyundai Motor Group recently unveiled the Factory Safety Service Robot, a robot for industrial site safety, and announced its pilot operation at Kia'sKia's South Korean plant. The Robot is based on Dynamics' Spot quadruped robot of Boston Dynamics, with artificial intelligence (AI), autonomous navigation, teleoperation technologies, and a computing payload developed by the Group'sGroup's Robotics Lab for various industrial tasks.

- According to IFR 2022, Robots for domestic tasks constituted the largest group of consumer robots. Almost 19 million units (+12%) were sold recently. Vacuuming and other indoor domestic floor cleaning robots are currently the most used applications. Such developments may further drive the market's growth in the future.

- In addition, ANSCER Robotics, a Bengaluru-based startup that developed the world's first autonomous mobile robot (AMR) "brain" to democratize robotics technology for everyone, debuted its line of AMRs for the first time at the India Warehousing Show (IWS), which was held at Pragati Maidan in New Delhi.

Asia-Pacific is Expected to Hold a Major Market Share

- The Asia-Pacific region is projected to hold a significant market share due to the considerable adoption of robots. Further, South Korea and China are dominant in adopting robotics due to the massive electronic and automotive manufacturing industry deployment.

- The Japanese government announced funding for developing eldercare robots to fill the estimated gap of around 380,000 skilled workers by 2025. In addition, By 2050, the Japanese government aims to ensure that all new cars sold in Japan will be either electric or hybrid. The country intends to offer subsidies to accelerate the private-sector development of batteries and motors for electricity-powered vehicles. This is expected to also drive the adoption of elderly care robots at their residences in the immediate future.

- Further, in October 2022, Robotex India, in collaboration with BMC Software India Pvt. Ltd., declared to launch multiple initiatives toward intensifying the STEM education ecosystem in India. With the industry 'Build Your First Robot,' BMC Software aims to empower 250 female learners from government schools in Pune with the technical skills required to expand their employability and bridge the gender divide. Such initiatives may further drive the growth of the market studied in the future.

- The automotive industry has been expanding significantly in China, a significant player in the global automotive market. The Chinese government sees the nation's auto industry, including the auto parts industry, as one of the main pillar industries of the nation. By 2025, the Chinese central government projects that 35 million automobiles will be produced nationwide.

- As the region faces an aging population, government organizations plan to rely more on robots in the workforce. For instance, the Housing Development Board (Singapore) intends to adopt autonomous drones or robots to identify which parts of public housing blocks need cleaning. The primary aim is to reduce the water required to clean by focusing only on the dirty areas.

- Further, Artificial intelligence technology company Ubtech Robotics launched the Adibot UV-C Disinfecting Robot at CES 2021. The Adibot robotic disinfection system was designed to offer a hospital-grade solution against COVID-19, integrating the robotics and AI from Ubtech with UV-C technology that disinfected targeted surfaces and air by deactivating the DNA and RNA of harmful pathogens.

Robotics Industry Overview

The Global Robotics Market is relatively fragmented, with some major market players such as ABB Ltd., Yaskawa Electric Corporation, Denso Corporation, Fanuc Corporation, and Kuka AG. The market vendors are focusing on expanding their customer base across foreign countries. The companies are leveraging strategic collaborative initiatives to increase market share and profitability.

In October 2022, ABB launched its smallest-ever industrial robot, offering unique possibilities for faster, more flexible, and high-quality production of wearable intelligent gadgets. With its compact size, class-leading payload, and unrivaled accuracy, the new IRB 1010 allowed electronics manufacturers to expand their production of devices via automation, including advanced watches, earphones, sensors, and health trackers.

In February 2022, Yaskawa Motoman, one of the world's largest manufacturers of industrial robots, launched two new collaborative robots such as HC10DTP and HC20DTP, each with six axes. The company described them as 'highly reliable robots (that) enriched easy capability for Yaskawa's HC-series line.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

- 4.5 Evolution of Collaborative Robots in the Industrial Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advent of Industry 4.0 Driving Automation

- 5.1.2 Increasing Emphasis on Safety

- 5.1.3 Demand from the Oil & Gas Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial

- 6.1.2 Service

- 6.2 By End-User

- 6.2.1 End-Users of Industrial Robots

- 6.2.1.1 Automotive

- 6.2.1.2 Food & Beverage

- 6.2.1.3 Electronics

- 6.2.1.4 Other End-Users of Industrial Robots

- 6.2.2 End-Users of Service Robots

- 6.2.2.1 Logistics

- 6.2.2.2 Military and Defense

- 6.2.2.3 Medical and Healthcare

- 6.2.2.4 Other End-Users of Service Robots

- 6.2.1 End-Users of Industrial Robots

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Yaskawa Electric Corporation

- 7.1.3 Denso Corporation

- 7.1.4 Fanuc Corporation

- 7.1.5 Kuka AG

- 7.1.6 Kawasaki Heavy Industries Ltd.

- 7.1.7 Toshiba Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Staubli International AG

- 7.1.10 Nachi Robotic Systems Inc.

- 7.1.11 Yamaha Motor Co. Ltd

- 7.1.12 Seiko Epson Corporation

- 7.1.13 Comau SpA (Stellantis N.V)

- 7.1.14 Omron Adept Technologies Inc.

- 7.1.15 Intuitive Surgical Inc.

- 7.1.16 Stryker Corporation