|

市場調查報告書

商品編碼

1441574

汽車金屬沖壓 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Automotive Metal Stamping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

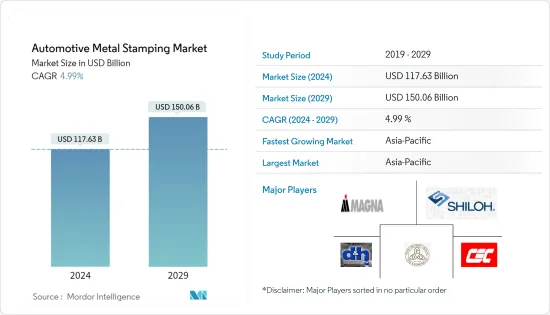

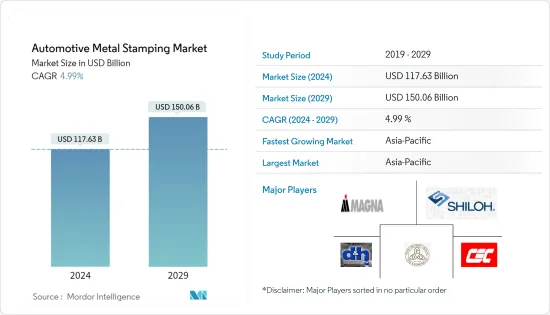

2024年汽車金屬沖壓市場規模預計為1176.3億美元,預計到2029年將達到1500.6億美元,在預測期內(2024-2029年)CAGR為4.99%。

全球汽車產量的增加和乘用車需求的增加可能會見證汽車金屬沖壓市場的大幅成長。然而,隨著為了提高燃油效率和減輕車輛重量而縮小引擎尺寸的趨勢不斷成長,預計鋁等輕質金屬將在汽車金屬沖壓公司中出現巨大需求。這可能會見證汽車金屬沖壓市場的顯著成長。

雷射金屬沖壓和液壓金屬沖壓等不斷發展的技術進步有助於降低製造成本,可能會推動汽車金屬沖壓市場的發展。製造業的快速擴張也推動了全球汽車金屬沖壓市場的發展。

金屬廣泛應用於汽車工業。重點整車廠與汽車沖壓企業簽訂製造契約,是後者業務拓展的重要來源。因此,汽車生產趨勢和針對汽車成分的政策框架對汽車金屬沖壓產業產生重大影響。

汽車金屬沖壓市場趨勢

沖裁工藝領域將佔據重要的市場佔有率 -

金屬沖壓在汽車行業中的使用日益廣泛,見證了市場的大幅成長。沖裁製程可以執行長時間的生產,這需要對機械或基材進行微小的改變。主要汽車產業更喜歡將沖裁製程作為生產大批量零件的常用製程。對高效車輛不斷成長的需求促使了創新和獨特的外部車身結構的設計,並考慮了空氣動力學效率。沖裁金屬沖壓提供了將金屬製造成更小、更易於管理的零件的技術,以便更緊密地包裝在車輛內部和周圍。

一些參與者正在與原始設備製造商建立業務合作夥伴關係,這見證了金屬沖壓市場的重大成長。例如,

- 2023 年 2 月,Fischer 集團在其 Achern 總部推出了尖端的 TruLaser 8000 Coil Edition 下料,實現了與通快合作的里程碑。此創新系統可自主加工多達 25 噸的捲狀金屬板材,透過提高材料利用率和資源效率,徹底改變金屬板材生產。該技術最初專注於汽車行業 Fischer 熱成型產品的鋁沖裁,標誌著重大飛躍。

雷射技術的進步,例如使用雷射沖裁技術支援的鈑金沖壓機,正在對市場產生積極影響。主要汽車零件製造中落料製程自動化程度的提升是落料製程的關鍵因素。由於這些因素,預計將在預測期內提振金屬沖壓市場。

亞太地區預計將主導目標市場 -

預計亞太地區將佔據汽車沖壓市場的大部分佔有率。該地區可支配收入的增加和全球國內生產總值的成長正在推動市場。汽車零件製造的便利性、汽車銷售以及日益嚴格的政府法規改善了電動車的採用,以及該地區原始設備製造商和供應商為滿足亞太地區汽車行業不斷成長的需求而採取的強勁擴張,預計將創造正面的影響預測期內的市場成長前景。

