|

市場調查報告書

商品編碼

1440396

系統整合:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)System Integration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

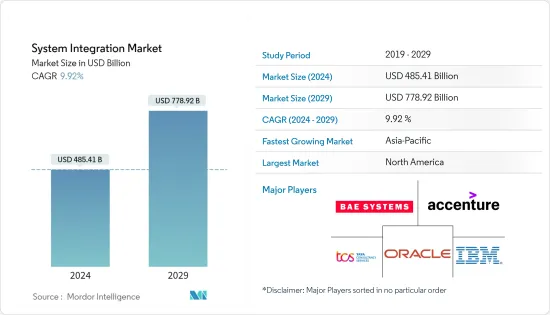

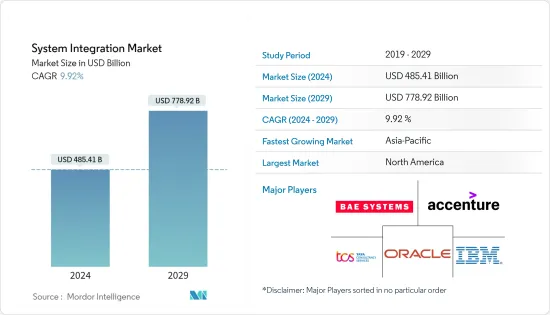

系統整合市場規模預計到 2024 年為 4,854.1 億美元,預計到 2029 年將達到 7,789.2 億美元,預測期內(2024-2029 年)年複合成長率為 9.92%。

系統整合市場的推動因素是雲端技術的不斷進步和採用,以及由於生產力提高和成本降低而導致終端使用行業需求不斷增加。

主要亮點

- 系統整合是指將多個單獨的子系統或子組件組合成一個更廣泛的系統,使子系統能夠協同工作。此外,系統整合將組織與第三方(例如客戶、供應商和股東)連接起來。

- 雲端運算使用的增加和中小企業(SME)的快速成長正在推動全球系統整合市場向前發展。此外,對低成本和高能源效率製造流程的渴望正在對系統整合市場的成長產生積極影響。

- 然而,COVID-19的感染疾病凸顯了各行業經營模式的弱點,他們正在利用雲端、人工智慧和物聯網等技術來數位化和擴展全部區域的業務。由於以下幾個原因,對系統整合的需求不斷增加可用的機會。隨著疫情得到控制以及系統整合解決方案在多個業務流程中變得越來越重要,許多零售、製造和汽車行業的投資預計將增加。

- 此外,隨著對軟體即服務 (SaaS) 解決方案的需求不斷成長,雲端整合也越來越受歡迎。雲端整合工具為組織提供了連接不同系統的新機會。雲端整合的優勢包括公共事業成本計算、無單點故障、擴充性、地理獨立性以及缺乏硬體支持,所有這些都使得雲端整合解決方案和服務可接受並有助於其實施。因此,包括金融服務和軟體公司在內的各種公司都在使用雲端運算。

- 一些行業參與者正在與較小的雲端供應商合作,以增加雲端的使用。例如,2022 年 4 月,Google 與 Accenture、Confluence、Databricks、Deloitte、Mongo DB 等合作推出了資料雲聯盟,以提高跨不同業務系統、平台和環境的資料可攜性和可訪問性。我做到了。聯盟成員提供基礎設施、API 和整合支持,以確保跨不同領域的多個平台和產品的資料可攜性和可存取性。為了幫助企業進行資料庫遷移,Google Cloud 與 TCS、Deloitte、Kyndryl、HCL、Wipro、Infosys、Cognizant 和 Capgemini 等系統整合商和顧問公司合作。

- 系統整合使組織能夠透過整合不同的流程來更聰明地運作。企業開始認知到系統整合的重要性,因為企業複雜性影響組織的競爭力和創造利潤的能力。系統整合技術為企業的IT基礎設施基礎設施提供集中、整合且經濟高效的解決方案。推動系統整合市場擴大的主要因素之一是IT用戶的增加。美國勞工統計局預測,到 2031 年,電腦相關職業的就業人數將增加 15%。

- 然而,缺乏客戶知識和業務預算限制正在阻礙系統整合產業的成長。此外,系統整合的高成本使中小企業難以過渡到系統整合,從而限制了市場的成長。相反,邊緣運算、物聯網(IoT)和人工智慧整合等技術進步可能為整個預測期內系統整合市場的擴張提供良好的前景。

