|

市場調查報告書

商品編碼

1441572

瓶蓋設備:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Bottle-Capping Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

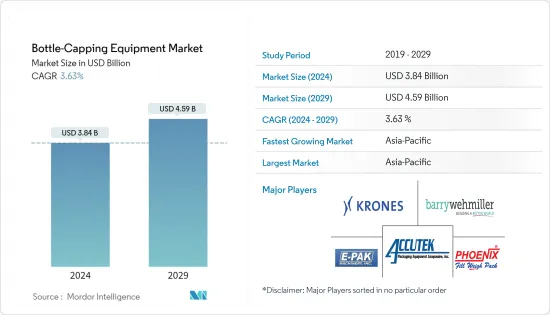

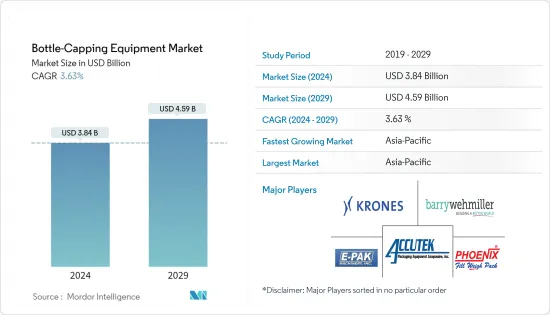

2024年瓶蓋設備市場規模估計為38.4億美元,預計到2029年將達到45.9億美元,在預測期間(2024-2029年)以3.63%的複合年增長率增長。

針對不同尺寸和類型的瓶子設計的旋蓋機應配備CIP(就地清洗)技術,以對旋蓋機進行消毒並避免污染。它在食品加工和製藥行業中很常見。 CIP 技術是完全自動化的,可最大程度地減少人類接觸,而人類接觸被認為是重要的污染源。預計此類技術創新將在預測期內推動市場發展。

主要亮點

- 對快速流通的飲料和藥品的需求不斷成長,迫使製造商提高生產線的速度。人們對能夠快速填充瓶子同時保持體積和重量精度的瓶蓋設備的需求不斷成長。隨著消費者健康安全意識的增強,對瓶子包裝材料的需求也不斷增加。

- 旋蓋機應用廣泛,主要在製藥和化學工業,用於緊密密封整個瓶子包裝。封蓋機提高了製造過程的品質和衛生水準。預計這些因素將推動對旋蓋機的需求。

- 旋蓋機用於包裝由塑膠、玻璃和金屬製成的不同類型的瓶子。近年來,由於注重健康的消費者可支配收入和生活水準的提高,對加工食品的需求增加,食品和飲料行業得到發展。對包裝飲料的需求不斷成長預計將推動瓶蓋設備市場的成長。

- 由於設備成本高昂,建造包裝產業需要大量資本投資。因此,整個裝置的整體維護成本非常高,這也限制了瓶蓋設備市場的成長。

- 隨著冠狀病毒感染疾病(COVID-19) 大流行的威脅日益嚴重,製藥業對瓶蓋機的需求不斷增加。這促使公司啟動研發過程來開發疫苗以防止病毒傳播,從而推動市場成長。

瓶蓋設備的市場趨勢

對製藥和化學工業的需求不斷增加

- 製藥和化學行業對防篡改瓶蓋的需求預計將會增加,因為它們需要兒童安全且無污染的包裝。公司正在尋找可以提供更長保存期限的產品。如今,許多製造商都在出貨產品,包裝的設計必須能夠承受運輸並在不同的環境條件下保持完整性。

- 藥品包裝必須符合國際安全監管標準,因此瓶蓋有助於防止污染,被認為是理想的選擇。瓶蓋設備的這些特徵促進了市場的成長。

- 根據 ITA 2022 年 7 月進行的一項研究,阿拉伯聯合大公國擁有強大的醫療基礎設施。建立世界一流的醫療基礎設施是阿拉伯聯合大公國政府的首要任務,近年來取得了顯著的發展和擴張。阿拉伯聯合大公國的醫療保健產業不斷發展,以滿足阿拉伯聯合大公國國民不斷變化的需求以及該國成為醫療旅遊區域中心的願望。各國的這一目標將利用工業來確保產品安全。

- 根據阿迪納特國際公司的研究,就產品安全而言,瓶蓋在處理藥品時更為重要。蓋子充當元素純度和不必要的環境污染之間的屏障。現代化已將管瓶封蓋機引入市場,有助於實現安全包裝的目標。製藥公司處理含有敏感成分的產品。因此,正確加蓋的無菌瓶很重要。製藥公司需要實用的瓶蓋流程來確保產品安全。市場上許多公司可以提供有針對性的機制來提高其產品品質。

