|

市場調查報告書

商品編碼

1441581

汽車懸吊系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Suspension System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

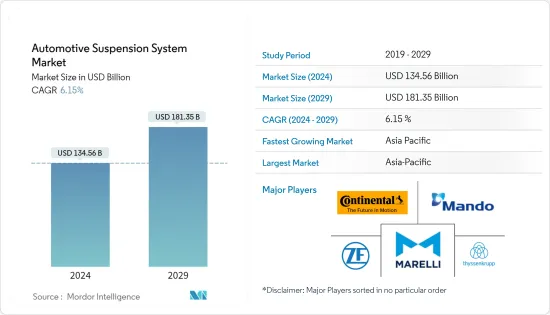

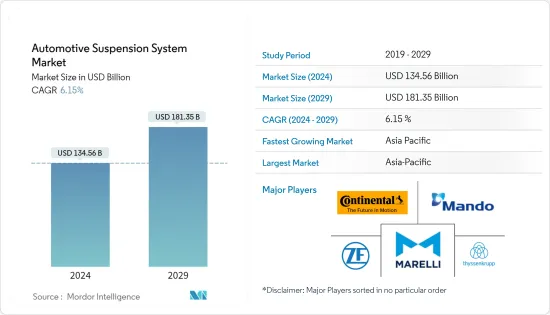

汽車懸吊系統市場規模預計到2024年為1345.6億美元,預計到2029年將達到1813.5億美元,在預測期內(2024-2029年)成長61.5億美元,年複合成長率為%。

2022 年,全球汽車產量約 8,500 萬輛。 2022年,中國小客車產量躍居世界第一,小客車產量約2,384萬輛,商用車產量約319萬輛,鞏固全球第一大小客車生產國地位。

從中期來看,對豪華車的普及和主動懸吊系統的普及預計將在預測期內推動市場需求。車輛自主性的提高預計將推動感測器和電子懸吊系統市場的成長。汽車空氣懸吊的發展是業界最重要的變革之一。

不斷變化的汽車製造模式和不斷提高的消費者期望要求汽車製造商將有效的性能元素融入他們的車輛中。OEM正在投資研發,將新技術整合到懸吊系統中,以提高操縱穩定性並提供更舒適的乘坐體驗。這些發展將推動車輛懸吊市場的發展。例如,2023 年 4 月,EXT 開發了 Era 前叉開創性雙正氣室設計的現代改造,專為滿足 Aria 應用的獨特需求而量身定做。在此基礎上,我們創造了一種減震器,它擁有顯著增強的空氣彈簧,將靈敏度和支撐力的極限推向了前所未有的水平,而以前只有螺旋彈簧減震器才能達到這一水平。

亞太地區和歐洲等地區預計將成為汽車懸吊系統市場成長最快的地區。在亞太地區,預計中國將在預測期內繼續成為市場成長的驅動力。

汽車懸吊系統市場趨勢

擴大商用車銷售拉動市場需求

由於物流業的成長以及貨車(用於叫車服務)等輕型商用車的使用增加,對商用車的需求不斷增加。輕型商用車的主要促進因素之一是,出於物流目的,人們越來越偏愛皮卡車和輕型貨車,而不是重型卡車和鐵路。物流需求的增加歸因於全球電子商務產業的成長。隨著電商市場的擴大,皮卡車、輕卡等輕型商用車的需求預計將增加。

2021年德國輕型商用車新車銷售總計265,732輛,2022年銷售312,400輛。 2021年法國新型輕型商用車銷量總計431,385輛。 2022年,登記車輛為347,069輛。

政府和汽車製造商為採用商用電動車所做的努力預計將在研究期間推動汽車懸吊市場的發展。過去幾年,電動商用車市場的主要汽車製造商紛紛制定電動出行策略,為全球懸吊市場的振興做出了貢獻。例如:

2022 年 5 月,蒂森克虜伯在巴西聖保羅開設了一個用於重型車輛懸吊產品全球開發的新技術中心,由該公司的彈簧和穩定器業務部門負責營運。蒂森克虜伯在聖保羅和伊比利特設有彈簧和穩定器工廠,為各種尺寸的車輛(包括小客車、巴士和卡車)生產彈簧和穩定器。

