|

市場調查報告書

商品編碼

1441594

虛擬實境 (VR) - 市場佔有率分析、產業趨勢與統計、成長預測(2024 年 - 2029 年)Virtual Reality (VR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

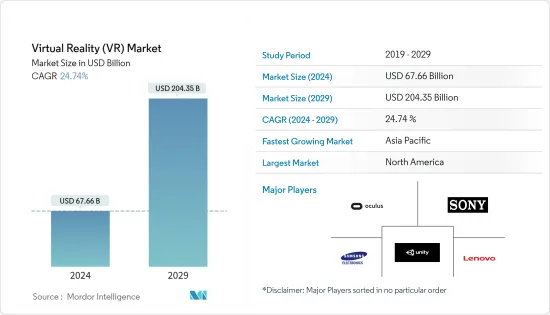

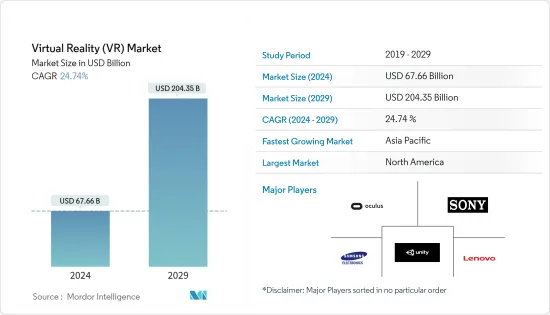

虛擬實境市場規模預計到 2024 年為 676.6 億美元,預計到 2029 年將達到 2043.5 億美元,在預測期內(2024-2029 年)CAGR為 24.74%。

虛擬實境包括使用電腦技術,本質上是創建人工環境。與傳統的使用者介面不同,VR 將使用者置於一種體驗之中。用戶無需觀看面前的螢幕,而是可以沉浸在 3D 世界中並進行互動。透過模擬盡可能多的感官,如聽覺、視覺、觸覺,甚至嗅覺,科技已經在全世界發生了變化。

主要亮點

- 在多個教育領域,教師擴大轉向虛擬實境技術,以提供卓越的教育標準。例如,在小學階段,VR在教育領域的引入使學生沉浸在VR技術世界中。該技術還為學生提供了更直覺、更有趣的課程,並且可以以更低的成本提供。

- 過去幾年,虛擬實境技術在遊戲產業中佔有了一席之地。 VR 塑造了新一代遊戲,為玩家提供身臨其境的第一人稱視角體驗。在過去的幾年裡,Oculus 和 HTC 等開發商致力於讓虛擬實境變得更容易獲得、更便宜。在此之前,Oculus 推出了 Oculus Quest,一款獨立的無線虛擬實境耳機。

- 此外,人工智慧技術在 VR 應用中的日益普及也增強了虛擬角色的智慧,從而提供了豐富的沉浸式環境。谷歌的機器學習工具為任何獨立耳機添加了 6DoF 控制器追蹤功能。同時,Facebook的DeepFocus框架使用AI在VR中創建焦點效果,LG使用AI來最大限度地減少VR用戶的暈動病。中國科技領軍企業百度和騰訊也致力於將人工智慧和虛擬實境融入行動解決方案和電玩遊戲中。

- 新興經濟體的遊戲開發商不斷努力增強遊戲玩家的體驗,為不同的遊戲機/平台(例如PlayStation、Xbox 和Windows PC)啟動和重寫程式碼,將其合併到獨立產品中並透過雲端平台提供給遊戲玩家。

- 為了以超低延遲運行遊戲,該平台需要良好的網際網路速度,而根據當前的網路基礎設施,這在全球範圍內仍然缺乏。 5G正處於測試階段。與目前的情況相比,網路覆蓋範圍的增強將使串流媒體變得更快,在當前情況下,擁有大量玩家沉積的新興經濟體無法獲得必要的速度或定價過高。

- 透過融合虛擬實境、擴增實境、混合實境和腦機介面創建的集體虛擬共享空間(稱為元宇宙)的快速發展將為使用者創造互動式和沈浸式體驗。微軟和英偉達等領先公司已經宣布他們將新的重點放在虛擬宇宙領域。

- COVID-19 危機影響了多家 VR 科技公司。在大流行的最初幾個月裡,由於居家令,虛擬實境遊戲中心關閉。例如,Sandbox 在北美和亞洲經營 10 個 VR 中心,允許客戶群進入虛擬世界。除了 Sandbox 之外,包括 The Void、Zero Latency、Dreamscape 和 Spaces 在內的多家 VR 中心和街機營運商在疫情期間被迫關閉其零售店,並在疫情爆發後面臨重大的財務和後勤課題。