- 2022 年 6 月,Shemesh Automation 推出了 Attilus,這是一款具有整合機器人技術和先進視覺系統的連續運動旋蓋機。整合機器人技術和漸進式視覺系統將使 ATTILUS 能夠在自動瓶蓋、泵浦和觸發器分類方面提供無與倫比的彈性、速度和更高的準確性。只需依一下依鈕即可更改瓶蓋類型,無需格式化零件,並顯著減少停機時間,從而為客戶節省金錢。

- 美國化工產業正透過調整產品組合、重塑供應鏈、加速材料創新等方式進行轉型,材料轉型預計將在2023年恢復。這種重置的重要性在於並由客戶需求的變化所驅動,包括所銷售的產品,並且可以追溯到原料的方法和選擇。透過高效創新和新產品開發,製造商開發了更快、更有效率的旋蓋機。

亞太地區預計將佔據較大佔有率

- 在大流行期間,終端用戶行業擴大生產設施以及製藥公司需求增加可能會繼續影響預測期內中國瓶蓋設備市場的成長。

- 印度是世界領先的牛奶生產國之一。隨著消費者的關注,乳製品供應商開始推出瓶裝產品。乳製品市場的供應商也在印度投資建造瓶子製造廠,這對瓶蓋設備的需求產生了積極影響。

- 根據分析,由於近年來產能增加,瓶蓋市場廠商受到化學肥料產業的高度關注。例如,2022 年 2 月,化學品和化肥部長曼蘇赫·曼達維亞 (Mansukh Mandaviya) 宣布,印度中央公共部門企業Rashtriya 化學品和化肥有限公司將建立一座生產工廠,每天生產15 萬瓶奈米脲。宣布。提高奈米脲瓶的生產能力將有助於農民滿足他們的需求。據該部長稱,預計 2022-23 年將生產約 60 億個奈米尿素瓶。這些發展以及化學、製藥、食品和乳製品行業不斷成長的需求可能會在預測期內推動印度市場的發展。

- 在日本,瓶蓋設備市場預計在預測期內將穩定成長。該國的市場成長預計將受到食品飲料和製藥業對永續解決方案日益成長的需求的影響。此外,許多知名市場供應商的自動化和不斷擴大的影響力以及其產品的不斷創新可能會增加預測期內對瓶蓋設備的需求。

- 亞太地區的其他國家包括澳洲、新加坡和韓國等國家。這些國家也有潛力佔據被調查市場的巨大佔有率。最終用戶產業正在提供創新和永續的飲料包裝,以符合該國的永續性努力。例如,2022年11月,Gentle Brands為Monbest超純水品牌韓國水晶飲料設計了一款新的「無標籤」瓶子,以幫助減少韓國的塑膠使用。這種發展可以為該地區的市場供應商創造機會。

瓶蓋設備產業概況

瓶蓋設備市場競爭激烈,JBT Corporation、Tetra Pak International SA 和 Krones AG 等主要公司提供相同類型的機器,為客戶提供最佳體驗,並在廣告上花費大量資金。 。

- 2022年10月,西得樂推出了1SKIN,一款獨特的無標籤再生寶特瓶。這是為了使西得樂的客戶能夠透過將出色的貨架吸引力與至關重要的生態認證相結合來實現其永續性目標並推動其奢侈品的銷售。 1 公升瓶裝瞄準了不斷成長的精緻果汁、茶和調味飲料市場。創新的 1SKIN 理念及其簡潔的外觀代表了永續性的突破。

- 2022 年 4 月,利樂為飲料公司推出了繫繩蓋的產品。該公司已投資超過 4 億歐元(4.28 億美元),預計到 2022 年底將出售超過 15 億套已關閉的房產。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業生態系分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 和烏克蘭-俄羅斯戰爭對該行業的影響

- 價格分析

- 進出口分析

- 旋蓋機經銷商及零件供應商

- 售後服務分析

第5章市場動態

- 市場促進因素

- 對製藥和化學工業的需求不斷增加

- 技術創新帶動自動旋蓋機需求

- 市場限制因素

- 存在替代解決方案和高初始投資

第6章市場區隔

- 科技

- 自動的

- 半自動

- 帽型

- 羅普帽

- 螺絲帽

- 依扣帽

- 軟木

- 最終用戶

- 藥品

- 個人護理和化妝品

- 食品和飲料

- 化學品

- 車

- 其他最終用戶

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- E-PAK Machinery Inc.

