|

市場調查報告書

商品編碼

1440435

羧甲基纖維素 (CMC) - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029 年)Carboxymethyl Cellulose (CMC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

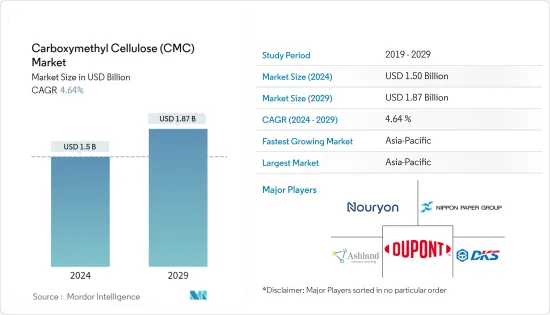

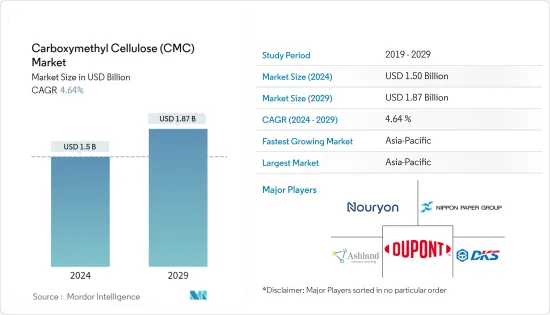

2024年羧甲基纖維素市場規模估計為15億美元,預計到2029年將達到18.7億美元,在預測期內(2024-2029年)CAGR為4.64%。

COVID-19 大流行損害了羧甲基纖維素 (CMC) 產業。全球封鎖和政府執行的嚴格規定導致了災難性的挫折,大多數生產中心都被關閉。儘管如此,該業務自 2021 年以來正在復甦,預計未來幾年將大幅成長。

主要亮點

- 加工食品和簡便食品的日益普及以及石油鑽探活動的激增是推動所研究市場成長的一些因素。

- 相反,替代品的可用性預計將阻礙所研究市場的成長。

- 儘管如此,製藥業的顯著成長可能會在預測期內創造利潤豐厚的成長機會。

- 預計亞太地區將主導市場,並可能在預測期內實現最高的CAGR。

羧甲基纖維素市場趨勢

食品和飲料行業的應用不斷成長

- 2022年,食品和飲料應用領域在羧甲基纖維素(CMC)市場中佔據重要收入佔有率。CMC廣泛用作乳製品、飲料、調味品和調味品、冰淇淋中的粘度調節劑/增稠劑、穩定劑和乳化劑、冷凍甜點等。CMC 透過調節冰晶尺寸的生長,賦予冰淇淋光滑的奶油質地,從而穩定冰淇淋。其穩定特性也用於乳製品中,與酪蛋白形成可溶性複合物,從而防止其在牛奶酸化時沉澱。此外,由於其優異的黏合和黏度調節特性,CMC 是烘焙食品中麩質的替代品。

- 已開發國家加工食品的大量消費以及飲食習慣的變化刺激了勞動一代對簡便食品的快速適應,推動了食品和飲料應用中對CMC的需求。此外,人們對良好飲食習慣的認知不斷增強,健康意識不斷增強,為市面上的無麩質食品讓路。

- 隨著人口持續成長,滿足日益成長的食品需求正在擴大食品和飲料產業,這是推動目標產業成長的關鍵因素之一。例如,根據美國人口普查局的數據,2022年美國零售食品飲料店的年銷售額約為9,470億美元,較2021年成長7.6%。

- 此外,根據 StatCan 的數據,2022 年 6 月加拿大食品和飲料商店的零售額約為 121 億加元(93 億美元),較 2022 年 1 月成長 1%。

- 全球食品和飲料行業的公司正在採取多種業務策略來鞏固其在市場中的地位。 2023年1月,美國跨國食品公司百事可樂宣布,計畫擴大在海德拉巴的業務,並在未來一年半內新增1,200名員工。

- 因此,考慮到上述因素,食品和飲料應用領域對CMC的需求將在短期內大幅上升。

亞太地區將主導市場

- 2022年,亞太地區在全球羧甲基纖維素市場中佔據主導地位,在收入方面佔有重要的市場佔有率。預計它將在預測期內保持其主導地位。

- 食品飲料、化妝品和醫藥應用領域對CMC的需求不斷成長是推動亞太地區目標產業成長的主要因素。由於中國和印度等國家可支配收入的增加,多美食和個人護理產品的支出不斷增加,推動了市場的成長。