虛擬實境 (VR) 市場趨勢

遊戲領域佔據最大市場佔有率

- 全球 VR 和 AR 遊戲玩家快速成長,市場視野不斷擴大。根據機器學習、人工智慧、巨量資料分析和 AR/VR 解決方案提供商 NewGenApps 的數據,到 2025 年,VR 和 AR 遊戲的全球用戶群預計將增至 2.16 億,價值將達到 116 億美元。

- 此外,消費者在 VR 通話和 VR 遊戲等情勢使用中的舒適度提高,也是 VR 技術在遊戲領域前景樂觀的因素之一。

- 根據娛樂軟體協會公佈的數據,近 2.27 億美國人每週玩電子遊戲,其中三分之二的成年人和四分之三的 18 歲以下兒童。大約 55% 的男性和 45% 的女性玩電子遊戲,玩電子遊戲的玩家平均年齡為 31 歲。

- 2022 年 2 月,索尼推出了適用於 PlayStation 5 的 VR2 和 VR2 Sense 控制器,為用戶提供更高層次的虛擬實境體驗,讓玩家能夠以高度的感官體驗逃離遊戲世界。 VR2 增加了高視覺保真度和增強的追蹤器。

- 2021 年 7 月,Virtex 宣布計劃推出虛擬實境體育場“Virtex Stadium”,球迷可以在球場中央與朋友一起觀看比賽。此次推出符合電子競技的日益普及以及 VR 消費性設備的價格和性能不斷提高的趨勢。根據 VentureBeat 統計,2021 年全球電競觀眾規模為 4.74 億,預計到 2024 年將達到 5.772 億。

北美佔有重要的市場佔有率

- 北美是虛擬實境市場的主要地區之一。它也是採用創新的先驅,這使北美比其他地區更具優勢。

- 此外,該地區擁有最多的專注於為各行業帶來創新 VR 技術的新創公司。據 Tracxn Technologies 稱,美國約有 951 家虛擬實境新創公司。其中包括 Orbbec、JauntVR、Dreamscape 和 Sandbox VR。 Dreamscape 正在創造一種基於位置的沉浸式虛擬實境娛樂。

- Tracxn Technologies 的目標是在洛杉磯開設一家VR 多廳影院,該影院將使用不受束縛的VR 耳機,這意味著參與者將佩戴由裝在客製化背包中的電腦驅動的VR 耳機,這將使他們能夠在空間中自由移動並與真實和虛擬物件以及彼此之間。

- 該地區的投資者正在積極尋求投資該地區的各種 VR 技術新創公司。例如,GFR基金已投資了17家北美基於VR技術的新創公司。預計此類投資將繼續,並預計將在預測期內推動市場成長。

- 該地區的各個研究中心和學者也一直在努力探索虛擬實境技術的潛力。例如,愛荷華州立大學的虛擬實境應用中心(VRAC)是一個專注於人類與科技交叉的跨學科研究中心。南加州大學創意科技研究所的醫療虛擬實境小組致力於研究和推進 VR 模擬技術在臨床上的應用。

虛擬實境 (VR) 產業概覽

全球虛擬實境市場的企業競爭力不斷增強。該市場由 Oculus、Google、三星、索尼、HTC 和聯想等主要參與者組成。就市場佔有率而言,這些重要參與者目前佔據市場主導地位。然而,隨著技術創新的不斷增加,許多公司正在透過獲得新合約和開拓新市場來擴大其市場佔有率。

- 2022 年 3 月 - 金融科技解決方案公司 Liquid Avtar Technologies Inc 推出了首個專為虛擬宇宙創建的忠誠度計劃和支付卡。該卡是一張實體卡,由 OptimizeFT 的 Engage360 支付卡和數位銀行解決方案平台提供支持,該平台在美國上市。

- 2021 年 10 月 - Capcom 廣受好評的 VR 版《生化危機 4》將在 Oculus Quest 2 上獨家推出。Capcom 與 Oculus Studios 和 Armature Studiovto 合作,推出了只有 VR 才能提供的沉浸式第一人稱視角。無論是站立還是坐著,玩家都將享受多種舒適選擇。支援傳送和房間規模的移動意味著您可以依照自己的方式探索遊戲世界。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 技術簡介

- COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- VR在商業應用的採用率不斷提高

- 各個最終用戶群對 VR 設定進行培訓的需求不斷增加

- 市場限制

- 長期使用 VR 耳機的健康風險

第 6 章:市場區隔

- 透過頭顯

- 系留頭顯

- 獨立頭顯

- 無螢幕檢視器

- 依最終用戶產業

- 賭博

- 媒體和娛樂

- 零售

- 衛生保健

- 軍事與國防

- 房地產

- 教育

- 依地理

- 北美洲

- 亞太地區

- 歐洲

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- Oculus VR LLC

- Sony Corporation

- Samsung Electronics Co. Ltd

- Lenovo Group Ltd

- Pico Interactive Inc.

