|

市場調查報告書

商品編碼

1441554

小客車:全球市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Passenger Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

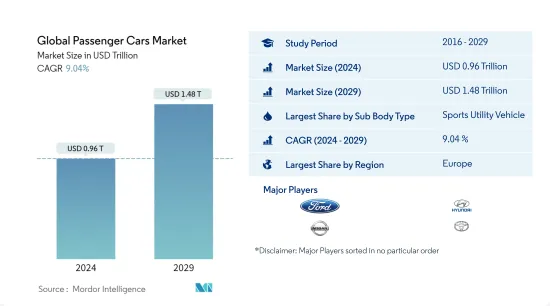

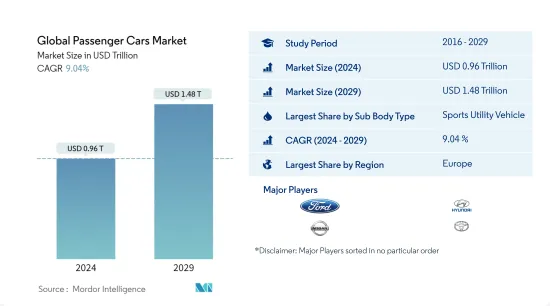

2024年全球小客車市場規模預估為9,600億美元,預估至2029年將達1.48兆美元,在預測期內(2024-2029年)將以複合年成長率9.04%成長。

主要亮點

- 依燃料類型分類的最大區隔市場 - 汽油:汽油在全球所有燃料類型中成長最快。汽油引擎比其他燃料選擇更好,因為傳統燃料容易獲得並且汽油引擎價格實惠。

- 依國家/地區分類最大的區隔市場 - 德國:在全球範圍內,中國佔小客車銷售的最大佔有率。由於消費者可支配所得的增加和生活方式的改變,中國對小客車的需求不斷增加。

- 依車身類型分類最大的區隔市場 - 運動型公共事業車:堅固的結構、全地形能力、大膽的外觀和強大的引擎是 SUV 成為全球小客車市場上最大的車身類型的一些因素。

- 依燃料類型分類成長最快的區隔市場 - FCEV:嚴格的標準、政府補貼以及持續鼓勵私人車主採用 BEV 使 BEV 成為全球小客車市場中成長最快的區隔市場。

小客車市場趨勢

依車身類型分類,運動型公共事業車是最大的區隔市場。

- 汽車產業是受COVID-19感染疾病造成的全球晶片短缺和供應鏈中斷影響最嚴重的產業之一。然而,汽車製造商特斯拉因其製造流程和生產的汽車導致氣候變遷而繼續受到批評。歐盟汽車買家似乎正在幫助減少石化燃料動力汽車的負面影響。

- 2020年,疫情對全球汽車市場產生了重大影響。 2020 年,隨著更多國家實施旅行限制,汽車產業經歷了多次挫折。 2020年,全球汽車銷量為6,380萬輛。預計2021年將出現小幅復甦,預計銷售量將達6,600萬輛。豐田和大眾集團均削減了超過 100 萬輛汽車的交付。

- 2021年全球小客車銷量約5,640萬輛,較與前一年同期比較成長近5%。 2021年,該地區最大的汽車市場是中國,銷量略低於2,150萬輛。預計汽車技術將在未來 10 年發生重大變化。到 2030 年,預計全球新車銷量中約 26% 為電動車,到 2022 年,全球車隊預計將新增 5,800 萬輛自動駕駛汽車。由於技術的進步,所需組件的種類不斷增加。成品的製造方式開始改變。這使得汽車供應商市場,尤其是汽車電子市場進一步區隔。自動化和電動預計將在不久的將來推動汽車市場的發展。

