|

市場調查報告書

商品編碼

1441592

汽車內裝 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Automotive Interior - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

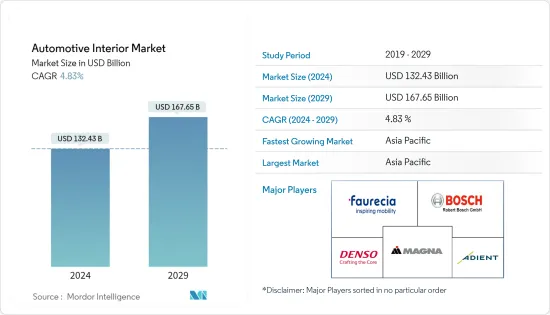

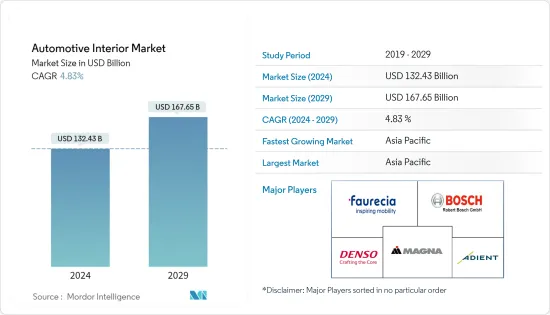

2024年汽車內裝市場規模預計為1,324.3億美元,預計到2029年將達到1,676.5億美元,在預測期(2024-2029年)CAGR為4.83%。

由於對汽車生產的影響,COVID-19 大流行阻礙了汽車內裝市場的成長。然而,2020年後汽車產量的穩定復甦將支持該市場未來幾年的發展。例如,馬瑞利 (Marelli) 2020 年前兩個季度的整體生產受到了 COVID-19 的重大影響。自 2020 年 3 月開始全國封鎖後,該公司不得不關閉其在該國的工廠約兩週。 ,本公司在採取必要措施後於2020年4月恢復營運。

車載資訊娛樂系統出現了多項技術主導地位,這極大地推動了汽車內裝市場的成長。例如:

主要亮點

- 車載資訊娛樂系統中內建的智慧型手機功能不斷增加。在北美和歐洲,超過90%的成年人透過手機上網,這一比例在其他地區也是最高的。隨著手機使用量的增加,汽車中用於相同用途的智慧型手機也增加。

- 製造商正在推出觸控螢幕資訊娛樂系統,這徹底改變了內部客艙體驗。如今,在觸控螢幕資訊娛樂系統取得了幾項新的進步之後,製造商推出了預測性觸控螢幕功能,該功能將遵循指令而無需實際觸控螢幕。這提高了駕駛員的舒適度和輕鬆度,從而獲得了動力。

消費者安全擔憂的增加、技術的進步以及對豪華汽車的需求激增預計將推動市場成長。政府對輕型和安全車輛的支持可能會推動市場成長。

亞太地區在汽車內裝材料市場的消費方面佔據最大佔有率。日本和中國將成為該地區不斷成長的需求的主要支持者。此外,印度產品需求前景的改善是另一個潛在的成長因素。歐洲憑藉其龐大的汽車製造商OEM基地,也將增加內裝材料市場的訂單。

汽車內裝市場趨勢

資訊娛樂系統可望主導汽車內裝市場

資訊娛樂系統是汽車內裝市場中最大的部分。早些時候,汽車僅提供一個資訊娛樂螢幕,但隨著技術的進步,資訊娛樂螢幕的數量和尺寸也在增加。

因此,資訊娛樂螢幕已成為每個汽車製造商的主要焦點,這些螢幕都充滿了最新的技術功能,如2022年,梅賽德斯-奔馳針對印度市場推出了S級車隊,即S350d和S450進口150輛新車。車內的資訊娛樂系統讓消費者驚嘆不已;該車配備 64 色環境照明和後座資訊娛樂螢幕,提供極致的舒適性和豪華感。

汽車製造商不斷升級其資訊娛樂系統,為客戶提供最好的功能和技術。最近推出的一些產品和型號包括:

- 2022年,Jeep還提出,Jeep大切諾基2022款車型可能會配備兩個後座資訊娛樂螢幕,其中儀表板上有一個螢幕,供前座乘客與駕駛員的導航系統進行互動。

- 2022年,豐田推出了新款Tundra TRD卡車,搭載3.5升V6雙渦輪混合動力引擎。從消費者的角度來看,皮卡車的內裝似乎很有前途。它配備了儀表板內資訊娛樂系統,可在不改變自然採光的情況下隨機改變亮度。

- 2022 年,Rivian 考慮到關鍵消費者的所有需求,推出了新款電動皮卡。這款新推出的皮卡在儀表板資訊娛樂系統板上配備了白蠟木裝飾。該系統由 12.3 吋橫向螢幕組成,內建於汽車 HVAC 通風口上方。