- StarVRCorporation

- FOVE Inc.

- Unity Technologies Inc.

- Unreal Engine (Epic Games Inc.)

- DPVR (Lexiang Technology Co. Ltd)

- Autodesk Inc.

- Eon Reality Inc.

- 3D Systems Corporation

- Dassault Systemes SE

- HTC Vive (HTC Corporation)

第 8 章:投資分析

第 9 章:市場的未來

The Virtual Reality Market size is estimated at USD 67.66 billion in 2024, and is expected to reach USD 204.35 billion by 2029, growing at a CAGR of 24.74% during the forecast period (2024-2029).

Virtual reality includes using computer technology, essentially to create an artificial environment. Dissimilar to the traditional user interface, VR places the user inside an experience. Instead of viewing a screen in front of them, users are immersed and can interact with the 3D world. With the simulation of as many senses as possible, such as hearing, vision, touch, and even smell, technology has transformed worldwide.

Key Highlights

- Across several educational fields, teachers have been increasingly switching to virtual reality technology to provide a superior standard of education. For example, on a primary level, the introduction of VR in the education sector enabled the students to be submerged in the VR tech world. The technology also gives students a more visual and interesting lesson, which can be provided at lower costs.

- Virtual reality technology carved its space within the gaming industry in the past few years. VR has shaped a new gaming generation that gives the players immersive, first-person perspective experiences. In the past few years, developers such as Oculus and HTC worked toward making virtual reality more accessible and affordable. Previously, Oculus launched its Oculus Quest, a standalone wireless virtual reality headset.

- Moreover, the growing pervasiveness of AI technology across VR applications also enhances virtual characters' intelligence, thereby delivering a rich, immersive environment. Google's machine learning tools add 6DoF controller-tracking capabilities to any standalone headset. At the same time, Facebook's DeepFocus framework uses AI to create focus effects in VR, and LG uses AI to minimize motion sickness among VR users. The Chinese tech leaders Baidu and Tencent are also working on integrating AI and VR into mobile solutions and video games.

- Game developers across emerging economies continually strive to enhance gamers' experience by launching and rewriting codes for diverse console/platforms, such as PlayStation, Xbox, and Windows PC, incorporated into a standalone product and provided to gamers through a cloud platform.

- To run a game with notably ultra-low latency, the platform requires a good internet speed, which is still lacking worldwide as per the current network infrastructure. 5G is in the testing phase. Such enhancements in the network coverage will enable streaming to become faster compared to the current situation, where emerging economies with colossal gamer deposition do not have access to the necessary speed or are priced at premiums.

- A quick development of the collective virtual shared space, known as the metaverse, created by converging virtual reality, augmented reality, mixed reality, and brain-computer interface, will create an interactive and immersive experience for the users. Leading companies like Microsoft and Nvidia have already announced their new focus on the metaverse space.

- The COVID-19 crisis impacted several VR tech companies. VR gaming centers were closed due to stay-at-home orders during the initial months of the pandemic. For instance, Sandbox was operating 10 VR centers in North America and Asia, allowing groups of customers to enter virtual worlds. Apart from Sandbox, several VR centers and arcade operators, including The Void, Zero Latency, Dreamscape, and Spaces, were forced to shut down their retail locations amid the pandemic and face significant financial and logistical challenges post the brunt of the pandemic.

Virtual Reality (VR) Market Trends

Gaming Segment Accounted for the Largest Market Share

- There has been a rapid growth in VR and AR gamers worldwide, expanding the market horizon. According to NewGenApps, a provider of Machine Learning, Artificial Intelligence, Big Data Analytics, and AR/VR solutions, the global user base of VR and AR games is expected to increase to 216 million users and will be worth USD 11.6 billion by 2025.

- Furthermore, the increased comfort levels of consumers in situational uses, such as VR calls and VR gaming, are among the factors which suggest a positive outlook for VR technology in gaming.