- 由於中國的城市化、可支配收入的成長以及社群媒體的影響力,美容和個人護理市場對更高品質、優質品牌產品的需求不斷成長。例如,根據中國國家統計局的數據,2022年1月,中國化妝品零售貿易收入約為91.8億美元。 2023年1月達到約97.6億美元。隨著中國二、三線城市化妝品需求進一步擴大,CMC市場預計短期內將維持成長動能。

- 此外,根據印度品牌資產基金會的數據,2021年印度國內醫藥市場規模為420億美元,到2024年可能達到650億美元,到2030年進一步擴大到120-1300億美元。

- 此外,印度是全球製藥業的一個重要且正在崛起的國家。例如,根據 IBEF 的數據,印度是全球第 12 大醫療產品出口國。印度藥品出口到200多個國家,其中美國是主要市場。學名藥佔全球出口量的20%,使該國成為全球最大的學名藥供應國。 22 會計年度印度藥品出口額為 246 億美元,21 會計年度為 244.4 億美元。因此,增加該國藥品出口預計將為羧甲基纖維素(CMC)市場創造上行空間。

- 此外,根據歐萊雅-2022年通用註冊文件,2022年亞太地區佔全球化妝品市場的42%以上,預計將推動羧甲基纖維素(CMC)市場的發展。

- 上述所有因素都可能在預測時間內推動亞太地區羧甲基纖維素(CMC)市場的成長。

羧甲基纖維素行業概況

羧甲基纖維素 (CMC) 市場本質上是分散的。市場的主要參與者(排名不分先後)包括杜邦、諾力昂、亞什蘭、日本製紙工業和 DKS 等。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 促進要素

- 越來越多採用加工食品和簡便食品

- 石油鑽探活動激增

- 其他司機

- 限制

- 市場上替代品的可用性

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第 5 章:市場區隔(市場價值規模)

- 應用

- 食品和飲料

- 油和氣

- 化妝品和藥品

- 洗滌劑

- 紙張加工

- 其他應用(採礦、油漆和塗料、建築、紡織加工、黏合劑、陶瓷)

- 地理

- 亞太

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太

第 6 章:競爭格局

- 併購、合資、合作與協議

- 市佔率分析(%)**/排名分析

- 領先企業採取的策略

- 公司簡介

- Amtex Chemicals, LLC

- Ashland

- Chongqing Lihong Fine Chemicals Co.,Ltd

- Daicel Corporation

- DKS Co. Ltd.

- DuPont

- Foodchem International Corporation

- Jining Fortune Biotech Co.,Ltd.

- Lamberti SpA

- MIKEM

- Mikro Technik GmbH

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- USK Rheology Solutions

- Zibo Hailan Chemical Co., Ltd.

第 7 章:市場機會與未來趨勢

- 製藥業顯著成長

- 其他機會

The Carboxymethyl Cellulose Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 1.87 billion by 2029, growing at a CAGR of 4.64% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the carboxymethyl cellulose (CMC) sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Increasing adoption of processed and convenient food and a surge in oil drilling activities are some factors driving the studied market's growth.

- Conversely, the availability of substitutes is expected to hinder the studied market's growth.

- Nevertheless, significant growth in the pharmaceutical sector is likely to create lucrative growth opportunities over the forecast period.

- The Asia-Pacific region is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Carboxymethyl Cellulose Market Trends

Growing Applications in the Food and Beverages Sector

- The food and beverages application segment accounted for a significant revenue share in the carboxymethyl cellulose (CMC) market in 2022. CMC is popularly used as a viscosity modifier/thickener, stabilizer, and emulsifier in milk products, drinks, dressings and seasonings, ice creams, frozen desserts, etc. CMC stabilizes ice creams by imparting a smooth and creamy texture by regulating ice crystal size growth. Its stabilizing property is also utilized in milk products where it forms soluble complexes with casein, thus preventing its precipitation upon the acidification of milk. Also, due to its excellent binding and viscosity-modifying properties, CMC is an alternative to gluten in bakery items.

- The large consumption of processed food in developed countries and the changing food habits stimulating fast adaptability to convenient food among the working generation boosted the demand for CMC in food and beverage applications. Furthermore, the growing awareness of good food habits and rising health consciousness made way for gluten-free foods in the market.