從年銷量和製造產量來看,中國仍然是全球最大的汽車市場,預計到2025年國內產量將達到3500萬輛。根據中國汽車工業協會的資料,2022年汽車銷量將超過2690萬輛,較2021年成長3.46%。2022 年印度年銷量為380 萬台,較2021 年的370 萬台成長超過25%。 2022年,印度乘用車產業經歷了數個破紀錄的年份。

該地區的幾家製造商正在引入不同的業務策略來迎合金屬沖壓市場的需求。例如,在2023年1月,2023年汽配展上,海斯坦普宣佈在印度興建第四條熱沖壓生產線。這款新設備加入了印度浦那現有的燙印生產線。該公司強調,此舉符合其印度和全球戰略。它旨在拉近與客戶的距離,並就製造商附近的解決方案進行協作。

由於上述因素,預計該行業將以合理的速度成長,從而增強預測期內汽車金屬沖壓市場的需求。

汽車金屬沖壓產業概況

汽車金屬沖壓市場有多家參與者,例如 Clow Stamping Company.、D&H Industries Inc.、Shiloh Industries Inc.、PDQ Tool & Stamping Co、Magna International Inc. 和 Integrity Manufacturing。一些公司正在利用新的創新技術擴大業務範圍,以便比競爭對手更具優勢。然而,市場分散,有多家本地企業在市場上運作。例如,

- 2023 年 2 月,Fischer 集團在其 Achern 總部推出了尖端的 TruLaser 8000 Coil Edition 下料,實現了與通快合作的里程碑。此創新系統可自主加工多達 25 噸的捲狀金屬板材,透過提高材料利用率和資源效率,徹底改變金屬板材生產。該技術最初專注於汽車行業 Fischer 熱成型產品的鋁沖裁,標誌著重大飛躍。

- 2022 年 9 月,通用汽車宣布投資 4.91 億美元,以提高其位於美國印第安納州馬里恩金屬沖壓工廠的鋼和鋁沖壓件的產量,用於未來產品,包括電動車。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場促進因素

- 預計汽車產量的增加將提振市場

- 市場限制

- 原物料價格波動可能會阻礙市場成長

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔(以美元計的市場規模)

- 科技

- 消隱

- 壓花

- 鑄造

- 翻邊

- 彎曲

- 其他技術

- 流程

- 滾壓成型

- 燙金

- 鈑金成型

- 金屬加工

- 其他流程

- 車輛類型

- 搭乘用車

- 商務車輛

- 地理

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太

- 印度

- 中國

- 日本

- 韓國

- 亞太其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第 6 章:競爭格局

- 供應商市佔率

- 公司簡介

- Clow Stamping Company

- D&H Industries

- Magna International Inc.

- PDQ Tool & Stamping Co.

- Alcoa Inc.

- Shiloh Industries Inc.

- Manor Tool & Manufacturing Company

- Lindy Manufacturing

- American Industrial Company

- Tempco Manufacturing

- Wisconsin Metal Parts Inc.

- Goshen Stamping Co. Inc.

- Interplex Industries Inc.

第 7 章:市場機會與未來趨勢

The Automotive Metal Stamping Market size is estimated at USD 117.63 billion in 2024, and is expected to reach USD 150.06 billion by 2029, growing at a CAGR of 4.99% during the forecast period (2024-2029).

Rising vehicle production and an increase in demand for passenger vehicle across the globe is likely to witness major growth in the automotive metal stamping market. However, with the growing trend toward engine downsizing in order to enhance fuel efficiency and lighter vehicles, lightweight metals such as aluminum are expected to witness huge demand among automotive metal stamping companies. This is likely to witness significant growth in the automotive metal stamping market.

Growing technology advancements such as laser metal stamping and hydraulic metal stamping, which help to reduce manufacturing cost, is likely to fuel the automotive metal stamping market. The rapid expansion of manufacturing industries is also fuelling the automotive metal stamping market across the globe.

Metals are widely used in the automotive industry. Key original equipment manufacturers have established manufacturing contracts with automotive stamping companies, which are an important source of business expansion for the latter. As a result, automotive production trends and policy frameworks aimed at automobile composition have a significant impact on the automotive metal stamping industry.

Automotive Metal Stamping Market Trends

Blanking Process Segment to Hold Significant Market Share -

The growing use of metal stamping in the automotive industry is witnessing major growth in the market. The blanking process can perform long production runs which require minor changes to the machinery or base material. Major automotive industries prefer the blanking process as the process commonly used to produce mass components. The rising demand for efficient vehicles has led to the design of innovative and unique outer body structures, with aerodynamic efficiency in consideration. Blanking metal stamping offers the technology to fabricate metal into smaller and more manageable pieces to be more tightly packaged in and around vehicles.

