|

市場調查報告書

商品編碼

1440397

全球自動販賣機 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Global Vending Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

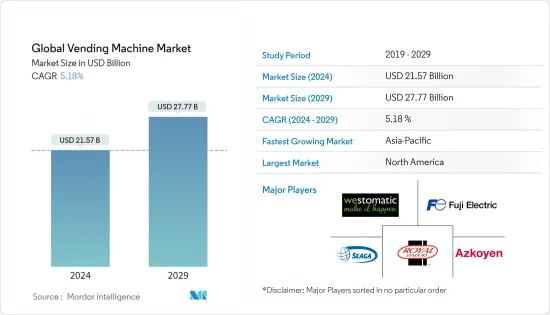

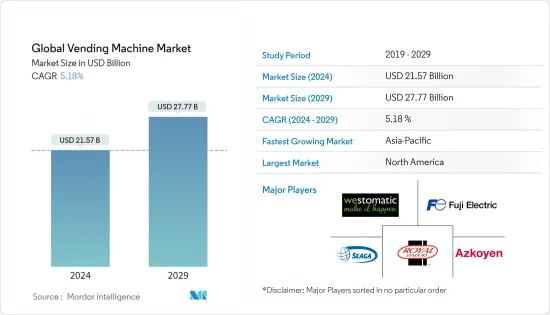

2024年全球自動販賣機市場規模估計為215.7億美元,預計到2029年將達到277.7億美元,在預測期內(2024-2029年)CAGR為5.18%。

由於城市人口生活方式的改變,對隨身攜帶的零食、食品和飲料的需求不斷成長,以及自動售貨機技術的進步等因素,這使得他們能夠快速交付產品,使其成為一種極其方便的選擇對於消費者來說,正在推動所研究市場的成長。

主要亮點

- 世界各地零售業的成長正在為所研究的市場成長創造有利的市場情勢。例如,根據美國人口普查局的數據,2022年第一季零售總額預計為17,473億美元,較2021年第四季成長3.7%。

- 自動販賣機擴大應用於商業場所和公司辦公室,以提高產品的可及性並保持場所的清潔和美觀。由於這些系統是自動化的,因此可以顯著減少獲得產品所需的時間。

- 此外,考慮到不斷成長的需求,自動販賣機製造商越來越注重開發新型自動販賣機,利用人工智慧、生物辨識和物聯網等先進技術,使其高效、方便用戶使用且安全。例如,2022 年 3 月,自動販賣機製造商 Digital Media Vending International 選擇了 Vending Tracker(由 SECO MIND USA LLC 的 CLEA 支援的自動販賣機系統管理解決方案)來開發支援人工智慧的自動販賣機。

- 然而,高昂的安裝和營運成本以及與在公共和商業場所銷售不健康垃圾食品相關的多項法規等因素可能會對所研究市場的成長產生負面影響。

- 在 COVID-19 大流行最初爆發期間,由於各種限制性法規以及公共場所和辦公室的關閉減少了自動販賣機的需求,對自動販賣機的需求產生了重大影響。然而,大流行提高了消費者對衛生重要性的認知,預計這將支持預測期內所研究市場的成長。

自動販賣機市場趨勢

商業場所自動販賣機安裝量增加

- 根據CCPIA的規定,商業房地產是指專門用於商業目的並旨在產生利潤的建築物、構築物和改良物。

- 最近世界各地商業空間的擴張正在創造對自動販賣機的巨大需求。自動販賣機呈上升趨勢的一些最常見的商業場所包括零售、酒店和住宿以及製造設施等。

- 例如,2021 年 7 月,快速消費品主要品牌印度斯坦聯合利華 (HUL) 為其家庭護理產品推出了店內自動販賣機 Smart Fill。作為試點項目,該公司已在孟買的 Reliance Smart Acme Mall 安裝了這些機器。

- 考慮到不斷增加的使用案例和需求,自動販賣機供應商也專注於開發創新產品。例如,2022年3月,美國新澤西州馬林紐波特中心開設了第一家「RoboBurger」門市。最近安裝的餐廳是一個 12 英尺見方的盒子,裡面有一個機器人系統,只需六分鐘即可烹飪並為顧客提供新鮮的牛肉漢堡。

亞太地區將實現高成長

- 亞太地區快速成長的商業和企業部門正在為研究市場的成長創造重大機會。此外,由於城市化進程的加速和西方文化的接觸,年輕人生活方式的改變極大地推動了對即食食品的需求。