依地區分類,歐洲是最大的部分。

- 世界各國政府一直在積極制定政策鼓勵採用電動車。中國、印度、法國和英國已宣布計劃在 2040 年完全淘汰汽油和柴油汽車產業。

- 汽車產業對清潔能源的需求不斷成長是推動市場成長的主要因素之一。 OEM也正在重新定義他們的電動車藍圖。例如,2022年3月,起亞汽車宣布進軍電動皮卡市場,並將於2027年推出兩款車型。 2022年3月,福特宣佈2024年將推出四款新一代電動商用車。

- 由於北美地區網路和智慧型手機的普及很高,電商公司有龐大的機會開拓零售電商市場。它還幫助電子商務公司透過更廣泛的覆蓋範圍拓展業務。這是全球電動車市場成長的關鍵因素。上述趨勢促使汽車製造商增加卡車研發支出,從而推動了電動車市場的成長。預計這些因素將有助於預測期內的市場成長。

小客車產業概況

全球小客車市場較為分散,前五大企業佔37.30%。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章執行摘要和主要發現

第2章 檢舉要約

第3章簡介

- 研究假設和市場定義

- 調查範圍

- 調查方法

第4章 產業主要趨勢

- 人口

- GDP

- CVP

- 通貨膨脹率

- 汽車貸款利率

- 電池價格(每度電)

- 物流績效指數

- 電動的影響

- 新XEV車型發布

- 充電站的部署

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 體型

- 小客車

- 掀背車

- 多用途車輛

- 轎車

- 運動型公共事業車

- 小客車

- 引擎類型

- 混合動力汽車和電動車

- 依燃料類型

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 依燃料類型

- CNG

- 柴油引擎

- 汽油

- LPG

- 混合動力汽車和電動車

- 地區

- 非洲

- 南非

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 韓國

- 泰國

- 亞太地區其他地區

- 歐洲

- 奧地利

- 比利時

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 法國

- 德國

- 愛爾蘭

- 義大利

- 拉脫維亞

- 立陶宛

- 挪威

- 波蘭

- 俄羅斯

- 西班牙

- 瑞典

- 英國

- 歐洲其他地區

- 中東

- 阿拉伯聯合大公國

- 其他多邊環境協定

- 中東

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 拉丁美洲其他地區

- 非洲

第6章 競爭形勢

- 重大策略舉措

- 市場佔有率分析

- 公司形勢

- 公司簡介

- BMW AG

- Ford Motor Company

- Honda Motor Co. Ltd.

- Hyundai Motor Company

- Kia corporation

- Mercedes Group

- Nissan Motor Company Ltd

- Toyota Motor Corporation

- Volkswagen AG

第7章 CEO 面臨的關鍵策略問題

第8章附錄

簡介目錄

Product Code: 93047

The Global Passenger Cars Market size is estimated at USD 0.96 trillion in 2024, and is expected to reach USD 1.48 trillion by 2029, growing at a CAGR of 9.04% during the forecast period (2024-2029).

Key Highlights

- Largest Segment by Fuel Type - Gasoline : Gasoline has the highest growth among all fuel types across globe. Easy availability of the traditional fuel and the affordable price of the gasoline engines provide an edge over other fuel options.

- Largest Segment by Country - Germany : Globally, China has witnessed the largest share in passenger car sales. The growing disposable income of consumers and changing lifestyles are increasing the demand for passenger cars in China.

- Largest Segment by Sub-Body Type - Sports Utility Vehicle : Strong build, ability to drive in all terrains and bold looks, strong engines are some of the factors making SUVs the largest sub-body type in the global passenger car market.

- Fastest-growing Segment by Fuel Type - FCEV : Stringent norms, governmental subsidies, continued encouragement of BEV adoption among private auto owners which is making BEV the fastest-growing segment in passenger car market globally.

Passenger Cars Market Trends

Sports Utility Vehicle is the largest segment by Sub Body Type.

- The automotive industry was one of the industries most affected by the global chip shortage and supply chain disruptions brought on by the COVID-19 pandemic. However, automobile manufacturer Tesla has continued to come under fire for contributing to climate change through the manufacturing process and the automobiles produced. EU car buyers appear to be contributing to reducing the harmful effects of fossil fuel-powered vehicles.