技術進步以及新車的推出和全球商用電動車的日益普及,預計將在預測期內推動汽車懸吊系統市場的成長。由於環境問題日益嚴重,電動商用車市場正處於成長階段,預計在預測期內市場將大幅成長。

預計亞太地區在預測期內將實現最高成長

預計亞太地區汽車懸吊系統市場的收益在預測期內將顯著成長。由於全部區域新車(包括小客車和商用車)銷量的增加,該市場正在經歷顯著成長。例如,

2022年,中國小客車銷量將超過2,300萬輛,成為亞太地區最大的市場。印度是該地區第二大市場,2022 年銷量約 380 萬輛。

隨著大公司在全部區域擴大生產設施,市場上可能會出現機會。例如,

2022 年 5 月,天納克宣布 2022 年 Mercedes-AMG SL 級豪華跑車將配備 Monroe 智慧懸吊產品組合中的兩項最新智慧懸吊技術。新車型將配備天納克的CVSA2半主動懸吊或整合式CVSA2/Kinetic懸吊。

這些舉措預計將在未來幾年提高汽車產量,進而提高全部區域對汽車懸吊系統的需求。

汽車懸吊系統產業概況

汽車懸吊系統市場適度整合,大陸集團、萬都公司、採埃孚、馬瑞利、蒂森克虜伯公司和萬都公司等主要企業佔據了主要市場佔有率。產品創新和新市場的地理擴張對於汽車懸吊市場的任何參與者的成功都發揮著重要作用。

2022 年 1 月,採埃孚股份公司推出了商用車部門,名為商用車解決方案。這使得該公司成為汽車行業最大的商用車供應商。

2022年5月,捷豹路虎(JLR)宣布推出新款路虎衛士130。 Defender 130標配路虎智慧全輪驅動(iAWD)系統與八速ZF自動排檔變速箱。它配備了「自我調整電子空氣懸吊」和路虎先進的地形反應系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 擴大全球汽車銷售

- 市場限制因素

- 先進懸吊系統高成本

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔(金額、市場規模)

- 元件類型

- 螺旋彈簧

- 鋼板彈簧

- 空氣彈簧

- 避震器

- 其他組件類型

- 類型

- 被動懸吊

- 半主動懸吊

- 主動懸吊

- 車輛類型

- 小客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Continental AG

- Mando Corporation

- ZF Friedrichshafen AG

- Thyssenkrupp AG

- Tenneco Inc.

- Marelli Corporation

- Hyundai Mobis Co. Ltd

- Hitachi Astemo Ltd

- BWI Group

- Sogefi SpA

- KYB Corporation

- LORD Corporation

第7章市場機會與未來趨勢

- 感測器和電子整合

The Automotive Suspension System Market size is estimated at USD 134.56 billion in 2024, and is expected to reach USD 181.35 billion by 2029, growing at a CAGR of 6.15% during the forecast period (2024-2029).

In 2022, some 85 million motor vehicles were produced worldwide. In 2022, China emerged as the global leader in passenger car production, manufacturing approximately 23.84 million such vehicles alongside 3.19 million commercial vehicles, solidifying its position as the foremost producer of passenger cars worldwide.

Over the medium term, demand for luxury cars and penetration of active suspension systems are expected to drive the market demand over the forecast period. The rise in vehicle autonomy is expected to drive the market growth for sensor- and electronic-based suspension systems. The development of air suspension in automobiles was one of the most significant changes in the industry.

The shifting paradigm of automobile manufacturing and rising consumer expectations will necessitate the incorporation of effective performance elements into vehicles by automakers. OEMs are investing in R&D to integrate novel technologies into suspension systems to improve steering stability and provide a comfortable ride. Such developments will drive the vehicle suspension market forward. For Instance, In April 2023, EXT developed an updated adaptation of the Era fork's pioneering dual-positive air chamber design, specifically tailored to meet the unique demands of the Aria application. Building upon this foundation, they have crafted a shock absorber that boasts a significantly enhanced air spring, pushing the boundaries of sensitivity and support to unprecedented levels previously attainable solely by coil-sprung shocks.

Regions like Asia-Pacific and Europe are forecasted to be the fastest-growing automotive suspension system market. In Asia-Pacific, China is expected to continue to be the driver of market growth during the forecast period.