系統整合市場趨勢

軟體/應用程式整合實現顯著成長

- 軟體整合將不同類型的軟體子系統組合起來創建一個整合系統。出於多種原因,可能需要軟體整合,例如建立需要透過 ETL 流程移動資料的資料倉儲,或連結各種資料庫和檔案式的系統。領先的組織使用雲端基礎的SaaS(軟體即服務)解決方案來輕鬆管理某些業務流程。

- 對自動化技術的需求不斷成長、雲端運算的使用以及寬頻基礎設施的擴展是推動系統整合市場軟體整合領域成長的一些關鍵因素。

- 系統整合允許組織同時存取和可視化資料,以做出更好的決策。因此,雲端運算技術的採用、寬頻基礎設施的成長以及企業提高現有系統效率的需求不斷增加是推動全球整合軟體市場成長的關鍵因素之一。 。消費者對虛擬的興趣日益濃厚也推動了產業擴張。

- 2022 年 3 月,思科系統宣布其新的 Cisco Intersight 平台和公共雲端整合將使 Kubernetes 叢集和虛擬機器能夠跨多個雲端進行監控。此外,還引進了思科 HyperFlex 超融合融合式基礎架構,為邊緣運算提供支援並為使用者擴展混合雲端功能。這使組織能夠更快地交付用於雲端整合的基礎架構和應用程式。

- Sonata Software 也於 2023 年 5 月被選為拜耳全新雲端基礎的農業食品解決方案的系統整合合作夥伴。專門從事實施、規劃、協調、調度、測試和升級技術解決方案的公司被視為系統整合合作夥伴。從本質上講,它控制著複雜 IT 解決方案從實施到營運的生命週期。

北美佔據主要市場佔有率

- 由於大型企業擴大使用雲端基礎的服務以及物聯網在工業自動化中的使用不斷增加,北美佔據了最大的市場。該地區的 BFSI 部門也正在採用最新技術,對北美系統整合市場具有巨大的成長潛力。為了實現這一目標,銀行努力滿足每位客戶的需求。

- 此外,企業可擴展性的提高以及巨量資料、雲端基礎服務和軟體即服務 (SaaS) 等先進技術的普及正在增加北美各個組織的業務複雜性。地區。

- 因此,對分散式資訊技術 (IT) 解決方案(例如用於簡化各種系統的系統整合)的需求不斷成長。此外,整合整合平台即服務 (iPaaS) 解決方案擴展了運輸和石油天然氣行業的系統整合應用。這允許您在多個應用程式之間共用整合資源。

- 此外,提供整合平台即服務 (iPaaS) 的金融基礎設施和整合技術供應商 PortX 將在 2023 年 6 月發布其 Integration Manager 產品的 2.0 版。這是一次重大更新,包含尖端功能,旨在改善對數位核心整合的控制並簡化業務流程。 Integration Manager 2.0 為金融機構提供 API主導的流程自動化,最大限度地減少內部員工的壓力,並提供核心提供者未提供的更廣泛的解決方案。

- 該銀行還聲稱,70% 的美國銀行客戶使用數位服務來滿足其財務需求。這有助於銀行擴大客戶群並保持市場競爭力。在預測期內,由於組織轉向這些服務,該地區對系統整合服務的需求預計將增加。

- 隨著各行業尋求系統整合以提高生產力,該地區正在出現各種夥伴關係和協作。例如,2022年5月,紅帽宣布與通用汽車建立合作關係,擴大邊緣軟體定義汽車的開發,為電動車的廣泛普及奠定基礎。該合作夥伴關係將支援各種車載安全和非安全應用,包括駕駛員輔助程式、資訊娛樂、連接和車身控制。

系統整合行業概況

系統整合市場競爭激烈,國內外廠商活躍。隨著市場規模的擴大並提供更多的機會,預計將有更多的參與者逐漸進入市場。研究市場的主要企業包括埃森哲、IBM 公司和 Wipro Limited。這些參與者採取了各種成長策略,如併購、新產品發布、擴張、合資和合作夥伴關係,以加強他們在這個市場的地位。

- 2022 年 4 月 - 布魯克公司宣布收購軟體和系統整合公司 Optimal Industrial Automation and Technologies。收購 Optimal Biopharma Tools 鞏固了布魯克作為小分子、生技藥品和新藥模式製藥公司領先軟體和解決方案供應商的地位。

- 2022 年 2 月 - Ansys 和 AWS 宣佈建立策略夥伴關係。此合作夥伴關係支援在 AWS 上部署 Ansys 產品,使模擬工作負載更加方便用戶使用,同時提供可擴充性和彈性,以便使用 Web 瀏覽器從任何地方輕鬆存取軟體和儲存解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 評估新型冠狀病毒感染疾病(COVID-19)對市場的影響

