|

市場調查報告書

商品編碼

1440270

流量計 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Flow Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

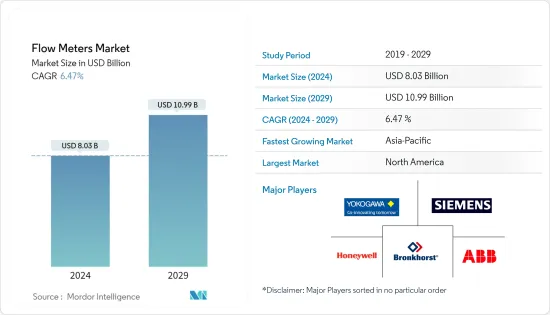

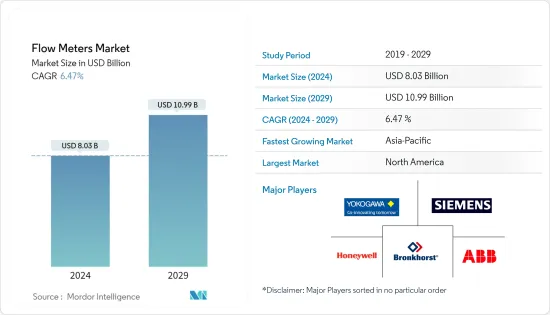

流量計市場規模預計到2024年為 80.3 億美元,預計到2029年將達到 109.9 億美元,在預測期內(2024-2029年)CAGR為 6.47%。

流量計,稱為流量感測器,是主要測量或調節管道內液體和氣體流量的電子設備。它們通常用於暖通空調系統、醫療設備、化工廠和化糞池系統。這些儀表主要可以檢測洩漏、堵塞、管道爆裂以及由於污染或污染造成的液體濃度變化。

主要亮點

- 流量感測器/設備通常連接到儀表以進行測量;然而,它們也可以連接到電腦和數位介面。流量計可分為兩大類:接觸式流量計和非接觸式流量計。當被監測的液體或氣體(通常是食品)會因與運動零件接觸而受到污染或物理改變時,使用非接觸式流量計。

- 工業物聯網、資產管理和高級診斷等多種新興技術也有助於在用戶和供應商之間形成新的合作。此外,最終用戶和供應商的策略一直在利用網路和雲端平台以及包括資料和分析在內的服務產品的進步。流量計也見證了監測和測量蒸汽、氣體、水、化學品和礦物油等流量的需求穩定成長。這些儀表在流量測量過程中提供關於理想和經濟數量的基本精度。它們在加工控制方面具有優勢。

- 流量計技術的主要趨勢包括流量計的數位訊號、多種測量格式、線上診斷和故障排除、遠端校準和配置以及具有線上警報的智慧感測器。透過強大的研究和開發實現的技術進步也使該行業能夠針對複雜的營運問題開發適當的解決方案。自動清潔也是市場上觀察到的革命性趨勢之一。這一趨勢有利於水和廢水管理等產業。

- 然而,預計某些因素會阻礙市場擴張。市場上現有的流量計僅有時與現代機器和基礎設施相容。因此,需要用更新、高效且相容的儀器來取代現有的過時版本。用新一代設備更換舊儀器的費用可能是一個昂貴的過程。這肯定會限制流量計的市場。

- 石油和天然氣、化學、紙漿和造紙、金屬和採礦等工業部門受 Covid-19 大流行影響最大,因此這些行業的產品需求也隨之下降。然而,許多服務於製藥、能源和公用事業應用的工業領域的需求顯著激增。此外,疫情也大大推動了工業自動化的採用,導致疫情期間的產品發布和創新增加。

流量計市場趨勢

電磁流量計佔據重要市場佔有率

- 電磁流量計利用法拉第感應定律偵測流量。電磁線圈產生磁場和捕捉電磁流量計內電壓(電動勢)的電極。電磁流量計由於有線圈和電極,流管內沒有任何東西,可以測量流量。

- 根據法拉第感應定律,在磁場內移動的導電液體會產生電壓。內管直徑、磁場強度和平均流速都成正比。另外,電磁流量計與其他流量計的一個本質差異是,由於電磁流量計是靠電磁感應工作的,所以導電液體是唯一可以偵測流量的液體。