Automotive Suspension Systems Market Trends

Growing Sales of Commercial Vehicles to Drive Demand in the Market

The demand for commercial vehicles is rising owing to the growing logistics industry and increasing usage of light commercial vehicles, such as vans (for ride-hailing services). One of the key driving factors for light commercial vehicles is the increased preference for pickup trucks and small vans over heavy-duty trucks and railways for logistics. The growing demand for logistics stems from the growing e-commerce industry globally. As the e-commerce market continues to expand, demand for pickup vans, small trucks, and other LCVs is also likely to increase.

The new vehicle sales of Light commercial vehicles in Germany stood at 265732 units in 2021 and 312400 units in 2022. The new vehicle sales of Light commercial vehicles in France stood at 431385 units in 2021. In 2022, the same was 347069 units registered.

The government and car manufacturers' initiatives to introduce commercial electric vehicles are expected to drive the automotive suspension market in the study period. In the past few years, the electric commercial vehicle market witnessed major automakers rolling out their strategies toward electric mobility, helping to boost the global suspension market. For instance:

In May 2022, Thyssenkrupp opened a new technology center for the global development of suspension products for heavy vehicles in Sao Paulo, Brazil, operated by its Springs & Stabilizers business unit. ThyssenKrupp has Springs & Stabilizers factories in Sao Paulo and Ibirite, which produce springs and stabilizer bars for vehicles of various sizes, such as cars, buses, and trucks.

Technological advancements, along with new vehicle launches and increasing adoption of commercial electric vehicles across the world, are expected to help the automotive suspension system market grow during the forecasted period. Due to the rising environmental concerns, the electric commercial vehicle market is in its growth phase, and the market is expected to rise exponentially during the forecast period.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

The Asia-Pacific automotive suspension system market is expected to grow at a significant rate in terms of revenue during the forecast period. The rise in new vehicle sales, including passenger cars and commercial vehicles across the region, is witnessing major growth in the market. For instance,

In 2022, over 23 million passenger cars were sold in China, making it the largest market in the Asia-Pacific region. India was the second biggest market in the region, with nearly 3.8 million unit sales in 2022.

Major companies expanding their production facilities across the region is likely to create an opportunity for the market. For instance,

In May 2022, Tenneco Inc. announced that the 2022 Mercedes-AMG SL-Class of luxury roadsters would feature two of the latest intelligent suspension technologies from its Monroe Intelligent Suspension portfolio. The new models will be offered with Tenneco's CVSA2 semi-active suspension or integrated CVSA2/Kinetic suspension.

Such initiatives are expected to drive automotive production in the upcoming years, which, in turn, would drive the demand for automotive suspension systems across the region.

Automotive Suspension Systems Industry Overview

The automotive suspension system market is moderately consolidated with leading players such as Continental AG, Mando Corporation, ZF, Magneti Marelli, Thyssenkrupp AG, Mando Corporation, etc., accounting for major market share. Product innovation and geographic expansion to new markets will play a major role in the success of any player in the automotive suspension market.

In January 2022, ZF Friedrichshafen AG launched a commercial vehicle division named Commercial Vehicle Solutions. This makes the company the largest commercial vehicle supplier in the automotive industry.

In May 2022, Jaguar Land Rover (JLR) announced the launch of the new Land Rover Defender 130. Defender 130 is fitted with Land Rover's Intelligent All-Wheel Drive (iAWD) system and eight-speed ZF automatic transmission as standard. It is fitted with 'Electronic Air Suspension with Adaptive Dynamics' and Land Rover's advanced Terrain Response system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Sales Across the Globe

- 4.2 Market Restraints

- 4.2.1 High Cost of Advanced Suspension Systems

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 Component Type

- 5.1.1 Coil Spring

- 5.1.2 Leaf Spring

- 5.1.3 Air Spring

- 5.1.4 Shock Absorber

- 5.1.5 Other Component Types

- 5.2 Type

- 5.2.1 Passive Suspension

- 5.2.2 Semi-active Suspension

- 5.2.3 Active Suspension

- 5.3 Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Commercial Vehicle

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Mando Corporation

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 Thyssenkrupp AG

- 6.2.5 Tenneco Inc.

- 6.2.6 Marelli Corporation

- 6.2.7 Hyundai Mobis Co. Ltd

- 6.2.8 Hitachi Astemo Ltd

- 6.2.9 BWI Group

- 6.2.10 Sogefi SpA

- 6.2.11 KYB Corporation

- 6.2.12 LORD Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Sensors and Electronics