- 市場促進因素

- 雲端技術的進步與採用

- 提高生產力同時降低 IT 管理成本的好處

- 市場挑戰

- 系統整合高成本

第5章市場區隔

- 按服務類型

- 基礎設施整合

- 軟體/應用程式整合

- 諮詢

- 按最終用戶產業

- 車

- 航太和國防

- 資訊科技和電信

- BFSI

- 衛生保健

- 油和氣

- 其他(能源、化工、採礦等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Accenture

- IBM Corporation

- Tata Consultancy Services Limited

- Oracle Corporation

- BAE systems

- Wipro Limited

- Cognizant

- Deloitte Touche Tohmatsu Limited

- Infosys Limited

- MDS Systems Integration(MDS SI)

第7章 投資分析

第8章市場機會及未來趨勢

The System Integration Market size is estimated at USD 485.41 billion in 2024, and is expected to reach USD 778.92 billion by 2029, growing at a CAGR of 9.92% during the forecast period (2024-2029).

The system integration market is driven by the ongoing advancement and adoption of cloud technologies and increased demand from end-use industries because of increased productivity and less cost.

Key Highlights

- System Integration refers to combining multiple individual subsystems or sub-components into one more extensive system, allowing the subsystems to function together. Furthermore, system integration connects the organization with third parties, including customers, suppliers, and shareholders.

- The growing usage of cloud computing and the rapid growth of small and medium-sized organizations (SMEs) are propelling the global system integration market forward. Furthermore, the desire for low-cost and energy-efficient manufacturing processes is favorably impacting the growth of the system integration market.

- However, the COVID-19 outbreak has highlighted weaknesses in business models across verticals, which has increased demand for system integration as it has provided several opportunities to digitize and expand the business across regions by utilizing technologies such as cloud, AI, and IoT. With the pandemic under control, numerous retail, manufacturing, and automotive sectors are expected to see increased investment as system integration solutions gain significance across multiple business processes.

- Furthermore, Cloud Integration has grown in popularity as the demand for the Software as a Service (SaaS) solution continues to increase. Cloud integration tools have opened new opportunities for organizations to connect disparate systems. The advantages of cloud integration include utility-style costing, the absence of a single point of failure, scalability, geographical independence, and the lack of hardware support, all contributing to cloud integration solutions and services being accepted and implemented. As a result, various businesses, including financial services and Software companies, use cloud computing.

- Several industry participants are partnering with small cloud providers in order to increase cloud usage. For instance, In April 2022, Google launched a Data Cloud Alliance in partnership with Accenture, Confluent, Databricks, Deloitte, Mongo DB, etc., to make data more portable and accessible across disparate business systems, platforms, and environments. Members of the alliance will provide infrastructure, APIs, and integration support to ensure data portability and accessibility between multiple platforms and products across various domains. To help enterprises migrate their databases, Google Cloud has partnered with system integrators and consulting firms such as TCS, Deloitte, Kyndryl, HCL, Wipro, Infosys, Cognizant, and Capgemini.

- System integration allows more intelligent organizational operations by bringing together different processes. As enterprise complexity has an impact on an organization's capacity to compete and generate profit, businesses are beginning to recognize the significance of system integration. Technologies for system integration offer businesses centralized, integrated, and cost-effective solutions for their IT infrastructure. One of the major factors propelling the expansion of the system integration market is the rise in information technology users. The U.S. Bureau of Labor Statistics predicts that employment in computer-related occupations will rise by 15% by 2031.

- However, a lack of client knowledge and business budgetary restraints are impeding the growth of the system integration industry. Also, The high cost associated with system integration makes it difficult for small and medium enterprises to switch to system integration, restraining market growth. On the contrary, technological advancements such as the integration of edge computing, the internet of things (IoT), and artificial intelligence are likely to provide lucrative prospects for system integration market expansion throughout the forecast period.

System Integration Market Trends

Software/Application Integration to have a Significant Growth

- Software integration is bringing together various types of software sub-systems to create a single unified system. Software integration can be required for several reasons, including setting up a data warehouse where data needs to be moved through an ETL process and linking various databases and file-based systems. Major organizations use software-as-a-service (SaaS) cloud-based solutions, enabling them to manage particular business processes without a hassle.

- The increasing need for automation technologies, cloud computing usage, and expanding broadband infrastructure are some of the key factors driving the growth of the software integration segment in the system integration market.