- 例如,根據中國國家改革和發展委員會的數據,中國農村人口向城市轉移的趨勢呈上升趨勢。此外,根據2021-2025年的「十四五」規劃,中國的目標是將都市化率提高到65%。

- 此外,印度、菲律賓和中國等國家資訊通訊科技產業的成長極大地推動了對辦公空間的需求,為該地區自動販賣機市場的成長創造了積極的前景。例如,根據印度國家軟體和服務公司協會 (Nasscom) 的數據,印度 IT 產業的收入預計將從 2021 會計年度的 1,960 億美元增至 2,222 會計年度的 2,270 億美元。

自動販賣機產業概況

全球自動販賣機市場競爭適度,由於自動販賣機的需求增加,預計在預測期內競爭將加劇,預計將吸引新的參與者。市場上的供應商專注於為其產品帶來創新,以獲得競爭優勢。該市場的一些主要參與者包括 Westomatic Vending Services Ltd.、富士電機有限公司、Seaga Manufacturing Inc. 和 Royal Vendors Inc.。

- 2022 年 5 月 - 瑞典自動販賣機公司 RVM Systems 宣布將在新加坡安裝一系列可同時消費 100 個貨櫃的反向自動販賣機。這些機器的主要目的是鼓勵人們負責任地處理不需要的塑膠瓶和飲料罐。這些機器還發放購物獎勵、ActiveSG 積分和其他獎勵。

- 2022 年 3 月 - 法國夏朗德鎮的一家餐廳設立了一台自動販賣機,讓顧客可以購買新鮮的美食,包括安杜耶乾酪、鵝肝醬,甚至是小菜。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- 評估 COVID-19 對市場的影響

第 5 章:市場動態

- 市場促進因素

- 快節奏的生活方式對包裝食品的需求不斷增加

- 科技投資為不同能力的民眾和新用戶提供更多支持

- 市場課題

- 安裝維護成本高

第 6 章:市場區隔

- 依技術

- 自動販賣機

- 半自動自動販賣機

- 依類型

- 包裝食品

- 飲料

- 其他類型

- 依應用

- 商業場所

- 公司辦事處

- 其他(遊樂園、運動場館、醫療設施、交通設施等)

- 依地理

- 北美洲

- 歐洲

- 亞太

- 拉丁美洲

- 中東和非洲

第 7 章:競爭格局

- 公司簡介

- Westomatic Vending Services Ltd.

- Fuji Electric Company Ltd.

- Seaga Manufacturing, Inc.

- Royal Vendors, Inc.

- Azkoyen Vending Systems

- Crane Merchandising Systems Inc

- Vending.com

- JOFEMAR SA

- EVOCA Group

- GUANGZHOU BAODA INTELLIGENT TECHNOLOGY CO., LTD

- Armark Corporation

第 8 章:投資分析

第 9 章:市場的未來

The Global Vending Machine Market size is estimated at USD 21.57 billion in 2024, and is expected to reach USD 27.77 billion by 2029, growing at a CAGR of 5.18% during the forecast period (2024-2029).

Factors such as growing demand for on-the-go snacks, food, and drinks due to changing lifestyle of the urban populations, along with the advancement in vending machine technology, which is enabling them to deliver products quickly, making it an extremely convenient option for consumers, are driving the growth of the studied market.

Key Highlights

- The growth of the retail industry across various parts of the world is creating a favorable market scenario for the studied market growth. For instance, according to the US Census Bureau, the total retail sales for the first quarter of 2022 were estimated at USD 1,747.3 billion, an increase of 3.7% from the fourth quarter of 2021.

- Vending machines are increasingly being used in commercial places and corporate offices to enhance the accessibility of products and maintain the place's cleanliness and aesthetics. As these systems are automated, they significantly reduce the time it takes to get a product.

- Furthermore, considering the growing demand, vending machine manufacturers are increasingly focusing on developing new vending machines that use advanced technologies such as AI, biometrics, and IoT to make them highly efficient, user-friendly, and secure. For instance, in March 2022, Digital Media Vending International, a vending machine manufacturer, selected Vending Tracker, a Vending System Management Solution powered by CLEA from SECO MIND USA LLC, to develop AI-enabled vending machines.

- However, factors such as high installation and operating costs along with several regulations pertaining to the sales of unhealthy junk food products in public and commercial places may negatively impact the growth of the studied market.