- Accutek Packaging Equipment Companies Inc.

- Barry-Wehmiller Companies Inc.

- Phoenix Dison Tec LLC

- Krones AG

- Tetra Pak International SA(Tetra Laval Group)

- Sidel Group(Tetra Laval Group)

- Ronchi Mario SpA

- Likai Technology Co. Ltd

- ProMach Inc.

第8章投資分析

第9章市場的未來

The Bottle-Capping Equipment Market size is estimated at USD 3.84 billion in 2024, and is expected to reach USD 4.59 billion by 2029, growing at a CAGR of 3.63% during the forecast period (2024-2029).

Capping machines designed for different sizes and types of bottles should be equipped with CIP (Clean-in-Place) technology to help sanitize the capping machine and avoid contamination. It is common in the food processing and pharmaceutical industries. CIP technology is fully automated, minimizing human contact, which is considered a significant source of contamination. Such technological innovations are expected to drive the market over the forecast period.

Key Highlights

- The growing demand for fast-moving beverages and pharmaceuticals is pushing manufacturers to increase the speed of their production lines. There is a growing need for bottle capping equipment to fill the bottles quickly while maintaining volumetric and weight accuracy. The demand for bottle packaging is also increasing as consumers become more conscious of healthy and safe products.

- Capping machines are widely used to securely seal bottles throughout the packaging, mainly in the pharmaceutical and chemical industries. Capping machines enhance the manufacturing process with quality and sanitization, a few factors expected to drive the demand for capping machines.

- Capping machines are used to pack different types of bottles made of plastic, glass, or metal. In recent years, rising disposable incomes and living standards of health-conscious consumers have increased the demand for processed foods, leading to the development of the food and beverage industry. The increasing demand for packaged beverages is expected to drive the growth of the bottle-capping equipment market.

- Building a packaging industry requires significant capital investments due to high equipment costs. Therefore, the overall maintenance cost of the entire set-up is very high, which also restrains the growth of the bottle-capping equipment market.

- The pharmaceutical industry witnessed increased demand for bottle capping machines with the growing threat of the COVID-19 pandemic. It prompted companies to initiate R&D processes to develop vaccines to prevent the spread of the virus, thus aiding the market's growth.

Bottle-Capping Equipment Market Trends

Increased Demand from Pharmaceutical and Chemical Industries

- The pharmaceutical and chemical industries are anticipated to generate demand for tamper-evident caps, as they require child-resistant and contamination-free packaging. Companies are looking for products that can provide a longer shelf life. With many manufacturers now shipping products, it is necessary to design packaging to survive the transport and sustain its integrity in different environmental conditions.

- The capping of bottles helps prevent contamination and is considered an ideal choice, as pharmaceutical packaging must fulfill international regulatory standards for safety. Such features of bottle-capping equipment will boost the market's growth.

- According to a survey conducted by ITA in July 2022, the United Arab Emirates has a robust medical infrastructure. Creating a world-class healthcare infrastructure is a top priority for the UAE government, and the sector has evolved and expanded significantly in recent years. The UAE healthcare sector has grown to meet the changing needs of the UAE population and the nation's desire to become a regional center for medical tourism. Such goals by the countries would leverage the industry for the safety of the products.

- According to a survey by Adinath International, when it comes to product safety, bottle caps are more critical when dealing with pharmaceuticals. The cap acts as a barrier between elemental purity and unwanted environmental contamination. Modernization led to the introduction of vial capping machines to the market, which will help achieve the goal of safe packaging. Pharmaceutical companies work with products containing sensitive ingredients. Thus, so properly capped sterilized bottles are critical. Pharmaceutical companies need practical bottle capping processes to ensure product safety. Many companies in the market can provide targeted mechanisms to improve product quality.

- In June 2022, Shemesh Automation launched Attilus, a continuous motion capping machine with integrated robotics and an advanced vision system. Integrating robotics and a progressive vision system will allow ATTILUS to deliver unmatched flexibility, increased speeds, and improved accuracy in automatic caps, pumps, and trigger sorting. Cap types will be changeable at the touch of a button, saving customers money by eliminating the need for format parts and dramatically reducing downtime.

- The US chemical industry is transforming by adjusting portfolios, reinventing supply chains, and fostering materials innovation, and 2023 may help restart materials' transformation. The significance of this reset lies in and is driven by changing customer demands, including the products sold, and traces back to the methods and selection of raw materials. With efficient innovation and new product development, manufacturers have developed faster and more efficient capping machines.