Several players are introducing business partnerships with the original equipment manufacturers which is witnessing major growth in the metal stamping market. For instance,

- In February 2023, Fischer Group achieved a milestone in its partnership with TRUMPF by introducing the cutting-edge TruLaser 8000 Coil Edition blanking at its Achern headquarters. This innovative system autonomously processes up to 25 tons of coiled sheet metal, revolutionizing sheet metal production with enhanced material utilization and resource efficiency. Initially focused on aluminum blanking for Fischer's hot-forming products in the automotive industry, this technology marks a significant leap forward.

Advancements in laser technology, such as the usage of laser blanking technology supported sheet metal stamping machines, are positively affecting the market. The rise in automation in the blanking process in major automotive component manufacturing is a key factor for the blanking process. Owing to such factors is anticipated to boost the metal stamping market over the forecast period.

Asia-Pacific Region is Expected to Dominate the Target Market -

The Asia-Pacific region is expected to have a majority share in the automotive stamping market. Rising disposable income and an increase in global domestic product in the region are driving the market. Ease of manufacturing auto parts, vehicle sales, and growing government regulations improving electric vehicles adoption and robust expansion adopted by original equipment manufacturers and suppliers in the region to accommodate rising demand from the automotive industry across the Asia-Pacific region is expected to create a positive outlook for market growth during the forecast period.

China continues to be the world's largest automobile vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the China Association of Automobile Manufacturers, over 26.9 million vehicles were sold in 2022, an increase of 3.46% from 2021. India finished 2022 with annual sales of 3.8 million units, up more than 25% from 2021's 3.7 million units. The passenger vehicle industry in India experienced several record-breaking years in 2022.

Several manufacturers in the region are introducing different business strategies to cater to the metal stamping market offerings. For instance, In January 2023, Auto Expo 2023- Components, Gestamp announced its fourth hot stamping production line in India. This new addition joins the existing hot stamping lines in Pune, India. The company emphasizes that this move aligns with its strategy for India and worldwide. It aims to foster proximity to customers and collaborate on solutions near manufacturers.

Owing to these aforementioned factors, the sector is expected to grow at a reasonable rate, enhancing the demand in the automotive metal stamping market during the forecast period.

Automotive Metal Stamping Industry Overview

The automotive metal stamping market has the presence of several players, such as Clow Stamping Company., D&H Industries Inc., Shiloh Industries Inc., PDQ Tool & Stamping Co., Magna International Inc., and Integrity Manufacturing. Several companies are expanding their footprints with new innovative technologies so that they can have an edge over their competitors. However, the market is fragmented with several local players operating in the market. For instance,

- In February 2023, Fischer Group achieved a milestone in its partnership with TRUMPF by introducing the cutting-edge TruLaser 8000 Coil Edition blanking at its Achern headquarters. This innovative system autonomously processes up to 25 tons of coiled sheet metal, revolutionizing sheet metal production with enhanced material utilization and resource efficiency. Initially focused on aluminum blanking for Fischer's hot-forming products in the automotive industry, this technology marks a significant leap forward.

- In September 2022, General Motors Co. announced an investment of USD 491 million to boost the production of steel and aluminum stamped parts for future products, including electric vehicles, at its Marion metal stamping facility in Indiana, United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Automobile Production is Anticipated to Boosts the Market

- 4.2 Market Restraints

- 4.2.1 Fluctuating Raw Material Prices May Hinder the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 Technology

- 5.1.1 Blanking

- 5.1.2 Embossing

- 5.1.3 Coining

- 5.1.4 Flanging

- 5.1.5 Bending

- 5.1.6 Other Technologies

- 5.2 Process

- 5.2.1 Roll Forming

- 5.2.2 Hot Stamping

- 5.2.3 Sheet Metal Forming

- 5.2.4 Metal Fabrication

- 5.2.5 Other Processes

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Clow Stamping Company

- 6.2.2 D&H Industries

- 6.2.3 Magna International Inc.

- 6.2.4 PDQ Tool & Stamping Co.

- 6.2.5 Alcoa Inc.

- 6.2.6 Shiloh Industries Inc.

- 6.2.7 Manor Tool & Manufacturing Company

- 6.2.8 Lindy Manufacturing

- 6.2.9 American Industrial Company

- 6.2.10 Tempco Manufacturing

- 6.2.11 Wisconsin Metal Parts Inc.

- 6.2.12 Goshen Stamping Co. Inc.

- 6.2.13 Interplex Industries Inc.