隨著汽車配備更多互聯功能,電信和技術廠商正在與主要汽車廠商合作,為客戶開發最佳的連網和資訊娛樂解決方案。

考慮到上述所有因素以及車載資訊娛樂系統的發展,預計汽車內裝市場將在預測期內出現繁榮。

亞太地區引領汽車內裝市場

亞太市場由小型/經濟型汽車區隔市場推動,該區隔市場對內裝零件的採用率更高。該地區的領先汽車製造商,如豐田、本田和現代,正在利用先進座椅系統、照明、電子設備和各種安全系統的優勢,使其成為其車型的基本功能。日本、中國、印度等主要經濟體電動車的出現進一步支撐了市場價值。

2022年4月,中國乘用車產量達99.6萬輛,銷售96.5萬輛。產銷量較上年分別下降41.9%和43.4%。 2022年1-4月,乘用車產量64.94億輛,較去年同期下降2.6%。

在中國,本土企業正在合作生產最好的內裝產品。例如,北汽雲翔汽車與ADAYO合作開發車載資訊娛樂系統。此次合作將為北汽銀翔打造新平台,有助於重建智慧汽車製造的平台化生產模式。中國企業帶著新的願景首次進入市場,為市場帶來成長。例如,2021年11月,中國領先的汽車內裝零件供應商延鋒汽車內裝(YFAI)推出了與TCL及其子公司TCL華星光電共同開發的業界首款板下攝影機車載智慧螢幕。

對優質內裝、舒適性以及平視顯示器和導航系統等新功能和創新功能的需求,以及對滿足安全標準的日益關注,正在推動該地區的市場發展。該地區的主要國家,如中國、日本、印度和韓國,預計將見證新技術的快速採用。由於其高汽車產能,中國預計將為亞太市場的成長做出重大貢獻。

在亞太地區,各國政府的補貼和稅收優惠等措施正在吸引汽車原始設備製造商建造其區域製造工廠。

汽車內裝產業概況

汽車內裝市場的主要參與者包括大陸集團、麥格納國際公司、電裝公司、佛吉亞、安道拓等。由於重要產品製造商為了獲得競爭優勢而採取的各種策略,例如集中研發活動、新產品開發、收購等,未來幾年汽車內裝市場可能會出現競爭。例如,

- 2022年5月,汽車科技公司李爾宣布,正在收購座椅加熱、主動冷卻、座椅感知器等內裝零件供應商IG Bauerhin。

- 2021 年 9 月,Adient 將開始使用 Cardyon;據科思創稱,這是一種採用科思創 CO2 技術生產的多元醇,作為 2021 年 11 月生產熱固化成型聚氨酯泡沫的永續原料。這些泡棉在 Adient 的尖端汽車座椅系統中用作緩衝墊。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔(市場規模(價值十億美元))

- 依車型分類

- 搭乘用車

- 商務車輛

- 依組件類型

- 儀表板

- 資訊娛樂系統

- 室內照明

- 車身面板

- 其他組件類型

- 依地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- Adient PLC

- Grupo Antolin

- Panasonic Corp.

- Faurecia

- Magna International

- Toyota Boshuku Corporation

- Hyundai Mobis Co.

- Pioneer Corporation

- JVCKENWOOD Corporation

- Robert Bosch GmbH

第 7 章:市場機會與未來趨勢

The Automotive Interior Market size is estimated at USD 132.43 billion in 2024, and is expected to reach USD 167.65 billion by 2029, growing at a CAGR of 4.83% during the forecast period (2024-2029).

The COVID-19 pandemic has hindered the growth of the automotive interior market due to its impact on vehicle production. However, a steady recovery post-2020 in vehicle production will support the development of this market in the coming years. For instance, Marelli had a significant impact on COVID-19 on its overall production in the first two quarters of 2020. The company had to shut its facilities for around two weeks in the country after the nationwide lockdown, which started in March 2020. However, the company resumed its operations in April 2020 with the necessary measures.

There have been several technological dominance followed in-vehicle infotainment systems, which has provided a significant boost to the automotive interiors market growth. For instance:

Key Highlights

- There is a rise in smartphone functions built into in-vehicle infotainment systems. In North America and Europe, over 90% of adults have access to the internet through their mobile phones, which is also among the highest among other regions. As mobile phone use has risen, smartphones for the same purposes in their cars have also increased.

- Manufacturers are introducing a touchscreen infotainment system, which has completely changed the in-house cabin experience. Today, after several new advancements seen by the touch screen infotainment system, manufacturers have introduced a predictive touchscreen feature that shall follow the instruction without actually touching the screen. This has improved drivers' comfort and ease, thus gaining momentum.

Increasing consumer safety concerns, rising technological advancements, and a surge in demand for luxurious vehicles are expected to boost the market growth. Government support for lightweight and safe vehicles will likely surge the market growth.

Asia-Pacific accounted for the largest share in terms of consumption in the automotive interior materials market. Japan and China will be the primary support for the region's increasing demand. Moreover, an improved outlook for product demand in India is another potential factor for growth. With its sizeable OEM base of automobile manufacturers, Europe will also add to the order in the interior material market.