- The year 2020 saw a substantial effect of the pandemic on global auto markets. As more nations restricted travel due to the pandemic in 2020, the automotive industry experienced several setbacks. In 2020, 63.8 million cars were sold worldwide. A slight rebound was expected in 2021, with 66 million cars expected to be sold. Toyota and the Volkswagen Group both saw reductions in their deliveries of more than a million cars.

- In 2021, approximately 56.4 million passenger cars were sold worldwide, representing a nearly 5% increase over the previous year. China had the largest regional automobile market in 2021, with slightly less than 21.5 million units. Automotive technology is expected to undergo significant change in the next ten years. Around 26% of new automobile sales globally are expected to be of electric vehicles by 2030, with an estimated 58 million new self-driving cars to be added to the global fleet by 2022. As a result of technological advancements, the types of components required to create the finished product have begun to change. This allows for further segmentation of the automotive supplier market, particularly the automotive electronics market. Automation and electrification are expected to boost the car market in the near future.

Europe is the largest segment by Region.

- Governments worldwide have been proactive in enacting policies to encourage the adoption of electric vehicles. China, India, France, and the United Kingdom have announced plans to completely phase out the petrol and diesel vehicles industry before 2040.

- An increase in the demand for clean energy in the automotive industry is one of the major factors contributing to the market's growth. OEMs are also redefining their roadmap for electric vehicles. For instance, in March 2022, Kia Motors announced that it would enter the electric pickup truck market, announcing that two models would be available by 2027. In March 2022, Ford announced that it would offer a new generation of four electric commercial vehicles by 2024.

- E-commerce companies have significant opportunities to explore the retail e-commerce market due to high internet and smartphone penetration in the North American region. It also helps e-commerce companies in expanding their business through broader reach. This is an important factor in the growth of the electric vehicle market in the world. The above trend has propelled automakers to increase their expenditure on the R&D of trucks, which has boosted the market growth of electric vehicles. These factors are expected to help market growth over the forecast period.

Passenger Cars Industry Overview

The Global Passenger Cars Market is fragmented, with the top five companies occupying 37.30%. The major players in this market are Ford Motor Company, Hyundai Motor Company, Nissan Motor Company Ltd, Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP

- 4.3 CVP

- 4.4 Inflation Rate

- 4.5 Interest Rate For Auto Loans

- 4.6 Battery Price (per Kwh)

- 4.7 Logistics Performance Index

- 4.8 Electrification Impact

- 4.9 New XEV Models Announced

- 4.10 Charging Stations Deployment

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Body Type

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Multi-purpose Vehicle

- 5.1.1.3 Sedan

- 5.1.1.4 Sports Utility Vehicle

- 5.1.1 Passenger Cars

- 5.2 Engine Type

- 5.2.1 Hybrid And Electric Vehicles

- 5.2.1.1 By Fuel Type

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Type

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid And Electric Vehicles

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Japan

- 5.3.2.6 Malaysia

- 5.3.2.7 South Korea

- 5.3.2.8 Thailand

- 5.3.2.9 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 UAE

- 5.3.4.2 Rest-of-MEA

- 5.3.5 Miidle East

- 5.3.6 North America

- 5.3.6.1 Canada

- 5.3.6.2 Mexico

- 5.3.6.3 US

- 5.3.6.4 Rest-of-North America

- 5.3.7 South America

- 5.3.7.1 Rest-of-Latin America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BMW AG

- 6.4.2 Ford Motor Company

- 6.4.3 Honda Motor Co. Ltd.

- 6.4.4 Hyundai Motor Company

- 6.4.5 Kia corporation

- 6.4.6 Mercedes Group

- 6.4.7 Nissan Motor Company Ltd

- 6.4.8 Toyota Motor Corporation

- 6.4.9 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219