- Due to system integration, organizations can access and visualize data simultaneously for better decision-making. As a result, the adoption of cloud computing technology, the growth of broadband infrastructure, and the rising demand from businesses to improve the efficiency of their current systems are some of the key factors driving the market growth of the global integration software market. Also boosting industry expansion is growing consumer interest in virtualization.

- In March 2022, Cisco Systems, Inc. revealed that its new Cisco Intersight platform integrations with public cloud integration would enable Kubernetes clusters and virtual machines to be observable across several clouds. In addition, Cisco HyperFlex Hyper-Converged Infrastructure was introduced to increase edge computing and expand users' hybrid cloud capabilities. This would allow the organization to offer infrastructure and apps for cloud integrations more quickly.

- Sonata Software was also chosen in May 2023 to serve as the system integration partner for Bayer's new cloud-based agri-food solution. A company that specializes in implementing, planning, coordinating, scheduling, testing, and upgrading technological solutions is considered a System Integration partner. It essentially controls the complex IT solution's deployment to operation lifecycle.

North America to Hold Major Market Share

- North America held the largest market as a result of the expanding use of cloud-based services by large enterprises and the expanding use of IoT in industrial automation. The BFSI sector of the region has also embraced modern technology, which has enormous growth potential for the North American system integration market. In order to accomplish this, banks are working very hard to ensure that they meet every customer's needs.

- Also, the rising scalability among businesses and the widespread adoption of advanced technologies, such as big data, cloud-based services, and Software-as-a-Service (SaaS), have increased the complexity of operations in different organizations in the North American region.

- Consequently, there is a rise in demand for distributed information technology (IT) solutions, such as system integration, for streamlining different systems. Additionally, integrating Integration Platform as a Service (iPaaS) solutions expands system integration applications in the transportation and oil and gas industries. It allows sharing of integrated resources across multiple applications.

- Moreover, In June 2023, PortX, a provider of financial infrastructure and integration technology that offers Integration-Platform-as-a-Service (iPaaS), will release version 2.0 of its Integration Manager product. This is a significant update that is jam-packed with cutting-edge features made to improve control over digital core integration and streamline business processes. The API-driven process automation offered by Integration Manager 2.0 to FIs minimizes the stress on internal staff and offers a wide range of solutions not offered by core providers.

- Also, 70% of Bank of America's clients use digital services for their financial needs, the bank claims. It can aid the bank in expanding its clientele and maintaining its competitiveness in the market. During the projected period, there will be an increase in the demand for system integration services in the region as a result of organizations switching to these services.

- The region is witnessing various partnerships and collaborations as industries look to switch to system integration to increase productivity. For instance, In May 2022, Red Hat announced a partnership with General Motors to expand the development of software-defined vehicles at the edge and lay the foundation for broader electric vehicle adoption. This partnership will support various in-vehicle safety and non-safety-related applications, including driver assistance programs, infotainment, connectivity, and body control.

System Integration Industry Overview

The system integration market is significantly competitive, with several local and international players operating. With the market expected to broaden and yield more opportunities, more players are expected to enter the market gradually. The key players in the market studied include Accenture, IBM Corporation, and Wipro Limited. These players have adopted various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in this market.

- April 2022 - Bruker Corporation announced the acquisition of Optimal Industrial Automation and Technologies, a software and system integration company. The Optimal biopharma tools acquisition strengthens Bruker as a key software and solutions provider for small molecule, biologics, and new drug modalities pharma companies.

- February 2022 - Ansys and AWS announced a strategic partnership. The collaboration will enable the deployment of Ansys products on AWS - making simulation workloads more user-friendly while offering scalability and flexibility with easy access to software and storage solutions from anywhere with a web browser.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Advancements and adoption of cloud-technologies

- 4.5.2 Benefits of increasing productivity while reducing IT Management cost

- 4.6 Market Challenges

- 4.6.1 High cost associated with system integration

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Infrastructure Integration

- 5.1.2 Software/Application Integration

- 5.1.3 Consulting

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 IT and Telecom

- 5.2.4 BFSI

- 5.2.5 Healthcare

- 5.2.6 Oil and Gas

- 5.2.7 Others (Energy, Chemical, Mining etc.)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Accenture

- 6.1.2 IBM Corporation

- 6.1.3 Tata Consultancy Services Limited

- 6.1.4 Oracle Corporation

- 6.1.5 BAE systems

- 6.1.6 Wipro Limited

- 6.1.7 Cognizant

- 6.1.8 Deloitte Touche Tohmatsu Limited

- 6.1.9 Infosys Limited

- 6.1.10 MDS Systems Integration (MDS SI)