- As the population continues to grow, meeting the increasing demand for food is augmenting the food and beverages sector, which is one of the key factors driving the growth of the target industry. For instance, according to US Census Bureau, in 2022, annual sales of retail food and beverage stores in the United States amounted to approximately USD 947 billion, which showed an increase of 7.6% compared to 2021.

- Moreover, according to StatCan, retail sales of food and beverage stores in Canada amounted to approximately CAD 12.1 billion (USD 9.30 billion) in June 2022, which showed an increase of 1% compared to January 2022.

- The companies involved in the global food and beverages industry are adopting several business strategies to strengthen their position in the market. In January 2023, American multinational food company PepsiCo announced that it is planning to expand its operation in Hyderabad and add 1,200 employees within the next one and a half years.

- Therefore, considering the factors above, the demand for CMC will rise significantly in the food and beverages application segment shortly.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific dominated the global carboxymethyl cellulose market in 2022, with a significant market share in revenue. It is projected to maintain its dominance during the forecast period.

- Growing demand for CMC in food and beverage, cosmetics, and pharmaceutical applications is the primary factor driving the growth of the Asian-Pacific region's target industry. The increasing expenditure on multicuisine foods and personal care products due to the growing disposable income in countries like China and India fuels market growth.

- Due to urbanization, growing disposable income, and social media influence in China, the beauty and personal care market is experiencing a burgeoning demand for higher quality, premium brand products. For instance, according to the National Bureau of Statistics of China, in January 2022, the retail trade revenue of cosmetics in China amounted to about USD 9.18 billion. It reached about USD 9.76 billion in January 2023. As the demand for cosmetic products expands further in second-and third-tier cities of China, the CMC market is expected to maintain its growth momentum shortly.

- Moreover, according to the India Brand Equity Foundation, India's domestic pharmaceutical market stood at USD 42 billion in 2021 and is likely to reach USD 65 billion by 2024 and further expand to USD 120-130 billion by 2030.

- Moreover, India is a significant and rising country in the global pharmaceuticals sector. For instance, according to IBEF, India is the 12th largest exporter of medical goods globally. Indian drugs are exported to more than 200 countries, with the United States being the key market. Generic drugs account for 20% of the global export volume, making the country the largest provider of generic medicines globally. Indian drug and pharmaceutical exports stood at USD 24.60 billion in FY22 and USD 24.44 billion in FY21. Therefore, increasing the export of pharmaceutical products from the country is expected to create an upside for the carboxymethyl cellulose (CMC) market.

- Furthermore, according to L'Oreal - Universal Registration Document 2022, the Asia-Pacific accounts for over 42% of the global cosmetics market in 2022, which is expected to boost the carboxymethyl cellulose (CMC) market.

- All factors above are likely to fuel the growth of the Asia-Pacific carboxymethyl cellulose (CMC) market over the forecast time frame.

Carboxymethyl Cellulose Industry Overview

The Carboxymethyl Cellulose (CMC) Market is fragmented in nature. The major players in this market (not in a particular order) include DuPont, Nouryon, Ashland, NIPPON PAPER INDUSTRIES CO., LTD., and DKS Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Processed and Convenient Food

- 4.1.2 Surge in Oil Drilling Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes in the Market

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Food and Beverages

- 5.1.2 Oil and Gas

- 5.1.3 Cosmetics and Pharmaceuticals

- 5.1.4 Detergents

- 5.1.5 Paper Processing

- 5.1.6 Other Applications (Mining, Paints and Coatings, Construction, Textile Processing, Adhesives, Ceramics)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amtex Chemicals, LLC

- 6.4.2 Ashland

- 6.4.3 Chongqing Lihong Fine Chemicals Co.,Ltd

- 6.4.4 Daicel Corporation

- 6.4.5 DKS Co. Ltd.

- 6.4.6 DuPont

- 6.4.7 Foodchem International Corporation

- 6.4.8 Jining Fortune Biotech Co.,Ltd.

- 6.4.9 Lamberti S.p.A.

- 6.4.10 MIKEM

- 6.4.11 Mikro Technik GmbH

- 6.4.12 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.13 Nouryon

- 6.4.14 USK Rheology Solutions

- 6.4.15 Zibo Hailan Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Significant Growth in the Pharmaceutical Sector

- 7.2 Other Opportunities