Automotive Interior Market Trends

Infotainment System Expected to Dominate the Automotive Interiors Market

The infotainment system is the largest segment in the automotive interiors market. Earlier, cars were offered only one infotainment screen, but as technology advances, the number and dimension of infotainment screens are also increasing.

As such, the infotainment screens have become the main focal point for every automaker, and these screens are packed with the latest technology capabilities, as In 2022, Mercedes-Benz launched its S-class fleet for the Indian market, namely, S350d and S450 importing 150 new cars. The infotainment system in the vehicle amazes the consumer; with 64-colour ambient lighting and rear seat infotainment screens, the car offers ultimate comfort and luxury.

Automakers constantly upgrade their infotainment systems to provide their customers with the best features and technologies. Some of the recent launches and models are:

- In 2022, Jeep also proposed that Jeep Grand Cherokee 2022 model may have two rear seat infotainment screens with a screen in the dashboard for the front-seat passenger to interact with the driver's navigation system.

- In 2022, Toyota launched its new segment Tundra TRD truck, powered by the 3.5-liter V6 twin-turbo hybrid engine. The pickup truck's interior seems promising from a consumer's point of view. It is equipped with the in-dash infotainment system, which changes brightness randomly without a change in natural lighting.

- In 2022, Rivian launched its new electric pickup truck considering all the requirements of critical consumers. This newly launched pickup truck is equipped with decorated ash wood on the dash infotainment system board. The system comprises of 12.3 landscape-oriented screen inbuilt placed just above the HVAC vents of the car.

As the cars come with more connected features, the telecom and technology players are partnering with major automotive players to develop the best connectivity and infotainment solutions for the customers.

Considering all the factors above and the development of in-vehicle infotainment systems, the automotive interiors market is expected to witness prosperity in the forecast period.

Asia-Pacific is Leading the Automotive Interiors Market

The Asian-Pacific market is driven by the small/economy car segment, which accounts for higher adoption of interior components. Leading automakers in this region, such as Toyota, Honda, and Hyundai, are embracing the advantages of advanced seating systems, lighting, electronics, and various safety systems, making them essential features across their car models. The emergence of electric vehicles in major economies, including Japan, China, and India, further supports the market value.

In April 2022, Chinese passenger car production reached 996,000 units, with sales registering 965,000 units. This accounts for the downfall of 41.9% and 43.4% respectively in production and sales compared to the previous year. In 2022, from January to April, passenger car production decreased by 2.6% year-on-year, registering 6,494 million units.

In China, local players are collaborating to produce the best interior products. For instance, BAIC Yunxiang Automobile Co. Ltd collaborated with ADAYO to develop vehicle infotainment systems. This partnership will build new platforms for BAIC Yinxiang and helps to restructure the platform production mode for intelligent vehicle manufacturing. Chinese players are debuting in the market with a new vision to provide growth to the market. For instance, In November 2021, China's leading automotive supplier for interior components, Yanfeng Automotive Interiors (YFAI), introduced an industry-first camera under panel onboard intelligent screen, which is co-developed with TCL and its subsidiary TCL CSOT.

The demand for premium interiors, comfort, and new and innovative features, like head-up displays and navigation systems, along with the growing focus on sufficing the safety standards, is driving the market in the region. Major countries in this region, such as China, Japan, India, and South Korea, are anticipated to witness the rapid adoption of new technologies. Due to its high vehicle production capacity, China is expected to contribute to Asia-Pacific's market growth significantly.

In Asia-Pacific, government initiatives, such as subsidies and tax concessions, across various countries are attracting automotive OEMs to build their regional manufacturing plants.

Automotive Interior Industry Overview

Key automotive interior market participants are Continental AG, Magna International Inc., Denso Corporation, Faurecia, Adient, and Others. The automotive interiors market is likely to expect competition in the coming years, owing to various strategies, such as focused research and development activities, new product developments, acquisitions, etc., by significant product manufacturers to gain a competitive advantage. For instance,

- In May 2022, Lear Corporation, an automotive technology, announced that it is acquiring I.G. Bauerhin, a seat heating supplier, active cooling, seat sensor, and other interior components.

- In September 2021, Adient will begin using cardyon; a polyol made using Covestro's CO2 technology, as a sustainable feedstock for the production of hot cure molded polyurethane foam in November 2021, according to Covestro. These foams are used as cushioning in Adient's cutting-edge automotive seating systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billlion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Component Type

- 5.2.1 Instrument Panels

- 5.2.2 Infotainment Systems

- 5.2.3 Interior Lighting

- 5.2.4 Body Panels

- 5.2.5 Other Component Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.1 North America

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Adient PLC

- 6.2.2 Grupo Antolin

- 6.2.3 Panasonic Corp.

- 6.2.4 Faurecia

- 6.2.5 Magna International

- 6.2.6 Toyota Boshuku Corporation

- 6.2.7 Hyundai Mobis Co.

- 6.2.8 Pioneer Corporation

- 6.2.9 JVCKENWOOD Corporation

- 6.2.10 Robert Bosch GmbH