- 電磁流量計在食品工業、化學應用、天然氣供應、廢水、採礦和電力設施中有著廣泛的應用。它們基本上不受液體溫度、壓力、密度和黏度的影響。

- 據美國地質調查局表示,去年全球銅礦產量估計為 2,100 萬噸。過去十年,全球銅產量穩定成長,從2010年的 1,600 萬噸上升。

- 電磁流量計最初是體積流量設備,但可以透過堵塞產品的密度來測量質量流量。密度值必須保持穩定以確保準確性。在少數情況下,密度計也與電磁計一起使用來提供質量流量讀數。

- 例如,採礦公司經常使用電磁流量計來測量具有特定襯裡的泥漿流量,以減少磨損。密度計向電磁流量計發送資料,以轉換為線上質量流量測量。全球採礦活動的成長鼓勵了電磁流量計的使用。據EIA表示,由於鑽井活動增加,導致流量計的採用,今年美國原油產量預計將增加40萬桶/日。

北美有望成為最大市場

- 北美地區預計將佔據重要的市場佔有率,這主要是由於石油和天然氣、化學品和發電行業的顯著發展。北美再生能源發電產業預計也將繼續對新計畫進行大量投資。據IRENA表示,去年全球再生能源裝置容量為3.1太瓦,較上年成長9.3%。近幾十年來,由於再生技術的價格下降以及對傳統能源對環境影響的擔憂,再生能源產業經歷了擴張。

- 根據《管道與天然氣雜誌》去年發表的報告,隔膜容積式流量計在美國廣泛用於商業和公用事業燃氣流量測量。這些儀表通常在餐廳和其他小型企業外使用來測量燃氣消耗量。較大的商業機構也使用隔膜表來測量燃氣消耗量,儘管在許多情況下,公用事業公司擁有該儀表。最近,在某些應用中,旋轉流量計已經取代了隔膜流量計。

- 因此,為了維持廢水系統的建立和組織,許多公司進行策略性收購以獲得所需的技術專業知識。例如,2021年 5月,TASI 集團收購了 Mission Communication 和 Norcross GA,以補充 TASI Flow 現有的資產管理和無線連接策略,在水和廢水處理市場上佔據強大地位。

- 公司也在研究領域推出創新的數位介面和軟體解決方案。例如,2021年 2月,Emerson推出了新軟體,透過在石油和天然氣行業應用 Roxar 2600 多相流量計(MPFM)來提高製程自動化。其快速自適應測量軟體架構可協助 Roxar 2600 以 10Hz 進行平行運算,並自動選擇特定時間的最佳配置。

流量計行業概況

流量計市場高度分散,主要參與者包括Yokogawa Electric Corporation、ABB Ltd、Siemens AG、Bronkhorst High-Tech BV和Honeywell International, Inc.。市場參與者採取合作、創新和收購等策略增強他們的產品供應並獲得永續的競爭優勢。

2022年9月,Yokogawa Electric Corporation宣布推出OpreXTM電磁流量計CA系列。這個新產品系列繼承了 ADMAG CA 系列,並作為 OpreX 現場儀表系列的一部分推出。這個新系列中的產品都是電容式電磁流量計,可以測量通過測量管的導電流體的流量,而無需接觸設備的電極。除了非潤濕電極架構之外,該系列還具有新穎的功能,可提高使用者友善性、可維護性和操作效率。

2022年 6月,Sensirion 透過 SFC5500 擴展了其質量流量控制器產品線。高性能質量流量控制器和儀表針對多種氣體進行了校準。此功能包括直插式配件,使用者可以從合適的組件清單中輕鬆更換。每個設備可以覆蓋傳統設備中存在的各種流量範圍。 SFC5500 是一款靈活的 SFC5500,可處理多種應用。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力 - 波特五力

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭激烈程度

- 最新技術發展

- COVID-19 對產業影響的評估

第5章 市場動態

- 市場促進因素

- 物聯網和自動化在流量測量應用中的滲透

- 安全和效率問題方面的工業需求不斷成長

- 市場挑戰

- 產品進步導致成本上升

第6章 市場細分

- 科技

- Coriolis

- 電磁

- 線上電磁流量計

- 小流量電磁流量計

- 插入

- 不同的壓力

- 超音波

- Clamp-on

- In-line

- 其他技術

- 最終用戶產業

- 石油和天然氣

- 水和廢水

- 化學與石化

- 食品與飲料

- 紙漿和造紙

- 其他最終用戶產業

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 亞太地區其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Yokogawa Electric Corporation

- ABB Ltd

- Siemens AG

- Bronkhorst High-Tech BV

- Honeywell International Inc.