- A significant impact on the demand for vending machines was observed during the initial outbreak of the COVID-19 pandemic as various restrictive regulations, and the closure of public places and offices reduced its demand. However, the pandemic has raised awareness among consumers regarding the importance of hygiene which is expected to support the growth of the studied market during the forecast period.

Vending Machine Market Trends

Commercial Places to Witness Increased Installation of Vending Machines

- According to CCPIA, commercial property is a building, structure, and improvements used specifically for business purposes and intended to generate a profit.

- The recent growth in the expansion of commercial spaces across various parts of the world is creating significant demand for vending machines. Some of the most common commercial places where vending machines have witnessed an upward trend include retail, hotels & lodging, and manufacturing facilities, among others.

- For instance, in July 2021, Hindustan Unilever (HUL), a major FMCG brand, launched an in-store vending machine, Smart Fill, for its home care products. The company has installed these machines at Reliance Smart Acme Mall in Mumbai as a pilot project.

- Considering the increasing use cases and demand, the vending machine providers are also focusing on developing innovative products. For instance, in March 2022, Newport Centre Mallin, New Jersey, in the United States, installed the first 'RoboBurger outlet. The recently installed outlet is a 12ft-square box containing a robotic system that'll cook and serve customers fresh beef burgers in just six minutes.

Asia-Pacific Region to Register High Growth

- The fast-growing commercial and corporate sector of the Asia Pacific region is creating significant opportunities for the growth of the studied market. Furthermore, changing lifestyles of youth owing to growing urbanization and exposure to western culture has significantly driven the demand for Ready-to-Eat meals.

- For instance, according to the National Reform and Development Commission of China, the country is witnessing an upward trend of rural residents moving to cities. Furthermore, according to its 14th Five-Year Plan for 2021-2025, China aims to raise its urbanization rate to 65%.

- Additionally, the growth of the ICT sector in countries such as India, the Philippines, and China is significantly driving the demand for office spaces, creating a positive outlook for the growth of vending machines market in the region. For instance, according to the National Association of Software and Service Companies (Nasscom), the Indian IT industry's revenue is expected to increase to USD 227 billion in FY22 from USD 196 billion in FY21.

Vending Machine Industry Overview

The Global Vending Machine Market is moderately competitive and is expected to grow in competition during the forecast period owing to increasing demand for vending machines, which is expected to attract new players. Vendors operating in the market focus on bringing innovation to their products to gain a competitive edge. Some major players operating in the market include Westomatic Vending Services Ltd., Fuji Electric Company Ltd., Seaga Manufacturing Inc., and Royal Vendors Inc.

- May 2022 - RVM Systems, a Swedish vending machine company, announced that it would install a range of reverse vending machines that can consume 100 containers simultaneously in Singapore. The primary objective of these machines is to encourage people to dispose of unwanted plastic bottles and responsibly drink cans. These machines also dispense shopping rewards, ActiveSG credits, and other incentives.

- March 2022 - Andouillette, foie gras, or even ris de veau - a restaurant in France's Charente town had set up a vending machine to enable customers to buy fresh gourmet dishes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Packaged Food Products Due to Fast-Paced Lifestyle

- 5.1.2 Technological Investments To Enable Greater Support For The Differently Abled Populace & New Users

- 5.2 Market Challenges

- 5.2.1 High Installation and Maintenance Cost

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic Vending Machines

- 6.1.2 Semi-Automatic Vending Machines

- 6.2 By Type

- 6.2.1 Packaged Food

- 6.2.2 Beverages

- 6.2.3 Other Types

- 6.3 By Application

- 6.3.1 Commercial Places

- 6.3.2 Corporate Offices

- 6.3.3 Others (Amusement Parks, Sports Venues, Healthcare Facilities, Transport Facilities, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Westomatic Vending Services Ltd.

- 7.1.2 Fuji Electric Company Ltd.

- 7.1.3 Seaga Manufacturing, Inc.

- 7.1.4 Royal Vendors, Inc.

- 7.1.5 Azkoyen Vending Systems

- 7.1.6 Crane Merchandising Systems Inc

- 7.1.7 Vending.com

- 7.1.8 JOFEMAR SA

- 7.1.9 EVOCA Group

- 7.1.10 GUANGZHOU BAODA INTELLIGENT TECHNOLOGY CO., LTD

- 7.1.11 Armark Corporation