Asia-Pacific Expected to Hold Significant Share

- The expansion of manufacturing facilities by end-user industries and increasing demand from pharmaceutical companies amid the pandemic may continue to shape the growth of the bottle-capping equipment market in China during the forecast period.

- India is one of the leading milk producers in the world. With consumers gaining significant traction, dairy vendors are launching their offerings in bottles. Dairy market vendors are also investing in bottle-making plants in India, thus positively influencing the demand for bottle-capping equipment.

- Due to the increasing production capacity in recent years, the bottle capping market vendors are analyzed to gain significant traction from the chemical and fertilizer industry. For instance, in February 2022, the Minister for Chemicals and Fertilizers Mansukh Mandaviya announced that Rashtriya Chemicals & Fertilizers Ltd, an Indian central public sector undertaking, is setting up a production plant to produce 1,50,000 bottles of nano urea per day. Increasing the production capacity of nano urea bottles will help farmers meet their needs. According to the minister, during FY 2022-23, about 6.0 crore bottles of nano urea will be produced. Such developments and increasing demand from the chemical, pharmaceutical, food, and dairy sectors may drive the market in India during the forecast period.

- Japan is expected to witness steady growth in the bottle capping equipment market during the forecast period. The country's market growth is expected to be influenced by the increasing demand for sustainable solutions in the food and beverage and pharmaceutical sectors. In addition, the growing automation and presence of many prominent market vendors and continuous innovation in their offerings may drive the demand for bottle capping equipment during the forecast period.

- The rest of the Asia-Pacific region consists of countries like Australia, Singapore, and South Korea. These countries also have the potential to gain a considerable share of the market studied. The end-user industries are offering innovative and sustainable beverage packaging in line with the country's sustainability efforts. For instance, in November 2022, Gentlebrand designed a new 'no-label' bottle for Korea Crystal Beverage, the Montbest ultra-pure water brand, to help South Korea reduce its use of plastics. Such developments may create opportunities for market vendors in the region.

Bottle-Capping Equipment Industry Overview

The bottle-capping equipment market has fierce competition due to major companies such as JBT Corporation, Tetra Pak International SA, and Krones AG that offer the same types of machines, delivering the best experience to their customers and spending high on advertising.

- In October 2022, Sidel launched 1SKIN, a unique label-less recycled PET bottle, to help Sidel's customers accomplish their sustainability goals and promote sales of high-end items by combining exceptional shelf appeal with the most significant eco credentials. The one-liter bottle is aimed at the growing market for delicate juices, teas, and flavored drinks. The revolutionary 1SKIN idea, with its simplified appearance, represents a breakthrough in sustainability.

- In April 2022, Tetra Pak launched tethered cap-attached products for beverage companies. It is expected to sell over 1.5 billion such closures by the end of FY 2022 after investing over EUR 400 million (USD 428.00 million).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Eco-system Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 and Ukraine-Russia War on the Industry

- 4.5 Pricing Analysis

- 4.6 Import and Export Analysis

- 4.7 Distributors and Spare Parts Providers of Bottle Capping Machines

- 4.8 After-sales Services Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand from Pharmaceutical and Chemical Industries

- 5.1.2 Innovations in Technology Driving the Demand for Automated Capping Machines

- 5.2 Market Restraints

- 5.2.1 Presence of Alternative Solutions and High Initial Investments

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Automatic

- 6.1.2 Semi-automatic

- 6.2 Cap Type

- 6.2.1 ROPP Caps

- 6.2.2 Screw Caps

- 6.2.3 Snap-on-Caps

- 6.2.4 Corks

- 6.3 End User

- 6.3.1 Pharmaceuticals

- 6.3.2 Personal Care and Cosmetics

- 6.3.3 Food and Beverage

- 6.3.4 Chemicals

- 6.3.5 Automotive

- 6.3.6 Other End Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 E-PAK Machinery Inc.

- 7.1.2 Accutek Packaging Equipment Companies Inc.

- 7.1.3 Barry-Wehmiller Companies Inc.

- 7.1.4 Phoenix Dison Tec LLC

- 7.1.5 Krones AG

- 7.1.6 Tetra Pak International SA (Tetra Laval Group)

- 7.1.7 Sidel Group (Tetra Laval Group)

- 7.1.8 Ronchi Mario SpA

- 7.1.9 Likai Technology Co. Ltd

- 7.1.10 ProMach Inc.