- Emerson Electric Co.

- SICK AG

- OMEGA Engineering

- Christian Burkert GmbH & Co. KG

- TSI incorporated

- Keyence Corporation

- Sensirion AG

- Azbil Corporation

- Endress+Hauser AG

- Krohne Messtechnik GmbH

第8章 投資分析

第9章 未來展望

The Flow Meters Market size is estimated at USD 8.03 billion in 2024, and is expected to reach USD 10.99 billion by 2029, growing at a CAGR of 6.47% during the forecast period (2024-2029).

Flow meters, called flow sensors, are electronic devices that primarily measure or regulate the flow rate of liquids and gases within pipes and tubes. They are commonly used in HVAC systems, medical devices, chemical factories, and septic systems. These meters can primarily detect leaks, blockages, pipe bursts, and liquid concentration changes owing to contamination or pollution.

Key Highlights

- The flow sensors/devices are generally connected to the gauges to render their measurements; however, they can also be connected to computers and digital interfaces. Flow meters can be divided into two groups, contact, and non-contact flow meters. Non-contact flow meters are used when the liquid or gas (generally, a food product) being monitored would be otherwise contaminated or physically altered by coming in contact with the moving parts.

- Multiple emerging technologies, such as IIoT, asset management, and advanced diagnostics, are also helping in forming new collaborations among users and suppliers. Moreover, the strategies for both end users and suppliers have been leveraging advancements in networking and cloud platforms and service offerings that include data and analytics. Flow meters are also witnessing a steady rise in the demand for monitoring and measuring the flow of steam, gas, water, chemicals, and mineral oil, among others. These meters offer essential precision regarding ideal and economic quantity during flow measurement. They offer advantages when it comes to processing control.

- Major trends in flow meter technology include digital signals for flow meters, multiple measurement formats, online diagnosis and troubleshooting, remote calibration and configuration, and smart sensors with online alerts. The technological advancements via robust research and development have also enabled the industry to develop appropriate solutions to complex operational problems. Automated cleaning is also one of the revolutionary trends observed in the market. This trend is advantageous for industries such as water and wastewater management.

- However, certain factors are projected to hinder market expansion. The existing flowmeters in the market are only sometimes compatible with modern machines and infrastructure. Therefore, there is a need to replace the existing outdated versions with newer, efficient, and compatible instruments. The expense of replacing the old instruments with the new generation of equipment might be a costly procedure. This will most certainly limit the market for Flow Meters.

- Industrial sectors, such as oil and gas, chemicals, pulp and paper, and metals and mining, were most affected due by the Covid-19 pandemic, thus witnessing a subsequent decline in the demand for products offered by these industries. However, demand significantly surged in many industrial sectors serving the pharmaceutical, energy, and utility applications. Furthermore, the pandemic also significantly fueled industrial automation adoption, resulting in increased product launches during the pandemic and innovation.

Flow Meters Market Trends

Electromagnetic Flow Meter Holds Significant Market Share

- Electromagnetic flow meters detect flow using Faraday's law of induction. An electromagnetic coil generates a magnetic field and electrodes that capture voltage (electromotive force) within an electromagnetic flowmeter. Due to the presence of coil and electrodes, there is nothing inside the flow pipes of an electromagnetic flow meter, and flow can be measured.

- According to Faraday's law of induction, moving conductive liquids inside the magnetic field generates voltage. The inner pipe diameter, magnetic field strength, and average flow velocity are all proportional. Also, an essential difference between electromagnetic and other flow meters is that because electromagnetic flowmeters work on electromagnetic induction, conductive liquids are the only liquids for which flow can be detected.

- Electromagnetic flowmeters have a wide range of applications in food industries, chemical applications, natural gas supplies, wastewater, mining, and power utilities. They are largely unaffected by the liquid's temperature, pressure, density, and viscosity.

- According to US Geological Survey, global copper mine production amounted to an estimated 21 million metric tons in the last year. Global copper production has steadily grown over the past decade, rising from 16 million metric tons in 2010.

- Electromagnetic flowmeters start as volumetric flow devices but can measure mass flow by plugging the product's density. The density value must remain stable for accuracy. In a few cases, a density meter is also used with electromagnetic meters to provide mass flow readings.