- As per the figures released by the Entertainment Software Association, nearly 227 million American people play video games weekly, including two-thirds of adults and three-fourths of kids below 18 years of age. About 55% of males and 45% of females play video games, and the average age of players playing a video game is 31 years.

- In Feb 2022, Sony came up with VR2 and VR2 Sense Controllers for the PlayStation 5 to give users a next-level virtual reality experience allowing players to escape into the gaming world with a high range of sensations. VR2 adds a high visual fidelity and enhanced trackers.

- In July 2021, Virtex announced that it plans to launch a virtual reality stadium, 'Virtex Stadium,' which lets the fans watch the game with their friends from the center of the field. The launch is in line with the growing popularity of e-sports and the growing affordability and performance of VR consumer devices. According to VentureBeat, the eSports audience globally accounted for 474 million in 2021 and is expected to reach 577.2 million by 2024.

North America Holds Significant Market Share

- North America is one of the prominent regions for the virtual reality market. It has also been a pioneer in adopting innovations, which provides North America with an edge over other regions.

- Further, the region has the highest number of startups focusing on bringing innovative VR technologies for various industries. According to Tracxn Technologies, there are approximately 951 Virtual Reality startups in the United States. A few of them include Orbbec, JauntVR, Dreamscape, and Sandbox VR. Dreamscape is creating a location-based immersive virtual reality entertainment.

- Tracxn Technologies aims to open a VR multiplex in Los Angeles which will use untethered VR headsets, which means that participants will be wearing VR headsets powered by a computer carried around in a custom backpack, which will allow them to move freely through space and interact with real and virtual objects as well as with each other.

- The investors in this region are actively looking to invest in diverse VR technology startups working in the region. For instance, the GFR Fund has invested in 17 North American startup companies based on VR technology. Such investments are expected to continue and are estimated to drive market growth in the forecast period.

- Various research centers and academics in the region have also been working to explore the potential of virtual reality technology. For instance, Iowa State University's Virtual Reality Applications Center (VRAC) is an interdisciplinary research center focused on the intersection of humans and technology. The Medical Virtual Reality group at the University of Southern California Institute for Creative Technologies is dedicated to studying and advancing the uses of VR simulation technology for clinical purposes.

Virtual Reality (VR) Industry Overview

The global virtual reality market is witnessing a rise in competitiveness among companies. The market consists of major players, such as Oculus, Google, Samsung, Sony, HTC, and Lenovo. In terms of market share, these significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- Mar 2022 - Liquid Avtar Technologies Inc, a fintech solutions company, has launched the first-ever loyalty program and payment card specially created for the metaverse. The card is a physical card powered by OptimizeFT's Engage360 payment card and digital banking solutions platform, available in the United States.

- Oct 2021 - Capcom's critically-acclaimed Resident Evil 4 is launching for VR, exclusively on Oculus Quest 2 Capcom partnered with Oculus Studios and Armature Studiovto to launch an immersive first-person perspective only VR can deliver. Standing or seated, players will enjoy plenty of comfort options. Support for teleportation and room-scale movement means you can explore the game's world your way.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of VR in Commercial Application

- 5.1.2 Increasing Demand for VR Setup for Training across Various End-user Segments

- 5.2 Market Restraints

- 5.2.1 Health Risks from Using VR Headsets in the Long Run

6 MARKET SEGMENTATION

- 6.1 By HMD

- 6.1.1 Tethered HMD

- 6.1.2 Standalone HMD

- 6.1.3 Screenless Viewer

- 6.2 By End-user Industry

- 6.2.1 Gaming

- 6.2.2 Media and Entertainment

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 Military and Defense

- 6.2.6 Real Estate

- 6.2.7 Education

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Asia Pacific

- 6.3.3 Europe

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oculus VR LLC

- 7.1.2 Sony Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Lenovo Group Ltd

- 7.1.5 Pico Interactive Inc.

- 7.1.6 StarVRCorporation

- 7.1.7 FOVE Inc.

- 7.1.8 Unity Technologies Inc.

- 7.1.9 Unreal Engine (Epic Games Inc.)

- 7.1.10 DPVR (Lexiang Technology Co. Ltd)

- 7.1.11 Autodesk Inc.

- 7.1.12 Eon Reality Inc.

- 7.1.13 3D Systems Corporation

- 7.1.14 Dassault Systemes SE

- 7.1.15 HTC Vive (HTC Corporation)