- For instance, mining companies often use an electromagnetic flow meter to measure slurry flow with specific liners to reduce abrasion. A densimeter sends data for the electromagnetic flowmeter to translate into an online mass flow measurement. The growth in mining activities globally is encouraging the use of electromagnetic flowmeters. According to EIA, crude oil production in the United States is expected to increase in the current year by 0.4 million b/d due to increased drilling activities, leading to flow meter adoption.

North America is Expected to Register the Largest Market

- The North American region is expected to hold a significant market share, primarily owing to the significantly developed oil and gas, chemicals, and power generation industries. The North American renewable power generation industry is also expected to continue to invest significantly in new projects. According to IRENA, In the last year, the global installed renewable energy capacity will be 3.1 terawatts, a 9.3 percent increase over the previous year. The renewable energy sector has undergone an expansion over recent decades due to decreasing pricing in renewable technologies as well as concerns about the environmental impact of more traditional sources.

- Diaphragm-positive displacement meters are widely used in the United States for commercial and utility gas flow measurement, per the Pipeline and Gas Journal report published last year. These meters are often used outside restaurants and other small businesses to measure gas consumption. Larger business establishments also use diaphragm meters to measure gas consumption, although, in many cases, the utility owns the meter. Recently, rotary meters have been replacing diaphragm meters in some applications.

- Thus, to maintain the establishment and organization of the wastewater system, many companies are making strategic acquisitions to gain the technical expertise required. For instance, in May 2021, The TASI Group of Companies acquired Mission Communication and Norcross GA to complement TASI Flow's existing Asset Management and Wireless Connectivity Strategy, enabling a strong presence in the Water and Wastewater market.

- Companies are also introducing innovative digital interfaces and software solutions in the studied segment. For instance, in February 2021, Emerson launched new software that boosts process automation with the application of the Roxar 2600 Multiphase Flow Meter (MPFM) for the oil and gas industry. Its Rapid Adaptive Measurement software architecture helps the Roxar 2600 to do the parallel calculation at 10Hz and automatically select the optimal configuration for a particular time.

Flow Meters Industry Overview

The flow meters market is highly fragmented with the presence of major players like Yokogawa Electric Corporation, ABB Ltd, Siemens AG, Bronkhorst High-Tech BV, and Honeywell International Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In September 2022, Yokogawa Electric Corporation announced the launch of the OpreXTM Magnetic Flowmeter CA Series. This new product series succeeded the ADMAG CA Series and was introduced as part of the OpreX Field Instruments family. The items in this new series are all capacitance-type magnetic flowmeters that can measure the flow of conductive fluids through a measurement tube without contacting the device's electrodes. This series has novel functionalities that increase user-friendliness, maintainability, and operational efficiency, in addition to the non-wetted electrode architecture.

In June 2022, Sensirion expanded its mass flow controller line with the SFC5500. The high-performance mass flow controllers and meters are calibrated for numerous gases. The feature includes push-in fittings, which the user from the list of suitable components can readily replace. Each device may cover a variety of flow ranges present in traditional devices. The SFC5500 is a flexible SFC5500 that can handle many applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Recent Technological Developments

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Penetration of IoT and Automation in Flow Rate Measurement Applications

- 5.1.2 Growing Industrial Demand regarding Safety and Efficiency Concerns

- 5.2 Market Challenges

- 5.2.1 Rising Cost With Product Advancement

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Coriolis

- 6.1.2 Electromagnetic

- 6.1.2.1 In-line Magnetic Flowmeters

- 6.1.2.2 Low Flow Magnetic Flowmeters

- 6.1.2.3 Insertion

- 6.1.3 Differential Pressure

- 6.1.4 Ultrasonic

- 6.1.4.1 Clamp-on

- 6.1.4.2 In-line

- 6.1.5 Other Technologies

- 6.2 End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Water and Wastewater

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Food & Beverage

- 6.2.5 Pulp and Paper

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Yokogawa Electric Corporation

- 7.1.2 ABB Ltd

- 7.1.3 Siemens AG

- 7.1.4 Bronkhorst High-Tech BV

- 7.1.5 Honeywell International Inc.

- 7.1.6 Emerson Electric Co.

- 7.1.7 SICK AG

- 7.1.8 OMEGA Engineering

- 7.1.9 Christian Burkert GmbH & Co. KG

- 7.1.10 TSI incorporated

- 7.1.11 Keyence Corporation

- 7.1.12 Sensirion AG

- 7.1.13 Azbil Corporation

- 7.1.14 Endress+Hauser AG

- 7.1.15 Krohne Messtechnik GmbH